COTD = Chart of the Day

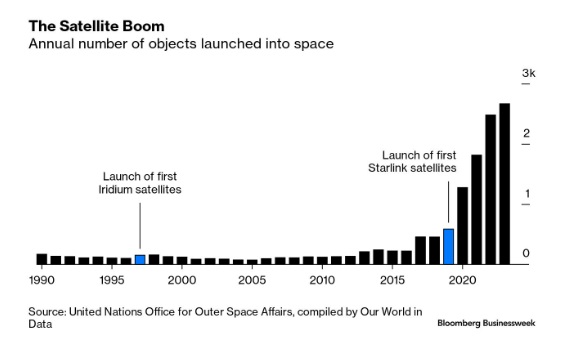

If the idea of tech impresarios sending fleets of satellites into space to revolutionize communications by making high-speed connections available just about everywhere sounds familiar, it should. That’s certainly the news of today, with Elon Musk’s Starlink already girdling the globe with more than 4,000 satellites in low-Earth orbit and rivals including Amazon.com Inc.’s 3,236-satellite Project Kuiper—the brainchild of founder Jeff Bezos—not far behind. – Bloomberg

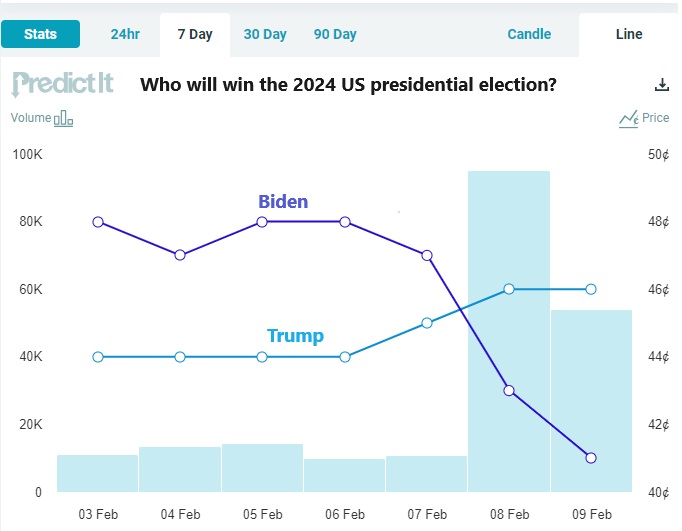

President Biden’s odds at PredictIt.org of being re-elected in November cratered after the release of last week’s special counsel’s classified documents report. He was cleared, but the following language in the report inflicted a major political flesh wound,

“at trial, Mr Biden would likely present himself to a jury, as he did during our interview of him, as a sympathetic, well-meaning, elderly man with a poor memory“. – Special Counsel’s Office

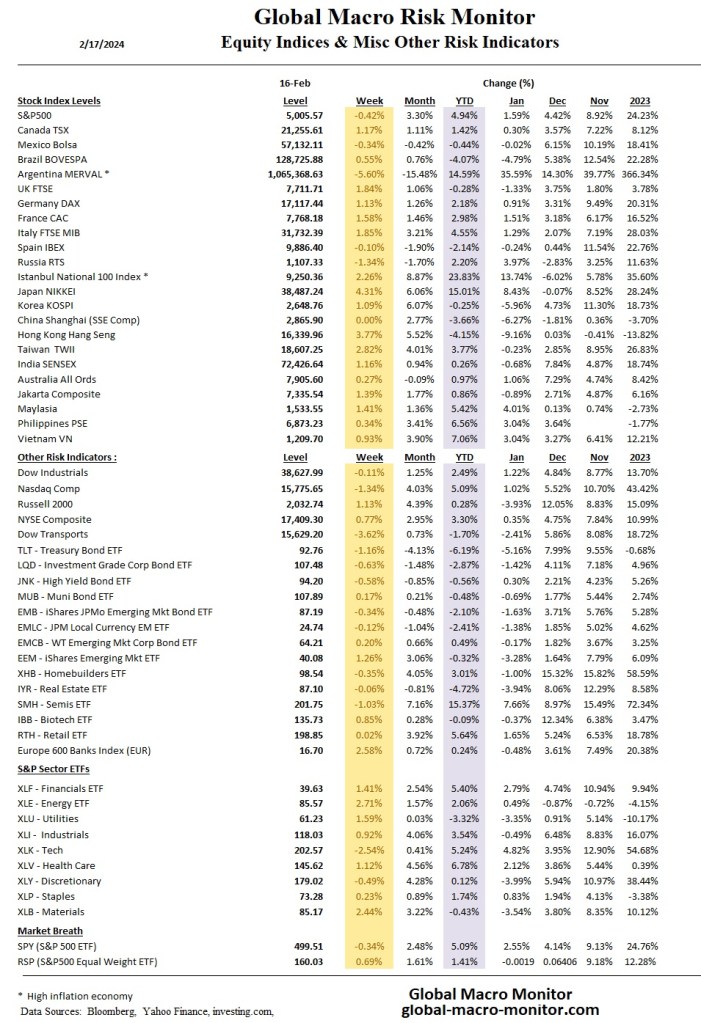

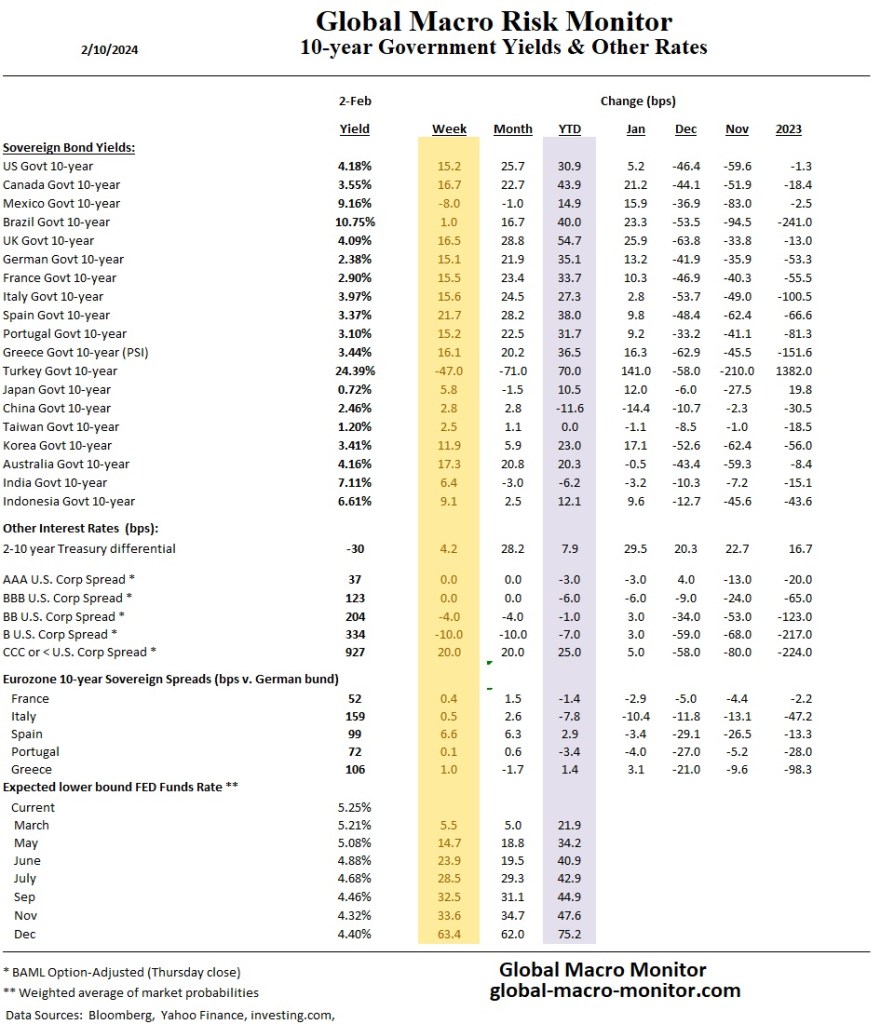

We added a Fed tracker at the bottom of the yields page, which measures the change in the expected Fed Funds rate at each upcoming FOMC meeting throughout the rest of the year. The rate is a weighted average of market probabilities. Note the significant market revisions this past week in the later months, such as an increase of 63 bps for the December meeting. Is Mr. Market listening?

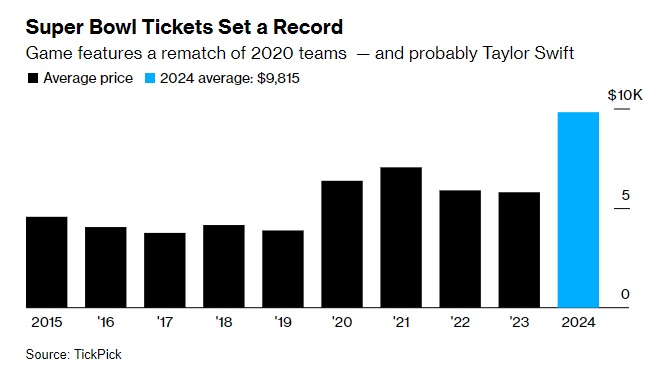

The 49ers’ running back, Christian McCaffrey, aka CMC, was instrumental in leading his team to Super Bowl LVIII, which will be played on February 11th in Las Vegas. CMC came to the Niners in a trade for draft picks in October 2022 from the Carolina Panthers, owned by hedge fund great David Tepper.

We are big fans of Tepper and have posted several pieces about him on GMM, including what he calls his worst trade ever — buying Russian local currency T-Bills or GKOs in the late ’90’s. Maybe he’s rethinking that; letting CMC go may be his worst.

McCaffrey, often referred to as the NFL’s best non-QB player and star is the real deal, folks. Stanford boy, runner up for the Heisman, and now going to the Super Bowl; and then to…wait for it… Disneyland.

Whatever the case, Super Bowl ticket prices are stratospheric. No inflation here.

Can’t wait for the prop bet on how many times Taylor Swift will be shown on camera.

Eerily, the last time the Chiefs and 49ers met in the Super Bowl was February 2020, just a few weeks before COVID broke out in the United States. Yikes!

Go Niners!

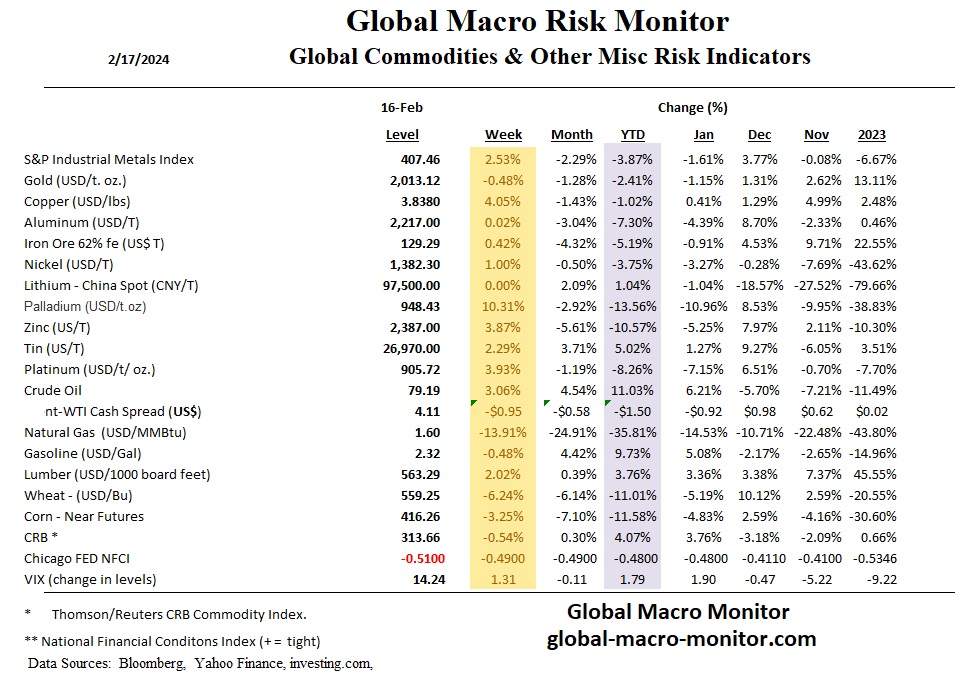

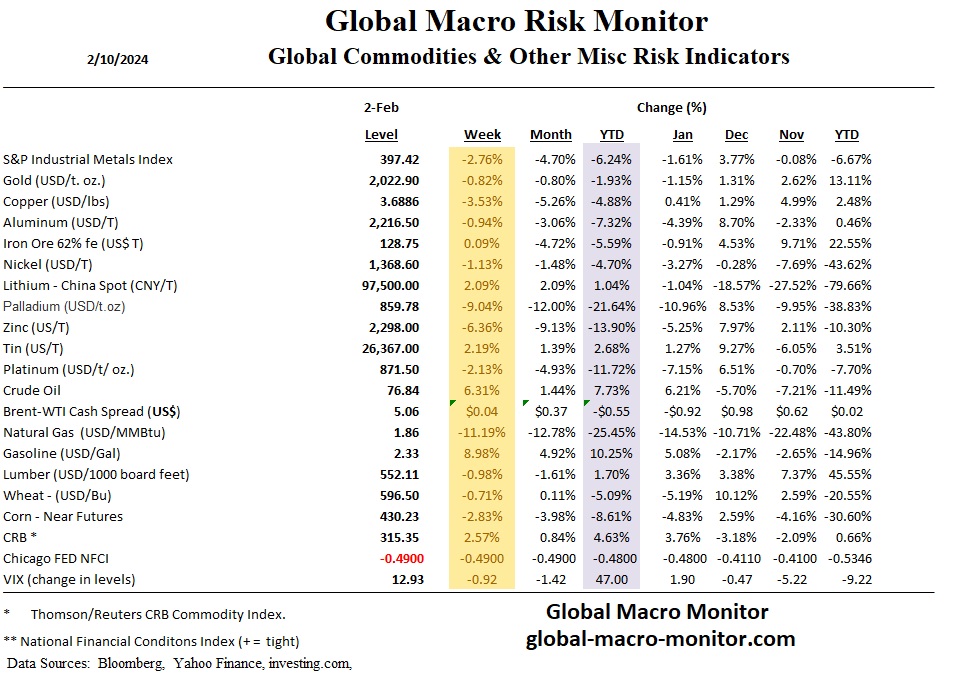

The Fed’s attempt to tighten monetary policy is being cannibalized by the private sector’s accelerated easing of financial conditions through market-based financial instruments. The following chart is simply stunning.

Since the Fed began its monetary tightening campaign in March 2022, lifting rates from zero to 5 percent, overall national financial conditions have eased significantly, as measured by the Chicago Fed’s National Financial Conditions Index (NFCI).

The NFCI is an index of a weighted average of 105 market financial indicators that cover a wide spectrum of the financial system, including the money markets, debt and equity markets, and the traditional and “shadow” banking systems.

Our quick “blink” review of the NFCI, going back to early 1970s shows the Fed doesn’t start cutting rates until there is a spike in the NFCI, which, given the weights in the index, usually occur with an adverse credit event.

We believe this will be a major issue debated at the Tuesday/Wednesday FOMC meeting between the doves and the hawks, and will most likely result in some hawkish rhetoric coming from Mr. Powell’s post-meeting presser. Seat belts?

Mr. Market is pricing close to a 50 probability of an interest rate cut in March. Zero chance, in our opinion, if the markets continue on the merry way.

As always, we reserve the right to be wrong, as we often are.

Stay frosty, folks.