Cracks in Global Economies Amid Easy Financial Conditions

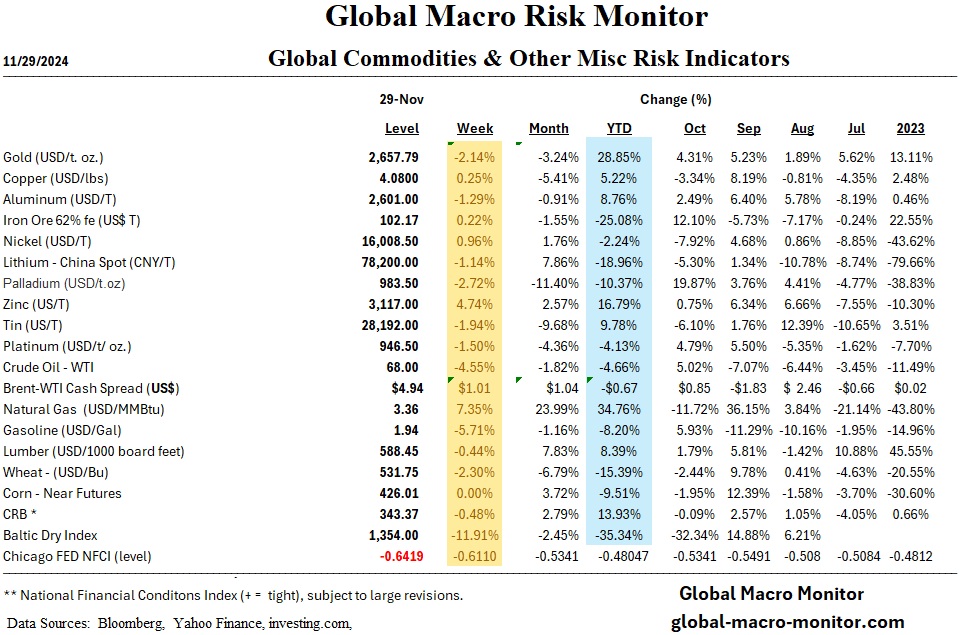

Despite the extremely easy financial conditions in the United States as measured by the Chicago Fed’s National Financial Conditions Index (NFCI), significant economic stress is emerging across key markets, exposing vulnerabilities that could threaten financial stability.

France

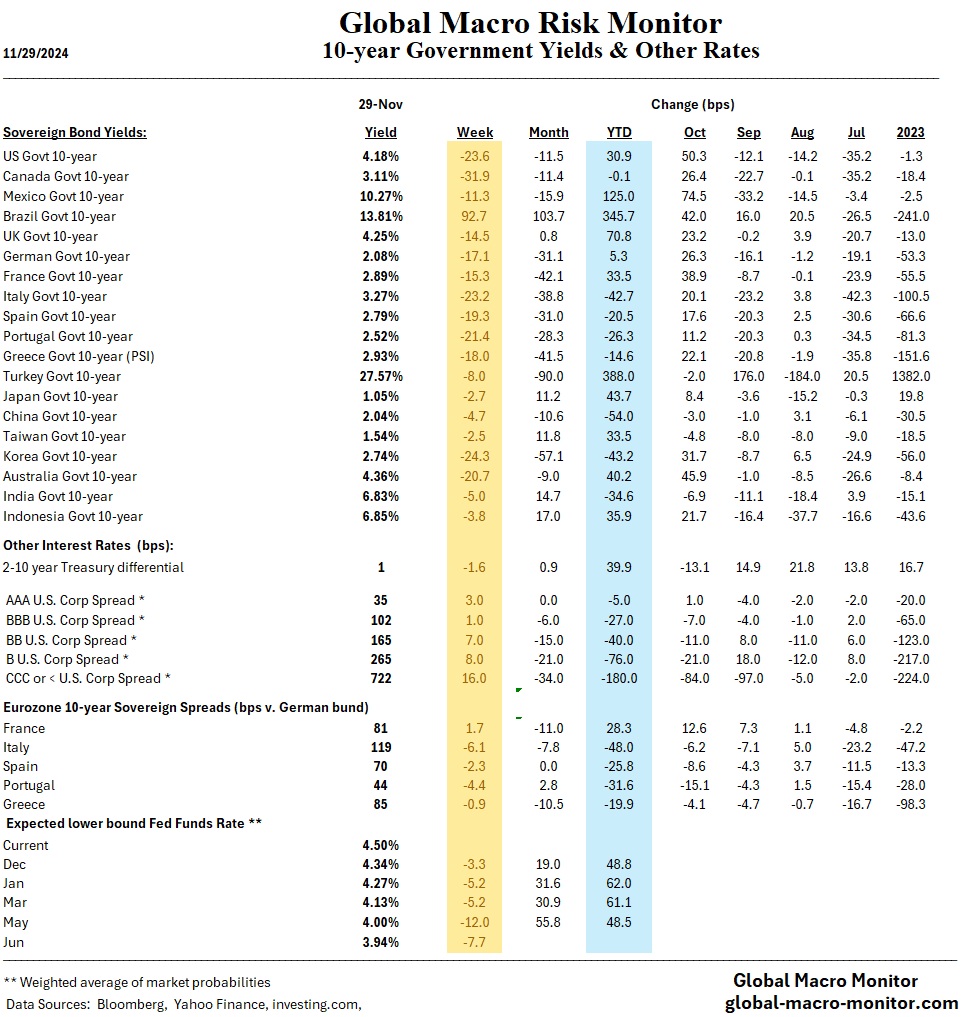

In France, political paralysis and strained public finances are raising alarms of a potential debt crisis. Borrowing costs have surpassed Greece’s amid investor fears over the government’s ability to pass a deficit-cutting budget. Prime Minister Michel Barnier faces resistance from far-right and leftist opposition parties, and his minority government risks collapse over fiscal reforms. France’s deficit, expected to reach 6.2% of GDP, leaves little room for maneuver. While analysts downplay the comparison to Greece’s past crisis, prolonged political uncertainty and reliance on extraordinary legislative measures like Article 49.3 are exacerbating concerns about governability and fiscal sustainability.

Russia

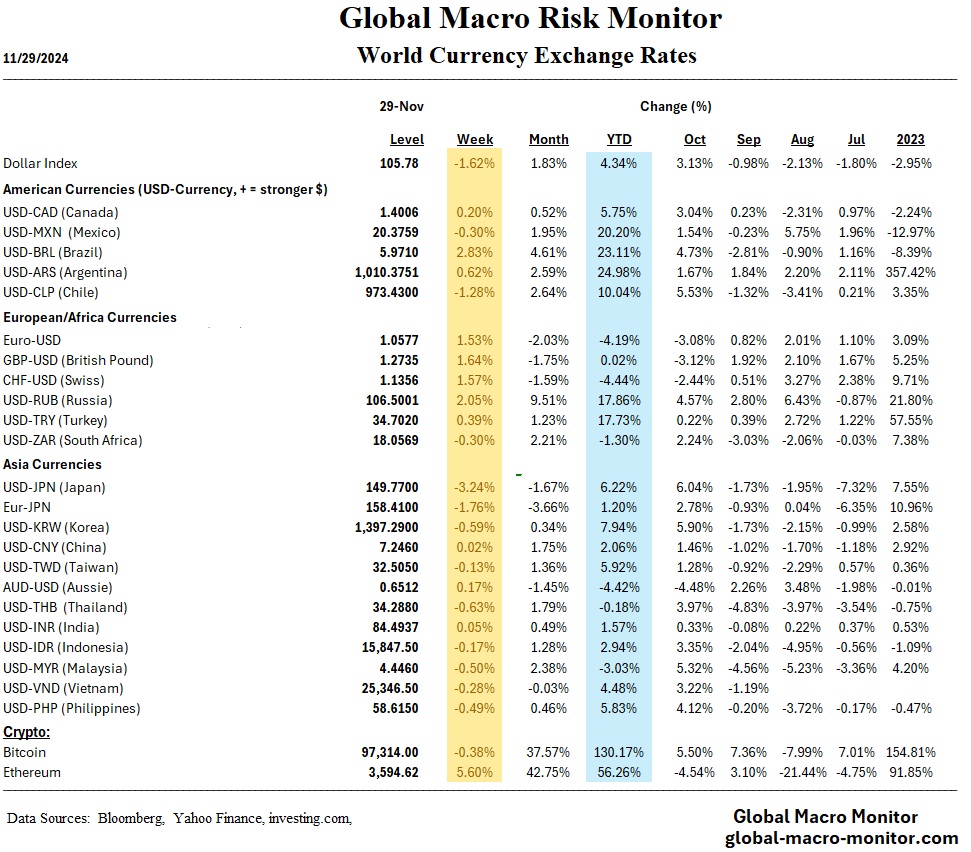

In Russia, the ruble has plummeted to its lowest levels since 2022, driven by falling oil prices, soaring inflation at 8.5%, and record interest rates of 21%. New U.S. sanctions on Gazprombank have disrupted critical financial channels, threatening the Kremlin’s ability to fund its war effort and receive export revenues. Meanwhile, defense spending continues to balloon, straining a war economy already grappling with labor shortages and rising consumer goods theft. Experts warn the economy risks overheating, further jeopardizing financial stability.

Brazil

In Brazil, the real has hit an all-time low, reflecting market skepticism over President Luiz Inácio Lula da Silva’s fiscal policies. A proposed $12 billion cost-saving plan has failed to reassure investors as rising state expenditures feed inflation and worsen the fiscal deficit, now at 9.3% of GDP. Despite robust GDP growth, the central bank has tightened monetary policy to combat inflation, but doubts persist over the government’s political will to implement meaningful reforms.

These developments highlight emerging cracks in major economies, even under historically favorable financial conditions.