Key Data

- U.S. equity markets rallied, with the S&P 500 gaining 1.74% and setting a record high.

- AI investments of $500 billion are expected to fuel U.S. growth.

- The Bank of Japan raised interest rates to 0.5%, the highest since 2008.

- Eurozone services activity expanded, but manufacturing remained sluggish.

- U.S. consumer sentiment fell due to inflation and job market concerns.

- Chinese youth unemployment declined to 15.7%.

- The ECB is expected to continue rate cuts to support growth.

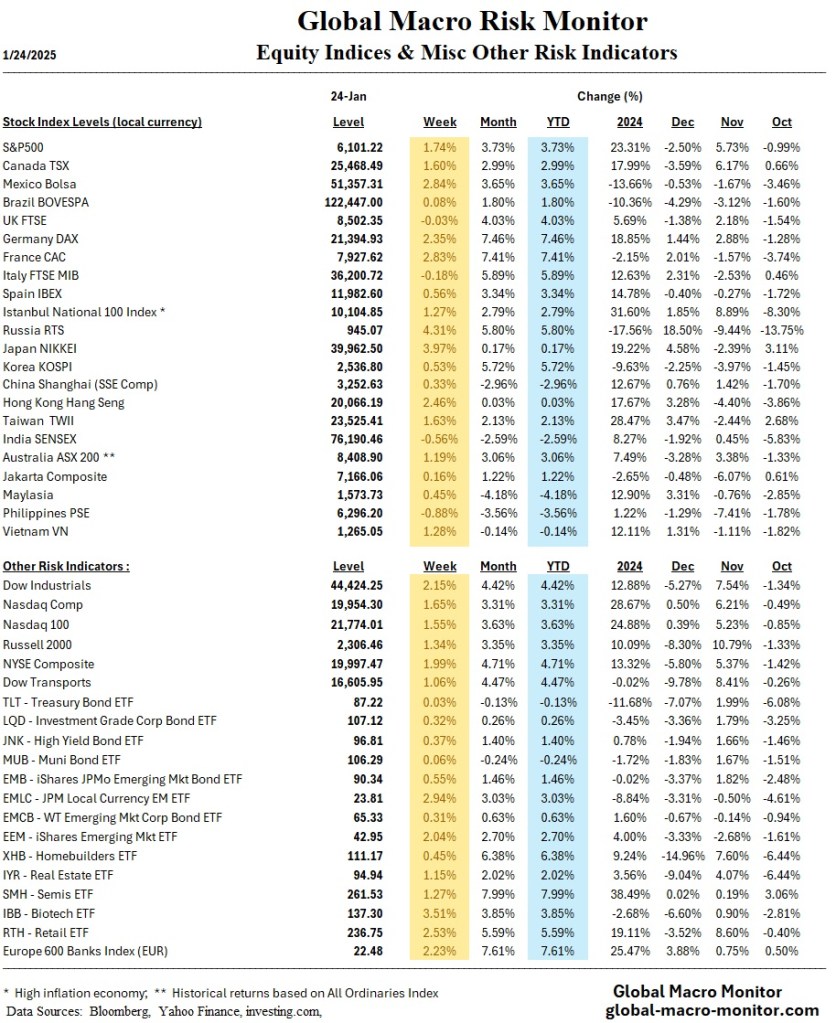

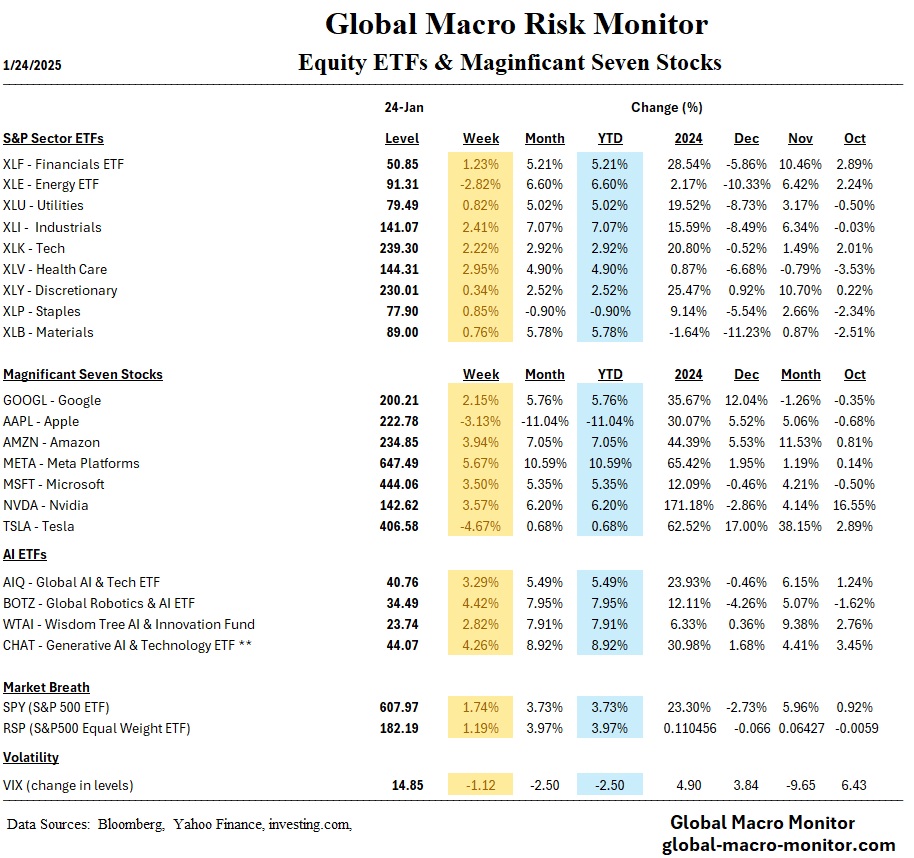

Global markets experienced a significant shift in the past week, with optimism over U.S. trade policy — no big tariff announcements — and central bank actions driving investor sentiment. In the U.S., major indices, including the S&P 500, soared to record highs, supported by renewed confidence in economic growth (Q4 GDP to be released on Thursday) and a $500 billion AI infrastructure project spearheaded by OpenAI, Oracle, and SoftBank. Growth stocks outpaced value stocks, and large-cap indices generally outperformed their smaller-cap counterparts. Meanwhile, U.S. Treasuries remained stable, though municipal bonds saw robust demand amid elevated issuance volumes.

Global Markets

Internationally, markets displayed mixed performances. European equities rose as optimism about potential European Central Bank (ECB) rate cuts grew, with Germany and France leading gains. The Bank of Japan (BoJ) made headlines by raising interest rates by 0.25 percent to 0.5%, the highest level since 2008, signaling confidence in achieving its inflation targets. This move bolstered investor optimism and lifted Japanese equities, with the Nikkei 225 climbing nearly 4%, though the strengthening yen tempered some gains for exporters. In China, equities edged higher as monetary policy remained accommodative, and U.S. trade tensions appeared to ease.

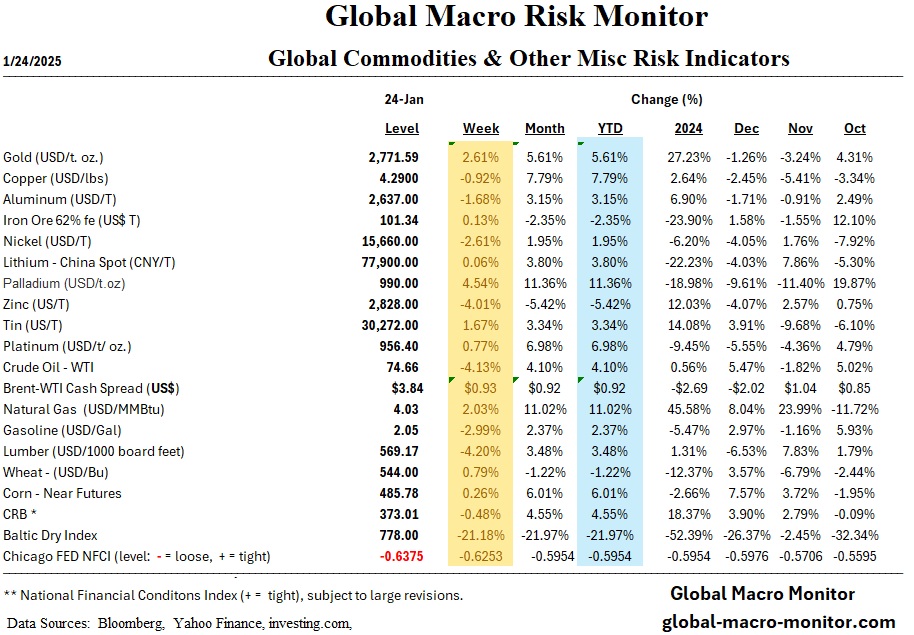

The dollar index was weaker by 1.77 percent. Mexico, Brazil, Korea, Malaysia, and Russia’s currencies rallied significantly against the dollar. Oil prices fell over 4 percent on the week and gold rose to $2,771 per ounce.

Economics

U.S.

Economic indicators reflected a mixed picture. Manufacturing activity expanded for the first time in six months, while services sector growth slowed. December’s existing home sales rose 2.2%, ending 2024 on a high note, but annual sales hit a 30-year low, weighed down by high mortgage rates. Consumer sentiment dipped, with concerns over inflation and unemployment emerging as key drivers.

Foreign

In the Eurozone, business activity showed signs of recovery, driven by modest growth in the services sector, while manufacturing remained weak. The BoJ’s rate hike reflected growing confidence in its inflation trajectory, supported by rising wages and higher consumer prices, which hit 3.0% annually in December. In China, a continued decline in youth unemployment and stable loan prime rates hinted at economic stabilization.

The Week Ahead

In the U.S., key economic data, including Q4 GDP and the Federal Reserve’s policy decision, will dominate the agenda. Markets have priced a 99.8 percent probability that the Fed will make no move. Internationally, all eyes will be on China’s PMI data, the ECB’s anticipated rate cut, and the Bank of Canada’s policy meeting, offering critical insights into global growth and monetary trends.