Last week’s Global Risk Monitor (GRM) warned of potential instability in global tariff negotiations, and unfortunately, those concerns proved prescient. Markets stumbled under the weight of fiscal volatility, erratic policy pronouncements, and renewed trade threats—all driven by the chaotic and impulsive style of President Donald Trump. The deterioration in investor confidence was not merely a reaction to weak economic data or disappointing earnings; rather, it was the product of policymaking that has come to resemble more of a hostile boardroom than a functional democracy.

Trump’s latest salvo—a proposed 50% tariff on European Union imports and a 25% penalty on iPhones—has thrown global supply chains and diplomatic alliances into disarray. These punitive measures, which followed a social media tirade declaring that trade talks with the E.U. were “going nowhere,” came without congressional input or interagency coordination. Apple’s stock fell over 7.6% for the week, wiping billions in market value, a move emblematic of the broader market damage caused by unfiltered threats and unpredictable governance.

New Jersey Generals

This isn’t the first time Trump has weaponized unpredictability as a strategy. One need only revisit his ill-fated foray into professional sports with the New Jersey Generals in the USFL. Then, as now, Trump demonstrated a profound misunderstanding of strategic pacing, long-term coalition building, and institutional integrity. His push to move the USFL to a fall schedule—directly challenging the NFL—was driven more by ego, revenge, and spectacle rather than viability. The result? Collapse. And it’s hard to ignore the parallels: antagonizing allies, ignoring systemic constraints, and opting for maximalist stances that backfire economically and diplomatically.

Flop and Chop

Markets this week bore the brunt of that same impulsiveness. The S&P 500 dropped 2.6%, the Dow fell 2.2%, and the Russell 2000—particularly sensitive to fiscal and trade shocks—plunged 3.5%, extending its year-to-date loss to 8.6%. Small caps, discretionary stocks, energy, and tech all led to the downside. Treasury yields spiked following a disastrous 20-year bond auction, sending the 30-year yield to a cycle high above 5%. The root cause? Rising fiscal deficits, compounded by Trump’s budgetary “Big Beautiful Bill,” add more long-term debt, undermining the U.S.’s creditworthiness.

Despite positive May PMI data showing a modest rebound in U.S. business activity, any optimism is being offset by a resurgence in price pressures, most of them, ironically, linked directly to tariffs. Export orders fell, and supply chain delays worsened. Chris Williamson of S&P Global noted that much of the demand surge was likely front-running further policy risk. Companies aren’t investing in growth—they’re bracing for another round of economic whiplash.

Threat of Retaliation

Even America’s allies are growing wary. The EU is preparing a carefully measured but firm response to Trump’s tariff threats, signaling the potential for a tit-for-tat escalation that markets are ill-prepared for. Japan, similarly, has hardened its negotiating position amid Trump’s economic belligerence, recognizing the dangers of being dragged into a game of political brinkmanship that endangers long-term regional stability.

And while Trump insists these moves will “bring back jobs,” the data suggests otherwise. Manufacturing gains remain elusive, with firms citing labor shortages, automation challenges, and investment hesitancy—issues that tariffs alone cannot solve. As his tenure in the USFL compellingly illustrates, Trump has long confused aggression with strategy and disruption with innovation. The net result—then and now—is institutional erosion and self-inflicted damage.

Heavy Metal Rock & Roll

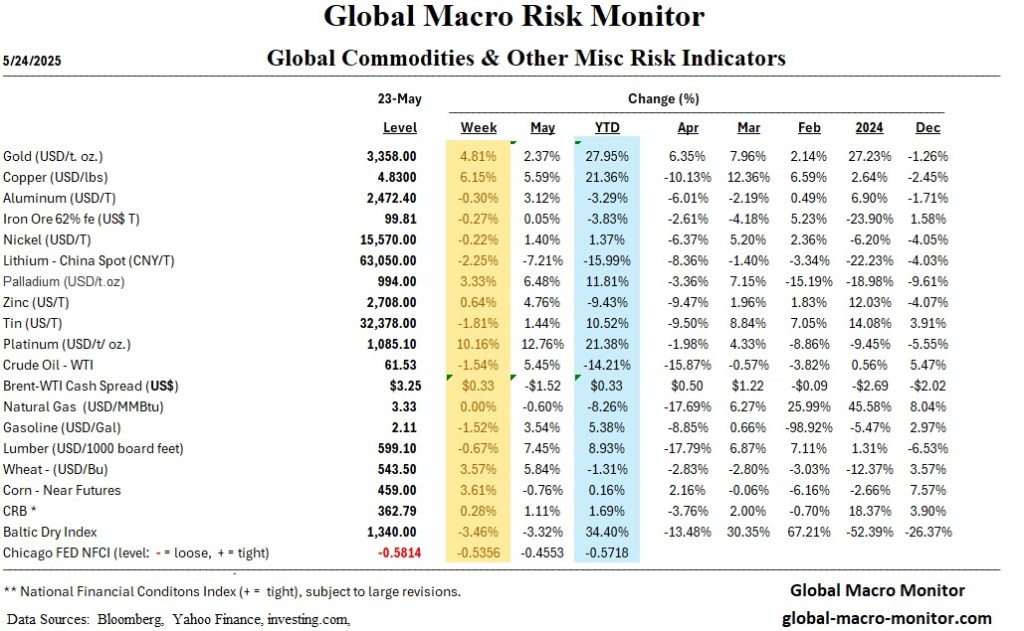

Gold, copper, and platinum all surged this week, up 5%, 6%, and 10% respectively—some some, of which are traditional hedges in times of political instability. Meanwhile, the dollar weakened 2% and the Chicago Fed’s NFCI showed significant easing in financial conditions, more a function of defensive repositioning than macro strength.

In conclusion, the current administration’s erratic policymaking, marked by threats instead of treaties and volatility instead of vision, is exacting a growing toll on markets, governance, and global credibility. Like the USFL, this experiment in economic brinkmanship may well end not in resurgence but in collapse. Investors, allies, and citizens alike would be wise to prepare for more turbulence unless—and until—strategic sobriety returns to the helm.

Markets

U.S. Market Analysis

-

U.S. equities declined across the board, with small- and mid-cap indices underperforming; the Russell 2000 fell over 3.5% on the week, now down 8.6% YTD.

-

Market pressure intensified after a weak 20-year Treasury auction and a surge in long-term yields, signaling increased investor concern over fiscal stability.

-

President Trump’s announcement of a proposed 50% tariff on EU goods and a 25% tariff on iPhones triggered a late-week selloff, contributing to a sharp pullback in tech stocks, including a 7.5% drop in Apple shares.

-

The Dow Jones Industrial Average and S&P 500 closed the week back in negative territory for the year, reversing gains from the prior week.

Global Market Analysis

-

European equity markets were shaken by tariff threats from the U.S., with the EU preparing limited but deliberate retaliatory measures.

-

Japan’s financial sector faced headwinds amid a sharp rise in domestic bond yields and pressure from rising global interest rates.

-

Chinese markets were supported by a continued pause in U.S.-China tariff escalation, although the absence of structural reform progress remains a concern.

Economics

U.S. Economic Overview

-

Moody’s downgraded U.S. sovereign debt, citing mounting deficits and fiscal risk, pressuring Treasury markets and contributing to yield curve volatility.

-

April existing home sales dropped to their lowest level since 2009, while new home sales surprised to the upside, albeit amid declining median prices.

-

Flash PMI data for May showed a rebound in both manufacturing and services sectors, but firms warned that tariffs were driving input costs higher and export orders lower.

-

Inflation expectations surged: 1-year expectations hit 7.3%, their highest since 1981, intensifying concerns about future consumer behavior and purchasing power.

Global Economic Overview

-

Eurozone trade surplus hit a record high, supported by March’s robust industrial production; however, services PMIs declined, reflecting uneven growth.

-

Japan’s core CPI strengthened into the new fiscal year, with inflation led by food and services.

-

China’s retail sales moderated in April but remained stronger than Q1 averages, while industrial production growth slightly outperformed expectations.

Week Ahead

Key U.S. & Global Events

-

Investors will monitor formal responses from the EU regarding retaliatory trade measures following Trump’s 50% tariff proposal.

-

The White House’s public messaging on trade, particularly in relation to Japan and Apple, will be key for sentiment.

-

G7 meetings in Canada could serve as a backdrop for coordinated pushback or policy alignment on U.S. trade actions.

Upcoming Economic Data

-

Tuesday: Durable Goods Orders, FHFA House Price Index, Conference Board Consumer Confidence

-

Wednesday: MBA Mortgage Applications, FOMC Minutes

-

Thursday: Initial Jobless Claims, Revised Q1 GDP, Pending Home Sales

-

Friday: Personal Income & Spending, Core PCE Price Index, Chicago PMI, Final University of Michigan Consumer Sentiment

Notable Earnings Reports

-

Tuesday: AutoZone, PDD Holdings, Okta

-

Wednesday: NVIDIA, Salesforce, HP Inc., Synopsys

-

Thursday: Costco, Dell Technologies, Best Buy, Marvell Technology

-

Friday: Shoe Carnival

This is truly one of your best. I also saw the stealthy wealthy interview on Smerconish. You do great work, Gary. I’m trying to withdraw a bit from politics. As I approach 80 and am still able to think clearly I’d like to think about something else. But I appreciate your output and read it with pleasure. Carry on. David