Global markets ended the week with rising internal stress beneath still-resilient headline equity levels, setting up a fragile start to the new week. While U.S. equities held modest January gains, risk signals deteriorated meaningfully late in the week, culminating in a sharp weekend collapse in cryptocurrencies—a development likely to pressure risk assets at Monday’s open.

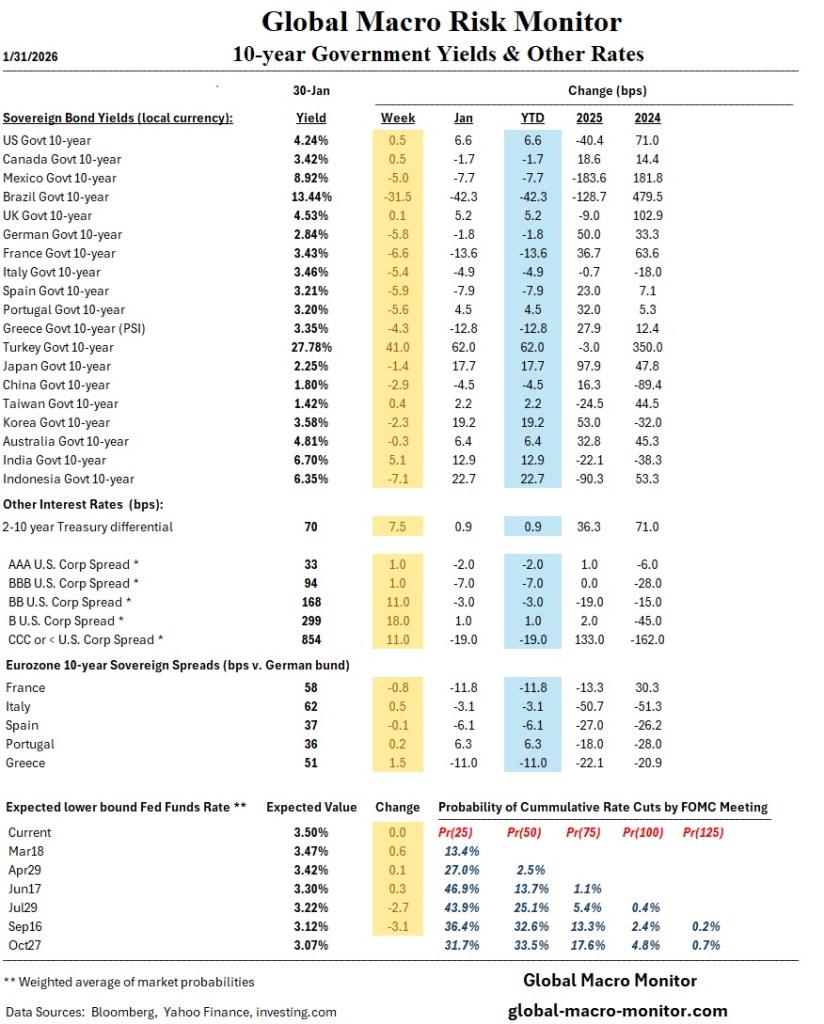

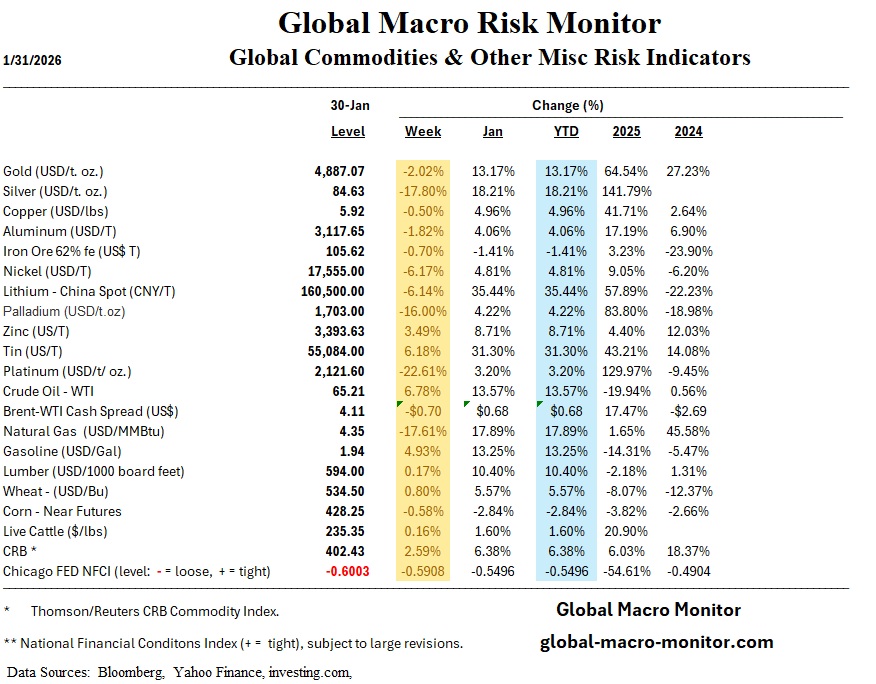

Beneath the surface, financial conditions remain extremely loose (see the NFCI in our Commodities Table), but cracks are emerging. The U.S. yield curve steepened sharply, with the 2s–10s spread widening to ~70 bps, signaling improving growth expectations but also greater sensitivity to inflation and policy risk. Equity leadership narrowed, small caps pulled back, and volatility rose into the month-end.

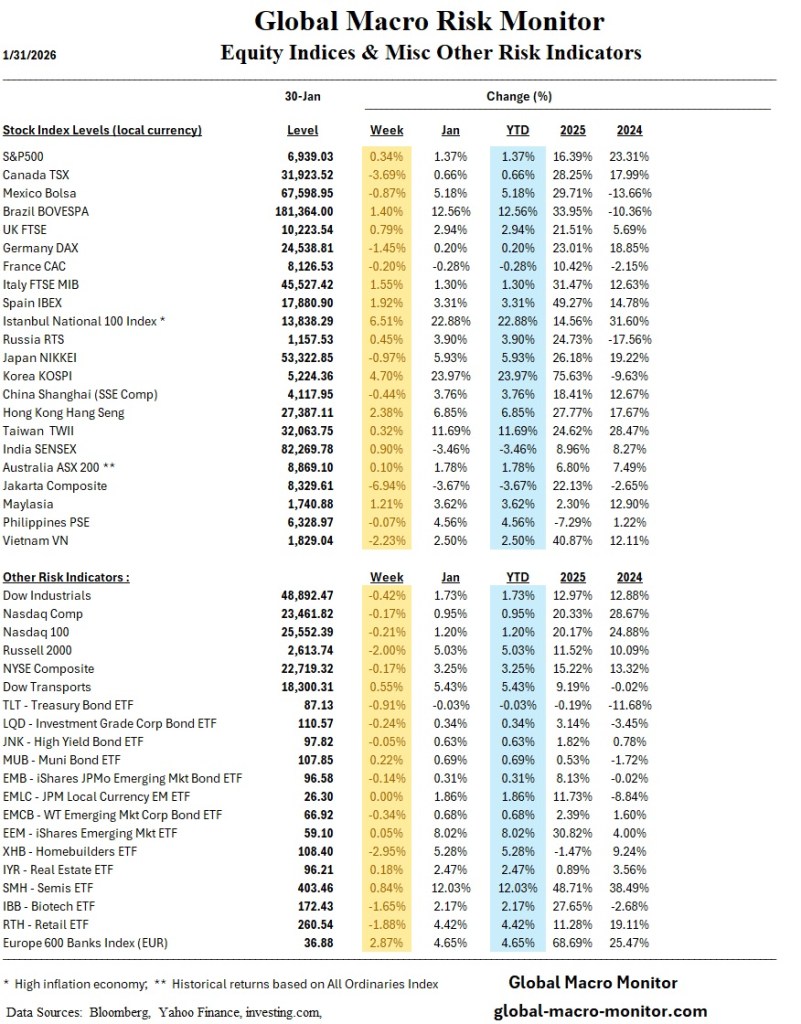

Globally, however, performance outside the U.S. was exceptional, led overwhelmingly by Asia. South Korea stood out as the best-performing equity market in the world, driven by massive capital inflows, AI-led earnings momentum, and its growing role as a global trading and technology hub. Taiwan and Brazil also posted outsized January gains, reinforcing the theme that global leadership is rotating away from the U.S. margin.

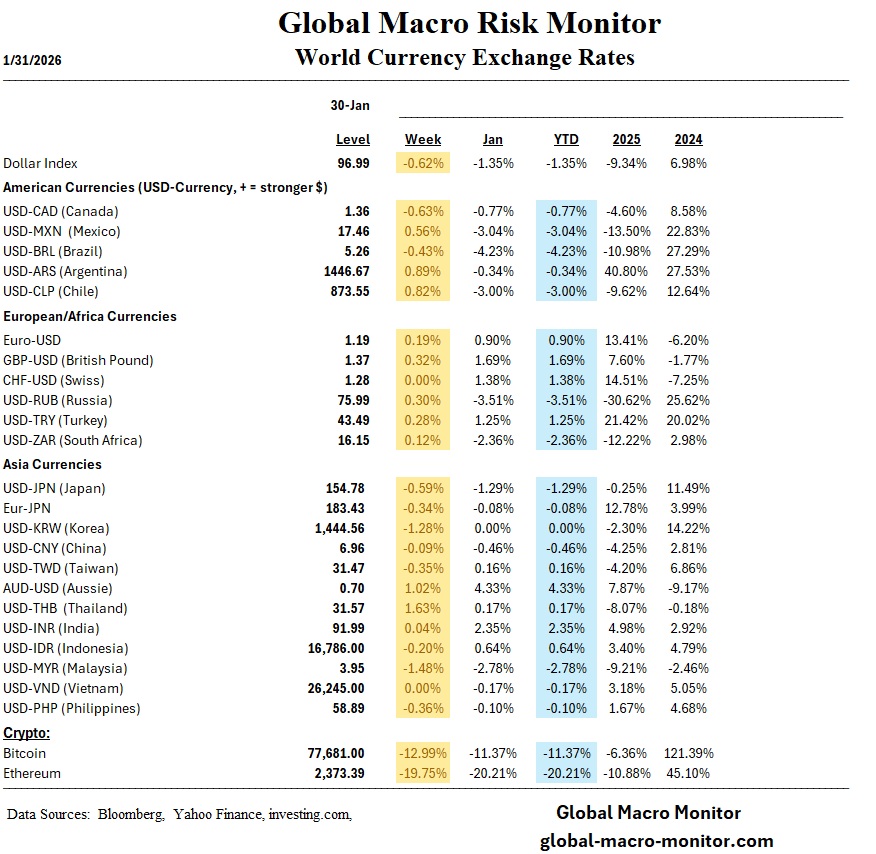

The most acute near-term risk comes from crypto markets, where Bitcoin fell nearly 10% over the weekend, confirming aggressive deleveraging at the far end of the risk spectrum. Historically, such moves tend to spill over into equities, particularly high-beta, small-cap, and speculative segments, raising the probability of a risk-off tone early in the week

Regional Market Performance Highlights

United States

- S&P 500 briefly broke above 7,000 before retreating

- Small caps lagged, with the Russell 2000 down ~2% on the week but still +5% in January

- Yield curve steepened sharply (2s–10s +8 bps), now ~70 bps

- Financial conditions remain extremely loose (See NFCI in Commodities Table), but increasingly vulnerable to market tightening shocks

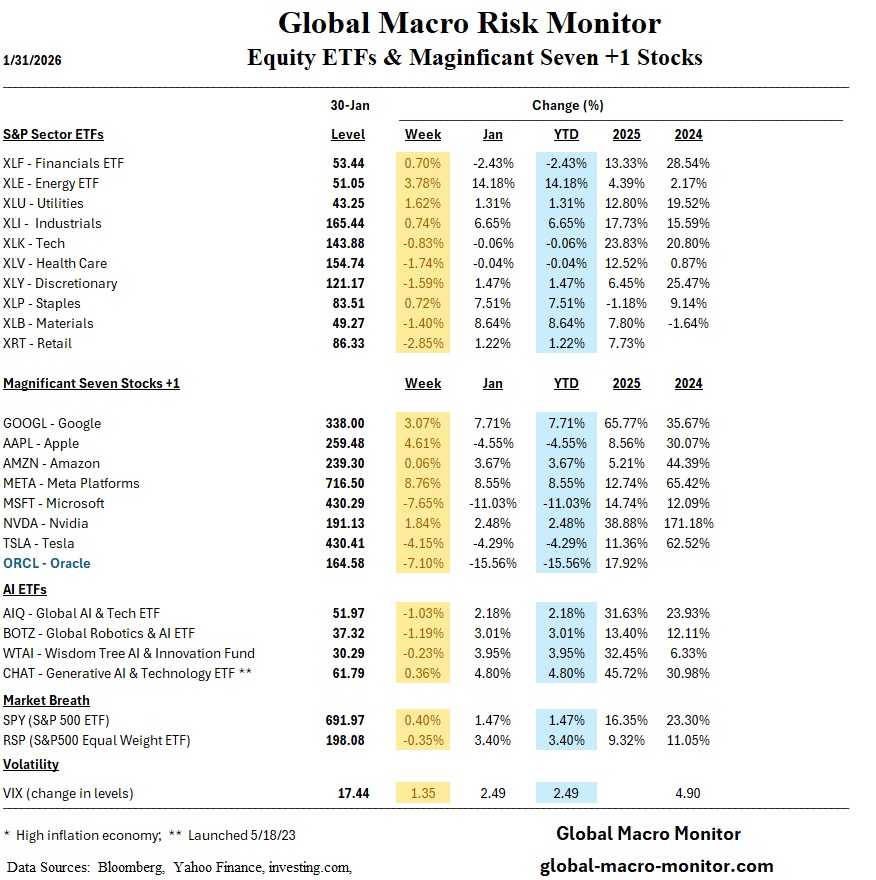

- Tech leadership fractured; volatility rose into month-end

- Semiconductor ETF +12% in January

Asia (Clear Global Leader)

South Korea – Exceptional Outperformance

- Up ~23% in January

- Best-performing equity market globally over the past year (+99%)

- Net foreign equity inflows of $96B since 2019, with $35B since 2025 alone

- AI-driven rally led by:

- Samsung Electronics (+186%)

- SK Hynix (+287%)

- Market capitalization surged to ~$3.1T, approaching Germany

- Korea is increasingly viewed as a global AI and trading hub amid fading U.S. economic dominance

Taiwan

- Equities up ~12% in January

- Semiconductor strength remains a dominant tailwind

- Benefiting from sustained global AI infrastructure demand

Japan

- Equities softer on the week amid yen volatility and election uncertainty

- FX dynamics remain critical for BoJ policy timing

Europe

- STOXX Europe 600 modestly higher

- Italy and UK outperformed; Germany lagged

- ECB expected to hold rates with inflation near target

- Growth stabilizing but still modest

Latin America

- Brazil up ~13% in January

- Central bank held rates but signaled possible calibration (cuts) ahead

- LatAm equities supported by easing inflation and selective policy flexibility

Commodities & Crypto

- Energy ETF +14% in January

- Precious metals were highly volatile and hit hard late-week, but still up big in January

- Crypto collapse is the dominant shock:

- Bitcoin is down ~10% over the weekend

- Represents forced deleveraging at the riskiest end of the spectrum

- Historically precedes short-term pressure on equities and credit

Week Ahead: Risk Catalysts & Market Focus

- Risk Markets Under Pressure at Monday Open

- Crypto selloff likely to spill into equities

- High-beta, small caps, and speculative tech are the most exposed

- Defensive sectors are likely to outperform early

- Key Macro Events

- U.S. employment report (Friday)

- ISM Manufacturing & Services

- ECB, BoE, RBA, and Banxico policy decisions

- Rates & FX

- Yield curve steepening raises sensitivity to inflation surprises

- USD volatility remains elevated amid geopolitical hedging and Fed transition

- Central Bank Messaging

- Fed: policy on hold, but easing optionality narrowing

- EM Asia: easing bias persists despite market pricing for hikes

- Japan: FX remains the key trigger for earlier BoJ action

Bottom line:

Markets enter the new week with strong global performance contrasts but deteriorating risk signals. Asia—especially Korea—remains the standout structural winner, but the crypto-led deleveraging shock materially raises near-term downside risk. Expect higher volatility, sharper dispersion, and a defensive bias until risk appetite stabilizes.