Happy Easter, folks!

The Trump administration’s tariff strategy continues to function less as a deliberate trade policy and more as a volatile, reactionary experiment. Markets are grappling with a growing realization: there is no unified objective anchoring current U.S. trade actions. Is the administration trying to reshore manufacturing? Raise revenues? Or promote freer and fairer trade? All three goals conflict—and the markets know it. The result has been a weakening dollar, rising gold prices, and diverging capital flows.

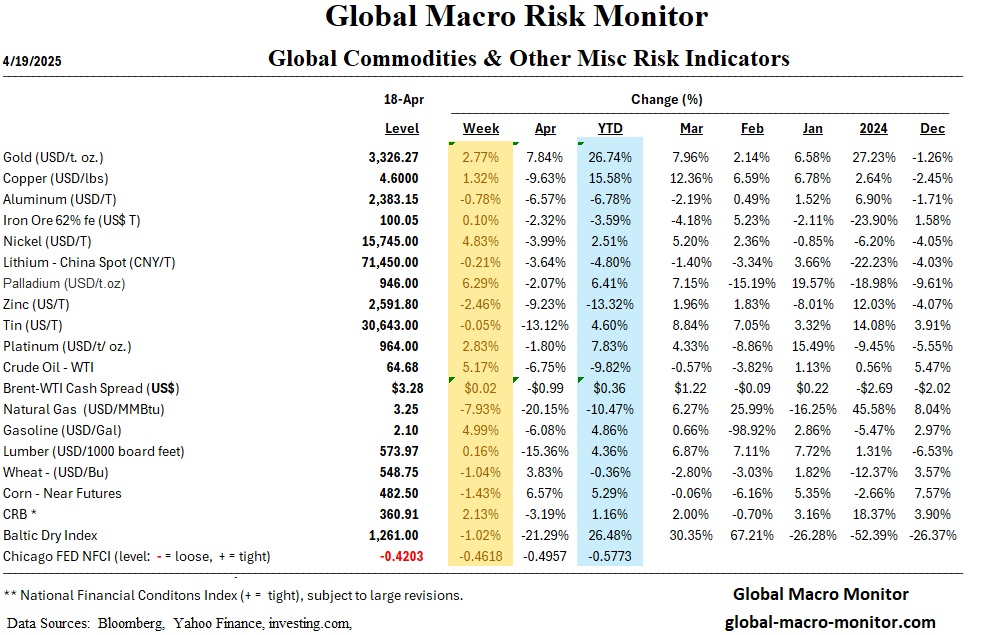

This week’s 3% rally in gold, alongside the sixth decline in seven weeks for the U.S. dollar, underscores a broader erosion of investor confidence in the U.S. policy framework. While U.S. bond yields stabilized and credit spreads modestly contracted, the underlying message remains clear: investors are hedging against deeper policy missteps. Until the administration resolves its own internal contradictions, volatility is likely to persist, and global capital will remain in search of clarity elsewhere.

The administration’s approach has produced a confusing cycle: new tariffs imposed, then partially reversed under pressure; sector-specific exemptions offered one week, then threatened again the next. The pause on semiconductor and electronics tariffs has done little to reassure investors given the lack of a consistent framework. Meanwhile, tariff-driven inflation threatens to stall growth just as the Fed tries to preserve monetary flexibility.

Market pressures may eventually force a strategic retreat. But until then, the White House appears more responsive to market headlines than to long-term macroeconomic outcomes. The central lesson of this week: instability is becoming structural.

Markets

U.S. Market Analysis

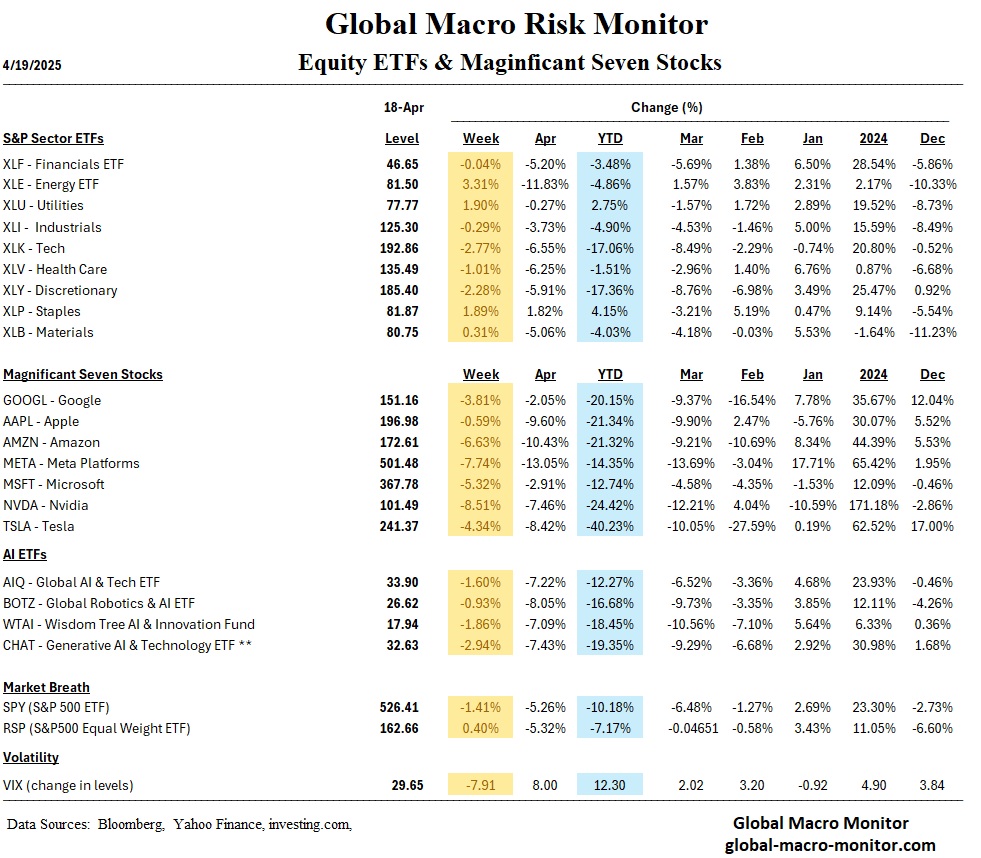

- Major indexes mixed: S&P 500 –1.5%, Dow –2.6%, Nasdaq –2.6%, Russell 2000 +1.1%.

- Sector rotation: Non-energy minerals and utilities outperformed; tech and consumer durables lagged.

- Gold surges: +2.8% % for the week, now up 26.7% YTD as investors seek protection from U.S. policy risk.

- Dollar decline accelerates: USD hits a three-year low, now down 8.5% YTD.

- Bond market stable: Yields declined across maturities. 10Y Treasury at 4.33%, credit spreads modestly narrower.

Global Market Analysis

- Europe: STOXX 600 +3.9%. ECB cuts deposit rate to 2.25%, signals more easing. Italy +5.74%, Germany +4.08%.

- Asia:

- Japan: Nikkei +3.4%, cautious BoJ; yen strengthens amid trade tension.

- China: Shanghai +1.19%; Q1 GDP +5.4%, but driven by pre-tariff demand. Stimulus expected.

- Emerging Markets: Risk-off sentiment persists, but no major capital dislocations yet.

Economics

U.S. Economic Overview

- Retail sales jump 1.4%, possibly boosted by pre-tariff buying.

- Fed holds line: Powell warns tariffs will raise inflation and lower growth. June rate cut still base case.

- Housing deteriorates: Housing starts –11.4% in March; builder confidence remains weak.

- Dollar weakness raises inflation risk, complicating Fed strategy.

Global Economic Overview

- ECB turns dovish: Rate cut to 2.25%, signals 2.0% likely by June.

- BoJ cautious: Trade risk delays rate hikes.

- BoC stays on hold: Canada acknowledges potential recession in trade war scenario.

- UK inflation drops to 2.6%, labor data softens. BoE likely to cut in May.

Week Ahead (April 21–25)

Key U.S. Events:

- Economic Data:

- Mon: Leading Indicators

- Wed: New Home Sales, Crude Inventories

- Thu: Jobless Claims, Durable Goods, Existing Home Sales

- Fri: University of Michigan Sentiment

- Earnings Highlights:

- Tesla (Tue), Alphabet (Thu), IBM, Intel, P&G, Boeing, PepsiCo, Merck

Key Global Events:

- Japan CPI: Friday – gauge of BoJ direction

- Eurozone PMIs: Wednesday – growth and inflation barometer

- Tariff Headlines: Potential trade deal news remains the primary wildcard