Weekly Economic and Market Summary

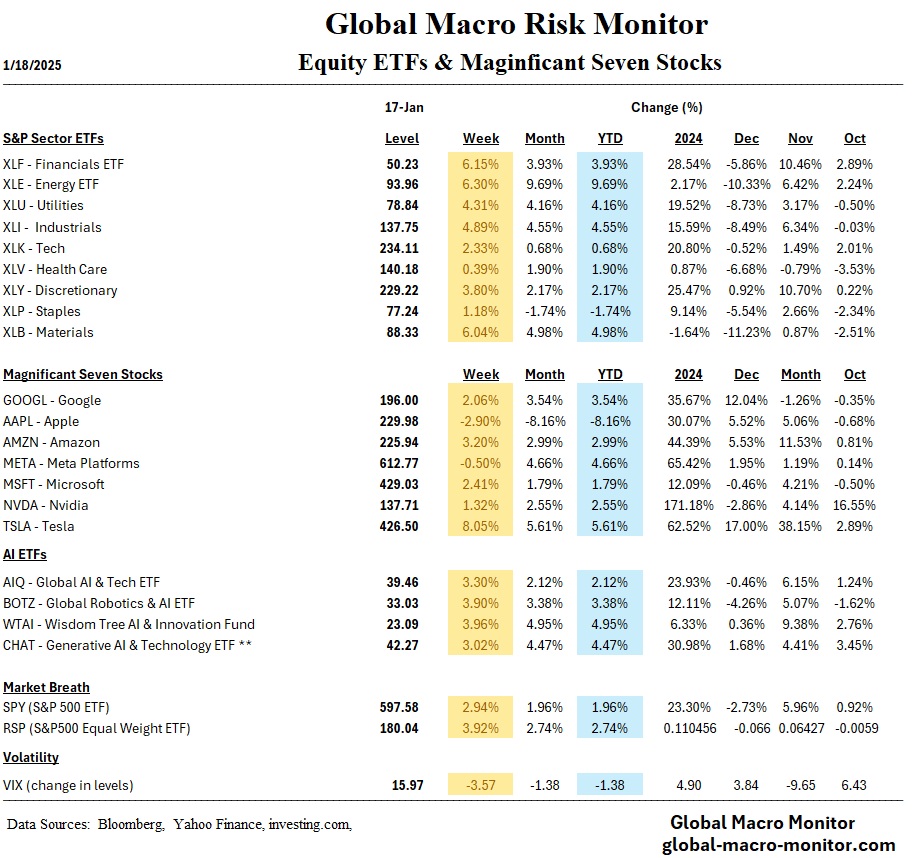

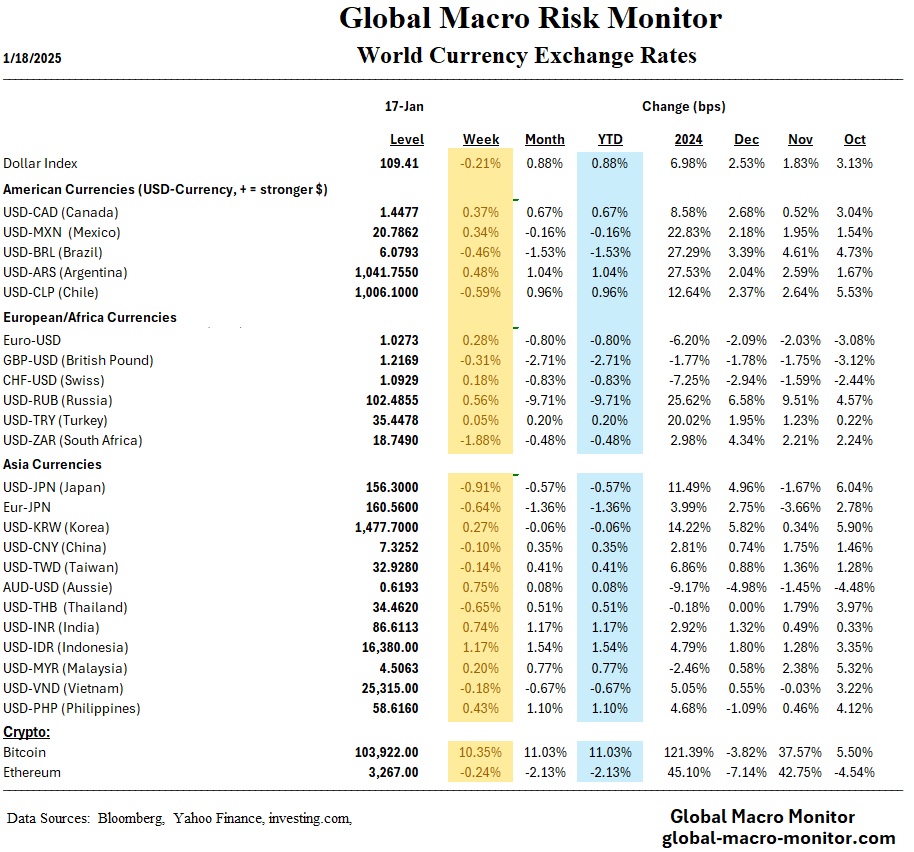

Global markets rallied amid softer U.S. inflation data, with the S&P 500 rising +2.94% for the week, driven by gains in financials and industrials. European markets outperformed, led by France’s CAC 40 (+3.75%), Germany’s DAX (+3.41%), and Italy’s FTSE MIB (+3.36%). The UK’s FTSE 100 climbed +3.11%, benefiting from cooling inflation and expectations of Bank of England rate cuts. In Asia, China’s Shanghai Composite gained +2.31%, supported by robust economic data, while Japan’s NIKKEI fell -1.90%, pressured by yen appreciation and declining export sector margins. Emerging markets delivered mixed results, with Vietnam’s VN Index dropping -1.39%.

Global Economics

The Eurozone saw easing inflation, with December data supporting ECB plans for gradual rate cuts in 2025. Germany’s GDP contracted -0.20% in 2024, marking its second consecutive annual decline, driven by weak investment and slowing exports. The UK’s inflation decelerated to +2.50% in December, down from +2.60% in November, fueling speculation of monetary easing.

In Asia, China’s Q4 GDP exceeded expectations at +5.40% year-over-year, with industrial production growing +6.20% and retail sales expanding +3.70%. Japan faced mixed signals; real wages fell -0.30% year-over-year, while the yen’s appreciation weighed on equities. Elsewhere, Hungary’s inflation rose to +4.60% in December, while Poland’s central bank held rates at 5.75%, citing elevated inflation expectations.

Easy Financial Conditions

The Chicago Fed’s National Financial Conditions Index (NFCI) indicates the loosest financial conditions since October 2021, when quantitative easing and zero interest rate policies were in full effect. Such easy financial conditions could reignite inflation, especially amid the incoming administration’s trinity of inflationary policies—tariffs, expansionary fiscal policy (mainly tax cuts), and mass deportations. These easing financial conditions act as the dry brush that could magnify and accelerate the inflationary pressures.