Global economic activity showed mixed momentum, with markets navigating a choppy week shaped by the end of a prolonged 43-day U.S. government shutdown and increasingly hawkish Federal Reserve communications. U.S. equities initially rallied on optimism but ultimately ended broadly flat to slightly lower, while bond markets adjusted to fading expectations of a December rate cut. International data presented uneven growth signals, and several regions continued to struggle with inflation pressures and policy uncertainty.

Global Markets

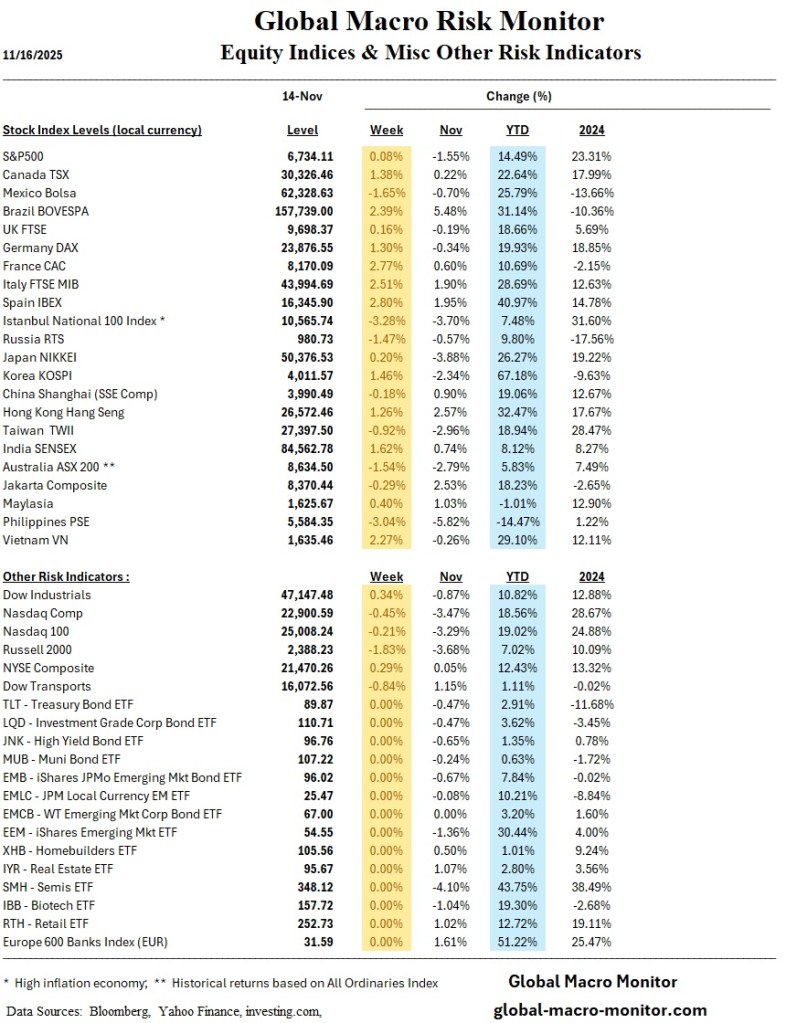

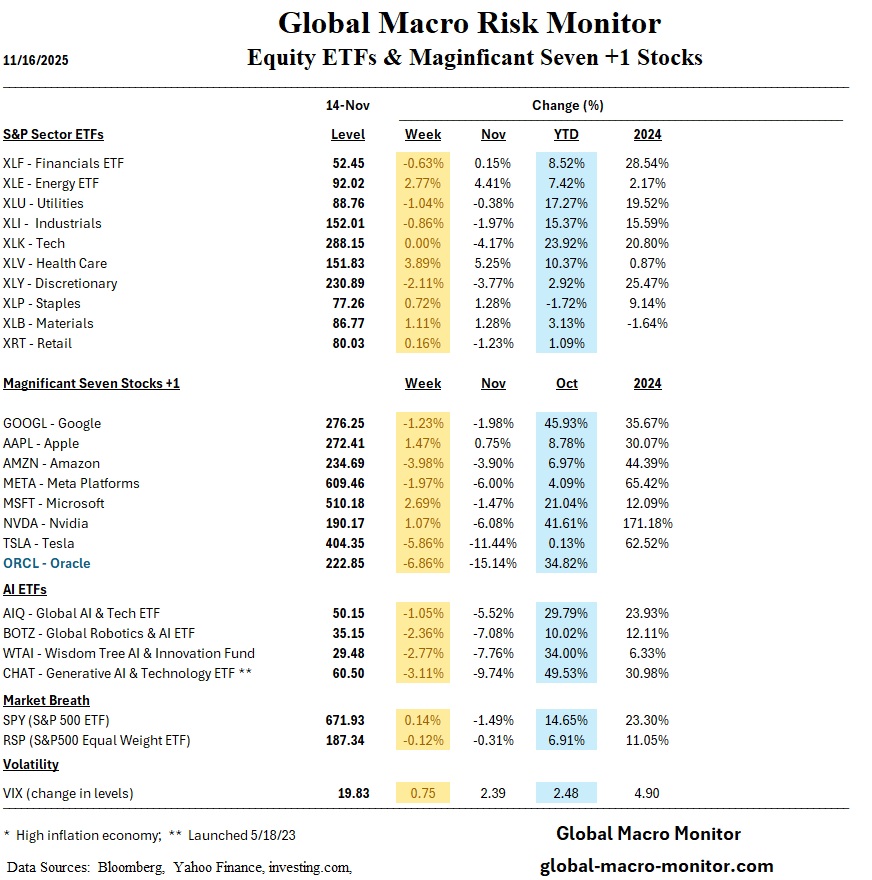

- Markets experienced volatility: early-week rallies faded by Thursday’s sell-the-news reaction after the U.S. government reopened, leaving the S&P 500 and Dow marginally higher for the week and the NASDAQ slightly lower.

- Market breadth improved modestly, with more stocks trading above 200-day moving averages across the S&P 500, Nasdaq, and Russell 2000 indices

- Global activity indicators were mixed: UK growth held modestly, Australia’s labor market strengthened, while China’s activity continued to soften

Regional Highlights

United States

- Federal Reserve:

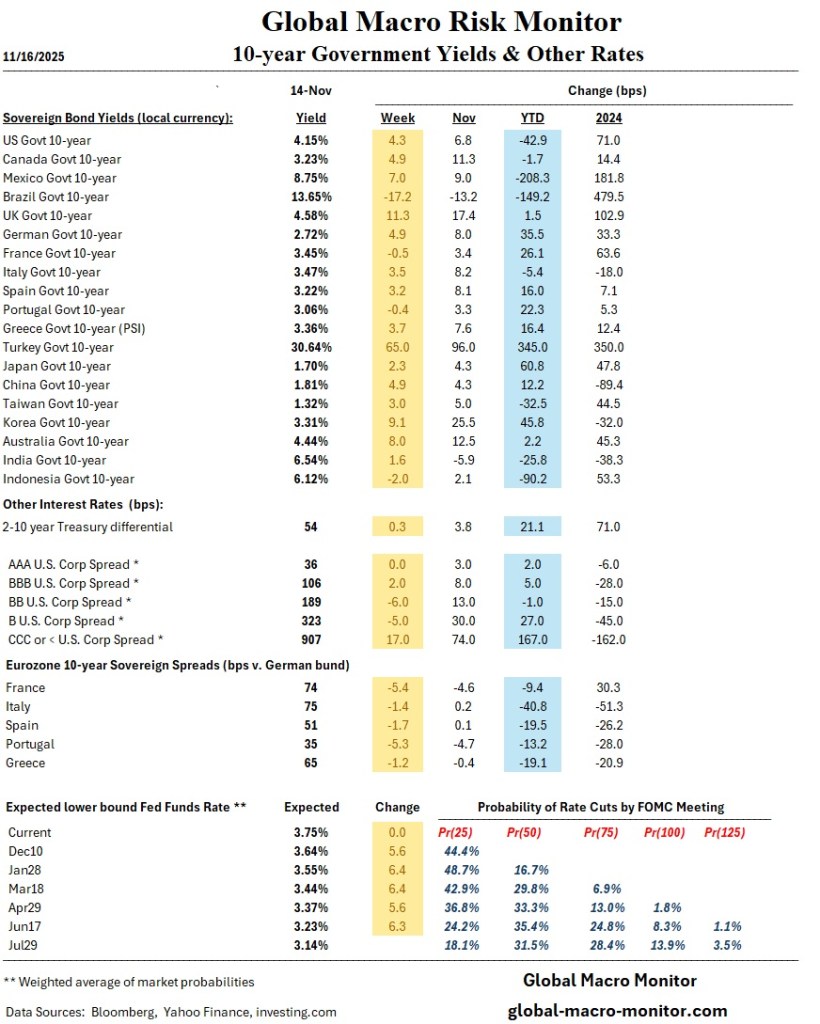

- Multiple Fed officials sent hawkish signals, sharply reducing expectations of a December rate cut. Probabilities fell from ~63–70% to roughly 41–46% during the week.

- Officials emphasized lingering inflation risks and uncertainty due to data gaps caused by the shutdown

- Economic Indicators

-

- CPI data release delayed; estimates point to +0.2% MoM and 3.0% YoY inflation; core CPI nowcast at +0.3%.

- PPI expected +0.2% MoM, reversing -0.1% prior month

- Initial jobless claims slightly improved week-over-week.

- Government shutdown resolution will slowly clear data backlogs, with the September jobs report scheduled for release November 2.

- Market Performance:

- Early-week equity rally driven by shutdown-ending progress; tech led initial gains before rotating out later in the week.

- Treasury yields rose slightly after hawkish Fed commentary

Europe

- UK reported modest Q3 growth with slowing wage gains—part of broader mixed global activity data.

- Romania kept its policy rate at 6.50%, facing elevated inflation (9.76% in October) driven by VAT hikes and removal of electricity price caps. Policymakers foresee modest declines in inflation over coming quarters

Japan

- Japan GDP release scheduled for the following Monday, noted as a key upcoming data point in the global calendar

- No additional Japan-specific data was included in the visible excerpts.

China

- China’s activity data “continued to soften,” signaling ongoing demand challenge.

- Trade- or manufacturing-specific details were not included in the retrieved excerpts.

Emerging Markets

- Romania highlighted as maintaining steady rates amid “high uncertainties and risks,” with inflation well above desired levels due to energy policy shifts and tax increases.

- No additional emerging-market political or macro developments were present in the visible material.

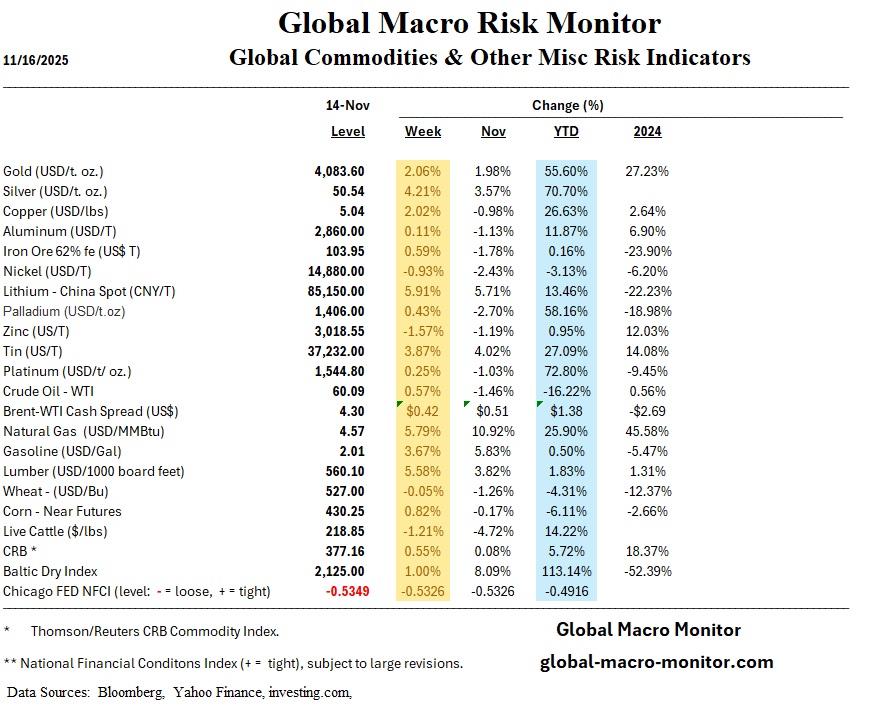

Commodities & FX

- Oil: EIA crude oil inventories rose by +6.41 million barrels.

- Natural Gas: EIA natural gas inventories increased by +45 bcf

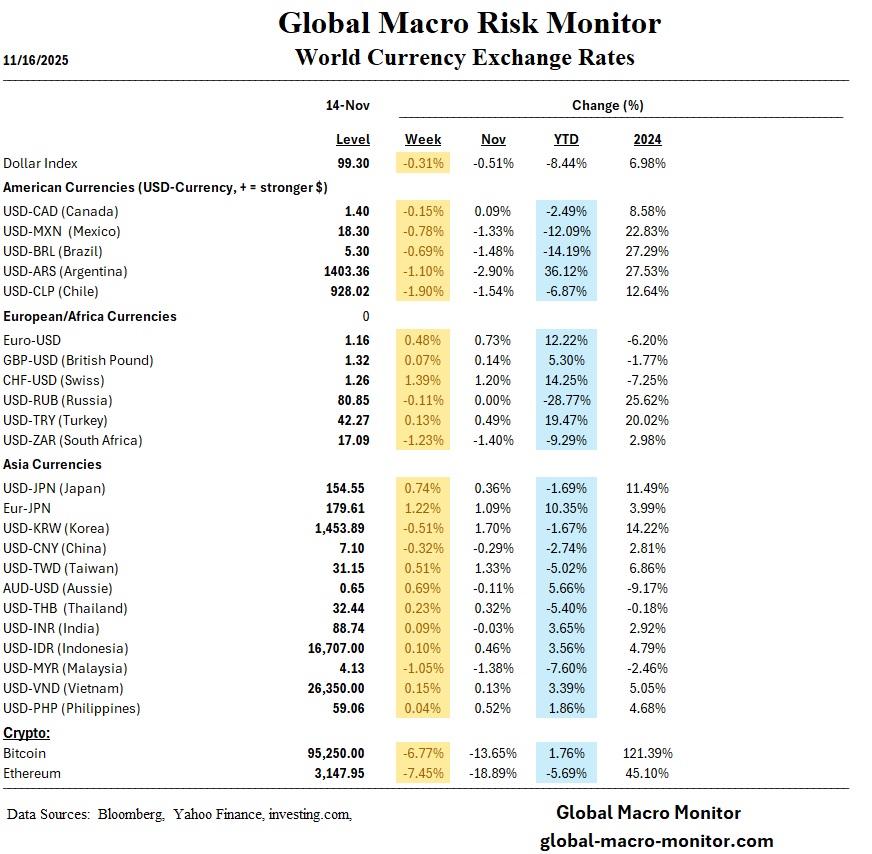

- Gold/BTC: Gold rose 2 percent and is now up over 50 percent on the year, a major outperformance relative to Bitcoin, which is up only 2 percent in 2025.

Week Ahead

- United States:

- Nonfarm Payrolls expected Tuesday or Wednesday; Existing Home Sales on Thursday.

- Global:

- Japan GDP (Mon.)

- Canada CPI (Mon.)

- Eurozone PMIs (Fri.)

- U.S. Data Backlog:

- September jobs report scheduled for November 20; additional delayed releases remain unscheduled due to shutdown disruptions