Weekly Summary

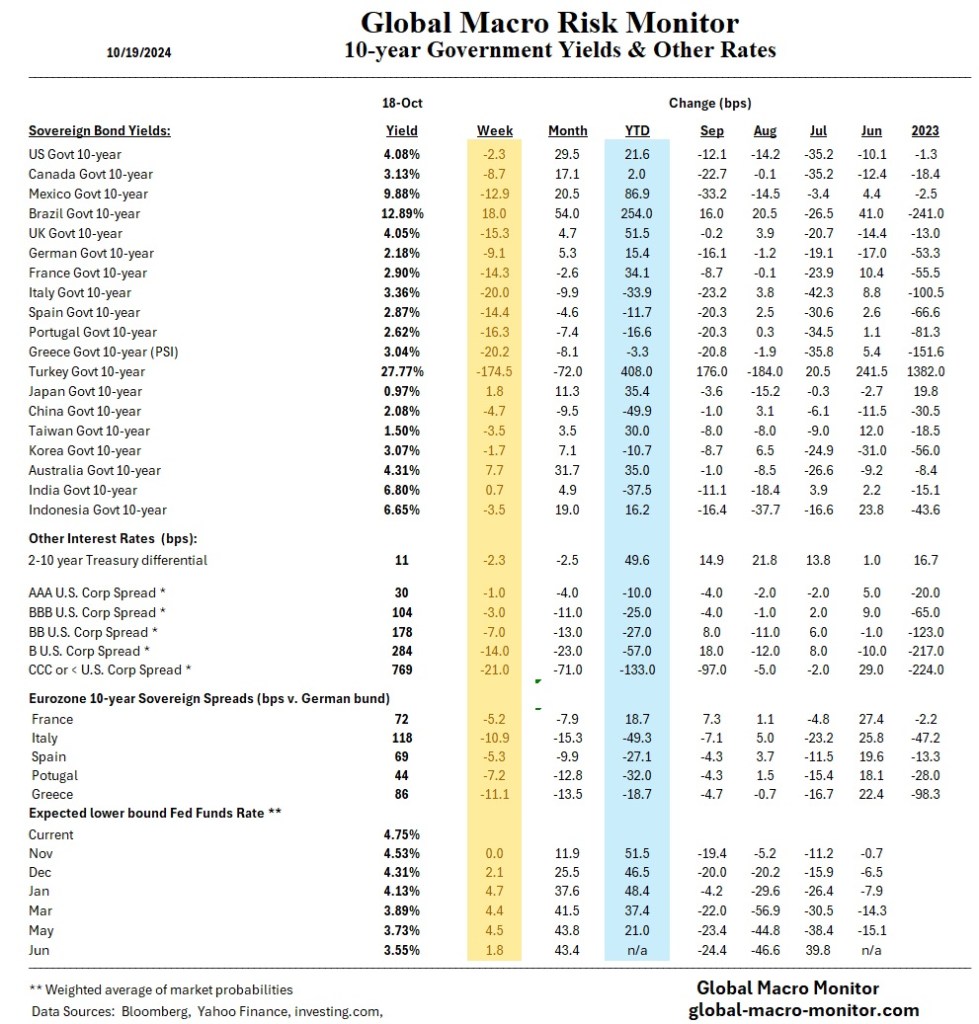

Big rally in Eurozone bond markets as the European Central Bank (ECB) reduced its key interest rate to 3.25%, marking its third 25 basis point cut this year. The decision reflects the ECB’s focus on lowering inflation risks and addressing a weaker growth outlook. The Governing Council stated that disinflation is progressing, with euro area inflation easing to 1.8% in September, below the 2% target for the first time in three years.

Key challenges persist for the euro zone, including manufacturing weakness in Germany and fiscal consolidation in France. The ECB lowered its 2024 GDP growth forecast to 0.8%, reflecting subdued domestic demand. Despite market expectations, the ECB maintains a cautious outlook, indicating December will offer more clarity as data-driven projections continue.