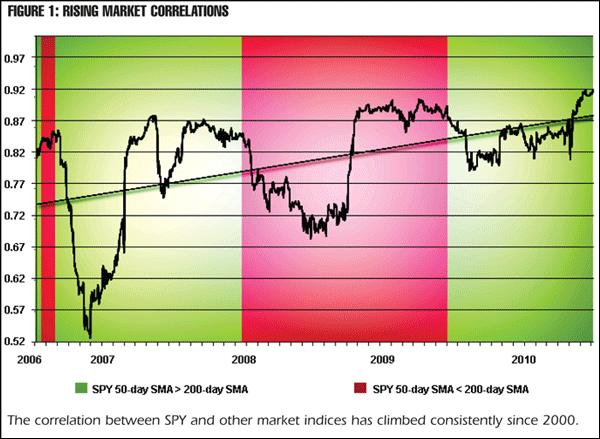

Great chart from Active Trader of the S&P5oo correlation with other markets. Have you noticed recently that all markets are moving together? U.S. Treasuries, domestic and foreign stocks, Greek Bonds, EM Debt, commodities, and foreign currencies all in lockstep? This is a clear sign loose monetary policy is starting to bite. If sustained, the animal spirits should start to spillover into the real economy.

The markets need a fundamental story — a new technology, a “new economy,” the “great reset” or a “new contract” — and some credit expansion to really get the liquidity driven Bubble 2.0 3.0 going. Build your Ark and the ride the flood. How it all ends? Stay tuned.