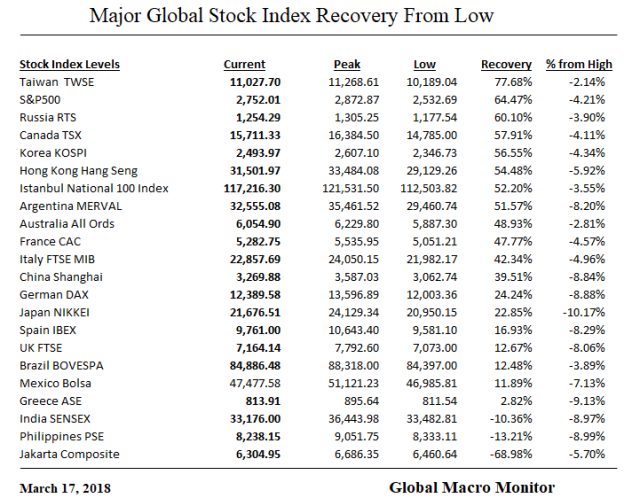

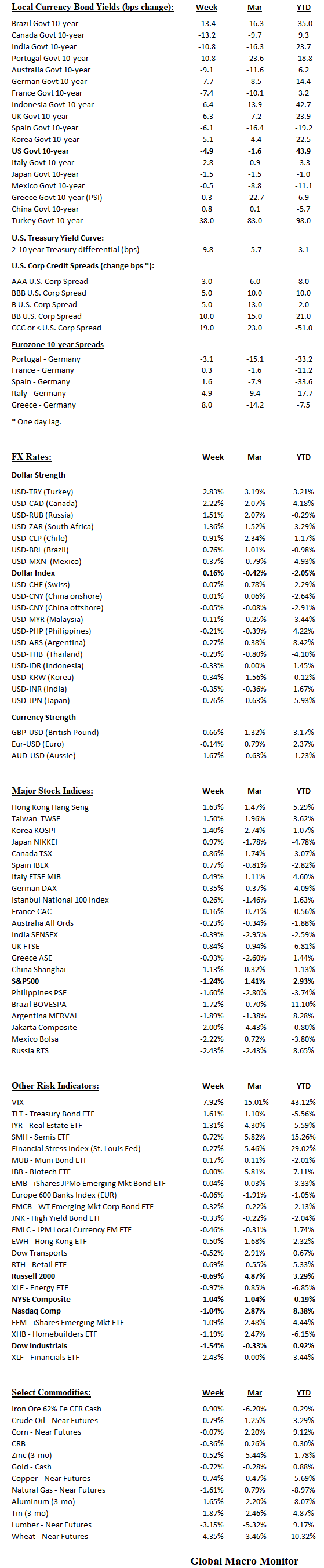

Equity markets are still struggling to get back to all-time highs as geopolitical and U.S. domestic political risk is on the rise and growth projections ratchet lower.

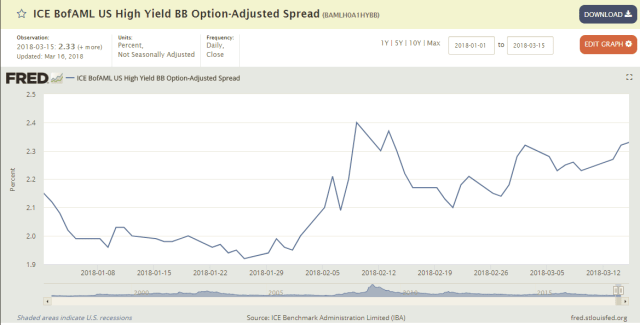

Corporate spreads are blowing out again.

The U.S. 10-year yield is very sticky, in a range of 2.80-2.95 percent. Surprising given the risk aversion and big shorts in the futures market. Not surprising given that the Fed has reversed from big buyer to big seller, foreign central banks have been selling, and new supply has increased.

We suspect this coming week will be a critical battle between the bulls and bears as the Fed meets and raises rates by another 25 bps. The key will be in their forward guidance.

The Geopolitical Risk Index (GPR) has reached its highest level since the 2003 invasion of Iraq. The previous high… twitter.com/i/web/status/9…—

Ole S Hansen (@Ole_S_Hansen) March 15, 2018

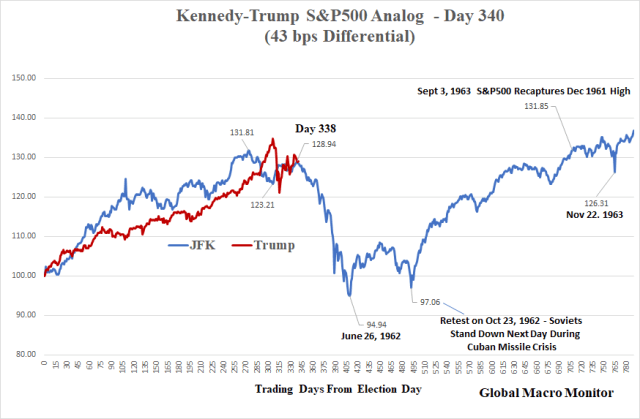

S&P500 Analog

Our JFK-Trump S&P500 continues to track. We have had some big push back on this analysis, such as: useless analysis; meaningless correlation; throw two charts on top of one another, you will always get a good analog.

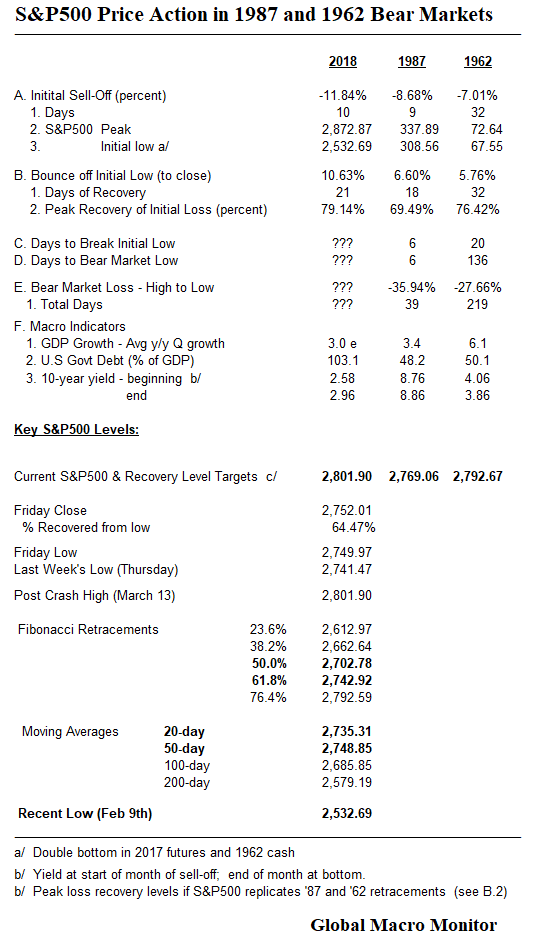

Let us now push back. We didn’t invent the analog. We discovered it through comparing the recent volatility shock to past data. We found only three comparable periods: 1) 1955: Eisenhower heart attack, which did not lead to bear market; 2) 1962: the “Kennedy Slide” or bear market, and 3) 1987: the October stock market crash.

What caught our eye was the similar big advance in the S&P500 after the JFK and Trump election, which were very close in percentage terms. They both peaked at a relatively close number of trading days, and the subsequent correction and attempt to get back to new highs have been similar (see table).

Speculative price action is timeless and should always be studied by any serious market watcher or analyst.

Folks looking only at similar patterns have given analogues a bad name. To have any predictive chance price and time have to be similar. The longer the time frame the better but at all times the percentage change has to be the approximately the same. Price vs time = psychology.

I like your analogue because the percentage change fits. I would bet the farm had it been over many years like it was leading up to the 1987 crash. I used an analogue then comparing it to the 1920’s bull.

Thanks for comments, Patrick. I agree.