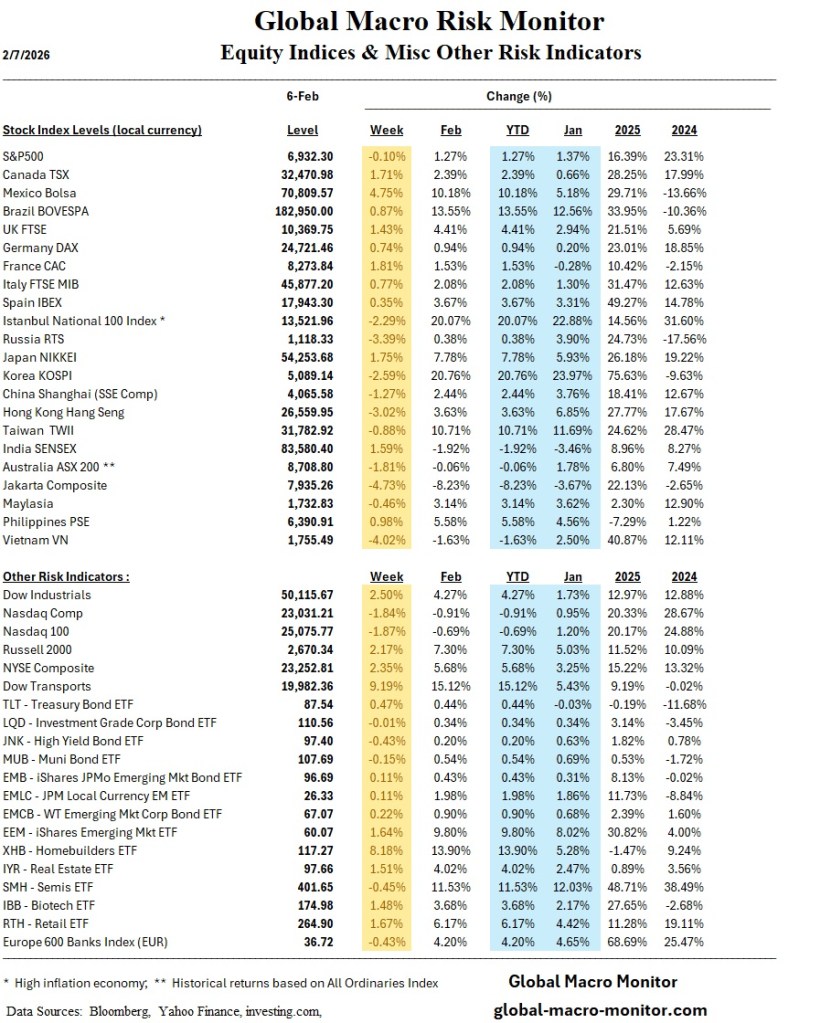

The week ending February 6 was defined by rising internal stress beneath still-resilient headline equity levels, with sharp dispersion across asset classes and regions. U.S. equities experienced notable volatility, with the S&P 500 briefly touching record highs early in the week before selling pressure intensified midweek. A sharp Friday rebound, however, reversed much of the damage and caught short sellers off guard, restoring modest weekly stability .

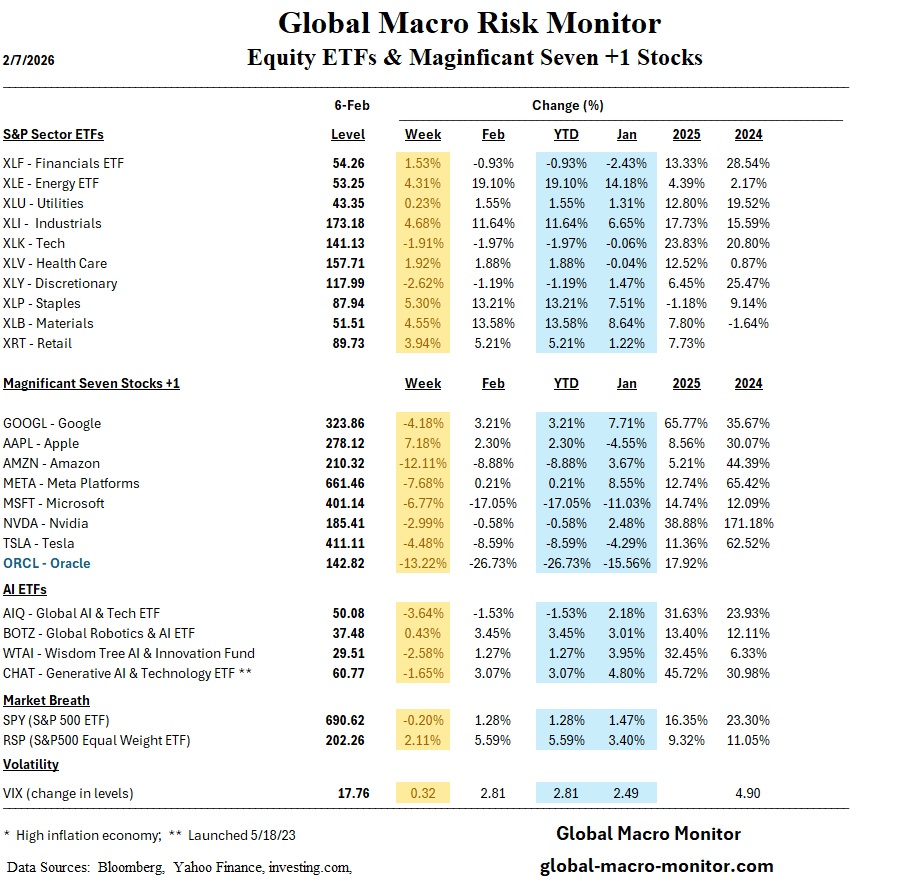

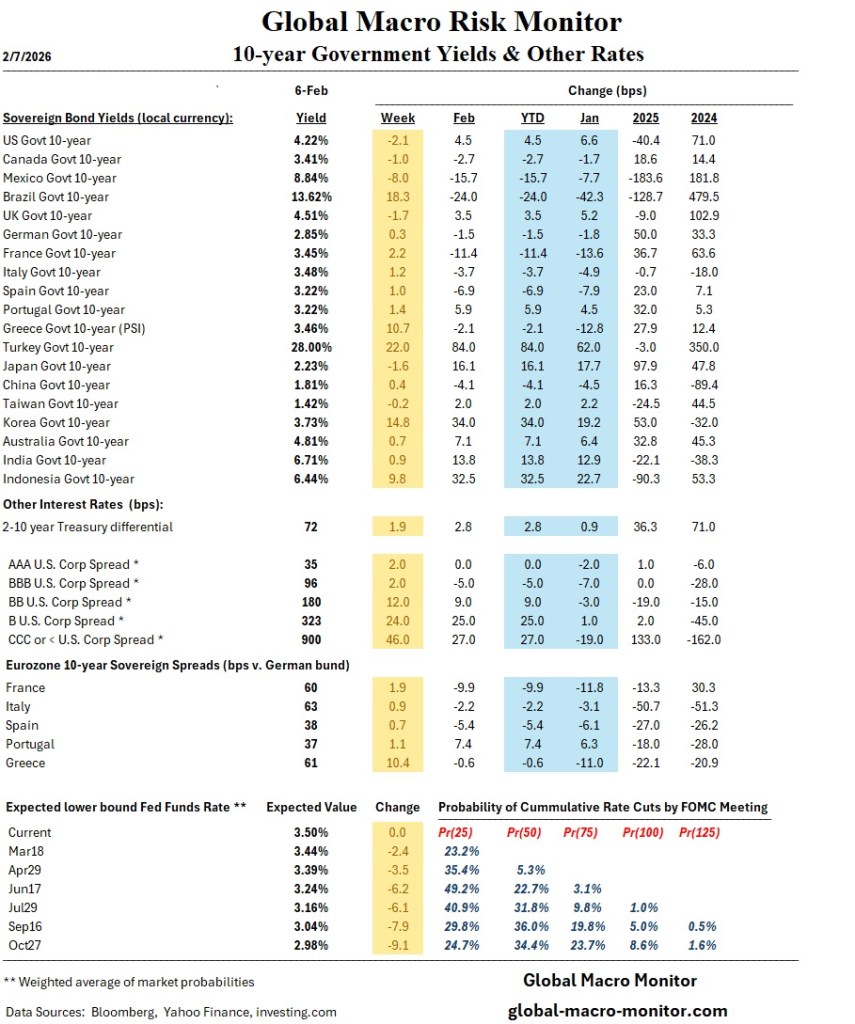

Beneath the surface, market leadership continued to broaden away from mega-cap growth, as cyclicals and value-oriented sectors—particularly energy, industrials, materials, and staples—outperformed meaningfully. In contrast, the “Mag 7” (excluding Apple) posted significant losses, reinforcing a rotation away from concentrated AI-driven equity exposure. Credit markets also reflected rising stress, with widening spreads in lower-quality credits and notable deterioration in peripheral Europe, including Greece .

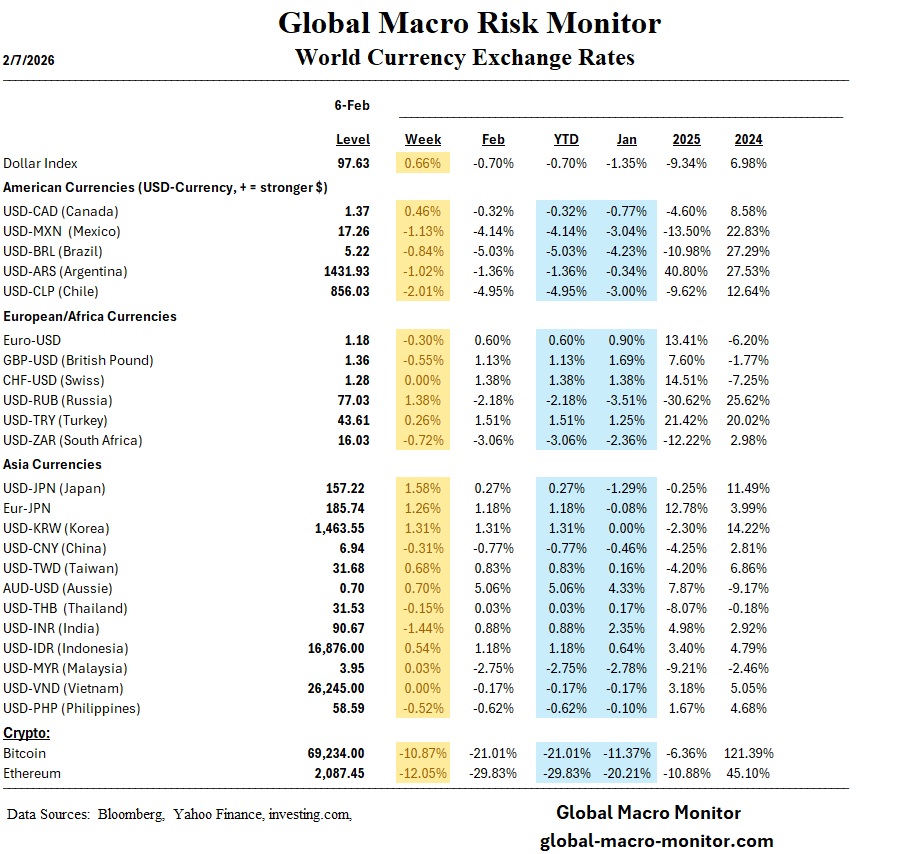

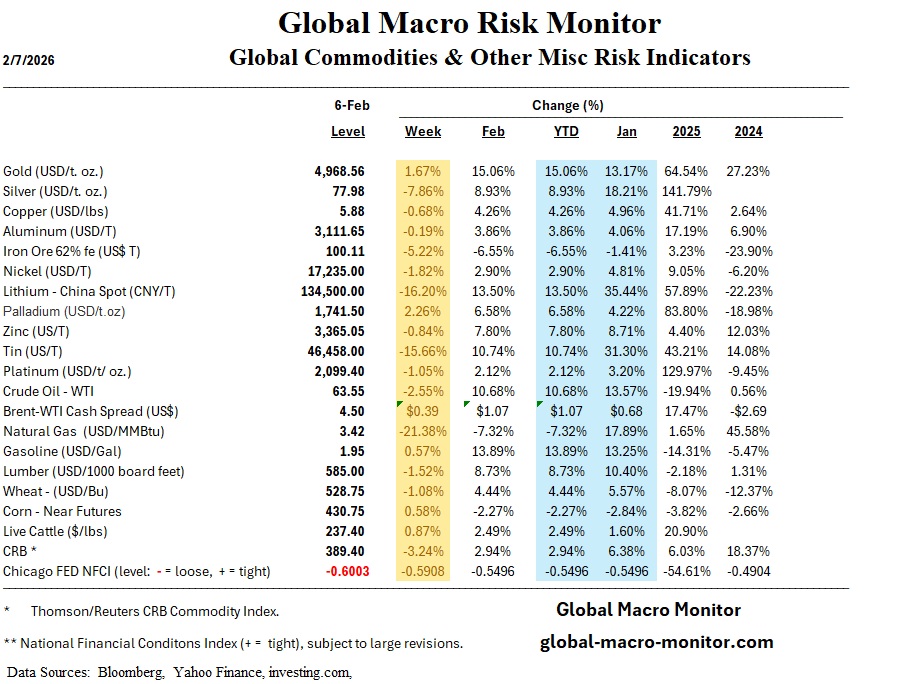

In commodities, gold strongly outperformed, finishing the week higher despite sharp early volatility, while silver lagged. This divergence underscored renewed demand for defensive, liquid hedges amid macro uncertainty. By contrast, Bitcoin underperformed sharply, ending the week down roughly 10% despite a dramatic $10,000 rebound on Friday, highlighting aggressive deleveraging across speculative risk assets.

Globally, leadership continued to shift outside the U.S., with select emerging markets such as Mexico posted outsized gains. Overall, the week reinforced a key theme: headline stability masking growing internal fragility, with positioning increasingly vulnerable to macro and policy surprises

Regional Performance Highlights

United States

- S&P 500 endured deep midweek losses before a powerful Friday rebound

- Market breadth continued to improve, favoring equal-weight and cyclicals

- Homebuilders surged, benefiting from rate expectations

- Energy, Industrials, Materials, and Staples were standout performers

- Tech and software stocks lagged sharply, reflecting AI saturation concerns

- Credit spreads widened in lower-tier credits, signaling rising risk aversion

Asia

- South Korea stocks have emerged as a global leader, driven by AI-linked earnings momentum but was subject to some profit taking

- Vietnam and Indonesia equities fell more than 4% on the week

- Japan equities rose modestly, though yen weakness remained a key overhang

Europe

- Core European equities were modestly higher

- Peripheral stress increased, with Greek spreads widening

- ECB tone leaned dovish as inflation dipped below target

Latin America

- Mexico’s Bolsa surged nearly 5%, one of the strongest global performances

- Broader regional equities supported by easing inflation trends

Commodities & Crypto

- Gold outperformed decisively, reinforcing its defensive appeal

- Silver declined despite broader metals volatility

- Bitcoin fell ~10% on the week, even after a sharp $10k Friday bounce

- Crypto weakness reflected forced deleveraging and speculative risk unwind

The Week Ahead

- Productivity and AI-driven growth expectations move center stage as key macro drivers

- U.S. markets face a rare data-heavy convergence: jobs, CPI, and retail sales

- Markets remain vulnerable to spillover from crypto deleveraging

- Expect continued sector dispersion, favoring defensives and cyclicals over speculative growth

- Central bank messaging—especially from the Fed and ECB—will be critical in shaping risk sentiment