Global markets navigated a risk-off week marked by renewed doubts over the durability of the AI-driven equity rally, rising volatility, and shifting expectations for a December U.S. rate cut. Strong corporate earnings failed to offset investor concerns about inflated tech valuations, while global activity indicators suggested modest but uneven momentum. Several asset classes exhibited outsized weekly moves, underscoring fragile sentiment across risk markets.

GLOBAL MARKETS

- Equities broadly declined, led by tech-heavy indices:

- NASDAQ −2.7%, pressured by AI valuation concerns.

- Hang Seng −5.0%, CSI 300 −3.1%—sharp reversals in China-linked tech names.

- Major European benchmarks also weakened: DAX −3.29%, FTSE MIB −3.03%, CAC 40 −2.29%.

- Mega-cap divergences:

- Google +8.47% posted standout strength.

- Oracle −10.81% saw the week’s largest drop among major tech names, reflecting tightening credit conditions around AI infrastructure.

- Market volatility rose:

- VIX climbed to ~28 midweek before settling near 23.

REGIONAL HIGHLIGHTS

United States

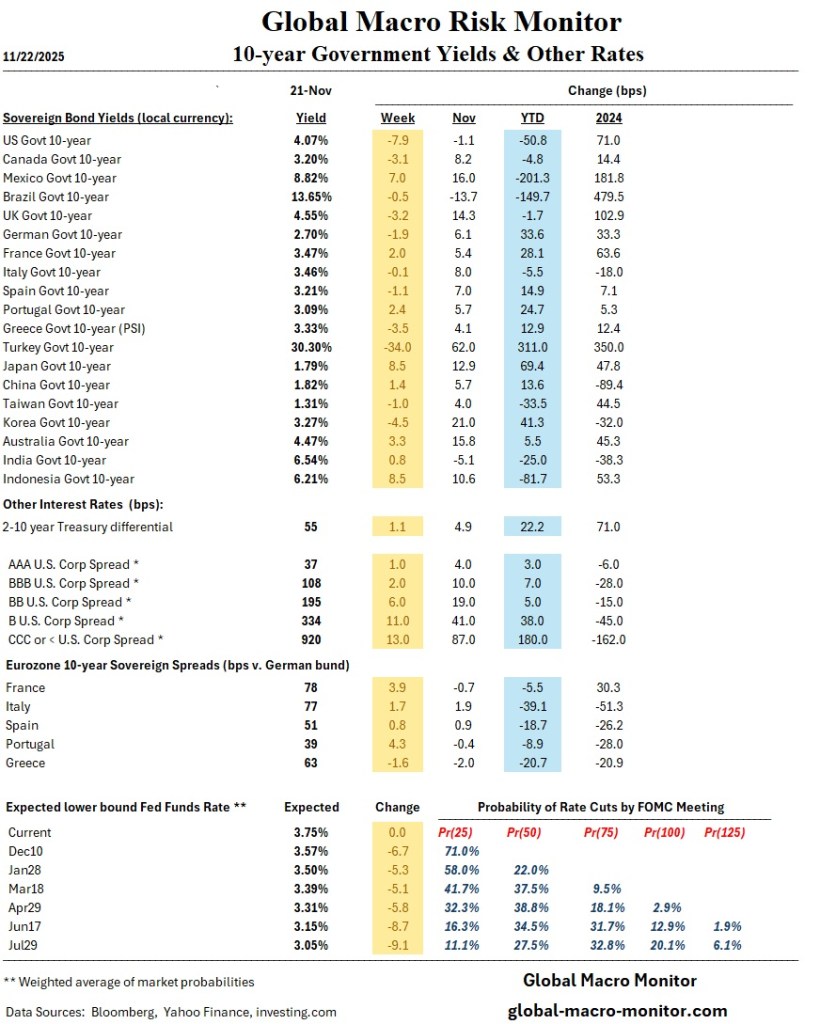

- Federal Reserve:

- December cut expectations rose to ~70%, reversing earlier hawkish interpretations of FOMC minutes.

- Fed officials acknowledged softening labor conditions but emphasized persistent inflation risks.

- Economic Indicators:

- Delayed September jobs report: +119k payrolls (well above expectations); unemployment rose to 4.4%.

- Treasury yields fell late week: 10-year −7.9 bps, supporting bonds.

- Market Performance:

- S&P 500 −1.95% on the week, tech lagged, and breadth weakened.

Europe

- Macro Data:

- Eurozone PMI composite held at 52.4, signaling steady expansion with weak manufacturing (49.7).

- Consumer confidence remained at an 8-month high (−14.2).

- Inflation & Policy:

- UK CPI fell to 3.6%, reinforcing expectations of further BoE easing.

- Equities declined broadly: Germany and Italy posted some of the steepest weekly losses.

Japan

- Markets:

- Nikkei −3.48%, pressured by sharp declines in AI-linked firms.

- Policy & Data:

- Government approved a ¥21.3T fiscal package; yields climbed as the 10-year JGB hit 1.78% (a 17-year high).

- Core CPI remained elevated at 3.0%.

China

- Equities:

- CSI 300 and Shanghai Composite suffered weekly losses (−3.77% and −3.90%) amid fading AI enthusiasm and deepening property-sector concerns.

- Policy:

- Authorities considering new nationwide mortgage subsidies and tax adjustments to stabilize the housing market.

EMERGING MARKETS

- Turkey 10-year yield fell +30 bps, the largest global weekly rate decline.

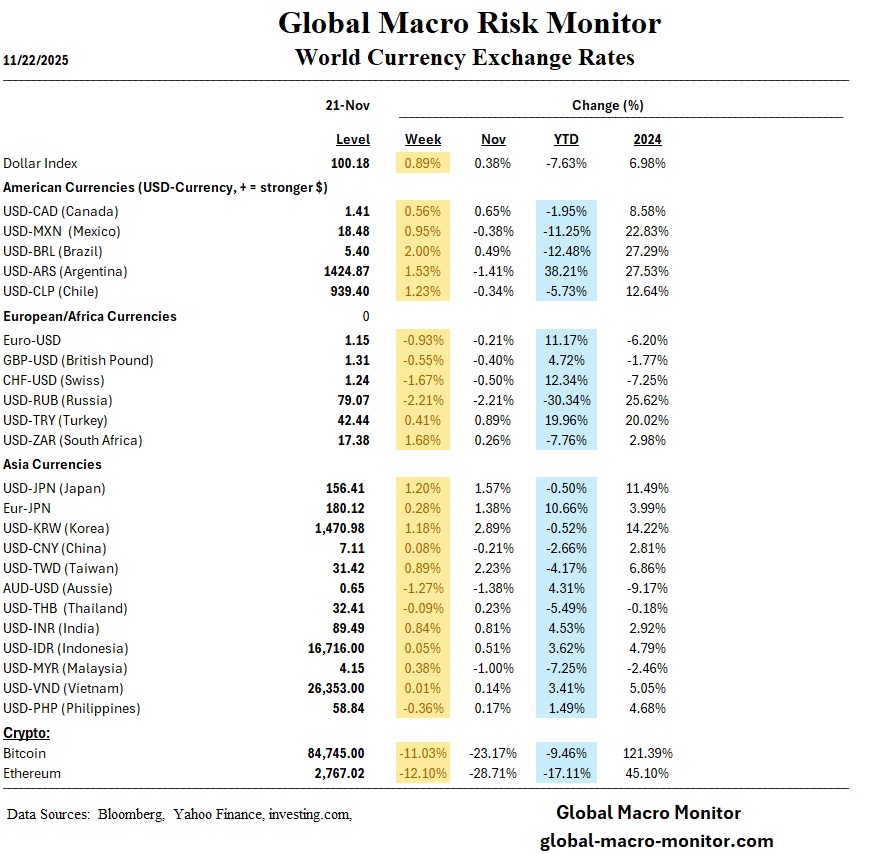

- Argentina peso weakened +1.53%, reflecting persistent macro volatility.

- South Africa cut rates, citing an improved inflation outlook and steadier domestic demand.

COMMODITIES & FX

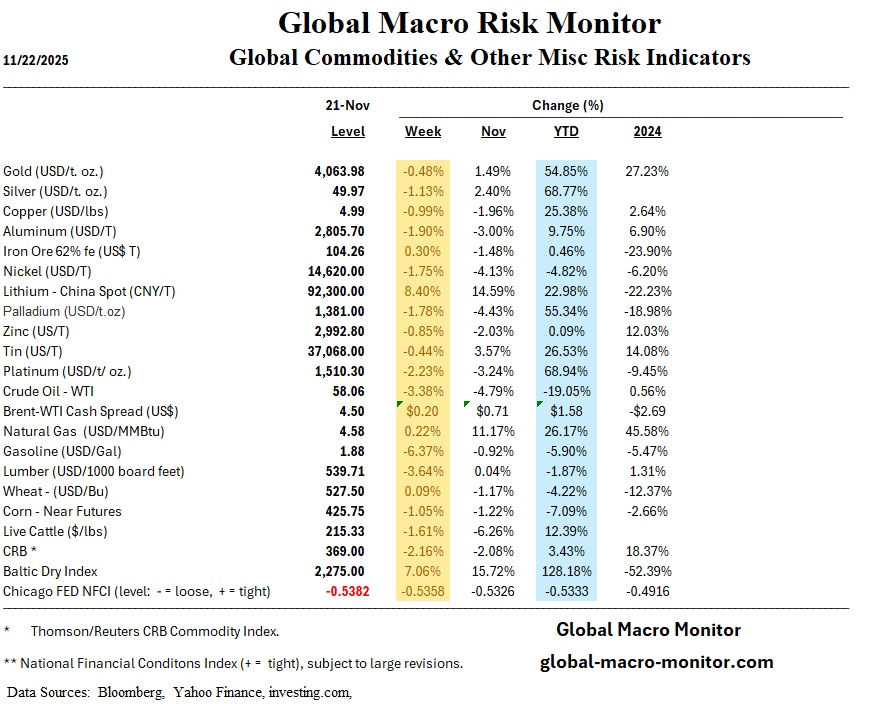

- Oil: WTI −3.38%, Brent spread increased (+$0.71), reflecting softer demand and geopolitical repricing.

- Metals:

- Lithium +8.4% was the week’s strongest commodity move.

- Gold remained stable (−0.48%).

- FX:

- USD broadly strengthened: USD/JPY +1.20% on Japan fiscal slippage; Dollar Index +0.89%.

- Crypto:

- Bitcoin fell −11.03%, extending a multiweek decline to near 7-month lows.

WEEKLY THEMES & OUTSIZED MOVES

AI Valuation Stress Drives Global Tech Reversal

- Oracle (−10.81%), Nvidia (−5.94%), and META (−7.50%) highlight a broad re-rating of AI infrastructure names.

- Asia tech mirrored the selloff: Hang Seng Tech-heavy components down >3%.

Risk-Off Flows Boost Bonds & USD

- U.S. 10-yr yield fell −7.9 bps, one of the sharpest G10 moves.

- Dollar strength broad-based—pressure particularly notable in EM FX.

Commodity Divergence

- Lithium’s +8.4% surge vs. WTI’s −3.38% fall signals diverging supply/demand narratives across raw materials.China Property Drag Returns

- Housing data deterioration and policy rumors reignited downside pressure across Chinese equities.

WEEK AHEAD

- U.S. data heavy: GDP 2nd estimate, PCE, durable goods, consumer confidence, jobless claims.

- Eurozone PMIs and UK fiscal commentary in focus.

- Japan inflation and fiscal implementation developments to shape JPY volatility.