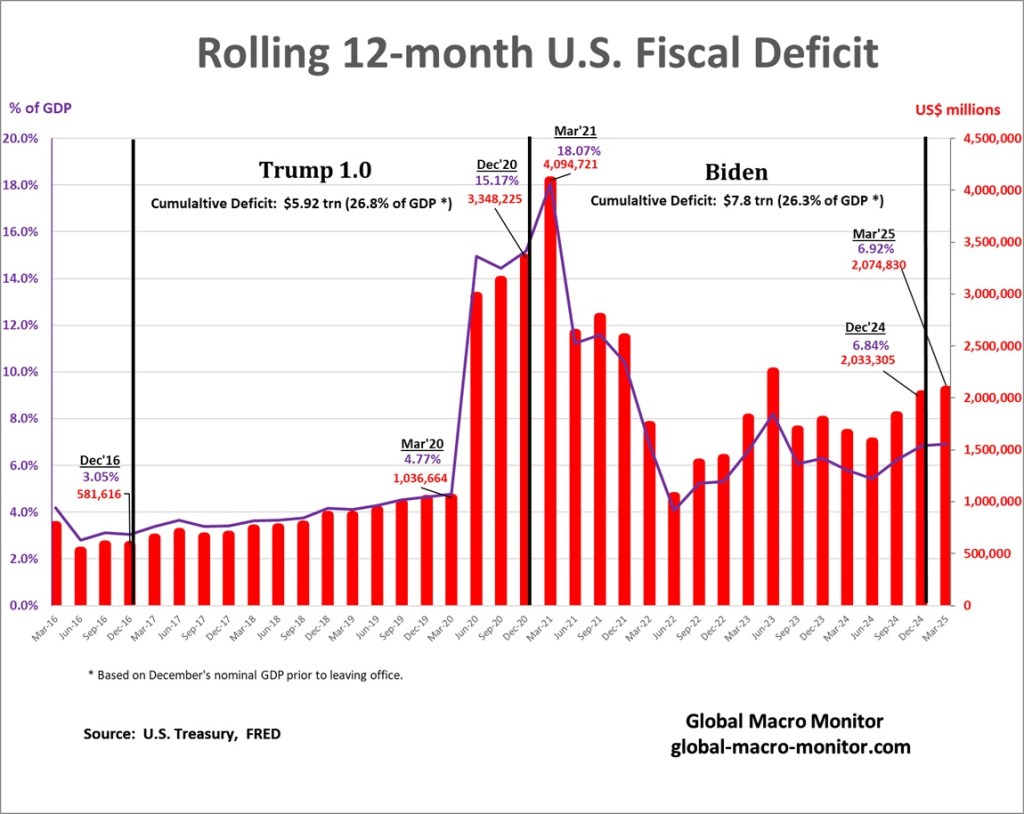

When President Donald Trump took office in January 2017, he inherited a relatively stable fiscal environment. The federal budget deficit stood at approximately $581 billion, or 3.05% of GDP—a level widely regarded as sustainable by historical standards. Ironically, that same 3.0% benchmark has since resurfaced as the stated deficit target for the Trump 2.0 administration.

Trump 1.0

Early in his first term, President Trump pledged to restore fiscal discipline and reduce the deficit. However, those ambitions quickly faded amid sweeping legislative changes. The passage of the Tax Cuts and Jobs Act of 2017 reduced federal revenues, particularly from corporate and individual income taxes, while discretionary spending, most notably on defense, continued to climb. As a result, the deficit steadily expanded throughout Trump’s first term.

COVID Deficits

The fiscal situation worsened dramatically in 2020 with the outbreak of the COVID-19 pandemic. In response to the public health emergency and economic shutdowns, the federal government launched a series of massive relief packages, including direct stimulus payments, enhanced unemployment benefits, and business assistance programs. While these measures were crucial in mitigating the economic fallout, they came at a steep fiscal cost. By March 2020, the rolling 12-month deficit had already reached $1.036 trillion (4.77% of GDP). Within months, it ballooned to $3.35 trillion, or 15.17% of GDP, by the end of Trump’s first term.

Federal Reserve Financing of COVID Deficits

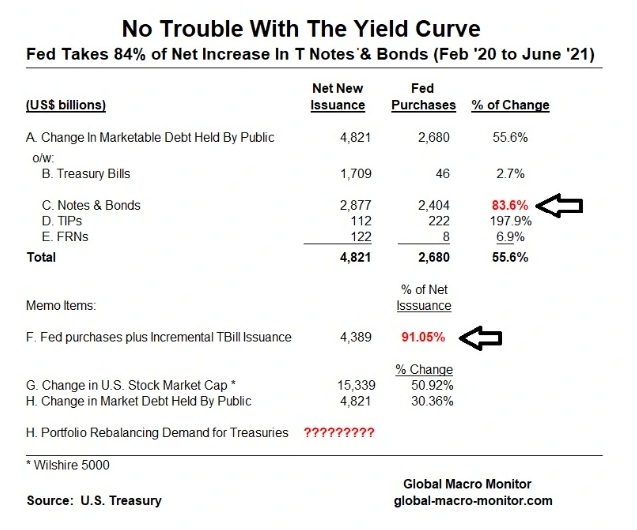

This explosion in borrowing marked the largest one-year deficit expansion since World War II, underscoring the magnitude of the crisis and the aggressive fiscal response. What began as an effort to rein in a manageable deficit quickly morphed into an era of unprecedented federal borrowing, all or most of it monetized by the Federal Reserve, laying the groundwork for subsequent inflationary pressures and long-term fiscal challenges (see, No Trouble… table below).

Biden Administration

President Joe Biden inherited this fiscal turbulence, taking office with a deficit nearing 15% of GDP. His administration enacted additional large-scale spending, including the American Rescue Plan, while also attempting to wind down pandemic-era outlays. Although the deficit declined from its peak, it remained far above pre-pandemic norms. By December 2024, at the close of Biden’s term, the rolling 12-month deficit was $2.03 trillion (6.84% of GDP) and ticked up slightly to $2.07 trillion (6.92% of GDP) by March 2025. The cumulative deficit during Biden’s tenure reached $7.8 trillion, or 26.3% of GDP, mirroring the scale of Trump’s borrowing.

Fiscal Revenues

On the revenue side, thus far during FY 2025 (October 2024–April 2025), individual income taxes were the largest source, totaling $1.681 trillion, up 7.0% from the prior year. Social insurance and retirement receipts followed at $1.018 trillion (+3.5%), while customs duties surged 34.4%, likely reflecting renewed tariff enforcement. In contrast, corporate tax revenues fell 9.2%, signaling economic softness or increased use of tax offsets.

Government Expenditures

On the spending side, the Department of Health and Human Services led all agencies at $1.058 trillion, a 10.7% year-over-year increase. Social Security expenditures rose 8.7% to $945 billion, and interest on the national debt jumped 9.6% to $684 billion—now exceeding defense spending ($509 billion) by over 30%, highlighting the growing weight of debt service in an era of higher interest rates.

In sum, the U.S. fiscal trajectory over the last two presidential terms has shifted from post-recession recovery under Obama to crisis-driven deficits under Trump, and into a structurally imbalanced, high-deficit environment under Biden. The road ahead requires confronting unsustainable entitlement growth, rising interest burdens, and sluggish revenue expansion, while safeguarding the broader economic foundation.

The big question is: can we get there before investors throw in the towel and a bond market crisis erupts?

Stay frosty, folks.

FED Financing of COVID Deficits