Global monetary policy remains mixed as central banks navigate inflationary pressures, growth slowdowns, and geopolitical shifts. The European Central Bank (ECB) and Swiss National Bank (SNB) eased rates amid economic concerns, while the U.S. Federal Reserve signals a hawkish rate cut next week. Inflation in the U.S. remains sticky, with November’s core CPI showing resilience, pushing Treasury yields higher. Asian markets reacted to China’s promise of fiscal stimulus, though details were scant. Japan will likely delay its next interest rate hike to January, while Turkey and Brazil diverge, with Turkey expected to ease and Brazil maintaining a hawkish stance.

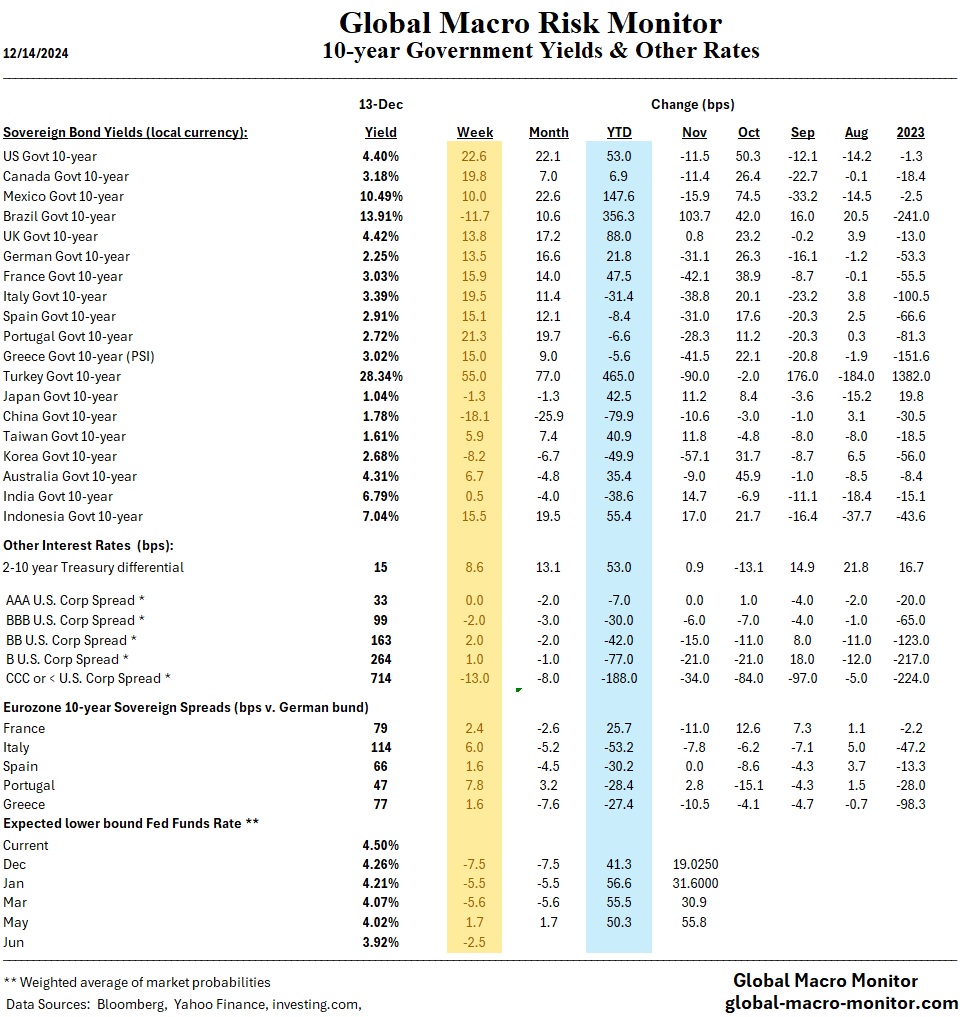

Equity markets showed mixed performance, with the Nasdaq reaching record highs due to tech sector strength, while most other indices dipped. Global bond markets sold off with the yield on the U.S. 10-year rising by over 20 bps for the week. Oil prices rebounded but face long-term bearish pressures. Central banks in emerging markets, including Latin America and Asia, are aligning easing cycles cautiously amid global headwinds.