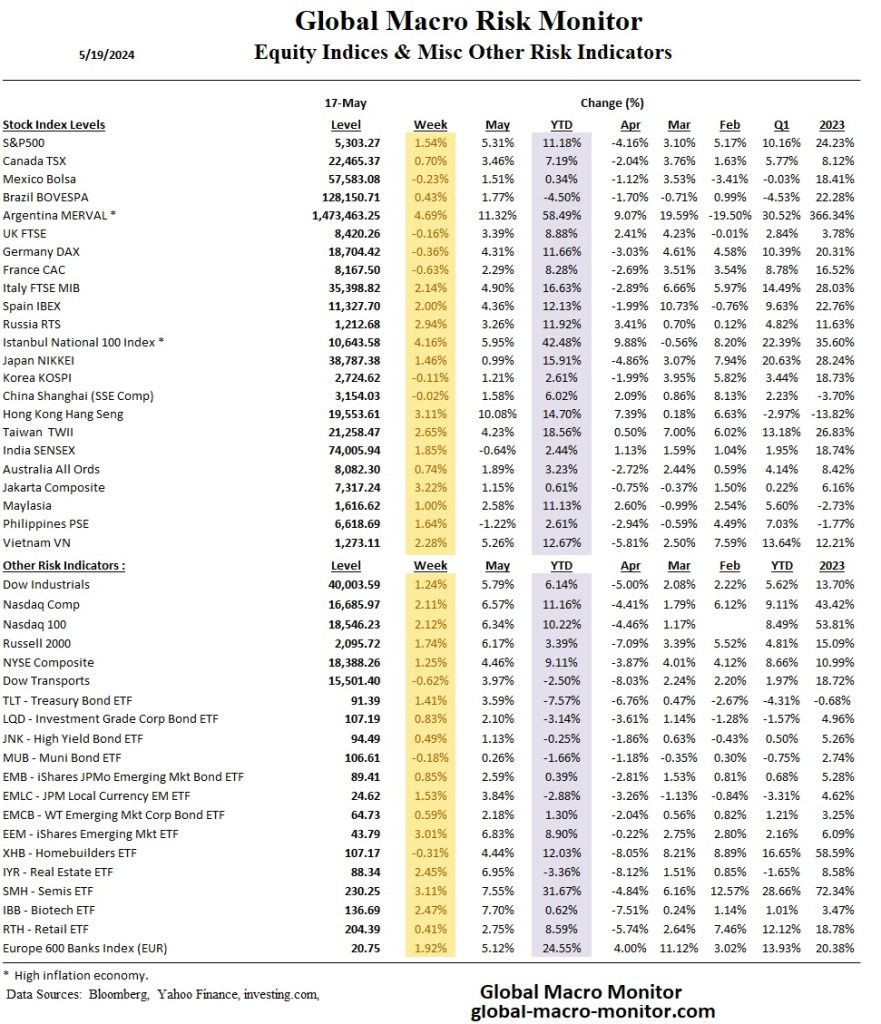

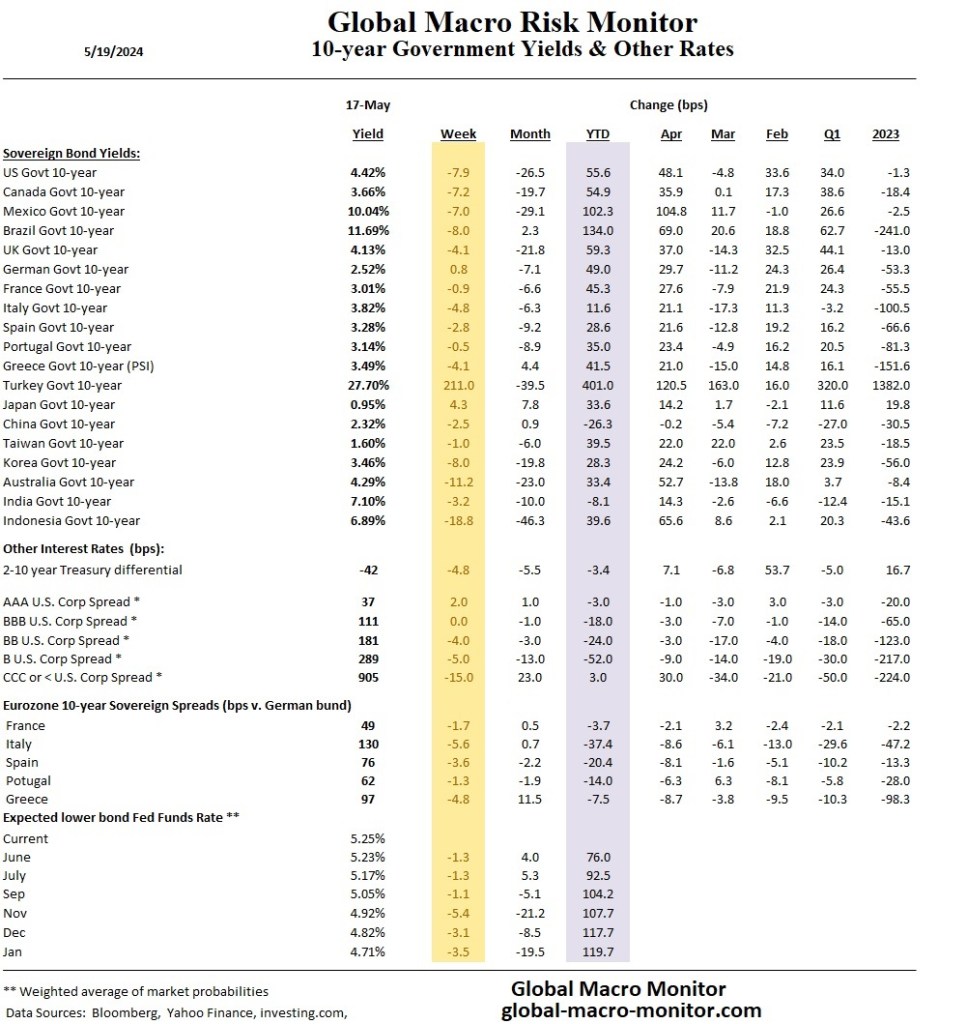

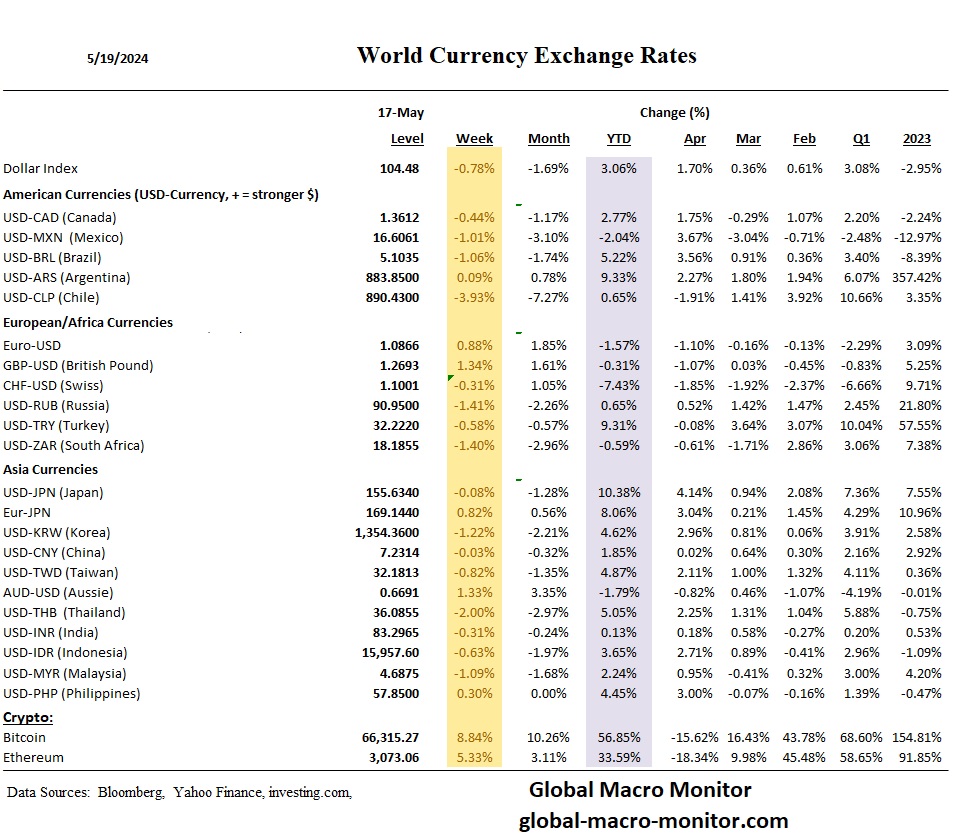

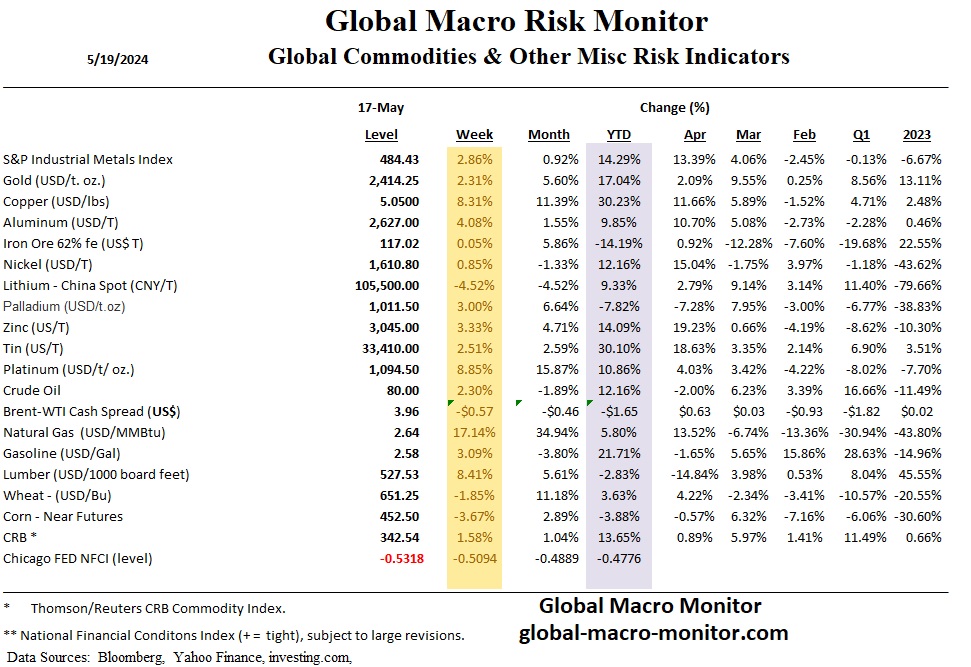

National financial conditions have eased significantly in May, making it more difficult for the Fed to start an easing cycle. Does Mr. Market understand the unstable feedback loop it is currently in? Just askin’.

National financial conditions have eased significantly in May, making it more difficult for the Fed to start an easing cycle. Does Mr. Market understand the unstable feedback loop it is currently in? Just askin’.

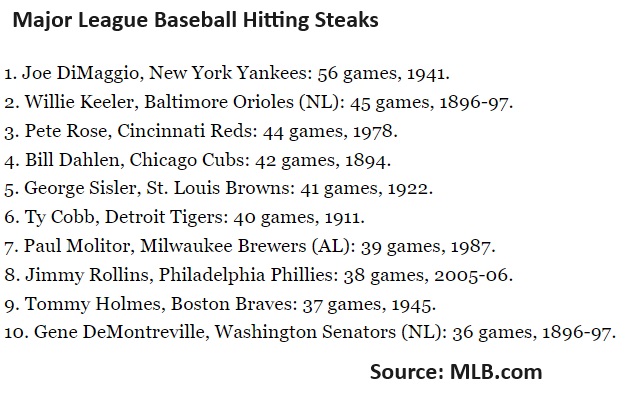

Wednesday will mark the 83rd anniversary of the start of Joe DiMaggio’s 56-game hitting streak—a record that remains unchallenged in baseball. Similarly, the stock market has exhibited its own streakiness recently, with the Dow Jones Industrial Average closing in the green last Friday, extending its winning streak to eight consecutive days.

Streaky Markets

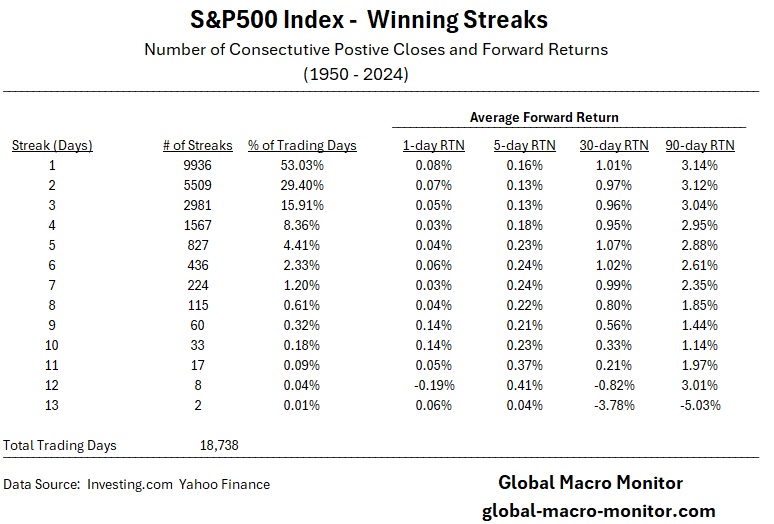

We find it noteworthy that it has been only 13 trading days since we posted our analysis, “S&P 500 – Will the 20-week MA Hold After Six Straight Down Days?” In that piece, we provided an in-depth look at losing streaks, noting the rarity of such occurrences. For instance, since 1950, the S&P 500 has only registered a 6-day losing streak in 1 percent of the trading days, and just 0.42 percent since 2000.

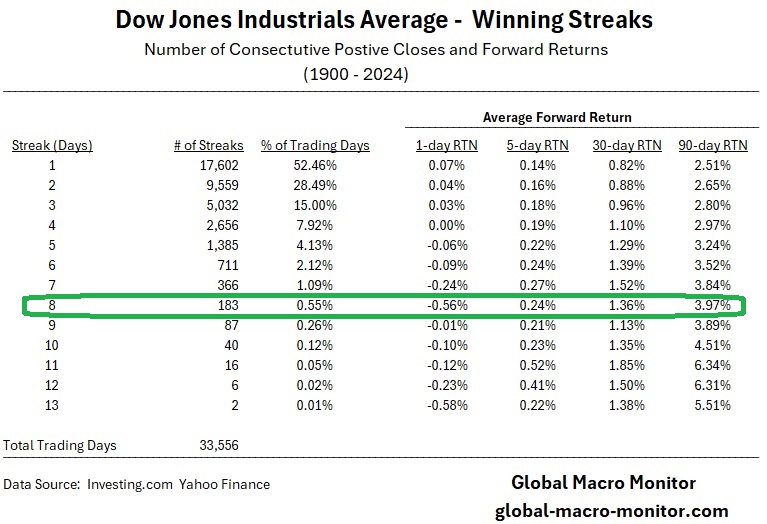

Dow Streaks

The table below illustrates that the Dow Jones Industrial Average has experienced an 8-day winning streak on only 183 occasions since 1900, which represents just 0.55 percent of the over 33,000 trading days. Our data indicate that the Dow typically closes lower the following day, demonstrating a regression to the mean.

House/Market Odds

It’s interesting to note that the Dow and S&P 500 generate a positive daily return 52.46 percent and 53.03 percent of the time, respectively. These odds are roughly equivalent to the casino’s advantage when betting it all on black or red in roulette. Betting against the market—or the house—never pays in the long run.

COTD = Chart of the Day

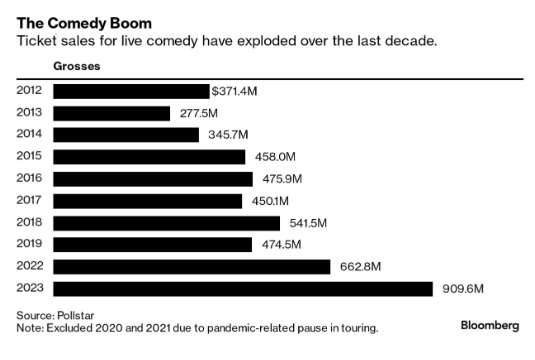

Stand-up comedy grosses have nearly tripled over the last decade, climbing to more than $900 million last year, according to Pollstar. – Bloomberg

Don’t let the title scare you off; this is a must-view.

Money Quote (be sure to view the video for context):

Free speech is never freer when it’s hate speech directed at Jews. – Prof Galloway

Click here to view the interview