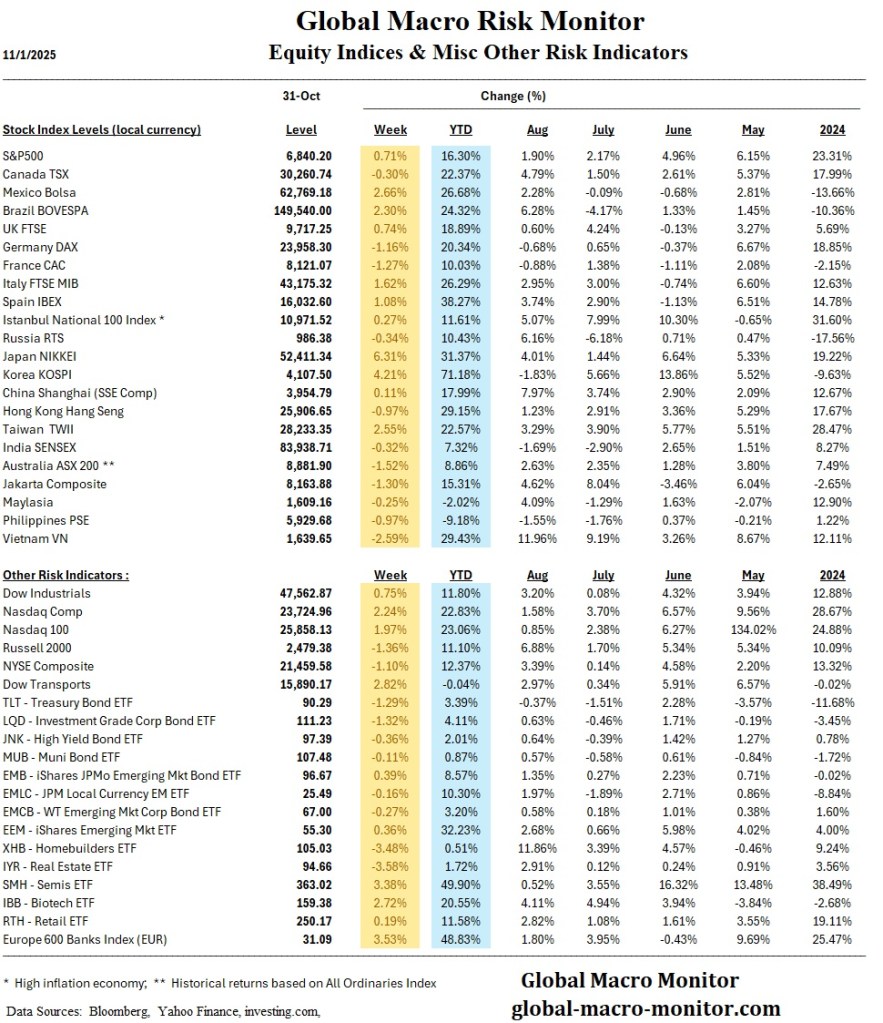

Global markets ended the week mixed as a U.S.–China trade truce and a widely anticipated Federal Reserve rate cut drove both relief and uncertainty. While U.S. equities held near record highs, global sentiment was tempered by uneven central bank actions and signs of slowing global trade momentum. Investors are navigating a “fog of policy”—one where monetary and trade decisions, rather than economic fundamentals, continue to dominate asset prices.

The disinflation trend remains intact across advanced economies, but diverging growth patterns suggest that synchronized easing may be harder to sustain. The United States remains resilient, Europe stabilizes modestly, Japan shows strength under policy continuity, and China grapples with soft demand and fading stimulus traction.

Regional Highlights

United States

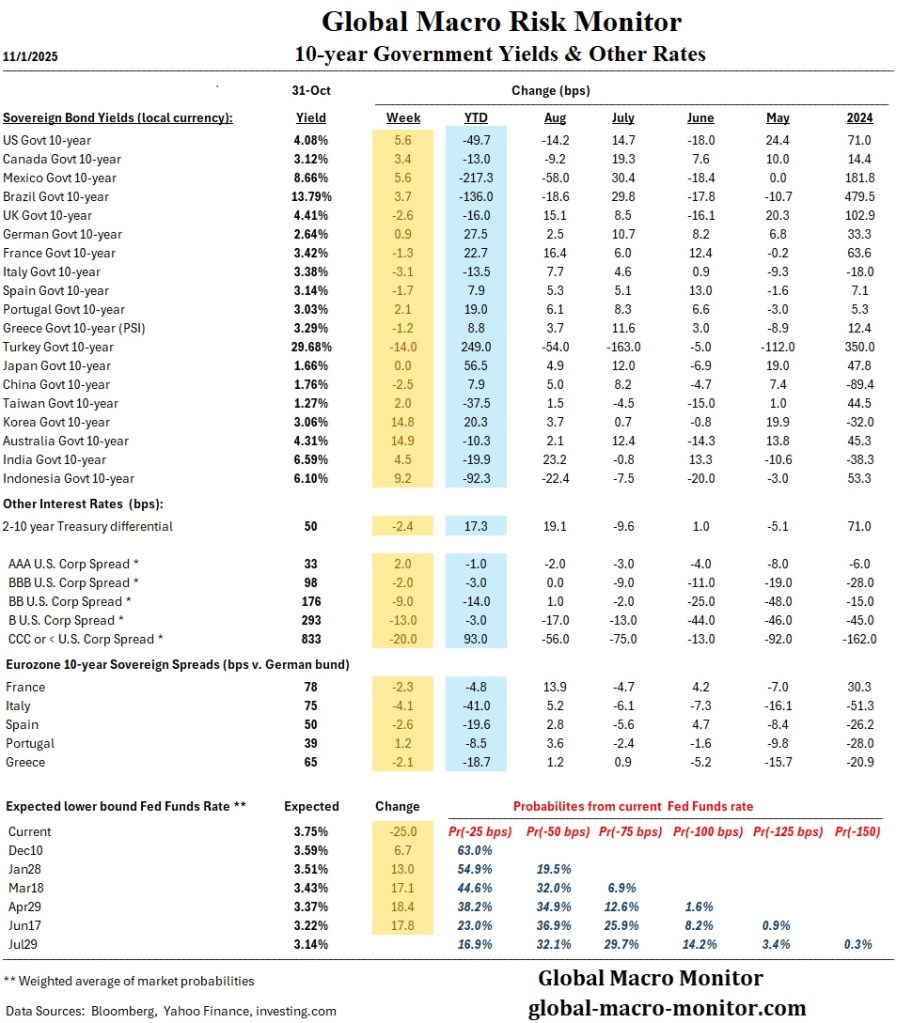

- The Federal Reserve cut the target range for the federal funds rate by 25 bps to 3.75%–4.00%, marking a second consecutive easing.

- Chair Jerome Powell emphasized that a December cut “is not a foregone conclusion,” reflecting a widening split within the FOMC.

- The government shutdown, now exceeding 30 days, has delayed major economic data releases including GDP, PCE, and employment figures.

- Consumer confidence fell for a third month to 94.6, a six-month low, with pessimism over job prospects rising.

- Pending home sales were flat in October, and mortgage rates edged back above 6% following the Fed’s hawkish tone.

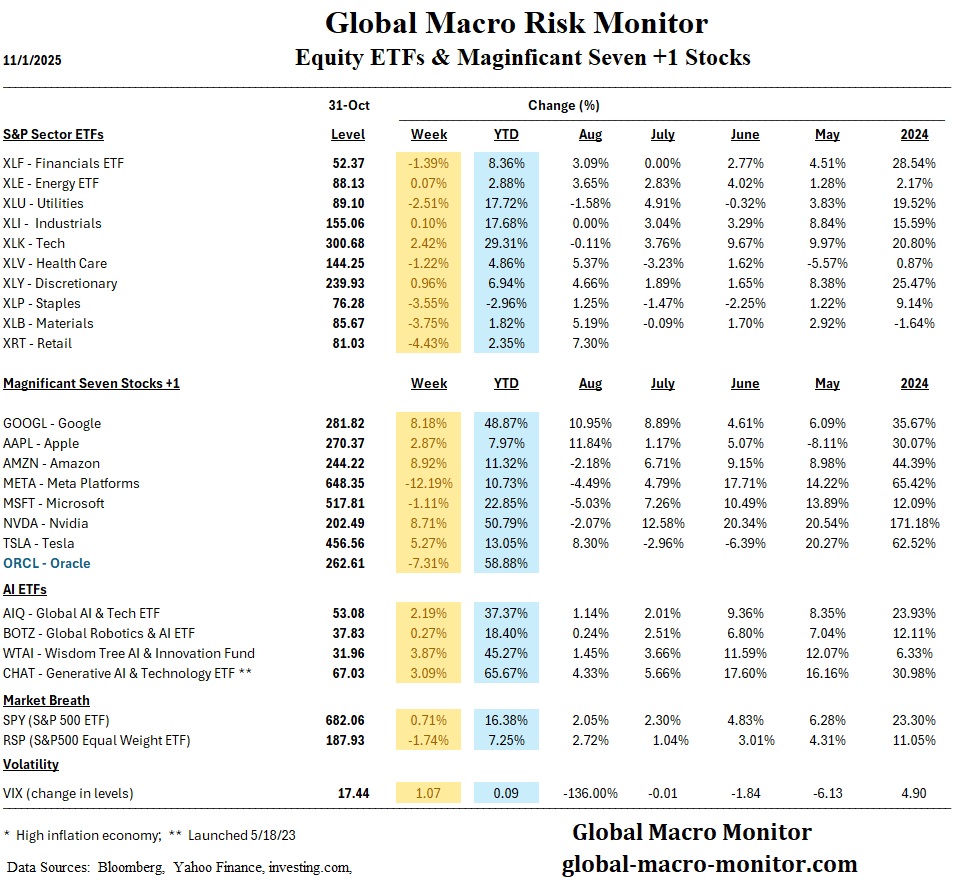

- Earnings season remains strong: roughly 82% of S&P 500 firms beat EPS expectations, with average EPS growth of 10.7%.

- Amazon and Google fared well after their earnings release, while Mr. Softee and Meta got hammered.

- Market breadth narrowed sharply as the S&P 500 hit new highs, yet only 56% of its components trade above their 200-day average.

Europe

- The ECB held rates steady at 2.00%, reiterating a data-dependent stance.

- Eurozone GDP grew 0.2% QoQ and 1.3% YoY, slightly above consensus, supported by France and Spain.

- Headline inflation slowed to 2.1%, with core CPI at 2.4%; services inflation remains sticky at 3.4%.

- The UK housing market showed resilience, with Nationwide HPI up 0.3% MoM, while mortgage approvals reached a nine-month high.

Japan

- Nikkei 225 rose 6.3% for the week and 16.6% for October, its best month since 1994.

- The BoJ held its policy rate at 0.50%, maintaining a cautious stance amid stronger Tokyo inflation (2.8% YoY).

- Governor Ueda noted upside risks tied to wage talks and tariffs, while Finance Minister Katayama issued warnings over yen volatility.

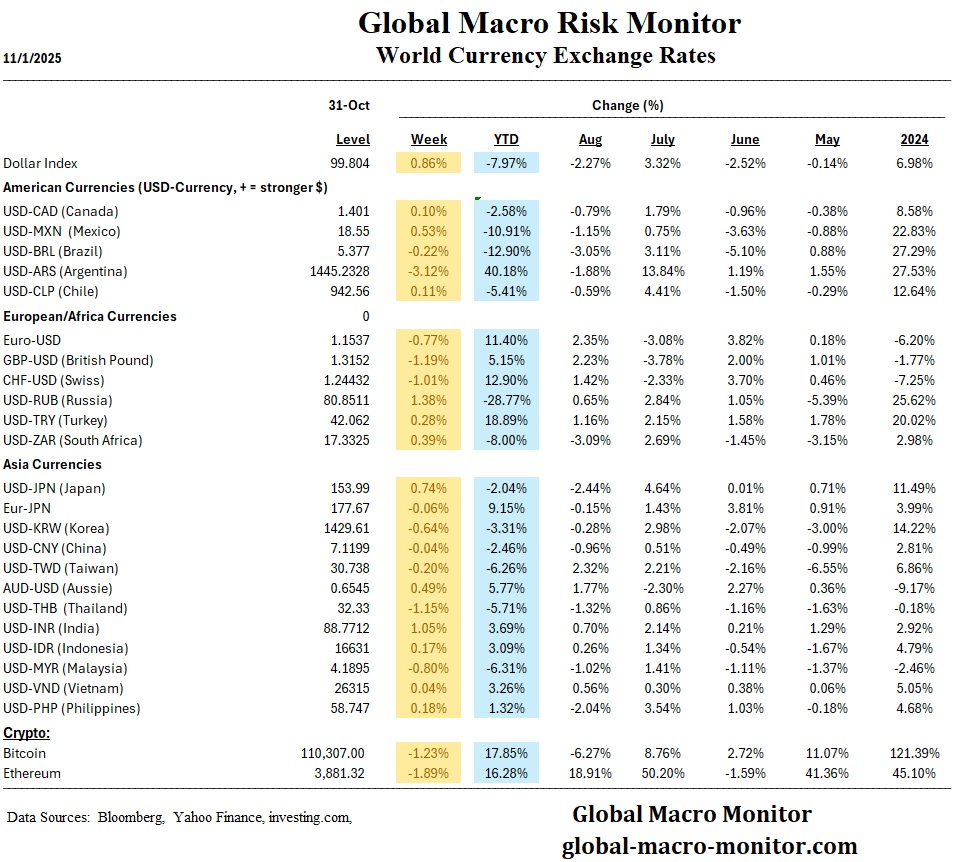

- The yen weakened to ¥154 per USD, and retail sales rebounded 0.5% YoY.

China

- Mainland markets were mixed; the CSI 300 fell 0.4%, while the Shanghai Composite gained 0.1%.

- October manufacturing PMI slipped to 49.0, signaling continued contraction, while the non-manufacturing PMI inched up to 50.1.

- Following the Xi–Trump meeting, limited progress was made—tariff relief was modest, and export controls on chips remain intact.

- Policymakers pledged to re-orient growth toward domestic demand and consumption, though concrete measures were lacking.

Emerging Markets

- Argentina’s midterms strengthened President Milei’s reform mandate, with his coalition securing 41% of congressional seats.

- Chile’s central bank held rates at 4.75%, citing mixed domestic data but improved external conditions and rising copper prices.

- South Africa’s external trade position improved amid higher commodity revenues.

- Banxico is expected to cut rates by 25 bps to 7.25% this week, following weak Q3 GDP and subdued inflation.

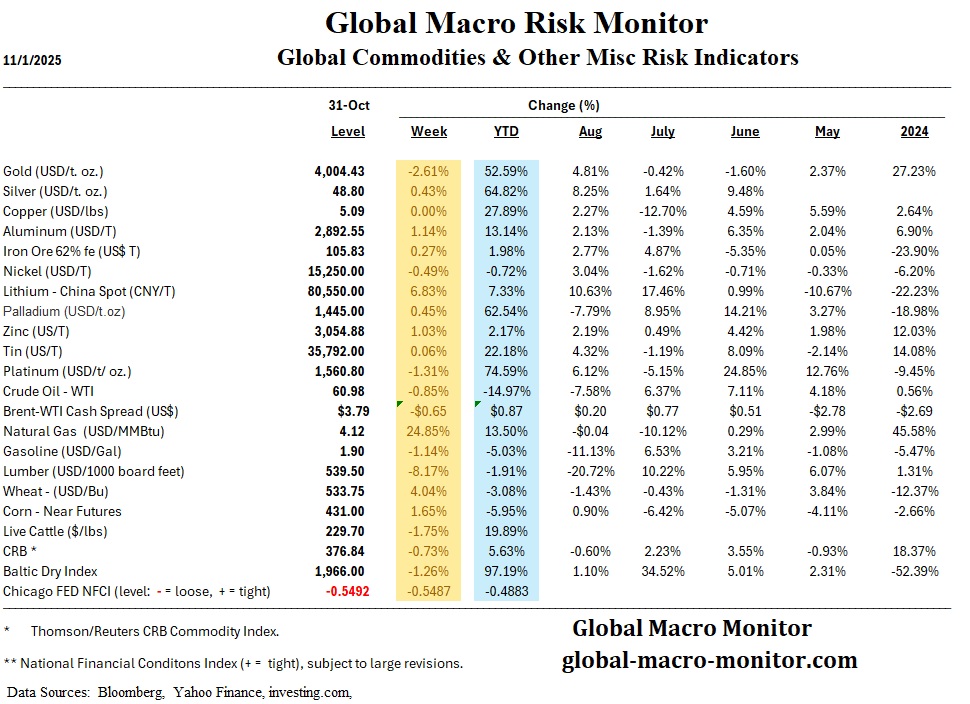

Commodities & FX

- Oil fell early on OPEC+ output concerns but rebounded on lower U.S. inventories and trade optimism.

- Natural Gas rose 25 percent on the week on expectations of a frigid U.S. winter

- Gold declined for a second straight week but remains +3% for October.

- Bitcoin retreated 6% after recent gains, while Visa announced expanded stablecoin integration across 40+ countries.

- The dollar strengthened modestly on Powell’s hawkish comments, while the yen and euro softened.

Week Ahead (November 3–7, 2025)

U.S. Events

- ISM Manufacturing (Mon) – Expected to remain in contraction near 49.0, reflecting tariff pressures and slowing new orders.

- ISM Services (Wed) – Forecast flat at 50.0, with AI-related demand offsetting tariff drag.

- Treasury Refunding Announcement (Wed) – Focus on issuance mix and implications for yield curve steepening.

- Jobless Claims (Thu) and Employment Report (Fri) – Data scarcity from the shutdown limits reliability; private estimates suggest modest hiring softness.

- Earnings Highlights – Reports from Palantir (Mon), AMD (Tue), Toyota (Wed), AstraZeneca (Fri).

Global Events

- RBA Meeting (Tue) – Expected hold at 3.60%, following hotter-than-expected Q3 inflation.

- BoE Meeting (Thu) – Likely to stay at 4.00%, but markets eye a possible December cut.

- Banxico Meeting (Thu) – Expected 25 bps cut to 7.25% amid weak growth.

- China Trade & PMI Data (Thu–Fri) – Key test for domestic demand momentum and post-summit sentiment.

- Eurozone Retail Sales (Fri) – Could validate modest recovery trends seen in Q3 GDP.

Key Takeaway

Markets are recalibrating expectations: central banks are still easing, but hesitantly; fiscal drag, trade frictions, and data gaps complicate visibility. Investors should expect volatility as the U.S. navigates the fallout from the shutdown, earnings season matures, and policy “fog” lingers into year-end.