Key Insights

- U.S. stock markets saw their fourth consecutive weekly decline, driven by recession fears and trade policy uncertainty.

- The Fed will keep rates unchanged, but inflation expectations have risen, raising concerns about stagflation.

- Eurozone faces economic headwinds, with ECB policymakers debating the timing of rate cuts amid geopolitical risks.

- Japan’s strong wage growth could lead to further interest rate hikes, while China struggles with deflationary pressures.

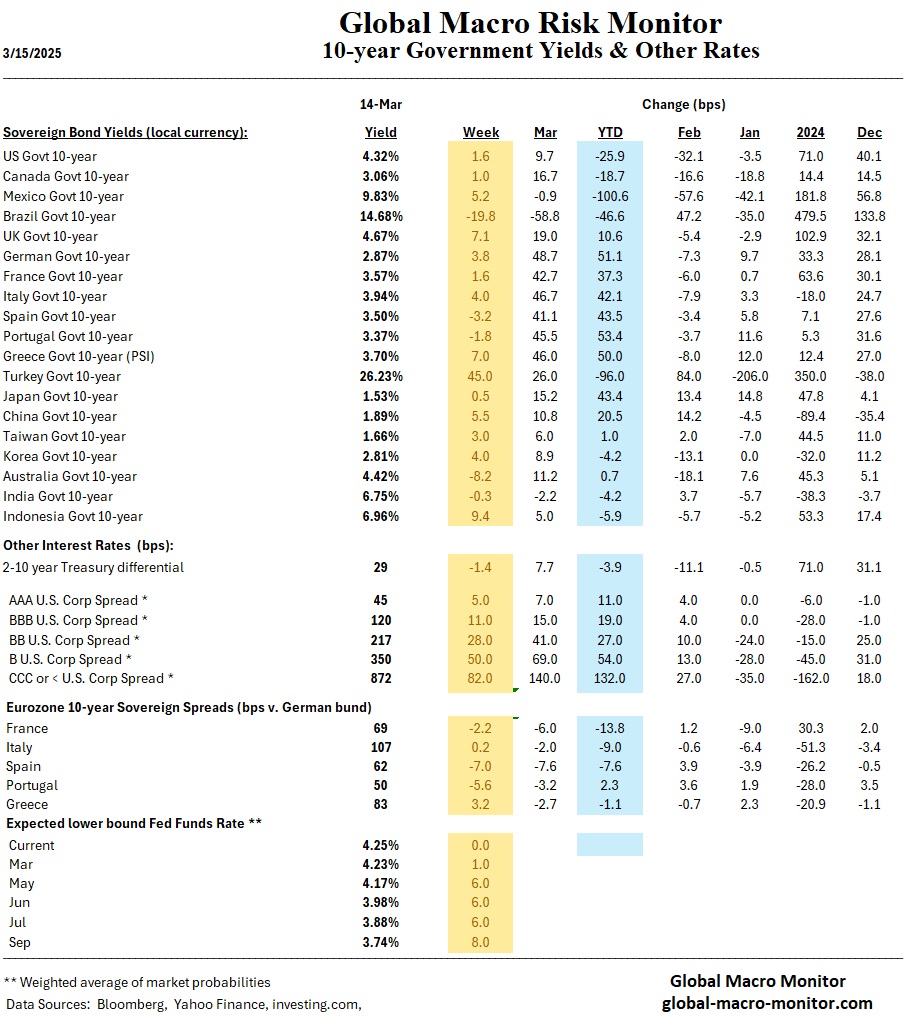

- Bond markets rallied on soft inflation data, but credit spreads widened amid economic uncertainty.

- Upcoming economic reports, including U.S. retail sales and industrial production, will shape market sentiment next week.

- Nvidia’s GTC conference and major corporate earnings will be key market movers in the tech sector.

- Financial conditions in the U.S. are tightening, as indicated by the Chicago Fed’s NFCI, reflecting widening credit spreads and declining equity prices.

Markets

The past week saw heightened volatility across global financial markets, driven by recession concerns, trade policy uncertainty, and mixed economic data.

- U.S. Stock Market Downturn: Major U.S. stock indices suffered losses, with the S&P 500, Nasdaq, and Dow Jones all recording weekly declines. The sell-off was fueled by persistent trade tensions and economic uncertainty, particularly surrounding the Trump administration’s new tariff announcements.

- Bond Market Movements: U.S. Treasuries advanced as lower-than-expected inflation data softened rate hike expectations. Investment-grade bond spreads widened, while municipal bonds underperformed due to seasonal weakness.

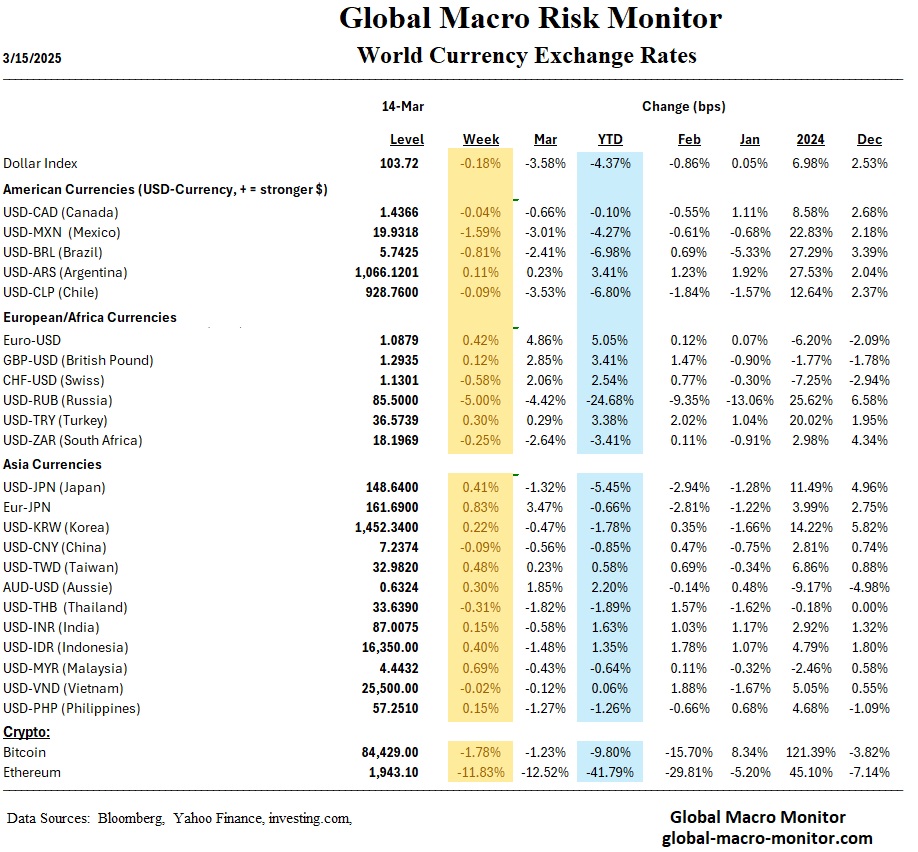

- European Equities Weakness: The STOXX Europe 600 Index fell by 1.23%, weighed down by concerns over U.S. tariffs impacting European exports. The ECB remains cautious on rate cuts, as inflation concerns persist.

- Japan & China Markets: Japan’s stock market posted modest gains, helped by a weaker yen boosting exports, but uncertainty over auto tariffs from the U.S. dampened sentiment. China’s markets rebounded on stimulus hopes, even as inflation data showed deflation risks.

Economics

Economic updates from key regions indicated slowing growth, inflation concerns, and monetary policy uncertainties.

- U.S. Inflation & Economic Sentiment: CPI data showed that consumer prices rose 0.2% in February, easing fears of stagflation. However, consumer sentiment plummeted, with inflation expectations climbing to 4.9%, the highest since November 2022.

- Eurozone Growth Challenges: The ECB’s future rate-cut path remains uncertain as policymakers worry inflation will stay above target. Germany’s new EUR 500 billion infrastructure plan aims to stimulate economic activity.

- Japan’s Wage Growth & Rate Outlook: Japan’s largest wage increase in three decades could push the Bank of Japan (BoJ) towards another rate hike later in the year.

- China’s Deflation & Trade Woes: Data suggests prolonged deflation risks, with consumer prices falling 0.7% YoY in February. Trade uncertainty with the U.S. remains a concern for China’s manufacturing sector.

- Emerging Market Trends: Latin America’s labor market shows strong momentum, but growth remains sluggish. Hungary’s inflation acceleration may delay central bank rate cuts.

The Week Ahead

Looking ahead, investors and policymakers will focus on key economic data and policy decisions.

- U.S. Federal Reserve Meeting (March 18-19): The Fed is expected to hold interest rates steady, but Chair Jerome Powell’s comments will be scrutinized for guidance on future rate cuts.

- Retail Sales & Economic Data Releases: Key reports include U.S. retail sales, industrial production, and housing market data. A weak retail sales print could reinforce recession concerns.

- Corporate Earnings & Market Events: Nvidia’s annual GTC conference and major earnings reports from Nike, FedEx, and Micron Technology will be in focus.

- Geopolitical & Trade Policy Developments: Markets remain on edge over further tariff escalations from the U.S. and updates on ceasefire talks in Ukraine.

Thank you!