7 Key Takeaways

- U.S. job growth slowed, with weaker-than-expected payrolls but a declining unemployment rate.

- Stock markets fluctuated due to tariff uncertainties, with Trump postponing tariffs on Mexico and Canada but maintaining those on China.

- Strong corporate earnings supported equities, with the S&P 500 showing 16.4% earnings growth versus 11.9% expected.

- U.S. Treasury yields declined, pricing in slower growth and potential Fed rate cuts.

- Eurozone inflation remains sticky, delaying European Central Bank rate cuts.

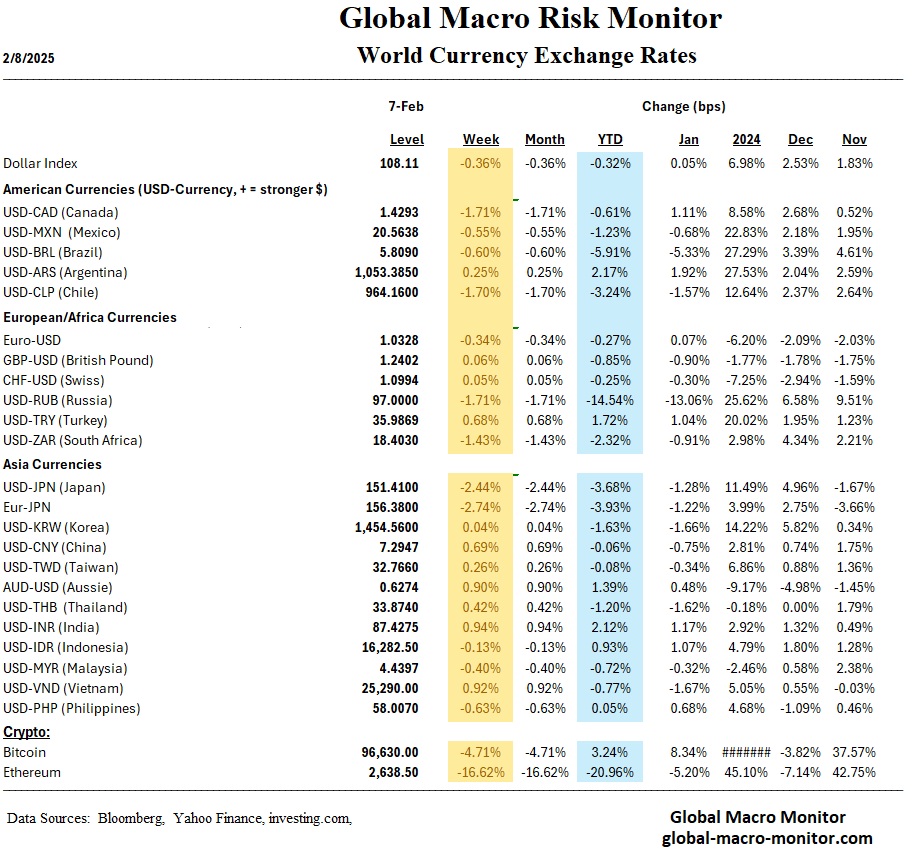

- Japan’s hawkish policy stance strengthened the yen, impacting exporters.

- China’s retail and travel data showed strong Lunar New Year spending, but manufacturing PMI indicated slower growth.

Markets

Stocks

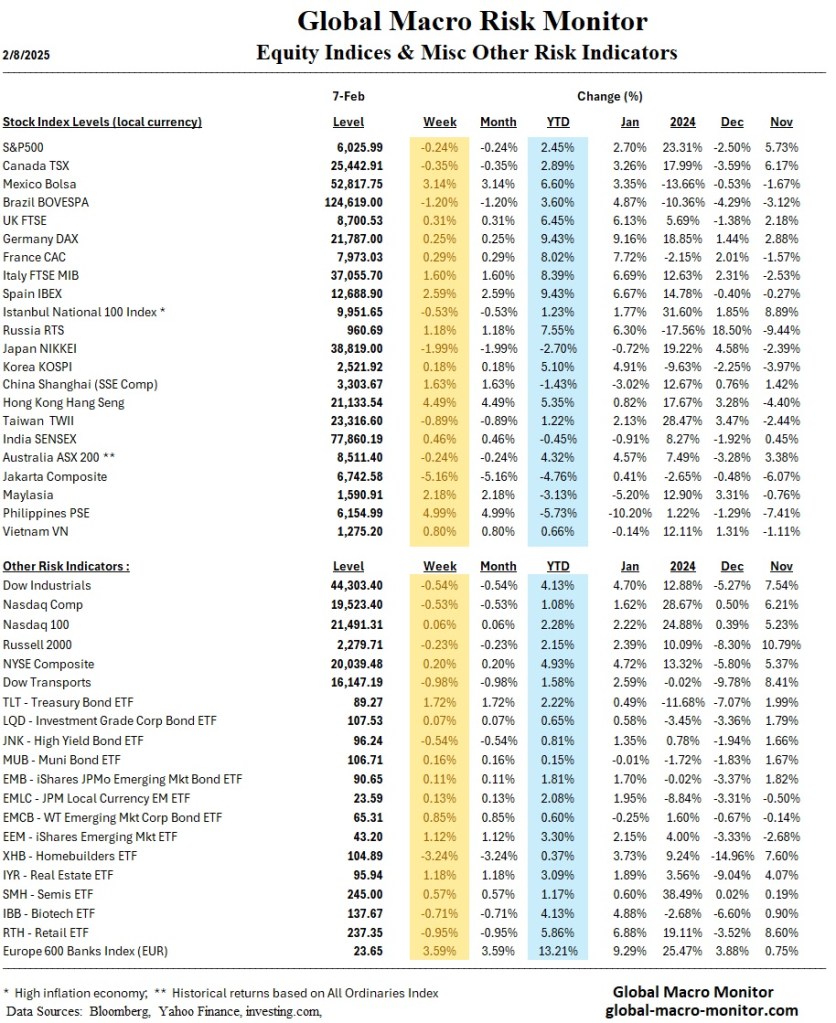

Markets experienced a volatile week as investors reacted to trade policy developments, economic data, and earnings reports. U.S. equities opened lower following the White House’s announcement of sweeping tariffs on imports from Mexico, Canada, and China. However, stocks rebounded after President Trump postponed tariffs on North American trade partners, easing fears of an imminent trade war. The S&P 500 declined 0.24%, while the Dow Jones Industrial Average and Nasdaq Composite also finished in negative territory. Strong corporate earnings helped limit losses, with 77% of S&P 500 companies surpassing expectations.

Globally, European stocks posted gains, with Italy’s FTSE MIB rising 1.6% and Germany’s DAX up 0.25%. Japan’s Nikkei 225 fell 2%, pressured by a stronger yen as the Bank of Japan (BoJ) shifted to a more hawkish stance. China’s Shanghai rose 1.63% in a shortened trading week, bolstered by robust Lunar New Year spending despite weak PMI data.

Bonds

U.S. Treasuries rallied as weaker-than-expected jobs data reinforced expectations of a dovish Federal Reserve. The 10-year Treasury yield fell to 4.50%, reflecting concerns over slowing growth. Municipal bonds and investment-grade corporate debt saw strong demand, with high-yield issuance remaining active. In Europe, the Bank of England cut rates by 25 basis points, while the Czech National Bank also eased policy but signaled caution moving forward.

United States

The U.S. labor market showed signs of gradual cooling, with 143,000 jobs added in January, well below December’s revised 307,000. However, the unemployment rate fell to 4.0%, suggesting underlying resilience. Job openings declined to a three-month low, reinforcing the view that hiring is stabilizing. Wage growth accelerated, with average hourly earnings rising 0.5%, which could complicate inflation control. Meanwhile, manufacturing PMI expanded for the first time in over two years, but business sentiment remained fragile amid ongoing trade policy uncertainty.

International

Europe’s economy presented a mixed picture. Eurozone inflation remained elevated at 2.5%, delaying expectations for European Central Bank (ECB) rate cuts. Germany’s factory orders surged 6.9%, but industrial production declined, highlighting economic imbalances. The Bank of England cut interest rates for the third time since August, citing slowing growth and persistent inflation risks.

In Asia, Japan’s BoJ signaled a more hawkish stance, strengthening the yen and pressuring exporters. China’s economy showed resilience in consumption, with Lunar New Year retail spending up 7% and travel demand hitting record levels. However, manufacturing PMI indicated slowing production growth, raising concerns over longer-term economic momentum.

Week Ahead

Looking ahead, tariff negotiations remain a key market driver, with potential trade developments between the U.S., China, Mexico, and Canada likely to impact sentiment. Investors will also watch inflation data, with the Consumer Price Index (CPI) and Producer Price Index (PPI) due next week. The Federal Reserve’s policy stance will continue to be a focus, particularly as market expectations for a 2025 rate cut cycle evolve. Meanwhile, corporate earnings season continues, with major reports from firms in the technology, consumer, and industrial sectors.

Global attention will also be on central bank decisions in emerging markets, particularly Turkiye, Poland, and Czechia, as policymakers navigate inflationary pressures. In Latin America, Ecuador’s elections will be watched for potential policy shifts amid regional political uncertainty. With markets navigating geopolitical risks, economic data, and corporate earnings, volatility is likely to persist in the near term.