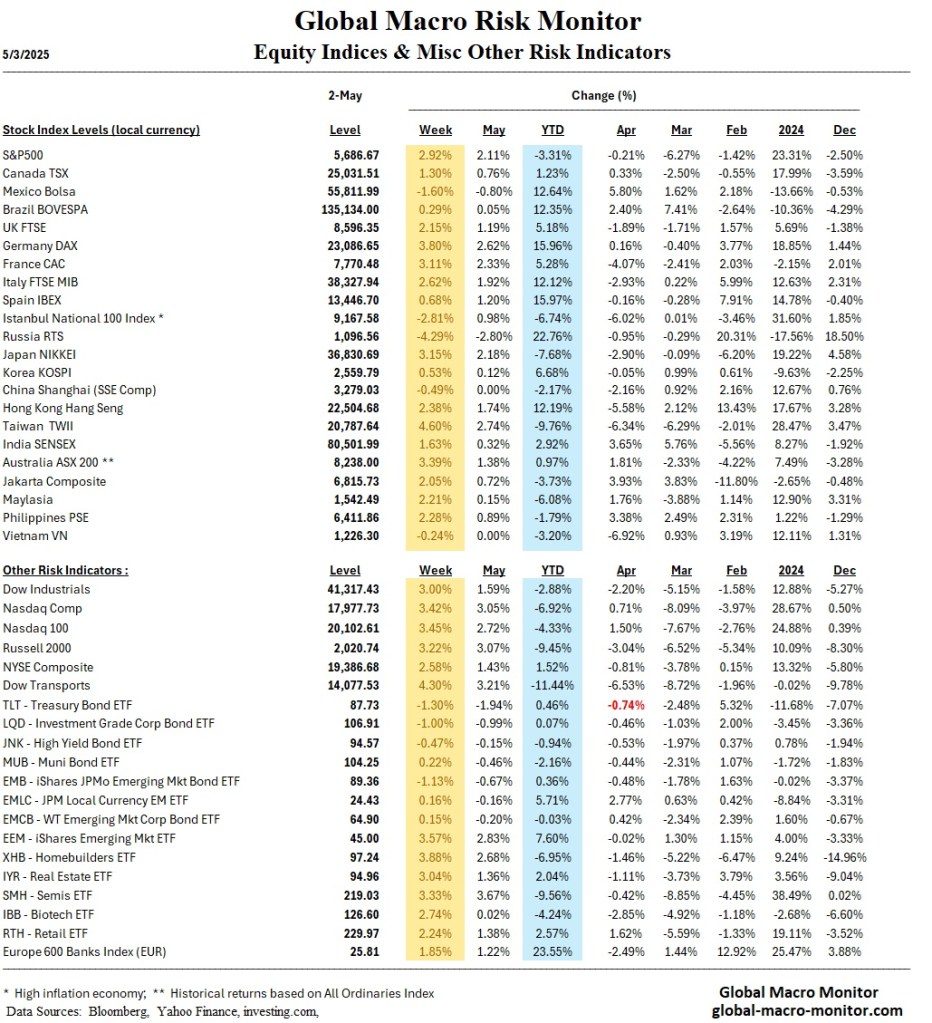

This week, global equities extended their recovery, buoyed by rising optimism over potential U.S.–China trade negotiations. Though no formal talks or trade agreements have been signed and most tariffs remain in place—including broad-based global levies—markets responded positively to U.S. administration signals suggesting some trade deals may be near (recall “Infrastructure Week” during Trump 1.0). This has helped drive the S&P 500 to its ninth consecutive gain, approaching a key technical level at 5747.66, its 200-day moving average.

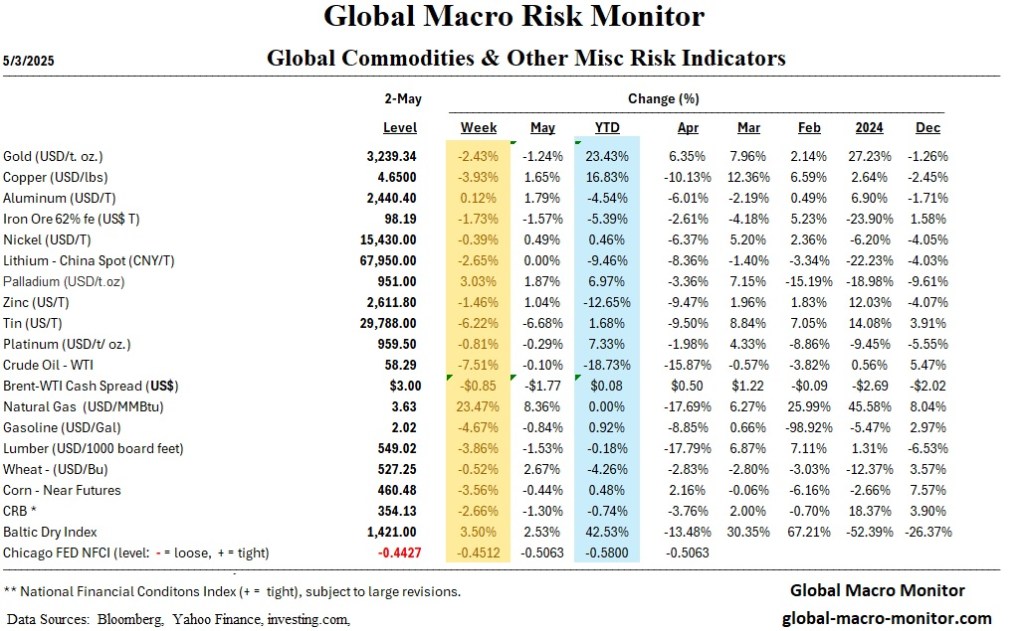

Investor sentiment has shifted, despite contradictory macroeconomic data. April’s U.S. payrolls report exceeded expectations with 177,000 new jobs, indicating labor market resilience. Meanwhile, Q1 GDP contracted 0.3%, driven primarily by an import surge ahead of expected tariffs. The contraction masked the underlying strength in consumption and business investment, which is probably distorted by the tariffs, pointing to front-loaded demand rather than structural strength.

Dazed and Confused

This divergence is creating confusion among economists. The rally appears disconnected from fundamentals, yet persists amid AI enthusiasm, solid tech earnings x/ Apple, and easing energy prices. Historically, markets revert to hopium and to a bullish default mode. Data from our “S&P500 Significant Digits” table supports this: since 1950, the S&P 500 has posted gains 72.46% of the time on an annual basis, with an average return of 8.71% and a standard deviation of 16.20%. On a monthly basis, the S&P500 is up 60% of the time.

Market breadth has improved, led by mega-cap tech, small-caps, and renewed strength in the AI sector. However, as noted in multiple reports, the post-tariff economic environment lacks historical analogs, similar to how language models operate without pattern certainty. Without a clear forward path, investors are defaulting to the historical mean—bullish.

Global Markets

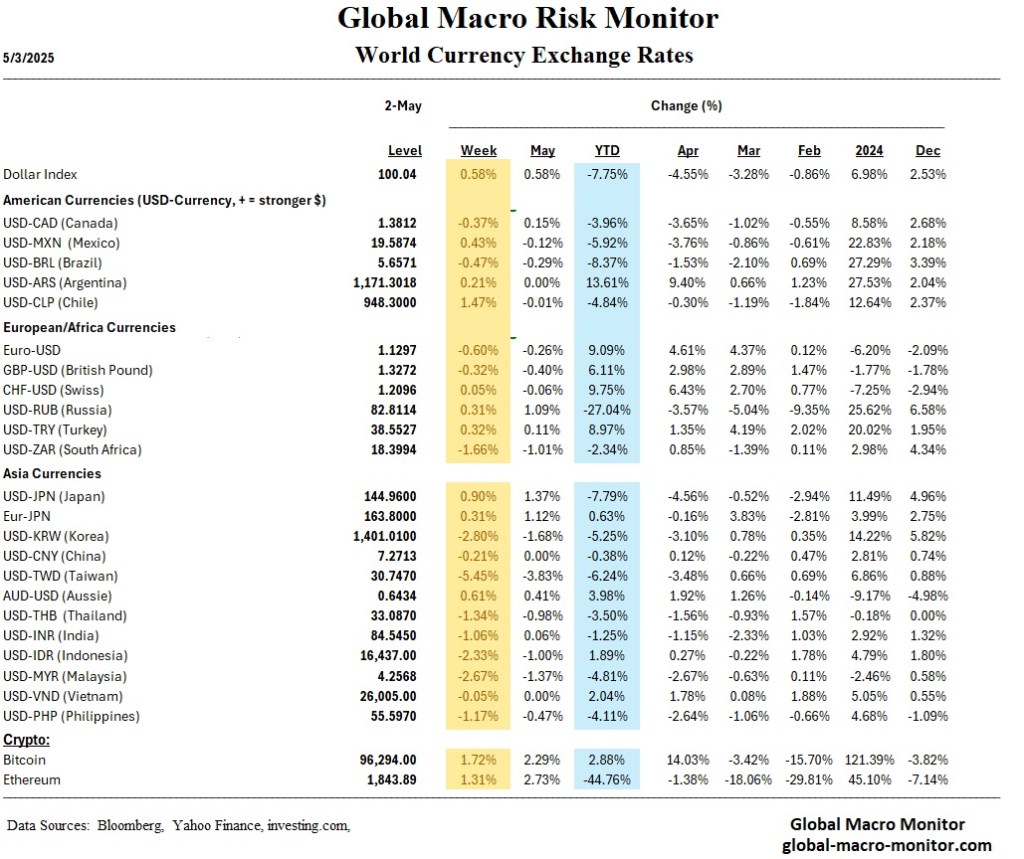

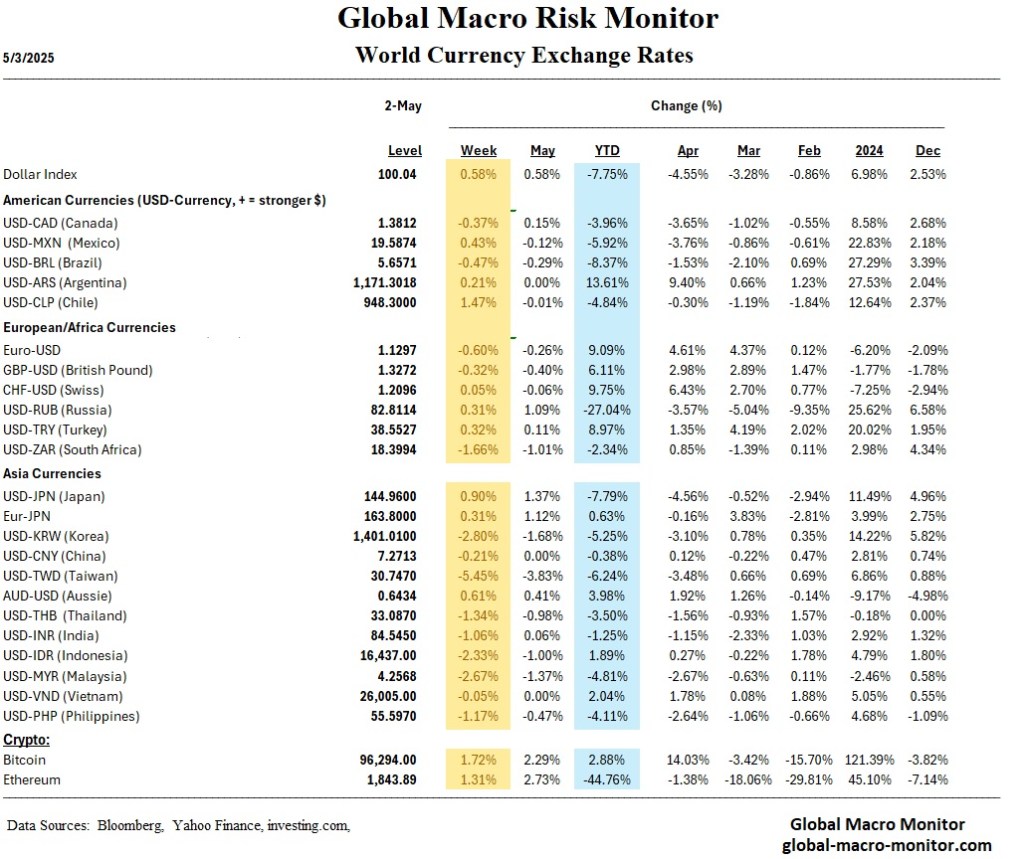

Globally, Eurozone Q1 GDP surprised to the upside, but inflation remains sticky. UK sentiment and housing have softened. Japan’s BoJ held rates steady and pushed back policy tightening, citing trade uncertainty. Chinese PMIs deteriorated, yet signals of trade thaw, including selective tariff exemptions, have supported regional equities.

Upshot

In sum, the market rally reflects forward-looking optimism rooted more in narrative than in data. The next test lies at the 5747.66 mark—whether momentum can overcome macro headwinds remains uncertain. The 200-day is just a chip shot away. Until then, markets appear to be pricing in the best-case scenario, which, in our opinion, will not be the best case as the Administration appears not to know what it wants: 1) Reshoring of manufacturing? 2) The tariff revenue? Or 3) Lower tariffs for American exports and freer trade? The macro market is choosing #3, but we believe Trump wants #1; both are mutually exclusive.

We believe empty shelves are just a few weeks away.

Stay frosty, folks.

Markets

- U.S. equities extended their recovery: S&P 500 posted a ninth consecutive gain, supported by strong earnings and easing trade fears.

- S&P 500 approaching 5747.66, its 200-day moving average, a key technical resistance level.

- Market breadth improved, with gains across large-cap tech and small/mid-cap stocks.

- Investor sentiment is buoyed by optimism over potential U.S.–China trade negotiations, though no agreement has been finalized.

U.S. Market Analysis

- Strong labor data: April nonfarm payrolls rose by 177,000, exceeding expectations; unemployment steady at 4.2%.

- Q1 GDP contracted –0.3%, mainly due to a surge in imports ahead of tariff implementation.

- Markets interpreted the negative GDP print as temporary and driven by front-loaded demand.

- AI and tech stocks led gains; mega-cap earnings (e.g., Microsoft, Meta) surprised to the upside.

- Treasury yields rose late in the week, reacting to jobs data; credit markets stable with narrowing spreads.

Global Market Analysis

- Europe: STOXX 600 +3.44% as trade tension eased; Germany +4.63%, France +3.57%, Italy +4.13%.

- Eurozone GDP beat expectations in Q1 at +0.4%; inflation remained elevated at 2.2% headline, 2.7% core.

- Japan: Nikkei +3.15%, TOPIX +2.27%. BoJ held rates steady and downgraded growth and inflation forecasts.

- Yen weakened modestly; 10Y JGB yield fell to 1.26%.

- China: Mainland indexes down slightly; Hang Seng +2.38%. Manufacturing PMI fell to 49.0—deepest contraction since Dec. 2023.

- Beijing hinted at a willingness to resume trade talks with the U.S.; partial tariff exemptions granted on select U.S. goods.

Economics

U.S. Economic Overview

- Labor market resilient, though early-week data (ADP, JOLTS) showed signs of softening.

- Consumer spending rose 0.7% in March; PCE inflation flat, offering comfort to the Fed.

- Market anticipates the Fed will hold rates steady in May; futures pricing of June cut has declined.

- Surging imports dragged GDP but suggested stronger-than-expected demand fundamentals.

Global Economic Overview

- Eurozone confidence indicators weakening, pointing to potential softness ahead despite Q1 strength.

- BoJ cautious amid trade uncertainty; inflation forecasts lowered, rate hike now likely delayed.

- UK housing cooled; mortgage approvals and business sentiment fell. BoE rate cut expectations rising.

- EM Asia shows divergence: India progressing in U.S. trade talks; China still assessing path forward.

Week Ahead (May 5–9)

Key U.S. Events:

Economic Data

- Mon: ISM Services

- Tue: Trade Balance

- Wed: FOMC Rate Decision, Consumer Credit

- Thu: Jobless Claims, Productivity, Unit Labor Costs

- Fri: No major reports

Earnings Highlights

- Mon: Palantir, Tyson Foods

- Tue: AMD, Arista, Marriott, EA

- Wed: Disney, Uber, Shopify, DoorDash

- Thu: Coinbase, ConocoPhillips

- Fri: Enbridge, Sun Life

Key Global Events:

- Japan CPI: Trade-sensitive inflation indicator due Friday

- Eurozone PMIs: Key growth/inflation gauge out Wednesday

- Tariff headlines: Continued trade talks remain the primary wildcard for risk sentiment