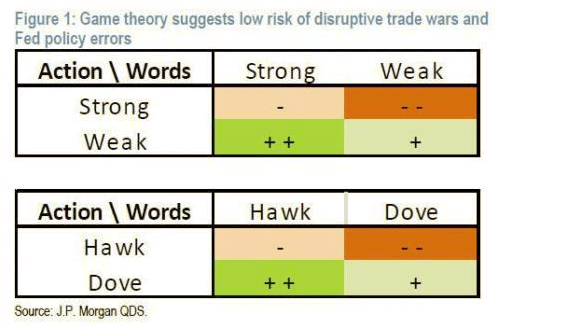

Last week we were thinking about pulling together a post using game theory to predict the outcome of the Trump administration’s tariff announcement. JP Morgan beat us to it, however.

More interesting is the JPM quant’s assertion that Trump will – or should – avoid launching a trade war at all costs, not least of all because he wants to avoid impeachment, which would be far more likely if Trump “destabilizes global markets” impairing the administration’s ‘market scorecard’ and likely leading to an election loss. And, as Marko adds, “lost elections open a path to impeachment, and other complications.” – JP Morgan, via Zero Hedge

China’s Strategy

There is no doubt, in our opinion, the Chinese government understands this. That they have Mr. Market on their side, which will punish President Trump with a bear market if the U.S. takes a hard line and chooses a trade war. President Trump has tied his success to a soaring stock market.

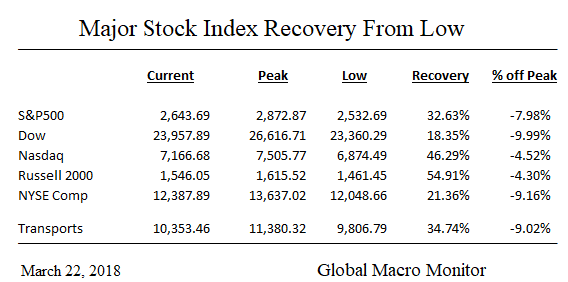

Today’s 700 plus decline in the Dow is a case in point. Market volatility dilutes U.S. bargaining power and may make the path to an outcome much more unstable. Thus more volatility. A classic feedback loop.

President Xi may calculate another 3,000 points shaved off the Dow, and the U.S. will capitulate.

We are not so sure this White House, Mr. Navarro, in particular, is as rational as JP Morgan believes. Nor is it so easy to control the genie once she is out of the bottle.

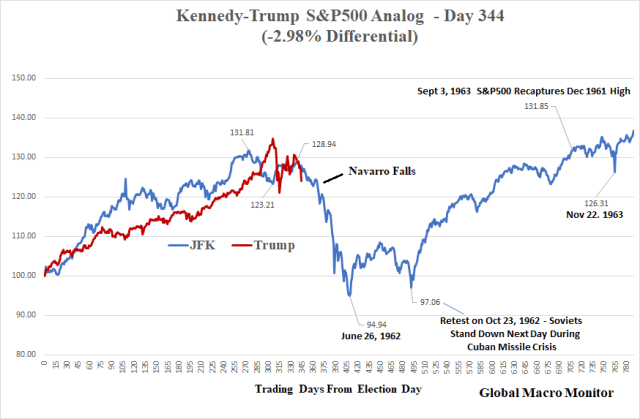

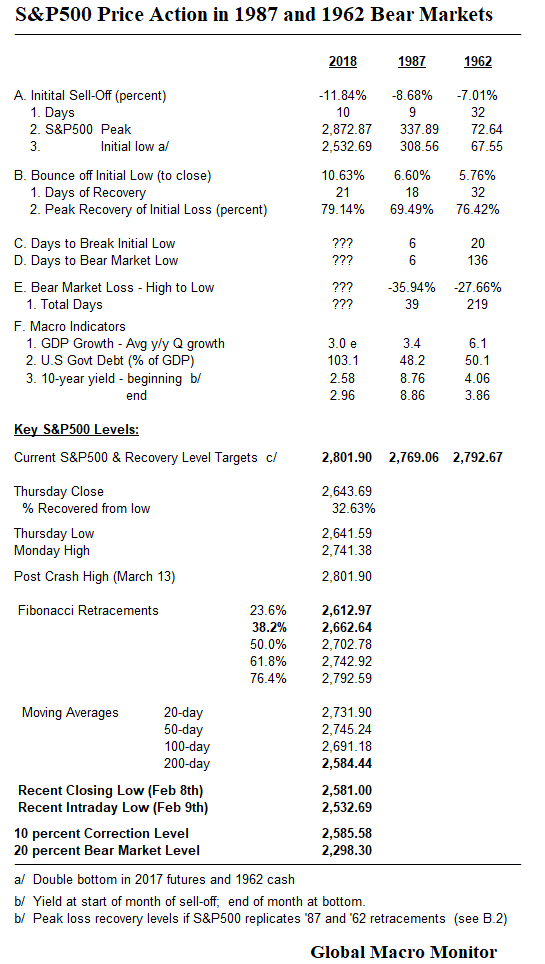

S&P500 Tips Over

As we suspected, and as our analog instructed, the S&P500 tipped over the “Navarro Falls” on Monday, and the sell-off got some real legs today. The JFK-Trump S&P analog continues to track on a directional basis like clockwork with the Trump S&P now almost 3 percent below the JFK S&P 344 trading days after election day.

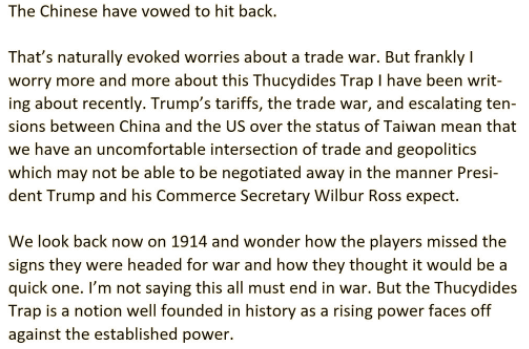

The Trade War Nobody Wants

The conventional wisdom of the market pundits is the tariffs are just an opening position, it is all noise, and will be over quickly. Upon hearing all this we immediately thought it was the same thinking at the beginning of World War I, the war nobody wanted.

We prepared to write something up, but our good friend, Greg McKenna, down in Australia beat us to the punch. Here is his profound thinking in the Friday morning commentary.

Source: Greg McKenna @gregorymckenna

That is big thinking, folks. Greg is one smart dude.

Deep State

We suspect it will not be long before we hear an official pronouncement the “deep state” is behind this sell-off. In fact, there are already whispers of such in the market. Just sayin’.

I hear and understand all your comments and concerns and I hate to sound like a recording but this time is different. Everything I hear and read, political, economic, realistic, say we have been taken, and all our “friends” are bleeding us. Is this the correct way to address it? Maybe yes! WTO takes 3-6 yrs and then they ignore or appeal again or find a loop hole. This time the Govt leases, subsidizes, loans, etc the Chinese companies so they can compete. This is not a developing country, it is the 2nd largest economy in the world. Compete fairly or face the consequences.

Thanks, RD. I agree with you that we have to address the issues. But, given the fragile nature of the economy and financial markets, it must be done gingerly, width a scalpels knife and not a sledge hammer. Imagine if China says no more access to their market for Apple, which is now 25 percent of revenues. That would shave 50 percent off the S&P500. The country and economy could not handle that. Furthermore bigger issues at work. See here: https://www.belfercenter.org/thucydides-trap/overview-thucydides-trap

Have little confidence in current administration to generate positive outcome. Thanks for comments, RD.

Pingback: Mr. Market Weakens U.S. Negotiating Position With China - truthtavern.com

Pingback: Mr. Market Weakens U.S. Negotiating Position With China - Sell The News

Pingback: Mr. Market Weakens U.S. Negotiating Position With China - Novus Vero

Pingback: Mr. Market Weakens U.S. Negotiating Position With China – Earths Final Countdown

Pingback: Mr. Market Weakens U.S. Negotiating Position With China – iftttwall

Pingback: Mr. Market Weakens U.S. Negotiating Position With China | Newzsentinel

Pingback: Mr. Market Weakens U.S. Negotiating Position With China | Zero Hedge

Pingback: Mr. Market Weakens U.S. Negotiating Position With China | Investing Daily News

Pingback: Mr. Market Weakens U.S. Negotiating Position With China - MaryPatriotNews

Pingback: Mr. Market Weakens U.S. Negotiating Position With China | Real Patriot News

Pingback: Mr. Market Weakens U.S. Negotiating Position With China – Wall Street Karma

Pingback: Mr. Market Weakens U.S. Negotiating Position With China – TradingCheatSheet

Pingback: China’s Other Nuclear Option… | Real Patriot News

Pingback: China's Other Nuclear Option… – Wall Street Karma

Pingback: China’s Other Nuclear Option… | Investing Daily News

Pingback: China's Other Nuclear Option… – ProTradingResearch

Pingback: China's Other Nuclear Option... | StockTalk Journal

Pingback: China's Other Nuclear Option… – TradingCheatSheet

Pingback: China’s Other Nuclear Option… – The Deplorable Patriots