Updated: Thursday, July 18, 2024

Using the Composite Indexes: The Leading Economic Index (LEI) provides an early indication of significant turning points in the business cycle and where the economy is heading in the near term. The Coincident Economic Index (CEI) provides an indication of the current state of the economy. Additional details are below.

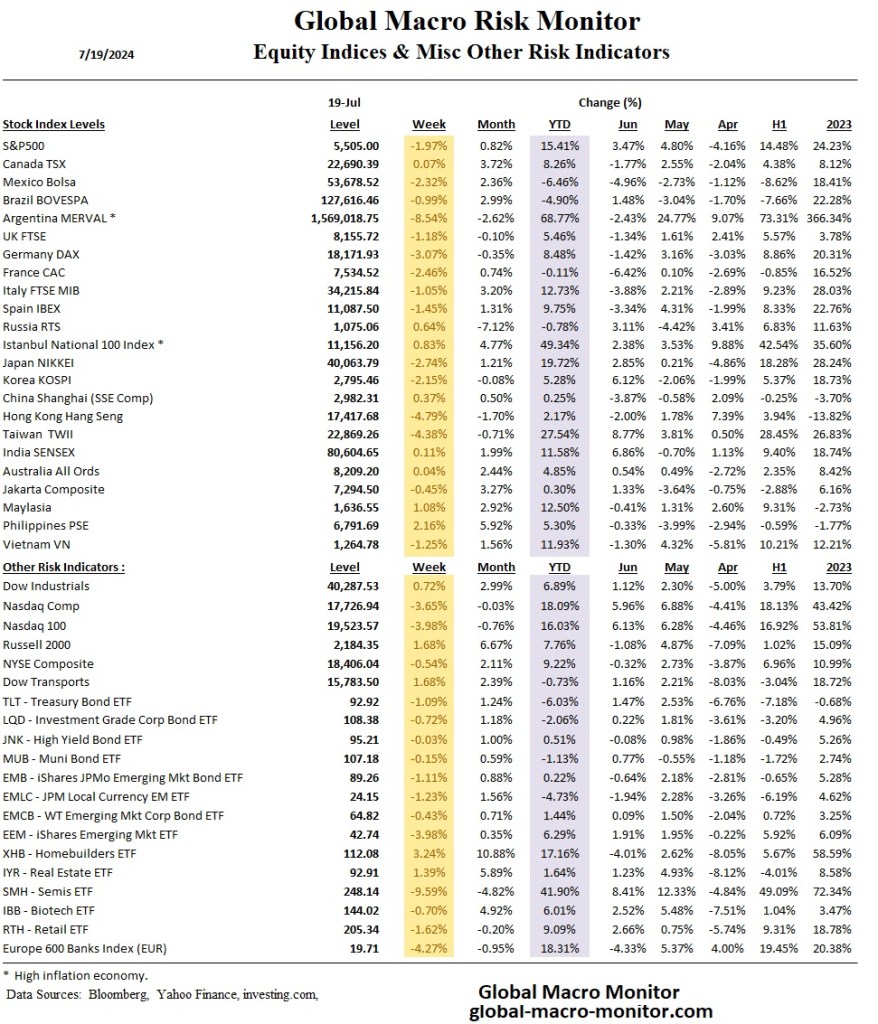

The Conference Board Leading Economic Index® (LEI) for the U.S. declined by 0.2 percent in June 2024 to 101.1 (2016=100), following a decline of 0.4 percent (upwardly revised) in May. Over the first half of 2024, the LEI fell by 1.9 percent, a smaller decrease than its 2.9 percent contraction over the second half of last year.

“The US LEI continued to trend down in June, but the contraction was smaller than in the past three months,” said Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board. “The decline continued to be fueled by gloomy consumer expectations, weak new orders, negative interest rate spread, and an increased number of initial claims for unemployment. However, due to the smaller month-on-month rate of decline, the LEI’s long-term growth has become less negative, pointing to a slow recovery. Taken together, June’s data suggest that economic activity is likely to continue to lose momentum in the months ahead. We currently forecast that cooling consumer spending will push US GDP growth down to around 1 percent (annualized) in Q3 of this year.” – Conference Board

Brace yourselves.

Turning and turning in the widening gyre

The falcon cannot hear the falconer;

Things fall apart; the centre cannot hold;

Mere anarchy is loosed upon the world,

The blood-dimmed tide is loosed, and everywhere

The ceremony of innocence is drowned;

The best lack all conviction, while the worst

Are full of passionate intensity.

Surely some revelation is at hand;

Surely the Second Coming is at hand.

The Second Coming! Hardly are those words out

When a vast image out of Spiritus Mundi

Troubles my sight: somewhere in sands of the desert

A shape with lion body and the head of a man,

A gaze blank and pitiless as the sun,

Is moving its slow thighs, while all about it

Reel shadows of the indignant desert birds.

The darkness drops again; but now I know

That twenty centuries of stony sleep

Were vexed to nightmare by a rocking cradle,

And what rough beast, its hour come round at last,

Slouches towards Bethlehem to be born?

China’s population shrank by 2 million people last year, a trend that looks set to continue given the number of babies born also hit a record low. Authorities are doing what they can to turn that around, offering couples incentives to have another child and expanding public health insurance to cover assisted reproductive services. It’s unclear how much of a difference they’ve made. – Bloomberg

FOTD: Factoid of the Day

In 2023 alone, the Magnificent Seven – the top technology companies in the United States –allocated a combined $370 billion to research and development. That is roughly equal to the European Union’s total R&D budget (counting both businesses and the public sector). – Dambisa Moyo, Project Syndicate

QOTD: Quote of the Day

The jig is up, and the sooner Mr. Biden and Democratic leaders accept this, the better. We need to move forward. – James Carville

The Services PMI® fell to 48.8% in June 2024 compared to May’s reading, contracting at the fastest pace in four years. This drop reflects declines in business activity, new orders, and employment, alongside challenges in supplier deliveries and inventory management.

These findings illustrate the increased volatility in the services sector, influenced by demand and supply-side issues.