On April 6, the Global Macro Monitor wrote:

The strategy’s incoherence is evident in absurd measures such as, for example, a tariff on coffee, an import for which the U.S. lacks viable domestic production except de minimis production in Hawaii and Puerto Rico. These policies reflect a reactive, politically charged agenda rather than a cohesive economic strategy. Ultimately, market forces are likely to compel a reversal…

Doesn’t the Administration understand the most basic concept of international trade and economics – Comparative Advantage? – GMM

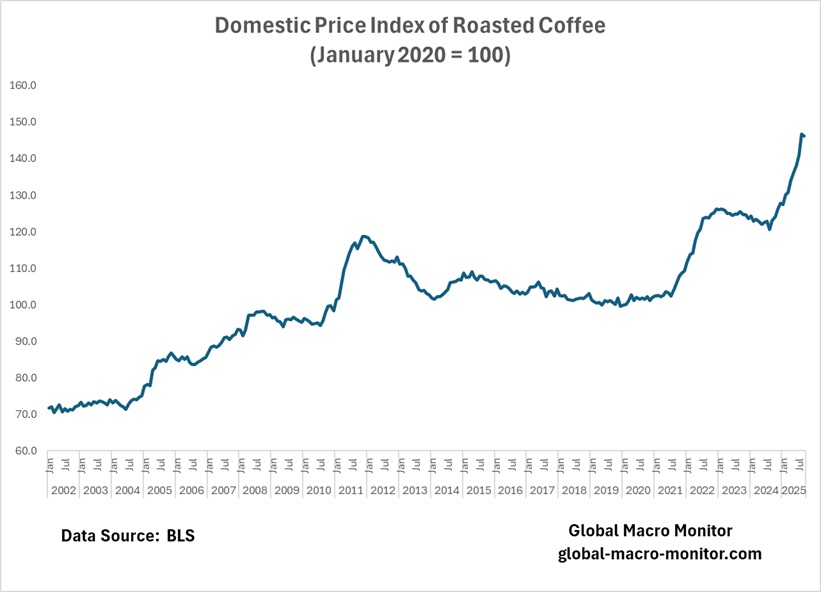

We grabbed a 2½-pound bag of coffee at Costco this week and nearly fell over—prices are up more than 20% from a year ago. With that kind of sticker shock hitting everyday items, Trump’s latest tariff reversal doesn’t come as a surprise at all. It fits the broader pattern we’ve been tracking: policy swings that feed directly into higher consumer costs.

Many of the commodities that will no longer face “reciprocal” tariffs have seen some of the biggest price increases since Trump took office, in part because of tariffs he imposed and a lack of sufficient domestic supply.

For instance, Brazil, the top supplier of coffee to the US, has faced tariffs of 50% since August. Consumers paid nearly 20% more for coffee in September compared to the prior year, according to Consumer Price Index data. – CNN, November 14

Impact on Bond Markets

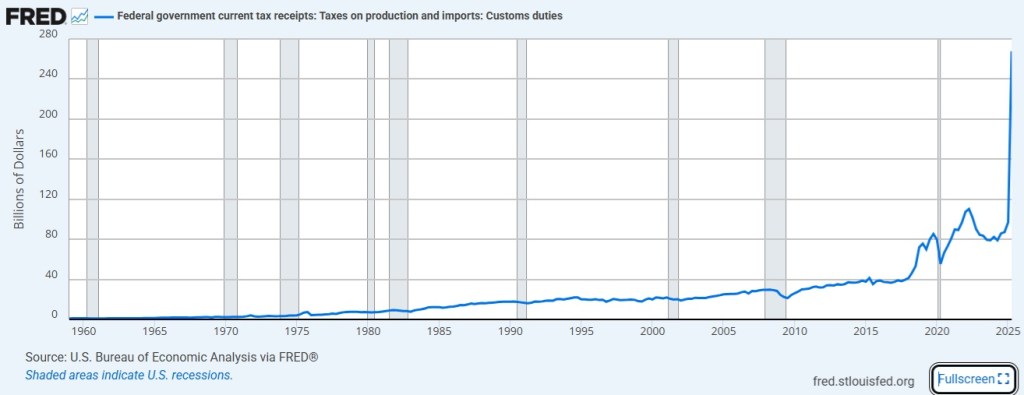

The real issue is whether global bond markets will start to price in the broader implications of a Trump tariff rollback—one that extends well beyond food imports. Customs duties have quietly become one of the fastest-growing revenue streams for the federal government, a rare source of fiscal buoyancy in an otherwise deficit-heavy landscape. If those tariffs come down, then—ceteris paribus—the Treasury loses a meaningful chunk of income, mechanically widening the budget deficit unless offset elsewhere. Emphasis on “extends well beyond food imports” for meaningful impact on federal tax receipts.

In that sense, tariff policy isn’t just a trade variable anymore; it’s a fiscal lever with direct consequences for supply dynamics in the Treasury market. Investors already nervous about persistent deficits and elevated issuance may view a tariff unwind as one more pressure point on the government’s financing needs. And in today’s environment—where duration supply, term premia, and fiscal credibility are back at the center of global macro—the bond market’s reaction function could turn decidedly less forgiving.

Tariff Revenues to the U.S. Government ($ billions)

Coffee Tariffs

Shortly after tariffs first landed in early April 2025 with “Liberation Day,” most imports were given a 10% rate. That alone was disruptive—this was the first time in recent memory that U.S. coffee imports were hit with tariffs. The shock was immediate, the questions were many, and the impact was felt across the specialty coffee supply chain. Four months later, tariffs on coffee are higher than ever. The landscape is shifting, and the situation is escalating. Here’s where things stand now, and what it means for you as a roaster.

While tariffs on coffee imports from many countries still face a 10% duty, geopolitical tensions have driven some rates much higher. Goods from Brazil, the world’s largest coffee producer, are now subject to a staggering 50% tariff. Other large coffee producers, like India (25%), Vietnam (20%), and Indonesia (19%), have also been hit with steep increases. These changes are reshaping the coffee trade in real time. — Genuine Origin

Juan Perón Resurrected

At Global Macro Monitor, we’ve been direct about this: Trump’s erratic, favor-driven policy style is steadily grinding the economy into a less efficient machine. Government by whim—and too often by favor or implied corruption—forces businesses to spend more time deciphering political signals than deploying capital. The economic gears are gumming up: investment gets delayed, supply chains get hedged into absurdity, and firms operate under the constant threat that today’s rule could be tomorrow’s tweet

The only thing masking the damage is a stock market still levitating on momentum, and even that looks like it’s on its final, exhausted leg. The parallel is obvious to us—this is the modern Juan Perón dynamic, where political volatility and personalist rule corrode economic performance long before financial markets finally reprice the risk.