Weekly Economic and Market Summary

Macroeconomics

- Strong Jobs Report: December added 256,000 jobs, surpassing forecasts by 100,000, and unemployment dropped to 4.1%. This robust labor market supports the Fed’s decision to slow rate cuts.

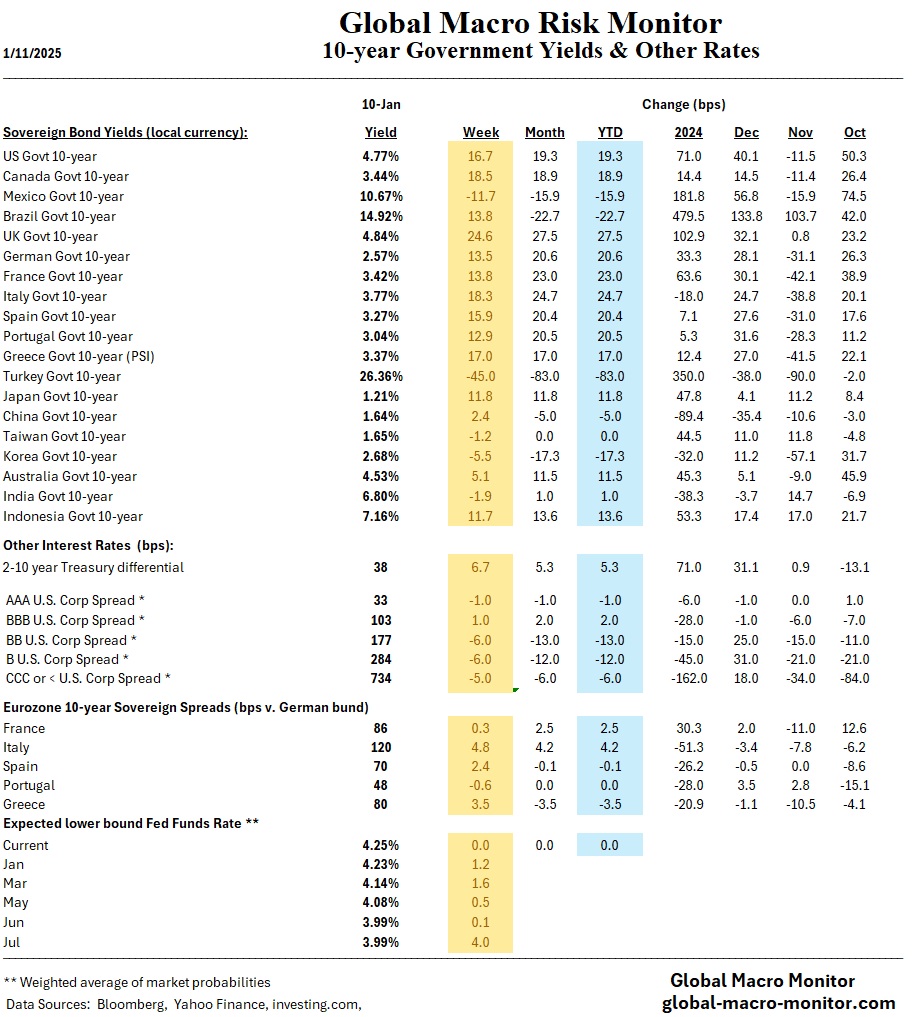

- Fed Policy: Federal Reserve minutes reflect a hawkish stance, with no significant rate cuts expected in 2025. Upside inflation risks persist, and Treasury yields hit multi-year highs.

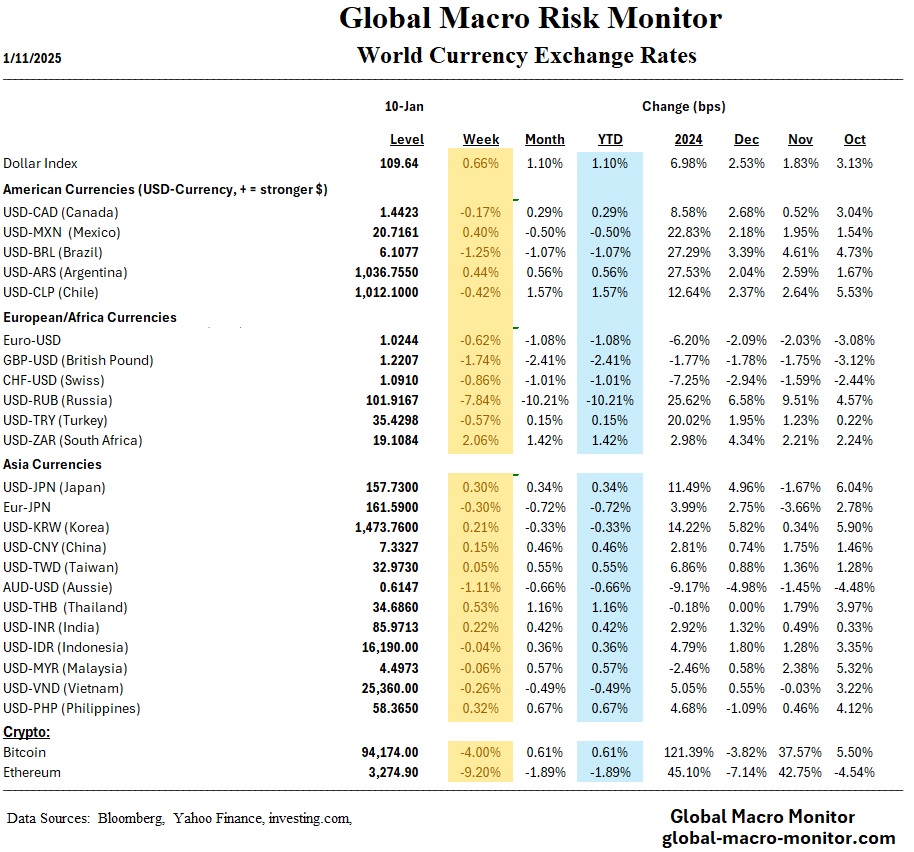

Global Markets

- UK Bond Market Concerns: UK 10-year gilt yields reached 4.92%, the highest since 2008, driven by fiscal concerns and investor skepticism about government borrowing.

- European Inflation: The eurozone saw inflation rise to 2.4% in December, spurred by energy and services costs, while the ECB signaled disinflation progress and potential rate cuts.

- China’s Economic Struggles: Persistent deflationary pressures saw China’s consumer prices inch up 0.1% annually, while its producer prices fell for the 27th consecutive month. Stimulus measures aim to boost activity.

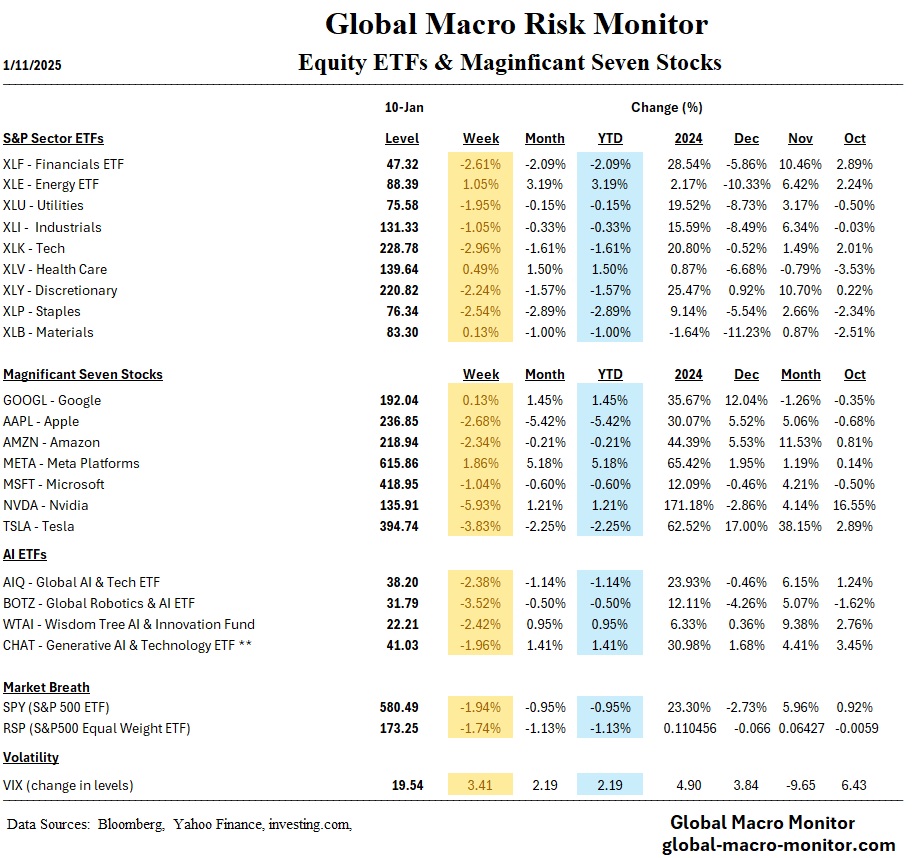

Market Performance

- U.S. Equities Decline: The S&P 500 dropped 2% for the week, with small-cap stocks entering correction territory. Rising bond yields weighed on valuations, particularly in rate-sensitive sectors.

- Treasury Yield Spike: The 10-year U.S. Treasury yield surged to 4.77%, its highest level in over a year, reflecting expectations of fewer Fed rate cuts.

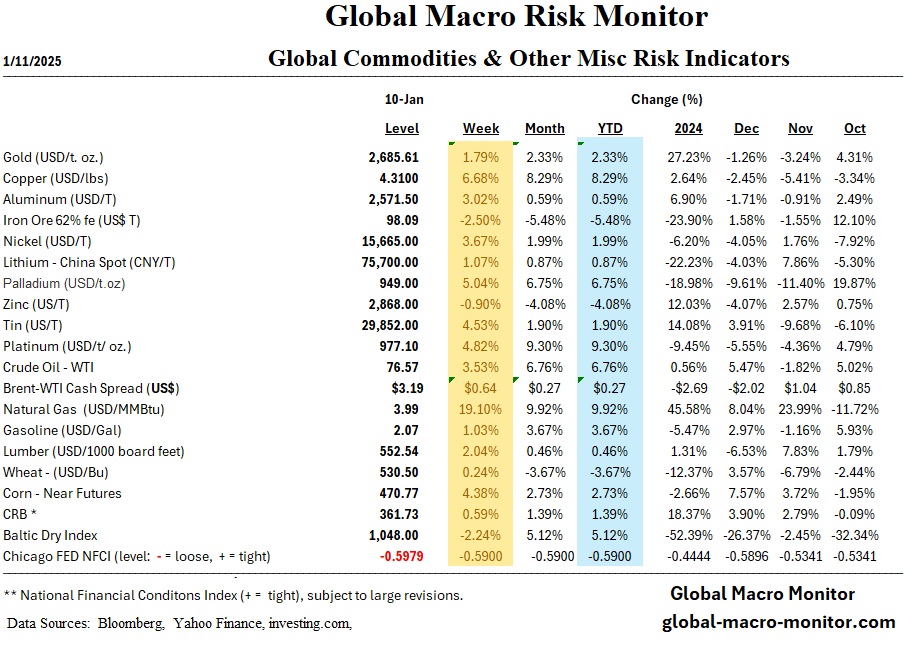

- Commodity Gains: Oil prices climbed 10% over three weeks, reaching $77, while gold rose for a second week to $2,717, nearing record highs.

These developments illustrate the dynamic interplay of inflation, central bank policies, and global economic pressures, which continue to shape market trajectories.