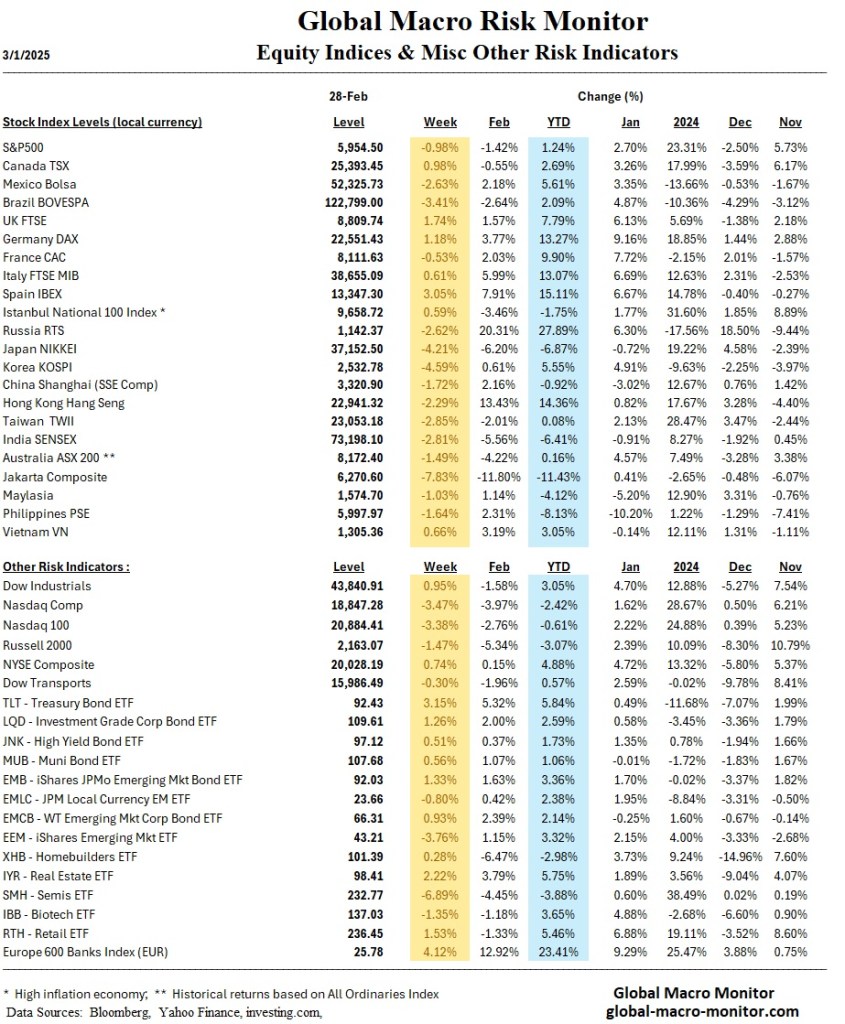

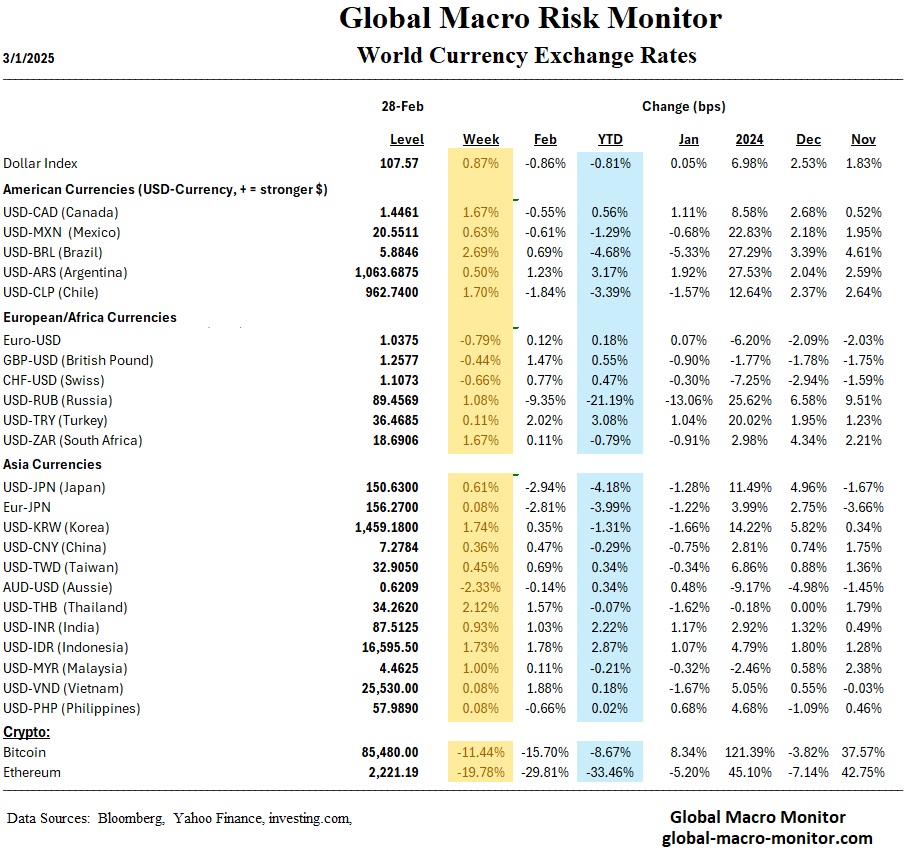

The past week saw heightened market volatility, with the S&P 500 and Nasdaq declining due to fading AI momentum and a growth scare, while the Dow Jones outperformed. The Atlanta Fed’s GDPNow model slashed Q1 GDP growth projections to -1.5%, signaling a potential contraction, exacerbated by weaker consumer spending and falling confidence levels. The bond market is flashing recessionary signals, as Treasury yields fell, and the yield curve remains inverted.

Brazilian markets faced sharp losses, with its stock market falling 3.41%, the real depreciating 2.7%, and bond yields surging 60 basis points amid concerns over rising interest rates and a shift to leftist populist economic policies. Meanwhile, Japan’s Nikkei dropped 4.21%, weighed down by a tech sell-off and U.S. tariff fears, while European equities posted modest gains.

Looking ahead, the market will focus on U.S. labor data, Fed rate expectations, and the March 4 tariff deadline. With risks rising, a defensive stance seems prudent, focusing on value stocks, liquidity, and hedging strategies.

Markets: U.S. and Global

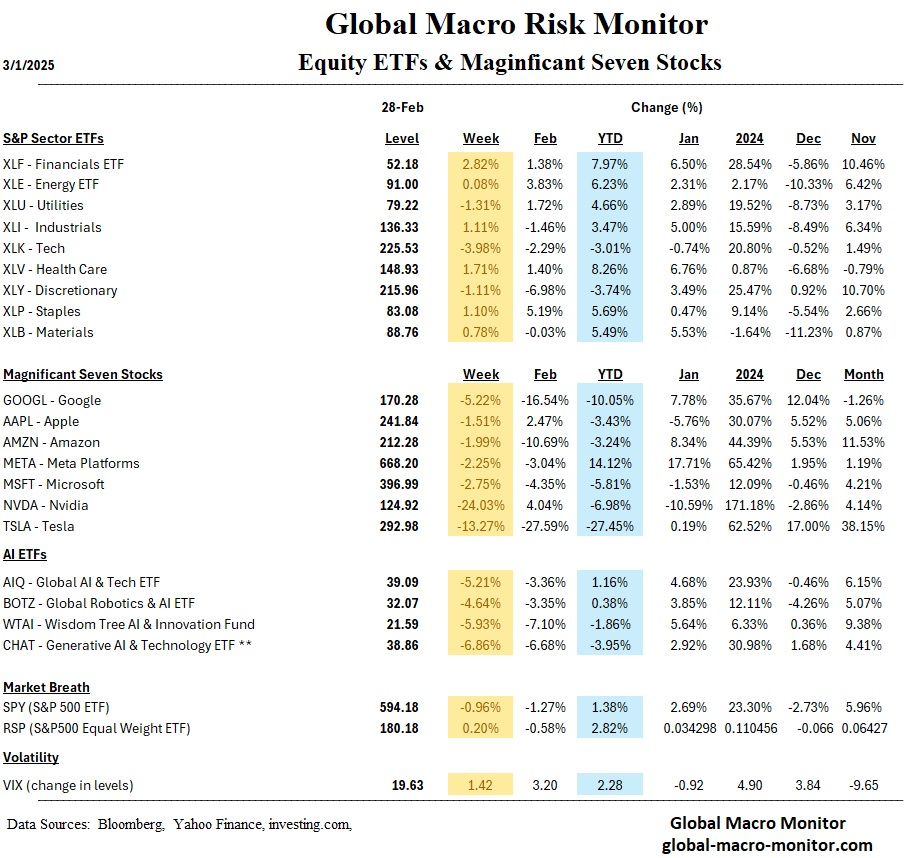

U.S. Equities Performance

- Dow Jones: +0.95%, continuing its year-to-date outperformance.

- S&P 500: -0.98%, second consecutive weekly decline.

- Nasdaq Composite: -3.47%, worst drop since early September.

- Growth stocks struggled:

- Nvidia (-24%) and Tesla (-13%) led the decline.

- Tesla has lost 82% of its post-election gains.

- AI-related stocks are under pressure, raising concerns over fading momentum in the sector.

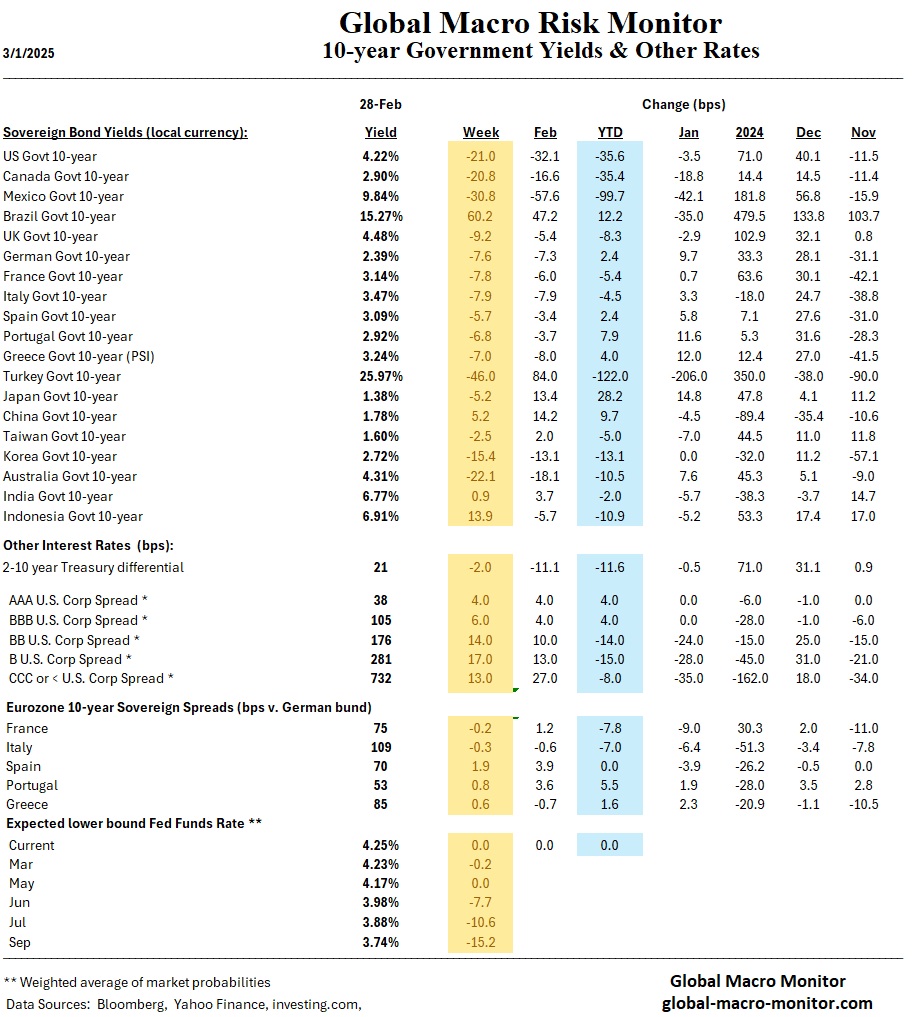

Interest Rates & Credit Markets

- Treasury yields declined, reflecting growth concerns and risk-off sentiment.

- Credit spreads widened, indicating higher investor caution.

- Market expectations for Fed rate cuts increased:

- 80% probability of a June cut.

- Three rate cuts priced in for 2025.

Global Market Trends

- Brazil’s Market Declines:

- Bovespa Index: -3.41%.

- Brazilian Real: -2.7%.

- 10-year bond yields: +60 basis points.

- Political uncertainty: Finance Minister Haddad’s influence is weakening, raising fears of looser fiscal policies.

- Japan’s Nikkei: -4.21%, hit by AI stock sell-offs and U.S. tariff concerns.

- Europe’s Mixed Performance:

- STOXX Europe 600: +0.60%.

- DAX (Germany): +1.18%.

- FTSE MIB (Italy): +0.61%.

- CAC 40 (France): -0.53%.

Economics: U.S. and Global

U.S. Economic Growth Concerns

- Atlanta Fed’s GDPNow Q1 estimate: Revised to -1.5%, down from +2.3%.

- Consumer Spending:

- Fell by 0.2% in January.

- Inflation-adjusted spending dropped 0.5%.

- Consumer Confidence:

- Conference Board Index dropped 7 points to 98.3 (steepest decline since August 2021).

- Expectations index fell below 80, a potential recession signal.

- 12-month inflation expectations surged from 5.2% to 6%.

Recession Signals from Bond Market

- 3-month/10-year yield curve remains inverted, signaling a potential downturn.

- PCE inflation slowed to 2.6% YoY, reinforcing rate cut expectations.

Brazil’s Economic Pressures

- Interest Rate Hikes: Selic rate at 13.25%, tightening corporate investment and spending.

- Political Risks: Speculation about a leftward fiscal policy shift increases investor caution.

- Weaker Investor Confidence: Brazil’s markets saw capital outflows amid policy uncertainty.

Week Ahead

Key U.S. Data Releases

- Monday (3/3): ISM Manufacturing Index.

- Wednesday (3/5): ISM Services Index, ADP Employment Report.

- Thursday (3/6): Weekly Jobless Claims, Trade Balance.

- Friday (3/7): Nonfarm Payrolls – Crucial for labor market assessment.

Market Risks

- March 4 Tariff Deadline:

- Trump’s planned tariffs on Canada, Mexico, and China could weigh on markets.

- Nasdaq’s Vulnerability:

- Recent sell-off may continue, though technical oversold conditions could trigger a bounce.

Global Events to Watch

- China’s Two Sessions (March 4-11): Key announcements on economic strategy and growth targets.

- ECB Meeting (March 7):

- Expected to cut rates to 2.50% amid weak eurozone growth.