Lots of complacency out there.

Just remember, folks, if you’re going to panic, panic before everyone else does.

Lots of complacency out there.

Just remember, folks, if you’re going to panic, panic before everyone else does.

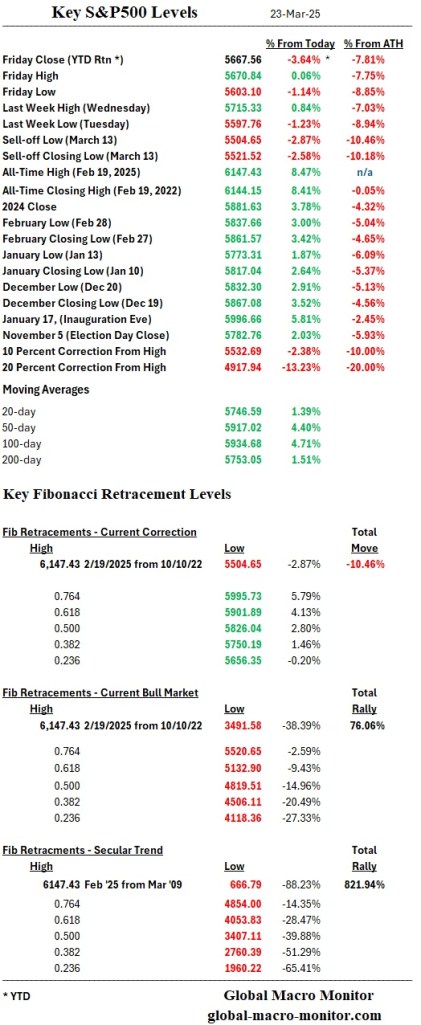

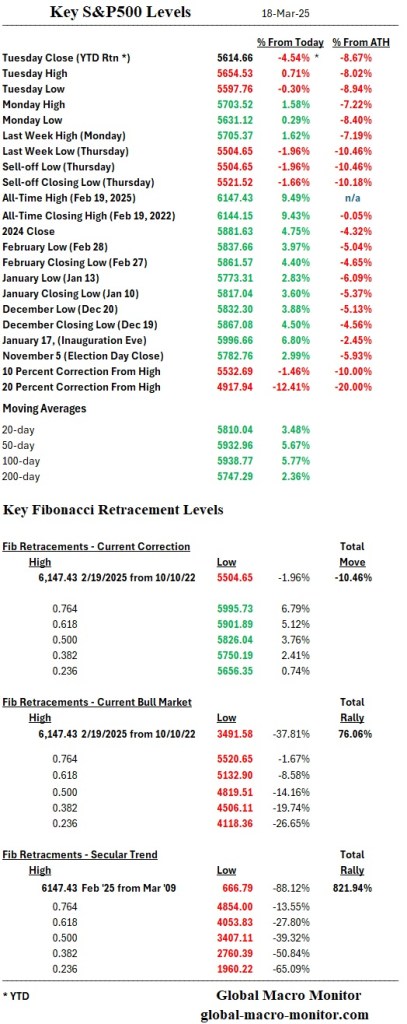

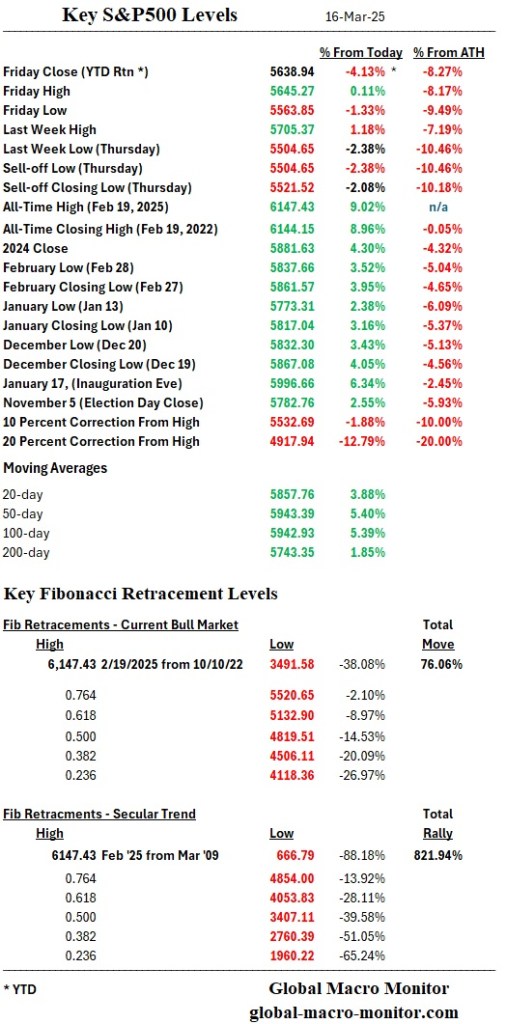

“The S&P 500 Index appears to be forming a bearish flag pattern, consolidating within a defined 5,600–5,700 range—a reflection of investor indecision amid ongoing macroeconomic uncertainty. The upper boundary near 5,700 has emerged as a short-term resistance level, with selling pressure intensifying as the index approaches this threshold. There is also visible hesitance to bid the market higher without a clear catalyst, particularly as market breadth remains fragile.

One focal point is the 200-day moving average at around 5,733—approximately 1.5% above Friday’s close. Traders appear to be watching closely to see if the index can challenge this level, which coincides with notable open interest and options activity, potentially amplifying volatility.

Notably, the 20-day moving average has recently crossed below the 200-day— to form the short-term “death cross” though not as strong a conviction of the 50-day cross but significant, nonetheless. This is the first such occasion the 20-day has been below the 200-day since January 2023, and while not always predictive of a bear market, it often serves as a warning signal of waning short-term momentum. Historically, these crossovers have introduced a period of heightened uncertainty and risk aversion, particularly when macro headwinds are present.

The market is now entering a catalyst-rich environment, with the key event being “Tariff Day” on April 2, when the U.S. is expected to formalize a new round of trade measures. Trump hinted at flexibility and the market responded by rallying. This looming policy risk has kept many investors on the sidelines, contributing to lower volume and reduced directional conviction.

Current positioning suggests that market participants are adopting a wait-and-see approach, unwilling to chase rallies while remaining cautious of downside surprises. This is reflected in increased hedging activity earlier in the month, though recent declines in volatility indices suggest a modest unwinding of protective bets.

Stay tuned, folks.

Key Observations:

Markets

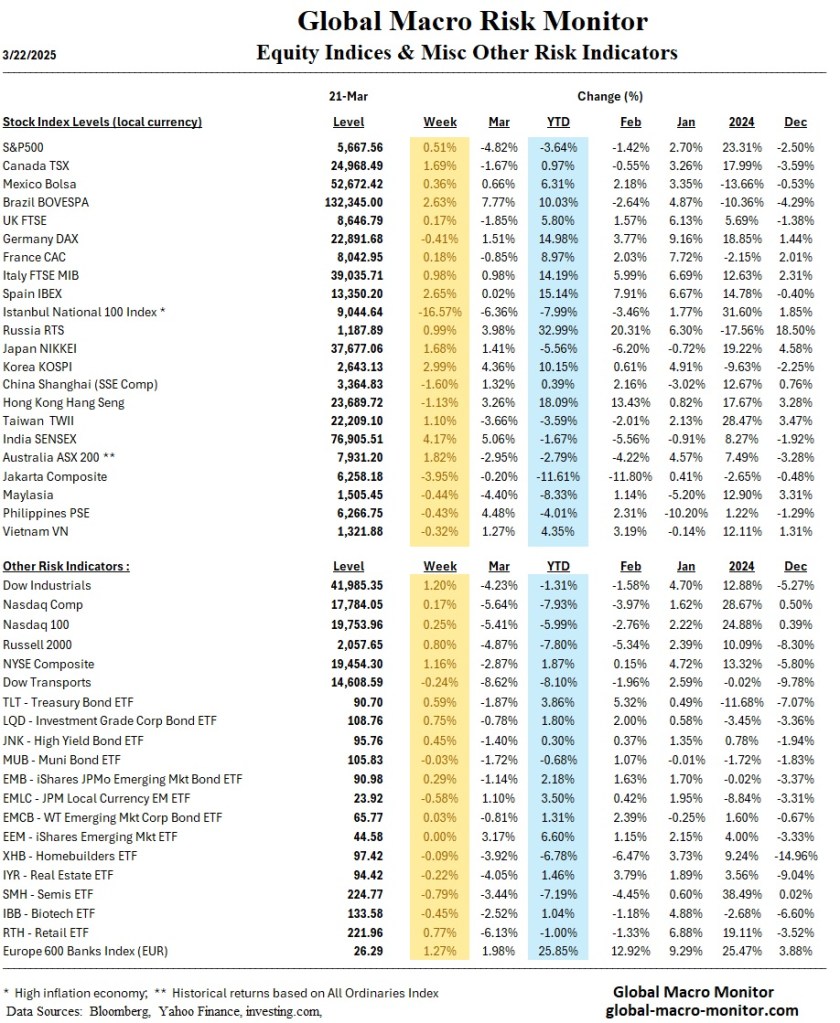

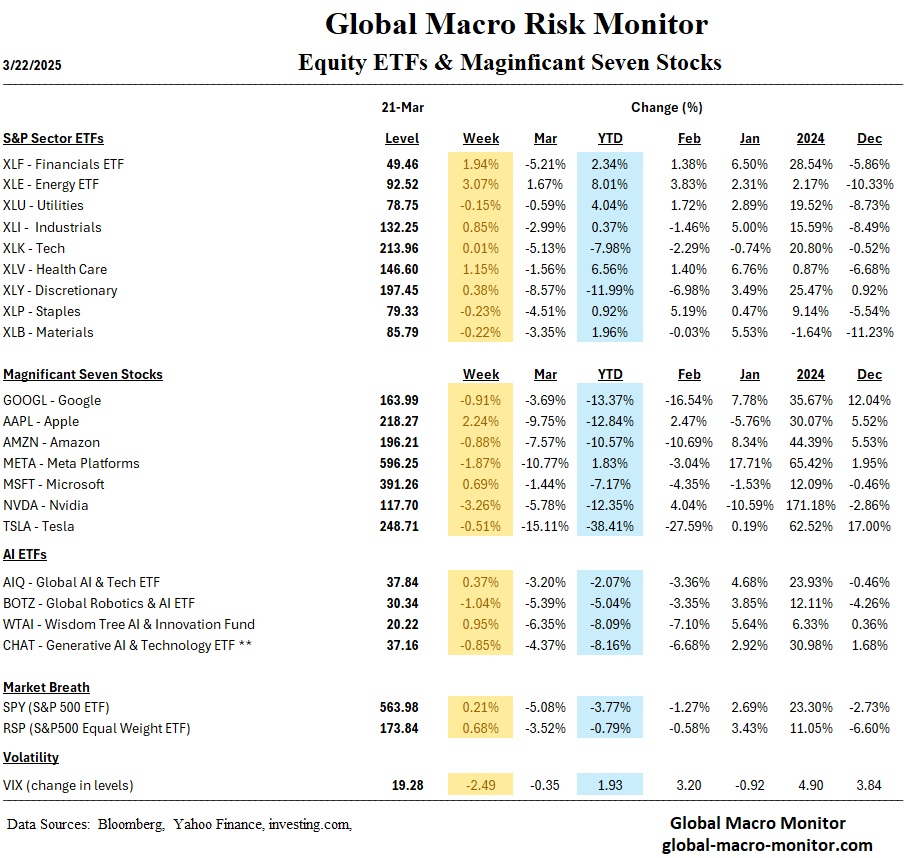

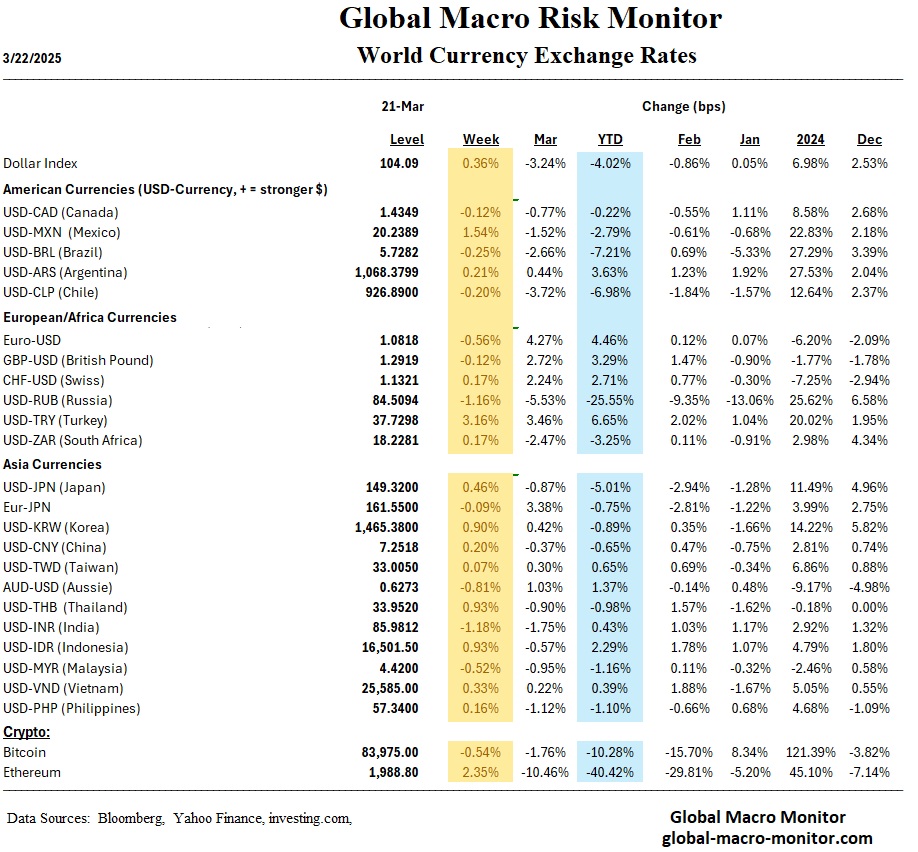

U.S. equities ended the week with modest gains, snapping multi-week losing streaks across the S&P 500, Nasdaq, and Dow. The S&P 500 rose 0.1%, while the Nasdaq gained 0.5%. However, the underlying trend remains cautious, as major indexes recently entered correction territory. Notably, large-cap tech stocks underperformed again, dragging down the Nasdaq, while value stocks—especially in Utilities, Energy, and Consumer Staples—continued to outperform growth.

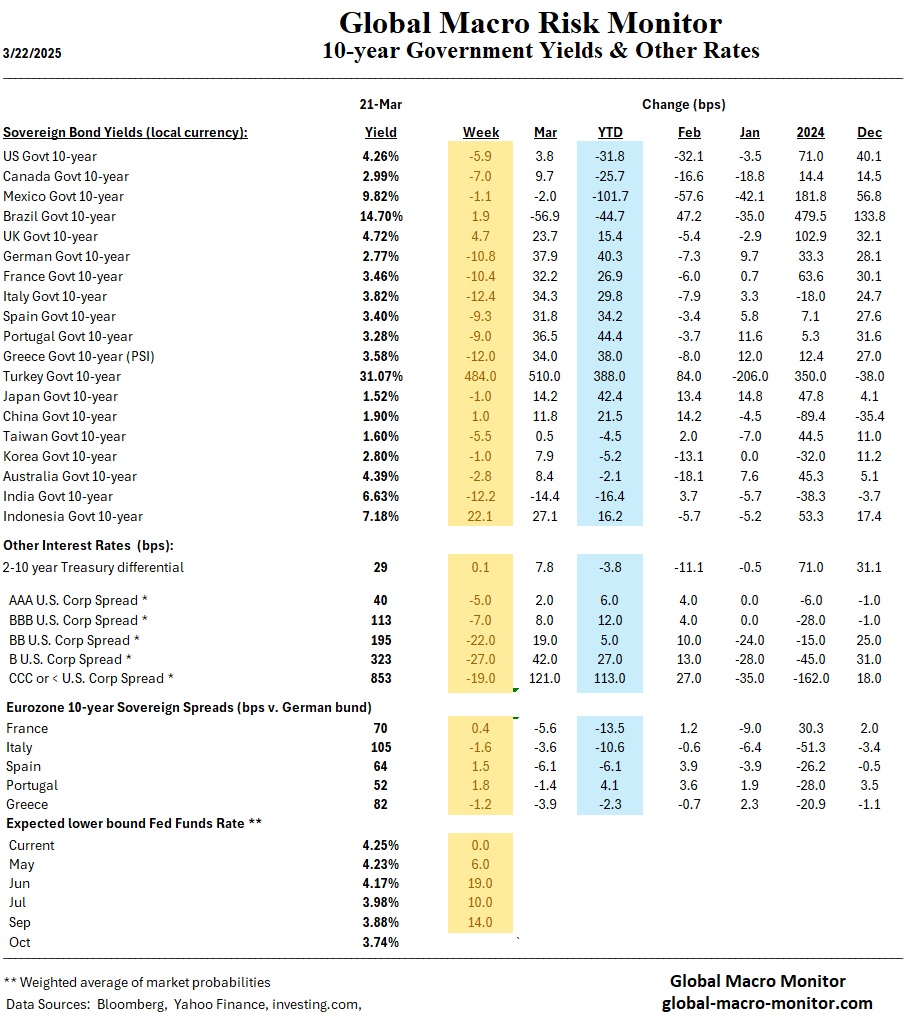

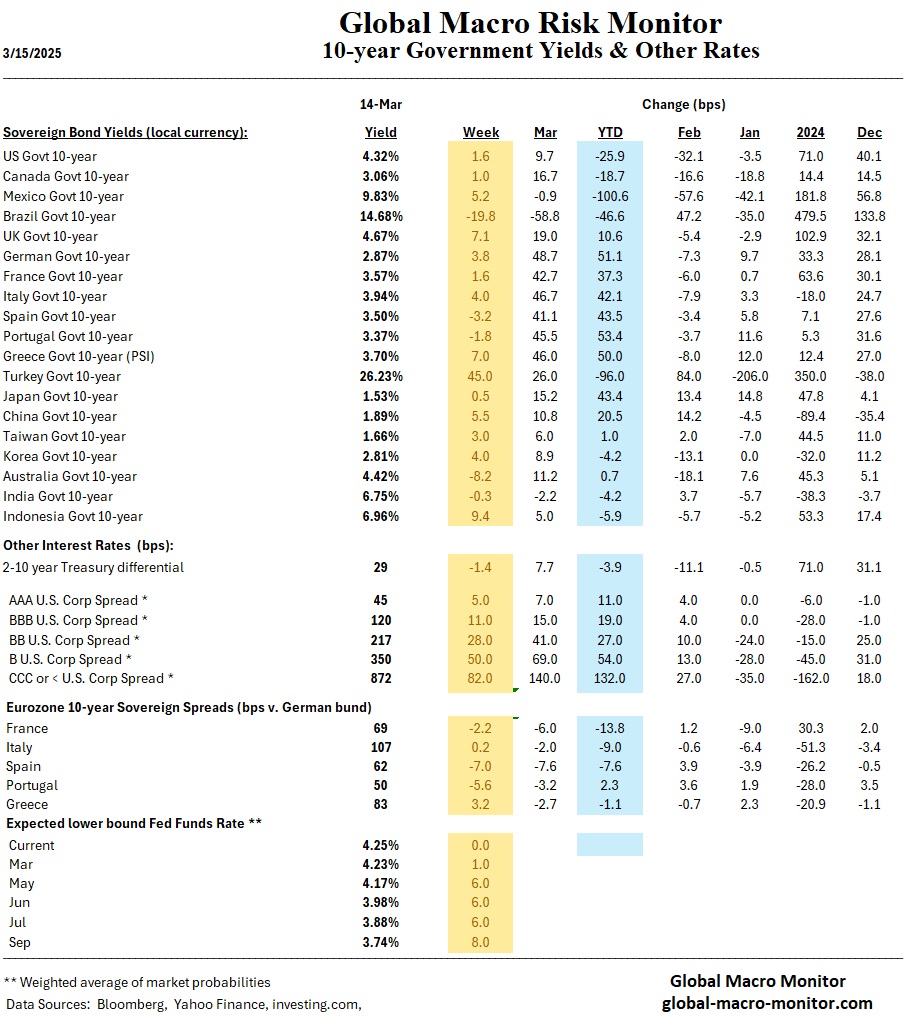

The Russell 2000 outperformed other indexes, despite ongoing volatility. Meanwhile, Treasury yields fell, with the 2-year yield down to 3.95% and the 10-year holding at 4.25%, driven by dovish Fed projections.

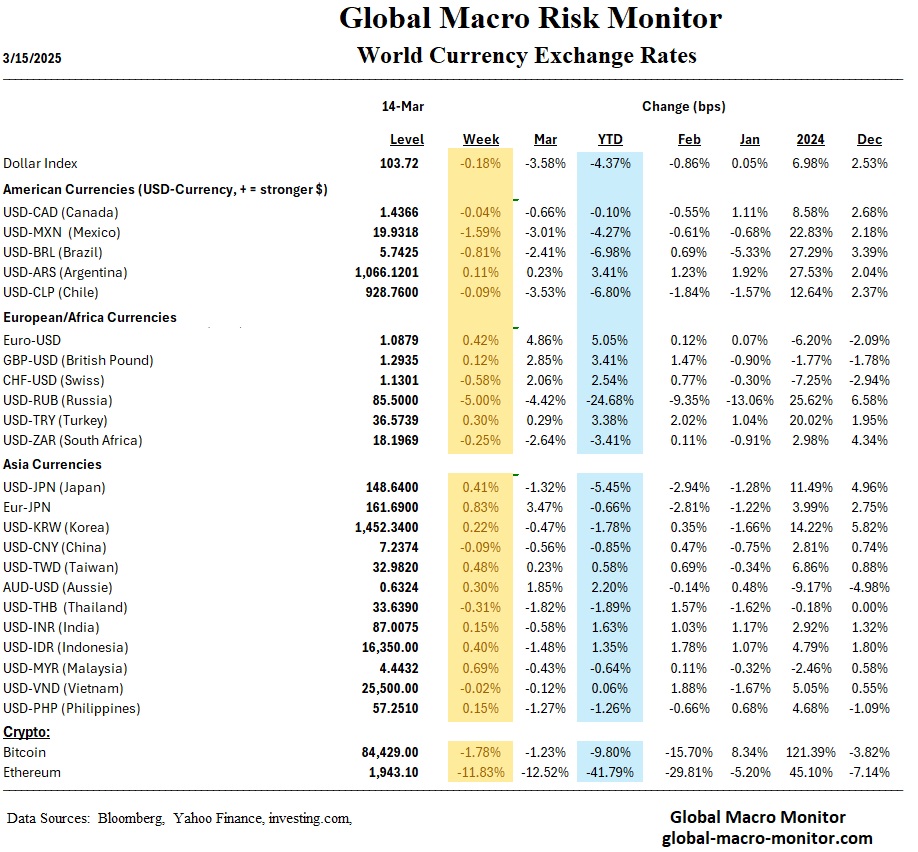

Globally, European markets posted mild gains, with the STOXX Europe 600 up 0.56%. The UK’s FTSE 100 and Italy’s FTSE MIB also rose, but Germany’s DAX slipped. Japanese equities rallied, with the Nikkei 225 gaining 1.68% on the back of foreign investor demand and BoJ’s policy hold. Chinese markets, in contrast, declined despite better-than-expected retail sales and industrial output.

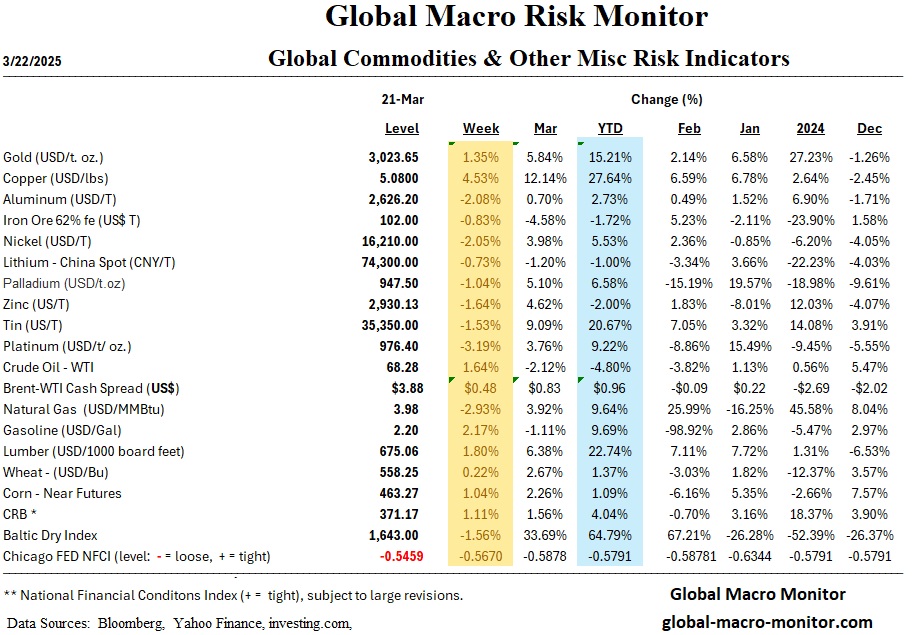

In emerging markets, Turkey faced volatility following political turmoil, while Brazil’s central bank raised rates again but hinted at a smaller hike ahead. Cryptocurrencies moved in line with equities, and gold extended its rally, signaling investor hedging.

Economics

The U.S. economic landscape remains mixed. Retail sales grew just 0.2% in February, below forecasts, while housing starts surged by 11.2% to 1.5 million units. The Fed left interest rates unchanged at 4.25%–4.5% but lowered GDP growth forecasts and raised inflation projections. Fed Chair Powell’s use of the term “transitory” regarding tariff-related inflationary effects reassured markets, though uncertainty remains elevated. Nevertheless, credit spreads came in during the week and the Russell outperformed signaling the markets are not too worried about a recession.

Inflationary concerns persist globally. The ECB’s Christine Lagarde warned that retaliatory tariffs could raise eurozone inflation by 0.5%, while the ECB is expected to cut rates in April and June. The Swiss National Bank cut its rate to 0.25%, while the BoE and Sweden’s Riksbank held rates steady, reflecting uncertainty over inflation trajectories.

Japan’s inflation remains sticky, with February’s core CPI at 3.0%. The BoJ maintained its rate but flagged potential rate hikes if wage-price dynamics persist. Meanwhile, China’s data beat expectations, with retail sales and fixed asset investment rising, but property development continued to decline, and unemployment rose to 5.4%.

Emerging Asia faces GDP downgrades due to a harsher U.S. tariff outlook, though China and Hong Kong were spared. Monetary easing is expected across major Asian central banks.

Week Ahead

Markets face a pivotal week with a full slate of economic data. Key U.S. indicators include PMIs (Monday), Consumer Confidence and New Home Sales (Tuesday), Durable Goods Orders and GDP (Wednesday–Thursday), and the PCE inflation report (Friday). These will be closely watched for signs of resilience or weakness in consumer activity and inflation pressures, particularly amid escalating tariff risks.

Technically, the S&P 500 struggles to reclaim the 5,700 resistance level and shows signs of a bear flag, suggesting potential downside. Market breadth is improving, yet momentum remains fragile.

Volatility indicators suggest some easing in hedging activity, which could set the stage for a gradual recovery—more of a “U” bottom than a sharp rebound. With tariff announcements expected by April 2 and geopolitical developments in focus, investor positioning may turn defensive. Expect modest risk appetite amid heightened macro uncertainty.

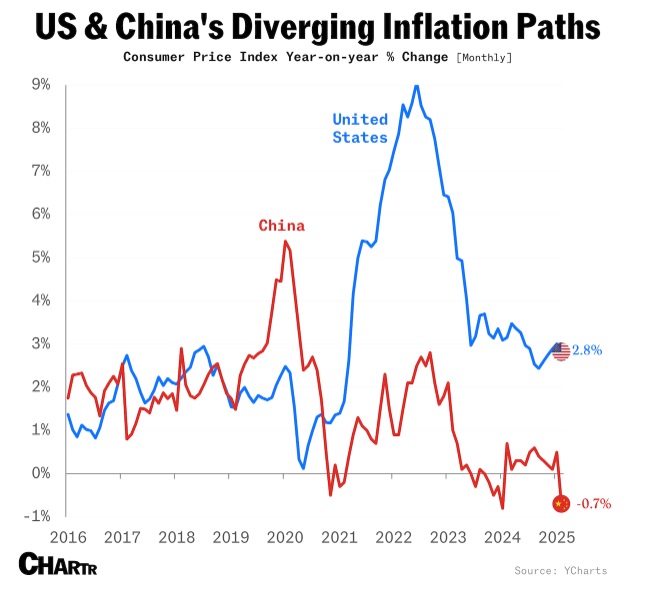

COTD – Chart of the Day

China and the U.S. are experiencing contrasting inflation trends, shaping distinct economic policy responses. In February 2025, China’s consumer price index (CPI) turned negative for the first time in 13 months, signaling deflation due to weak domestic demand, a real estate crisis, and manufacturing overcapacity. The U.S., however, grapples with post-COVID inflation at 2.8%, prompting the Federal Reserve to maintain relatively high interest rates. China is deploying stimulus measures to revive demand, while the U.S. remains cautious with monetary policy. These divergent paths, trade tensions, and currency fluctuations create complex investment risks and opportunities for global markets.

The bounce lacked sufficient momentum to reach the 200-day moving average but managed to hit 5700 before pulling back. We suspect the index will chop between 5500 and 5700 for the next few days or possibly a couple of weeks before testing and breaking the recent low.

Key levels to watch:

For now, our priors are the index will remain in a consolidation phase, with sellers capping upside moves and buyers stepping in near support. A break below 5504.65 could accelerate downside momentum, while a move above 5703.52 would indicate renewed buying strength.

Stay frosty, folks.

Nice distillation of the macro driving markets by (Pe)ter (Bo)ockvar. The dude gets it.

“There are like megatrends that I think that are reversing to the point where the playbook that worked so well over the last couple of years, throw it away, it’s not going to work. The world is changing, we’re at major inflection points I believe in the markets….” – Peter Boockvar on CNBC

The bounce we were anticipating came Friday, with futures leading the way. After Thursday’s close, buyers stepped into the futures market and commenced to bid the index up. The 200-day is now the upside target (+1.85%), which could come quickly as the fast money shorts will be forced to cover as the market creeps higher. We could be wrong and keeping it close.

Nevertheless, we still believe we are in only the second inning of a nine inning game of pain as the global political and economic order is being demolished by the Trump Administration. Markets seemed to like the old world order, in our opinion, and we have no idea what will replace it. Meanwhile, there will be great uncertainty about the emerging New World Order, and you know how markets love uncertainty.

Stay frosty, folks.

Key Insights

Markets

The past week saw heightened volatility across global financial markets, driven by recession concerns, trade policy uncertainty, and mixed economic data.

Economics

Economic updates from key regions indicated slowing growth, inflation concerns, and monetary policy uncertainties.

The Week Ahead

Looking ahead, investors and policymakers will focus on key economic data and policy decisions.

This montage of baseball movies is a must-view, folks. Prepare yourself for goosebumps.

Opening day is next Tuesday with the Dodgers taking on the Cubbies in Tokyo.