KEY ISSUES

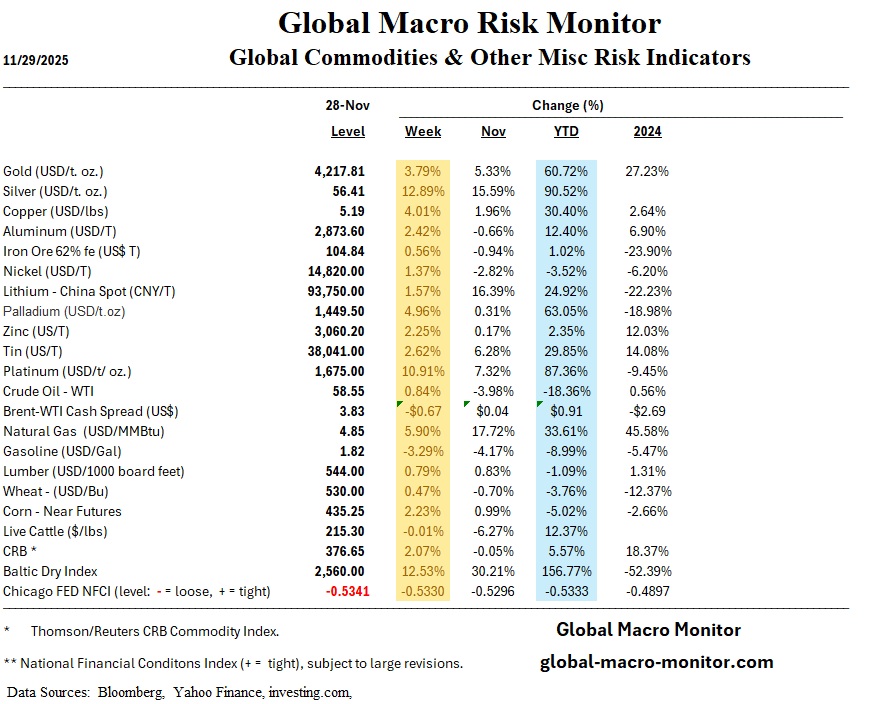

- Silver surged 13% for the week and is now up over 90% year-to-date—vastly outperforming Bitcoin, which is down 3% on the year.

- Eurozone banks climbed 5% during the week and are now nearly 70% higher year-to-date when accounting for the currency boost.

- Market volatility fell sharply, with the VIX dropping 7 points to 16, signaling stronger investor risk appetite.

These developments: precious metals momentum, European banking sector strength, and a major decline in volatility were central to global market behavior this week.

GLOBAL MARKETS SUMMARY

Risk assets rallied across global markets. U.S. equities posted broad gains in a holiday-shortened week, supported by softer economic data and dovish messaging from Federal Reserve officials. The markets have priced an 86% probability of a 25 bps rate cut by the Fed at its December 10th meeting. Small caps outpaced large caps, and technology shares rebounded strongly.

The standout move came from silver, which surged 13%, a move reflecting both inflation concerns and increased demand for safe-haven or alternative assets.

European markets also strengthened, with a notable rally in bank stocks. Meanwhile, volatility dropped substantially, creating a supportive backdrop for equities and credit.

UNITED STATES

Equities & Markets

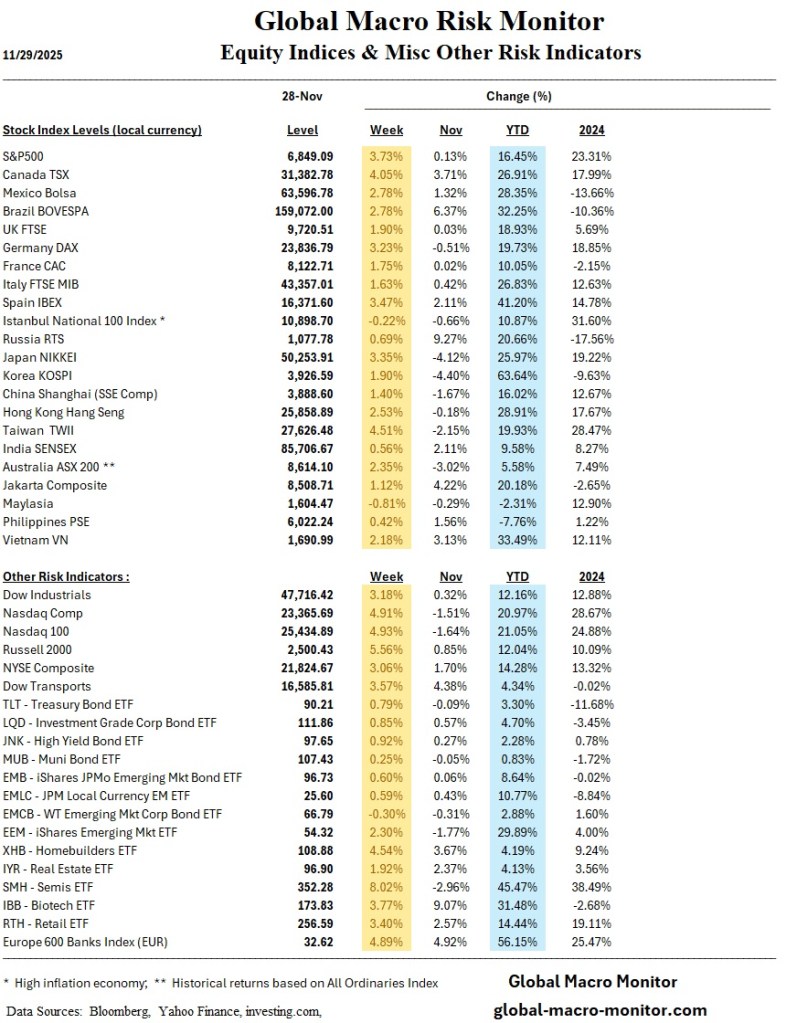

- Major indices posted weekly gains:

- Dow: +3.18%

- S&P 500: +3.73%

- Nasdaq: +4.91%

- The Russell 2000, a gauge of smaller companies, rose 5.52%, reflecting a shift toward risk-on sentiment.

Economic Data

- Retail sales: +0.2% for September, below expectations.

- PPI: +0.3% headline; +0.1% core.

- Jobless claims: Declined to 216,000, the lowest since April.

- Consumer confidence: Fell to 88.7, signaling growing economic caution.

Policy & Rates

- Fed Beige Book:

- Employment edged lower.

- Prices continued moderate increases.

- Consumer spending weakened further.

- Treasury market: Yields fell as investors priced in a likely December rate cut. The yield on the 10-year Treasury note fell 5 bps to 4.02%

EUROPE

Equities

- STOXX Europe 600: +2.35%

- DAX: +3.23%

- CAC 40: +1.75%

- FTSE 100: +1.90%

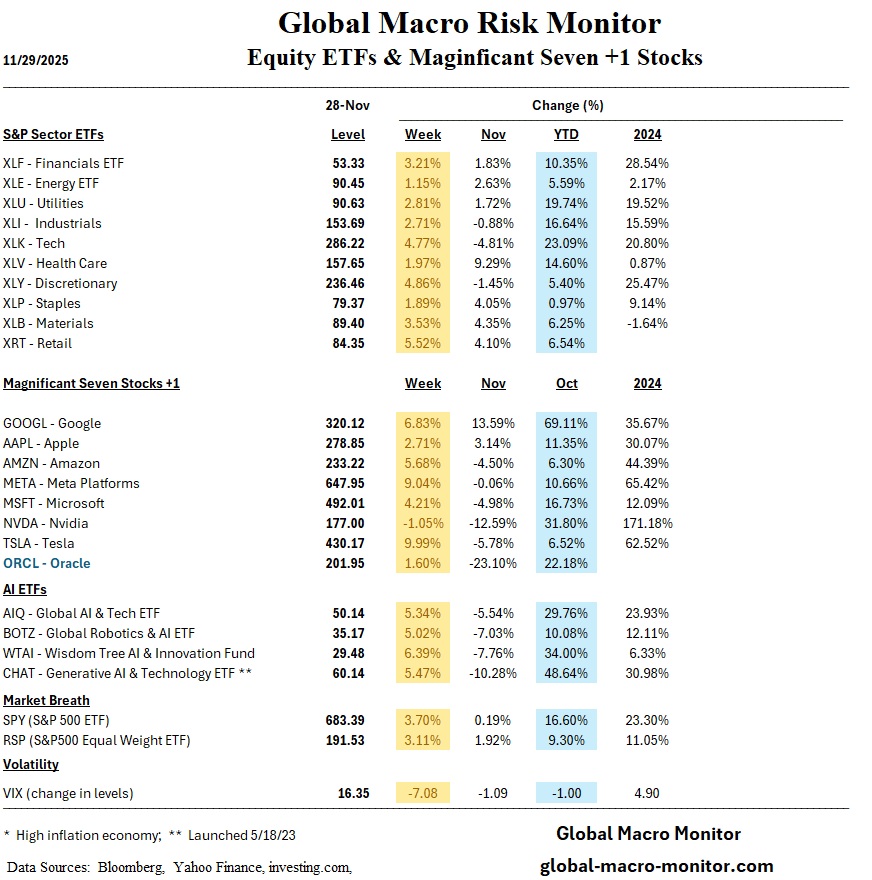

Eurozone Banks: Weekly and Year-to-Date Standouts

Banks in Europe rallied roughly 5% for the week and are now nearly 70% higher year-to-date when currency gains are factored in. We doubt anyone believed at the beginning Euro banks would outperform Nvidia by a factor of 2x by December 1st.

Key drivers included:

- Higher net interest margins

- Strong capital positions

- Stable inflation near ECB target

- Improved sentiment toward European financials

Macro Developments

- Inflation across major eurozone countries remained subdued.

- UK’s new budget introduced £26 bn in tax increases.

- Germany’s business sentiment weakened, while consumer willingness to buy improved.

JAPAN

Japanese markets rallied strongly:

- Nikkei: +3.35%

- TOPIX: +2.45%

Momentum was fueled by dovish signals about global monetary policy, a rebound in tech/AI shares, and steady Tokyo inflation at 2.8%, reinforcing speculation that the Bank of Japan may contemplate a future rate hike.

The 10-year JGB yield rose to 1.82%, approaching levels last seen 17 years ago.

CHINA

Chinese equity benchmarks advanced:

- CSI 300: +1.64%

- Shanghai Composite: +1.40%

- Hang Seng: +2.53%

Despite these gains, industrial profits fell 5.5% year over year, indicating slowing momentum and highlighting persistent structural challenges—particularly within manufacturing and real estate.

OTHER KEY MARKETS/GEOPOLITICAL DEVELOPMENTS

Russia–Ukraine Peace Framework Discussions

A 28-point U.S. proposal has gained traction among NATO and EU members, offering a potential basis for negotiations but still requiring major concessions from both sides.

South Korea Monetary Policy

The Bank of Korea kept the Base Rate at 2.50%, noting rising inflation but maintaining flexibility for future cuts amid global uncertainty.

MARKET VOLATILITY TRENDS

The VIX dropped sharply to 16, falling 7 points in one week.

This move signals:

- Declining hedging costs

- Renewed appetite for equities and credit

- Possible overconfidence if economic data fails to stabilize

The drop in volatility was one of the most influential forces shaping global risk sentiment the past and upcoming week.

PRECIOUS METALS: SILVER’S POWERFUL SURGE

Silver’s 13% weekly rally has pushed its year-to-date gain beyond 90%, dramatically surpassing Bitcoin’s –3% performance.

Key catalysts include:

- Strong industrial demand

- Elevated geopolitical tensions

- A softer U.S. dollar

- Growing investor preference for tangible, inflation-resistant assets

EUROPEAN FINANCIAL SECTOR: BANKS BREAK OUT

Eurozone banks delivered another standout performance this week.

Their strong gains reflect:

- Stabilizing macroeconomic conditions

- Attractive valuations

- Positive earnings momentum

- Enhanced foreign interest due to currency strength

This sector remains a cornerstone of the European equity story in 2024.

OUTLOOK: WHAT TO WATCH NEXT

- Federal Reserve: Market expectations remain aligned with a possible December rate cut.

- Eurozone Inflation (Dec 2): A reading near target could support earlier ECB easing.

- Bank of Japan: Investors await guidance on potential tightening.

- China: Markets look for signs of additional stimulus as growth softens.

- Volatility: With the VIX at 16, markets could be vulnerable if data surprises to the downside.