Today’s Drudge Report headline, with George Washington staring from a dollar bill under the headline “NATL DEBT $37 TRILLION” and accusations of falsified inflation data, encapsulates the growing perception that America’s fiscal and political trajectory is veering toward Banana Republic territory. As both a political analyst and an economist who worked in Argentina during its catastrophic hyperinflation of the late 1980s, I find the parallels increasingly unsettling.

Key Economic Indicators

The United States is experiencing a dangerous cocktail: record-high national debt; persistently large fiscal deficits; protectionist trade policies; official economic statistics under attack, and the risk of being manipulated by the government; creeping autocracy and authoritarianism; and equity markets at euphoric highs. The S&P 500’s surge masks a hollow core — real wage stagnation, eroded purchasing power, and an over-reliance on debt-financed consumption. The slow erosion of trust in official inflation data compounds the problem; when investors, households, and global creditors doubt government numbers, policy credibility collapses.

Historical Comparison: Argentina’s Warning

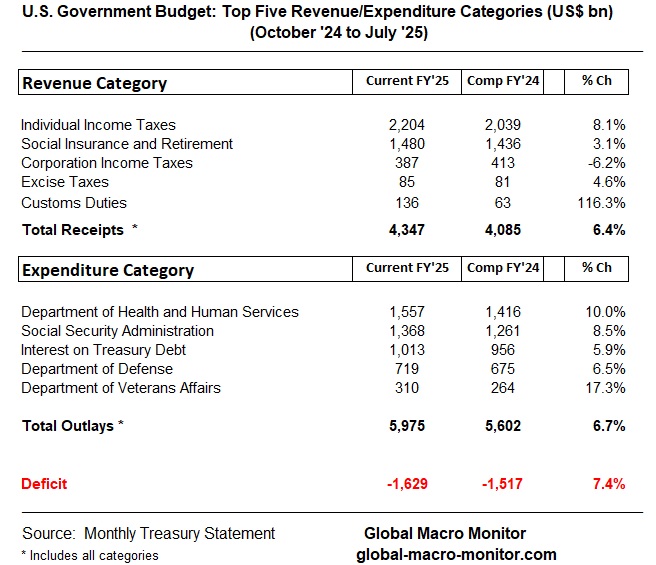

In Argentina, I watched the population sleepwalk into financial ruin, lulled by artificially low inflation figures, fiscal policy that relied too much on boosting revenues rather than controlling spending, the lack of an independent central bank, huge wealth and income inequalities, and massive capital flight. Though the U.S. and Argentina economies are vastly different, some similarities we see in the U.S. today are ominous. Once objective data is politicized, the ability to correct course without severe social pain vanishes. Moreover, the hoopla over tariff revenues as the fiscal savior is just that – hoopla. As the table illustrates below, customs duties only account for 3 percent (albeit growing) of the U.S. government budget receipts.

Future Outlook

If the U.S. continues this trajectory—i.e, rejecting credible statistics, pressuring companies to sideline dissenting economists, and relying on market highs to reassure the public—it risks a future where reality intrudes suddenly and brutally. We may awaken to an economy impaired not by external shocks, but by our own self-inflicted distortions. The lesson from Argentina is clear: complacency is not a cushion, it’s a trapdoor.

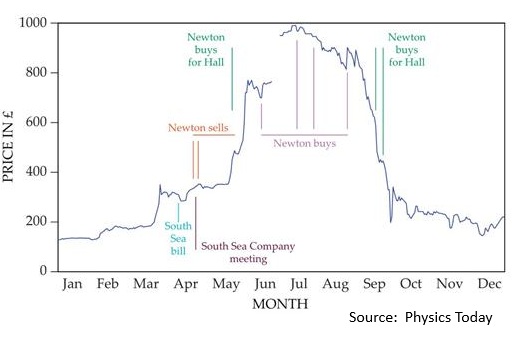

Gravity and the Lesson of Isaac Newton

Let us end with a story of how gravity was really discovered.

Isaac Newton, one of history’s greatest scientific minds, was not immune to the powerful pull of speculative mania. During the South Sea Bubble of 1720, Newton initially demonstrated prudence, selling his shares early for a healthy profit. But as prices soared and friends grew fabulously wealthy, he succumbed to what we now call FOMO—Fear of Missing Out—and re-entered the market near its peak. When the bubble burst, Newton suffered catastrophic losses, later lamenting that he could “calculate the motions of the heavenly bodies, but not the madness of men.”

His experience was a sobering demonstration of a truth he already understood in physics: what rises rapidly under its own momentum will inevitably be pulled back down by gravity. Today’s U.S. markets, now more speculative than at any time in history, mirror that same dangerous psychology. Algorithm-driven surges, meme stock frenzies, and short-term profit chasing have replaced long-term fundamentals, creating an economic environment where upward momentum feels unstoppable—until it isn’t.

Newton’s loss was more than financial; it was a recognition that the laws of nature apply to human behavior in markets as well as to falling apples. In a culture that prizes speed and quick gains over discipline, his hard-earned lesson is more relevant than ever: gravity is patient, and in markets, it always wins in the end.

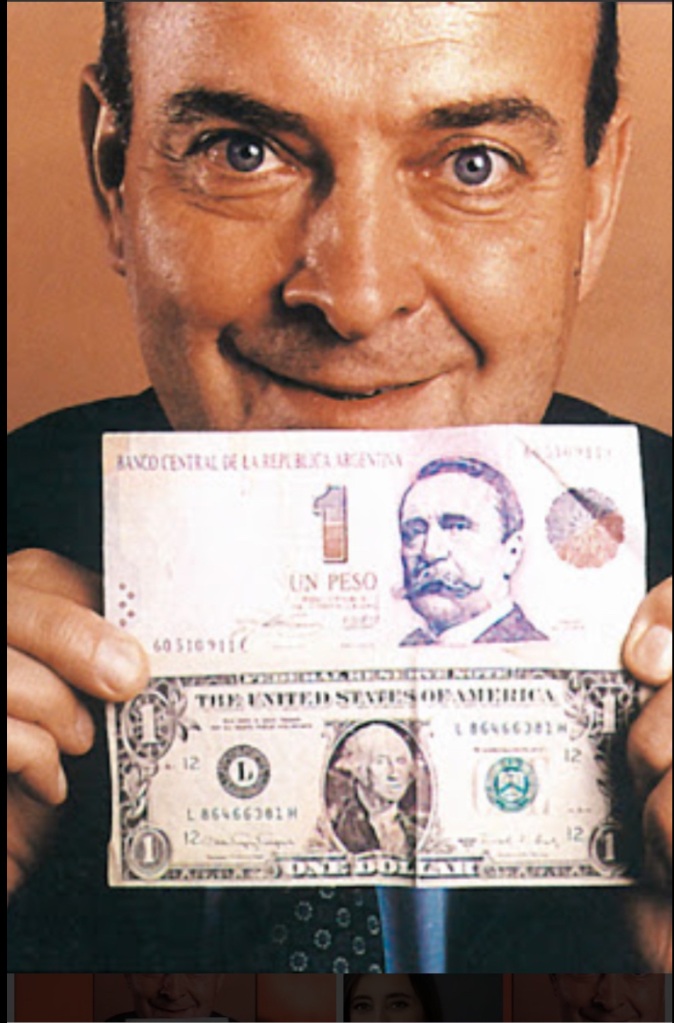

Domingo Cavallo, Argentina Finance Minister (1991-96, 2001), touting the country’s convertibility of one peso = one dollar during its currency board regime. The currency board eventually collapsed in 2001 under the weight of massive capital flight. The peso now trades at 1,313.00 per/$US

Hat Tip: Craig B.