Our analysis of the impact of the Coronavirus is a work in progress and nobody knows the endgame. It is still the early days of the epidemic, and its dynamics will take time to understand. The scale of the impact will depend on how contagious and lethal it reveals itself. That is the second derivative of the infection rate – the rate of change of the rate of change.

There is a supply shock to global manufacturing as many factories in the world’s supply chain will be shuttered for longer, which shifts the global supply curve left, increasing-price and production pressures. Ergo component shortages, higher prices, and lower production.

The 2 percent decline in the U.S. stock market and collapse in bond yields are signaling a potential global aggregate demand shock that offsets inflationary pressures of the supply shock.

As of Friday, 10,000 cases have been confirmed by China, surpassing the total from the 2002-2003 SARS epidemic. The new virus has killed 171 people in China.

The epicenter of the outbreak is Wuhan, one of China’s largest manufacturing centers. Foxconn and Pegatron have operations there, as do memory manufacturers such as XMC (non flash) and Yangtze Memory Technologies Co. (non-volatile memory).

Auto producers, such as General Motors, Honda, Volkswagen, BMW and Daimler also populate the region.

The electronics industry is poised for a cascading disruption that could change industry growth forecasts for the year. Bill McLean, president of semiconductor research firm IC Insights, said the virus has exacerbated the economic unease that has stalled semiconductor capital investment.

“Brexit, trade issues and now the coronavirus are causing global uncertainty,” he said at a Boston-based forum. “Uncertainty causes [businesses and consumers] to freeze.” Worldwide, semiconductor capital spending is forecast to decrease by roughly 6 percent this year, from $103.5 billion in 2019 to roughly $97.6 billion.

Zhang Ming, an economist at government-backed think-tank the Chinese Academy of Social Sciences, warned that the virus could push China’s economic growth below 5 per cent a year in the first quarter, reported the Financial Times. Economic consensus currently puts China’s GDP growth at 5.7 percent. That average has steadily declined since 2018, according to McLean. — EE Times

More than 300 of the Global Top 500 companies have a presence in Wuhan, including Microsoft and Siemens. Wuhan is located in the Hubei Province.

Wuhan has 10 car factories, including those Honda, Renault, PSA and General Motors. The car industry represents around 20 percent of the city’s economy and employs 200,000 people directly and more than a million indirectly.

Most factories lose about two weeks of production in total during the Lunar Holiday but more production will be lost as the holiday has been extended.

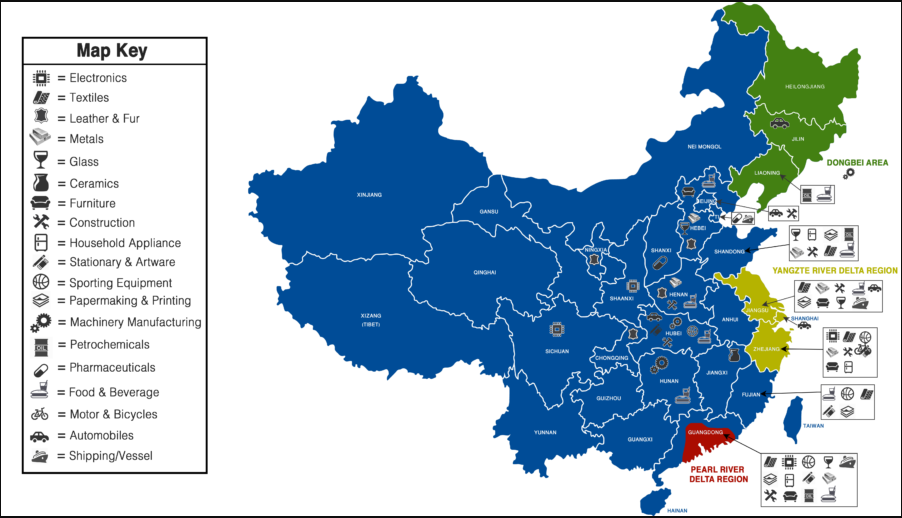

Here is a look at the main manufacturing regions in China.

China Manufacturing Distribution Breakdown

Electronic Industry: Mainly in Guangdong (33%), the rest in Yangtze River delta, Sichuan, Shaanxi Provinces.

Textile Industry: Mainly in Zhejiang (18%) and Jiangsu (20%), the rest in Fujian, Guangdong, Shandong Provinces.

Leather & Feather: South-East Coastal areas, Hebei, Henan, Chongqing and Ningxia provinces.

Metal Product: Zhejiang, Guangdong, Jiangsu, Shandong, Hebei, Henan provinces.

Glass: More in Hebei, Jiangsu, some in Shandong and Guangdong provinces.

Ceramics: Jingdezhen in Jiangxi provinces

Furniture: Mainly in Guangdong and Hebei province, the rest in Jiangsu, Zhejiang, Shanghai, Chengdu and Beijing.

Construction: More in Shandong province, the rest in Hubei, Henan, Guangdong, Jiangsu, Beijing, Zhejiang.

Household Appliance: Guangdong, Zhejiang, Shandong provinces.

Artware & Stationary & Sporting: Zhejiang, Fujian, Guangdong, Hubei

Papermaking & Printing: Guangdong, Zhejiang, Jiangsu, Shandong, Fujian

Machinery Manufacturing: Dongbei Area, Hunan and Hubei provinces.

Petrochemical Industry: Shandong (32%), Liaoning (21%), Guangdong (15%)

Pharmaceutical Industry: Tianjin city, Xian city in Shanxi province

Food & Beverage: Liaoning, Shandong, Jiangsu, Guangdong, Fujian, Hebei, Henan, Hunan, Hubei, Inner Mongolia

Transportation Equipment:

- Motor & Bicycle: Taizhou city in Zhejiang province (40%)

- Shipping/Vessel: Yangtze River delta, Pearl River Delta, Bohai Bay Areas

- Automobile: Mainly in Jilin, Hubei, Shanghai and Yangtze River delta, the rest in Pearl River Delta, Beijing

Source: Berkeley Sourcing Group

Source: CNN

Pingback: The Global Supply & Demand Shock Of The Coronavirus | Zero Hedge

Pingback: The Global Supply & Demand Shock Of The Coronavirus – iftttwall

Pingback: The Global Supply & Demand Shock Of The Coronavirus | WESTON POST

Pingback: The Global Supply & Demand Shock Of The Coronavirus - Excalibur News

Pingback: The Global Supply & Demand Shock Of The Coronavirus – SYFX+

Pingback: The Global Supply & Demand Shock Of The Coronavirus – Olduvai.ca

Pingback: The Global Supply & Demand Shock Of The Coronavirus – ProTradingResearch

Pingback: The Global Supply & Demand Shock Of The Coronavirus – Finanz.dk

Pingback: The Global Supply & Demand Shock Of The Coronavirus – TradingCheatSheet

Pingback: The Global Supply & Demand Shock Of The Coronavirus – plan B

Pingback: The Global Supply & Demand Shock Of The Coronavirus – Investing Money Trends

Pingback: The Global Supply & Demand Shock Of The Coronavirus | ValuBit

Pingback: The Global Supply & Demand Shock Of The Coronavirus | Real Patriot News

Pingback: The Global Supply & Demand Shock Of The Coronavirus | Newzsentinel

Pingback: Something Wicked This Way Comes – Hardscrabble Future

Pingback: The Global Supply & Demand Shock Of The Coronavirus – Nwo Report

Pingback: The Global Supply & Demand Shock Of The Coronavirus – Patriot Powerline

Pingback: This Week’s Best Investing Articles, Research, Podcasts 2/7/2020 - Stock Screener - The Acquirer's Multiple®

Pingback: COTD: Coronavirus Risk To Manufacturing | Global Macro Monitor

Pingback: Coronvirus in Lombardia e Veneto: un problema per l’economia di tutta Europa – Business Insider Italia

Pingback: Coronavirus in Lombardia e Veneto: un problema per l’economia di tutta Europa – Tortuga Econ

Pingback: Stages Of A Pandemic: Denial, Panic, Fear, and Rationality | Global Macro Monitor

Pingback: Coronavirus in Lombardia e Veneto: un problema per l’economia di tutta Europa - Tortuga Econ

Pingback: 10 articoli di Tortuga da recuperare ora che dobbiamo stare a casa - Tortuga Econ

Pingback: NOM? – Anankeros

According to the latest figures from the World Health Organization, there have been at least 153,648 cases of coronavirus globally, with at least 5,746 deaths from COVID-19.

Pingback: The CK-35: How NOT to Build a Portfolio | Global Macro Monitor

Pingback: The World’s Scariest Chart | Global Macro Monitor

Pingback: Black Swan Hunting | Global Macro Monitor