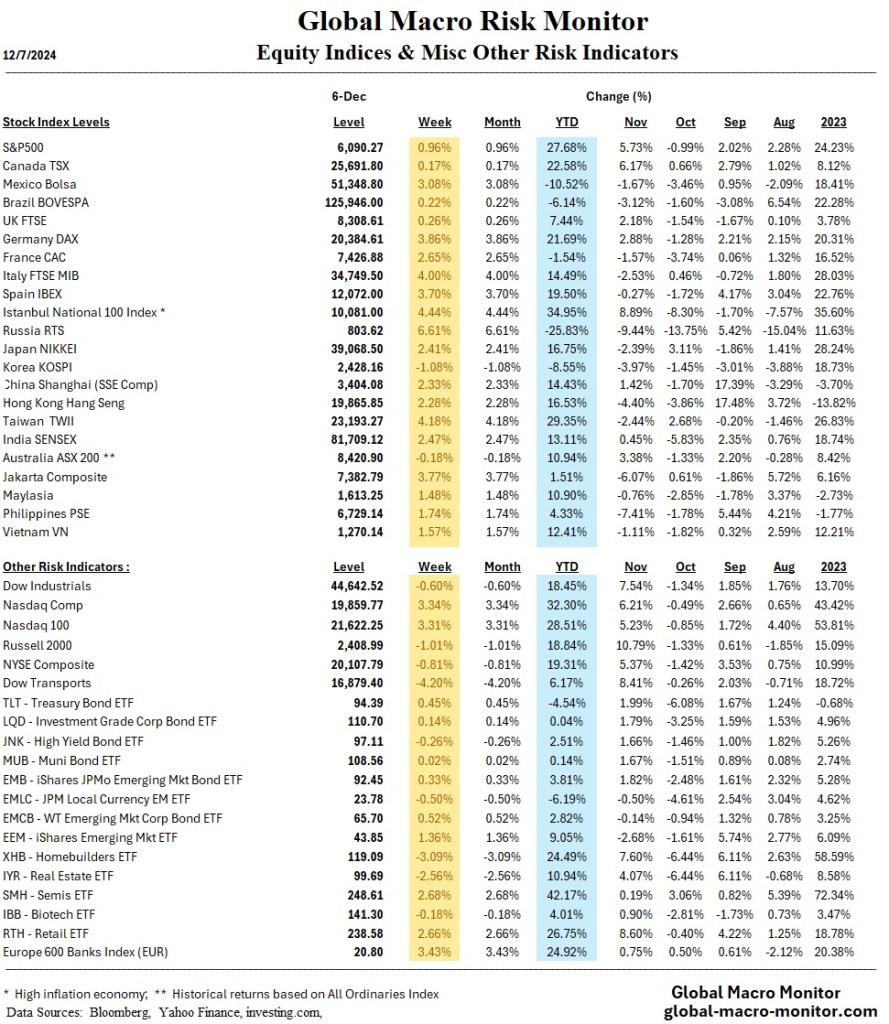

Global markets experienced a mixed yet eventful week, marked by a rally in U.S. growth stocks, diverging sector performance, and critical macroeconomic data releases. The NASDAQ surged over 3% for its third consecutive weekly gain, joining the S&P 500 in record territory, while the Dow slipped slightly after hitting midweek highs. Growth stocks significantly outperformed value counterparts, with U.S. large-cap growth indices climbing 3.6% versus a 1.9% drop in value stocks. Consumer discretionary and tech sectors led gains, contrasting sharply with declines in the energy and materials sectors.

U.S. Employment Situation

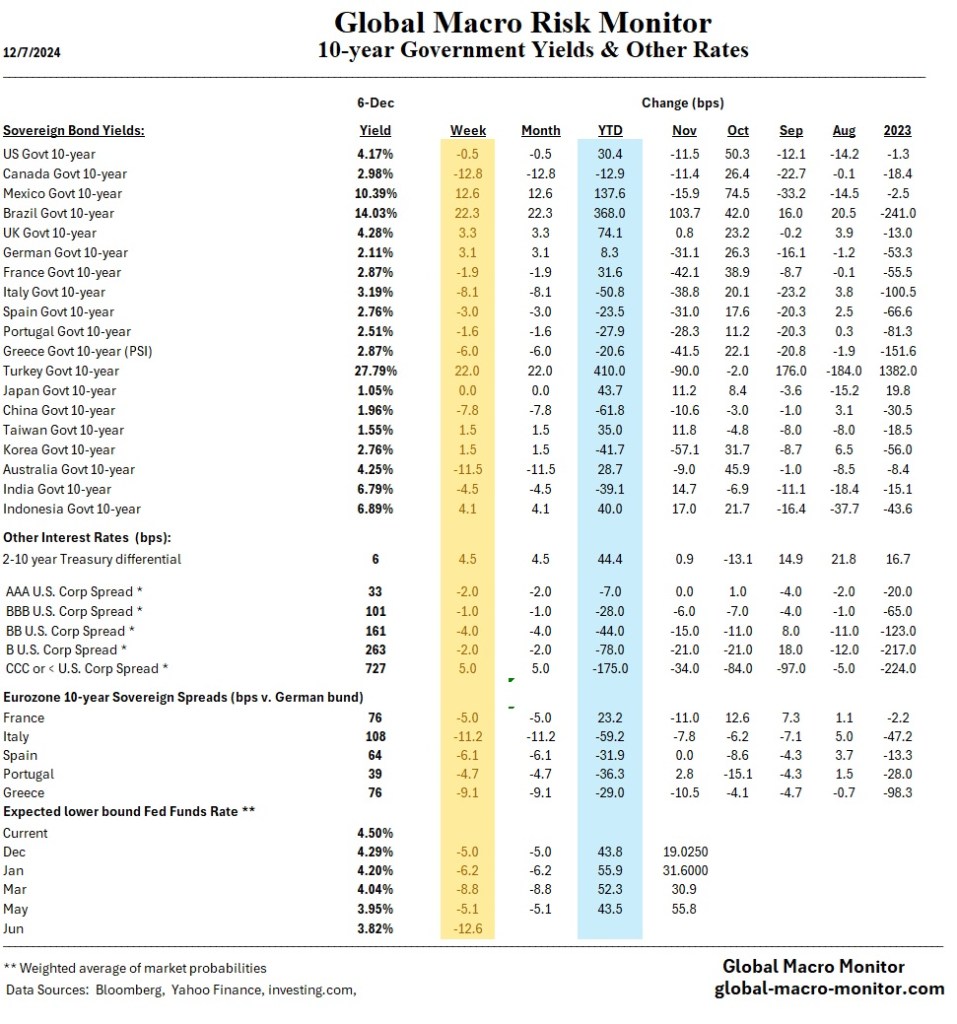

U.S. labor market data highlighted a stronger-than-expected 227,000 increase in nonfarm payrolls in November. However, mixed signals arose as household survey data revealed a 355,000 net employment loss, and unemployment increased to 4.2%. Wage growth at 4.0% year-over-year points to persistent inflationary pressures ahead of the Federal Reserve’s pivotal December meeting, where a 25 basis point rate cut appears increasingly likely.

Brazil Under Pressure

Internationally, European equities advanced despite political turbulence in France, while China’s retaliatory measures in critical minerals exports signaled rising geopolitical tensions. Brazilan markets remain under pressure as the plan to cut government spending came up short of expectations.

Bonds

Treasury yields declined, bolstering bond returns, and U.S. consumer sentiment improved, reaching a six-month high. Markets anticipate further rate cuts in 2025 as global central banks balance growth risks and their attempt to bring inflation into their target zones.

This week’s CPI release will be critical for shaping near-term Fed policy.

Pingback: EM Currencies Getting Shellacked | Global Macro Monitor