Global markets closed the week with a clear message: policy easing is supporting risk appetite, but leadership is rotating, and stresses are emerging beneath the surface. The Federal Reserve’s December rate cut reinforced expectations that the tightening cycle is firmly behind us, triggering a steepening of the U.S. yield curve, with the 2–10 spread widening by roughly 8.3 bps, a constructive signal for banks and cyclicals, but also a sign that growth and inflation uncertainty persist.

Equities continue to broaden, with small caps (Russell 2000) and the S&P 500 Equal Weight Index outperforming, underscoring investor rotation away from mega-cap tech. That rotation was accelerated by a sharp sell-off in Oracle, which reignited concerns around AI-related capital intensity and valuation discipline.

In commodities, precious metals decisively outperformed, with silver surging roughly 6% and gold adding about 2%, extending their dominance over cryptocurrencies, which lagged despite easier financial conditions. Conversely, energy markets weakened materially, led by a more than 20% collapse in U.S. natural gas prices and a notable pullback in oil.

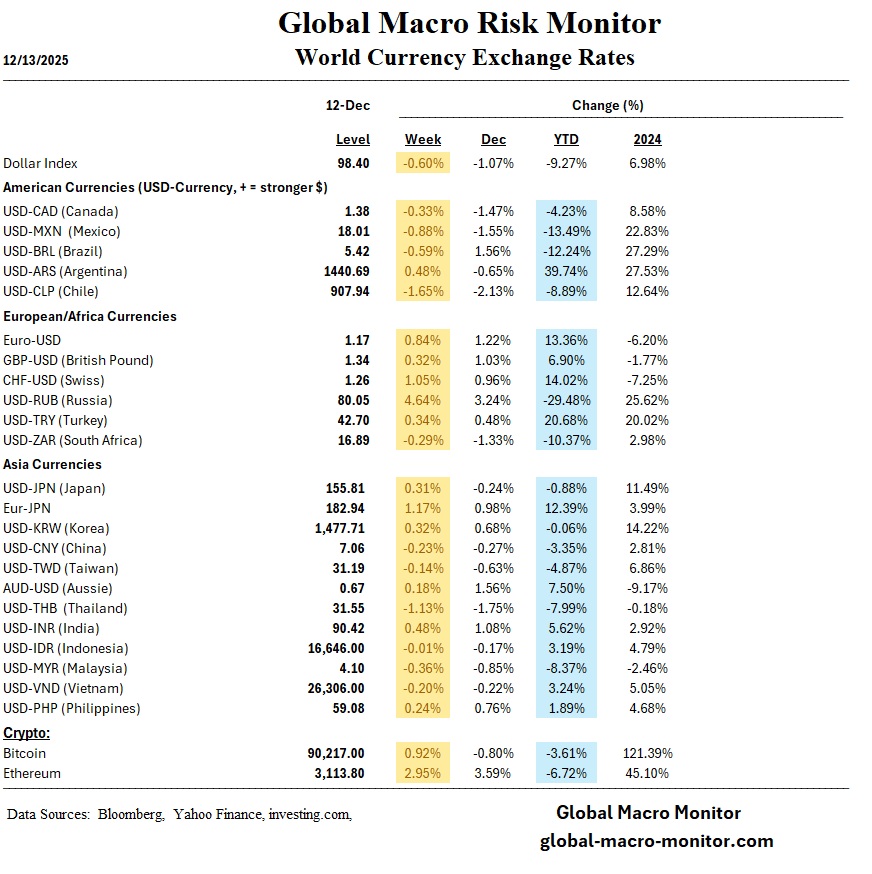

Emerging markets delivered mixed signals: Mexico’s bond yields spiked, reflecting inflation surprises and repricing of Banxico’s terminal rate, while Vietnam’s equity market sold off sharply on liquidity concerns, highlighting uneven financial conditions across EM. Overall, the backdrop remains supportive, but increasingly fragile, as liquidity and policy optimism clash with valuation, earnings, and geopolitical risks.

Rates, Policy, and Fixed Income

-

Fed cut rates by 25 bps, reinforcing a late-cycle easing narrative while maintaining optionality.

-

Yield curve steepened meaningfully (2s–10s +8.3 bps), favoring banks and cyclicals.

-

Mexico’s sovereign yields jumped, driven by upside inflation surprises and expectations of a more hawkish end to Banxico’s easing cycle

Equities: Rotation and Breadth

-

Russell 2000 outperformed, reflecting sensitivity to easing financial conditions.

-

S&P 500 Equal Weight index broke out, signaling broader participation beyond mega-caps.

-

Oracle shares were sharply lower, amplifying concerns over AI capex intensity and earnings durability.

-

Tech leadership softened while value and cyclicals gained traction.

Commodities and Real Assets

-

Silver surged ~6%, with gold up ~2%, extending strong relative performance versus crypto.

-

Energy commodities weakened sharply:

-

Oil fell over 4% on supply and demand concerns.

-

Natural gas collapsed more than 20%, one of the weakest assets of the week

-

Emerging Markets and Global Risk

-

Vietnam equities sold off sharply, driven by domestic liquidity stress.

-

Latin America remains differentiated: Mexico shows macro resilience, but markets are repricing inflation risk.

-

Broader EM sentiment supported by tight credit spreads, yet vulnerable to policy and funding shocks

Week Ahead: Key Catalysts and Market Risks

-

U.S. Data Focus – Inflation and Growth Signals

-

CPI, retail sales, and employment data will be critical in shaping expectations for the pace and durability of Fed easing.

-

Any upside inflation surprise could challenge the recent yield-curve steepening narrative and pressure small caps and financials.

-

Markets remain sensitive to whether soft labor data reflects a benign slowdown or a more material demand deterioration.

-

-

Central Banks – Global Policy Calibration

-

Attention turns to the Bank of Japan, where a rate hike could push Japanese yields higher and transmit upward pressure to global long-end rates.

-

The ECB and BoE are expected to strike a cautious tone, reinforcing the theme of late-cycle fine-tuning rather than aggressive easing.

-

In EM, Banxico’s communication will be watched closely after Mexico’s inflation surprise and yield spike.

-

-

Equities – Rotation vs. Valuation

-

Investors will test whether small-cap and equal-weight outperformance can persist if long-term yields drift higher.

-

Continued weakness in mega-cap tech—particularly around AI capex discipline—could reinforce rotation, but also increase overall volatility.

-

Earnings updates from cyclically sensitive sectors will help validate (or undermine) the broadening rally.

-

-

Commodities – Diverging Signals

-

Precious metals momentum remains constructive amid policy uncertainty and geopolitical risk.

-

Energy markets remain vulnerable, with natural gas oversupply and weak demand dynamics likely to persist unless weather or geopolitical factors intervene.

-

-

Risk Framing

-

Markets enter the week supported by liquidity and momentum, but with thin tolerance for negative surprises.

-

The dominant question remains whether policy easing can sustain growth without reigniting inflation—or whether volatility rises as that balance is tested.

-