Must view, folks. See these stunning new products showcased at the recent Las Vegas Consumer Electronics Show (CES).

Must view, folks. See these stunning new products showcased at the recent Las Vegas Consumer Electronics Show (CES).

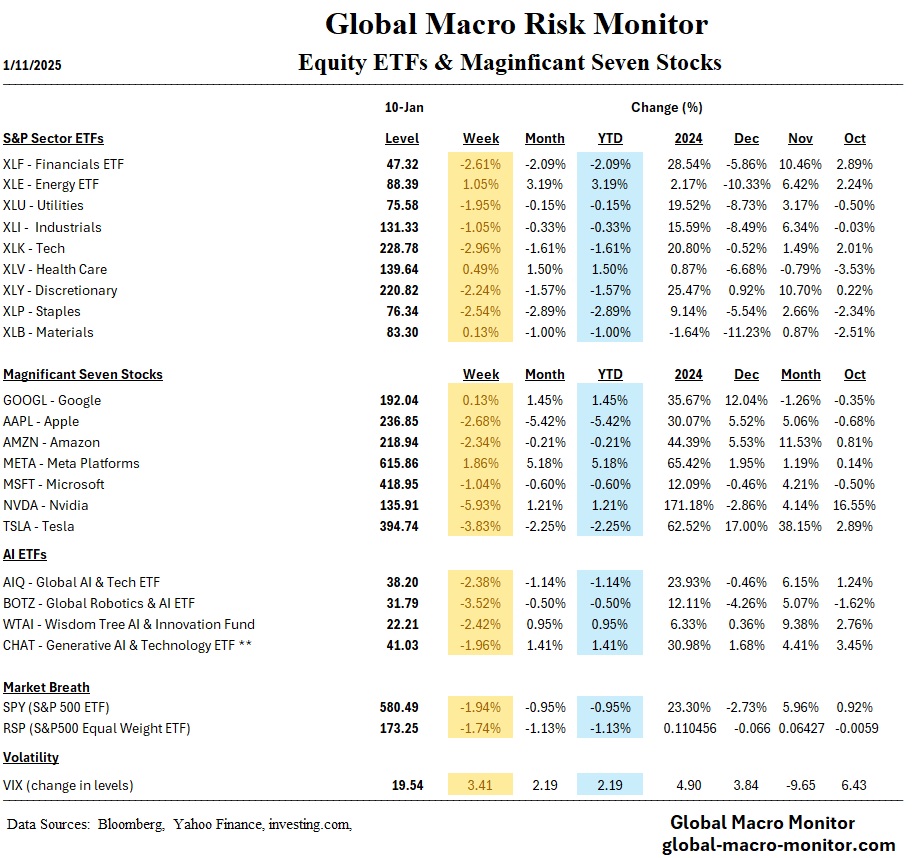

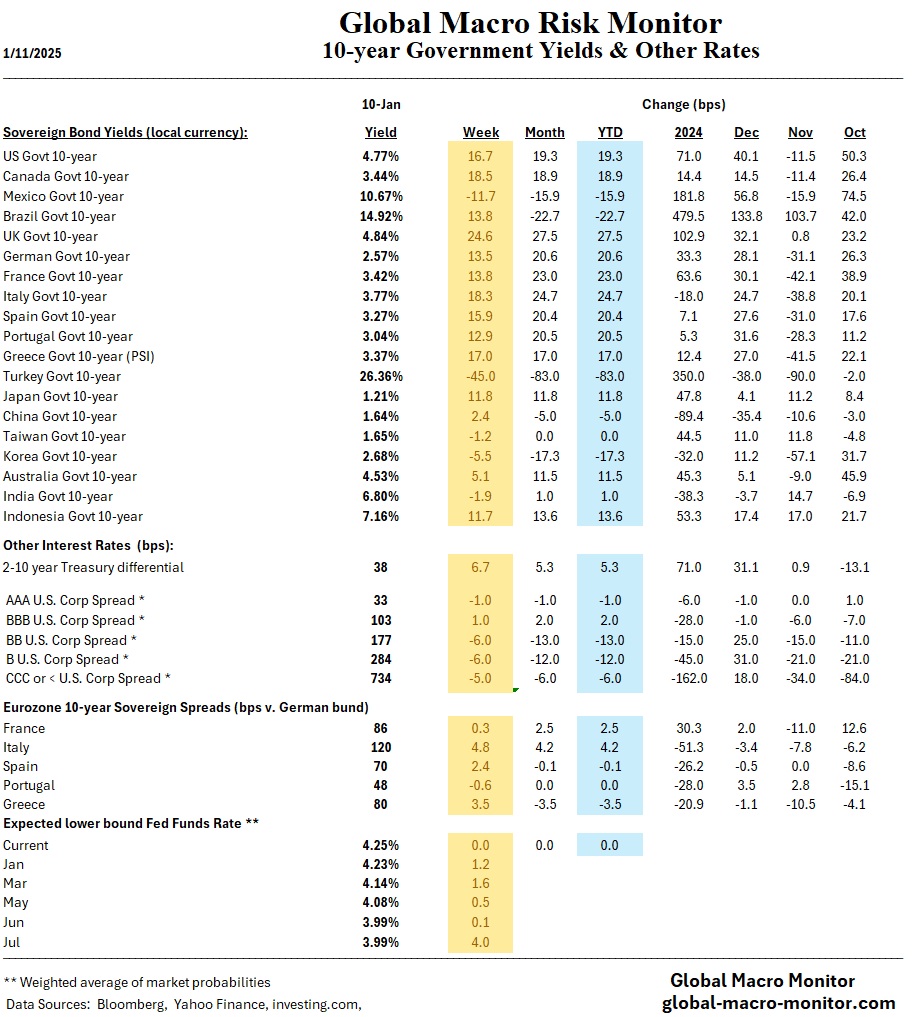

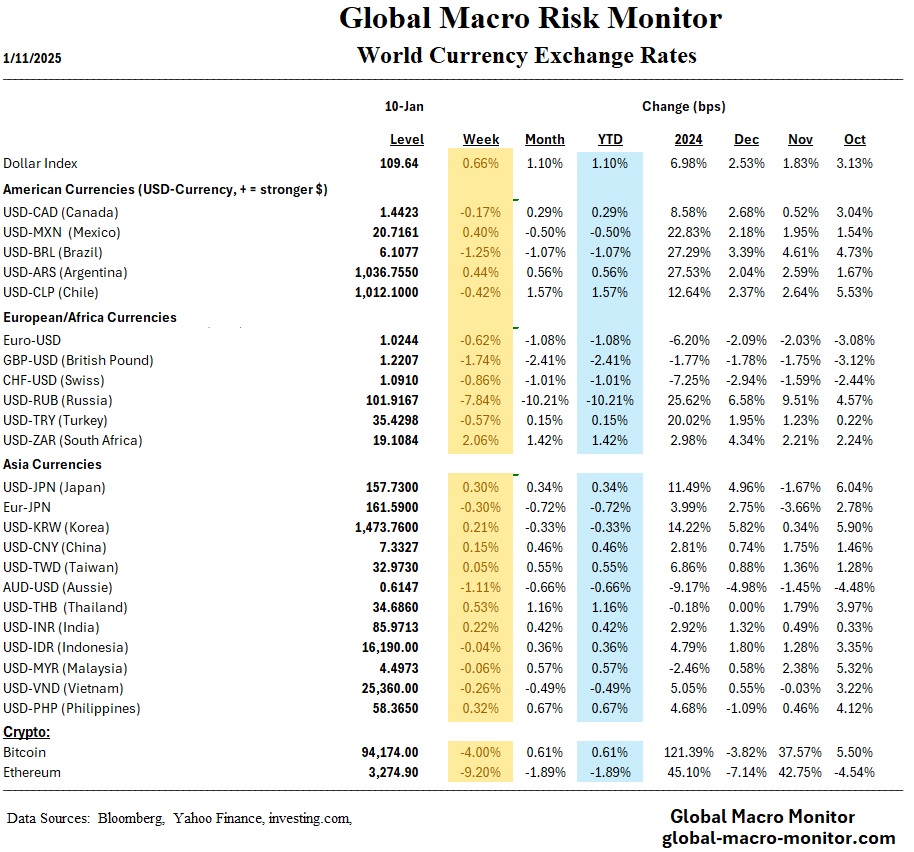

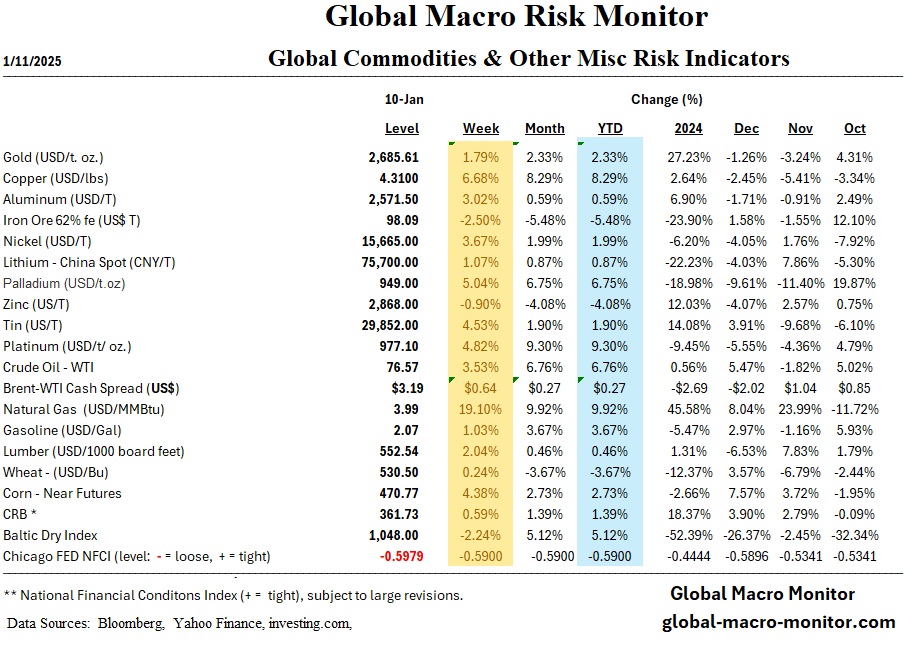

These developments illustrate the dynamic interplay of inflation, central bank policies, and global economic pressures, which continue to shape market trajectories.

Here’s a repost to help kickstart your New Year of better health.

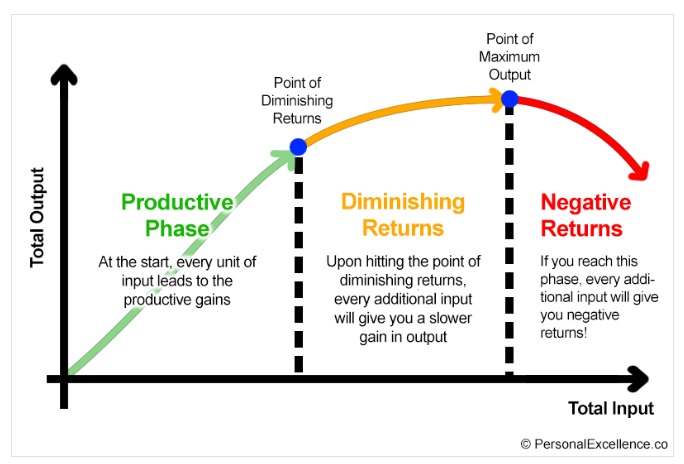

One of the most complex concepts for my students to internalize when I taught Econ 101 was that of thinking on the margin. You probably remember the theory of diminishing marginal productivity, diminishing marginal returns, and diminishing marginal utility (satisfaction). For the math inclined, they are functions with a positive first derivative coupled with a negative second derivative.

Economists like to dress up pretty straightforward ideas with very big words, most likely to obfuscate the fact that economics is just reasonably simple logic.

Traders And Investors Must Also Think On The Margin

It is also essential for traders and investors to think on the margin. They must understand and identify the marginal (last) buyers and sellers in the markets they traffic because those buyers and sellers set and determine the market price. It applies to all asset markets, from stocks to residential real estate.

You have undoubtedly heard the adage “retail always buys the top,” which was a reasonably good contrarian indicator before central banks flooded the markets with liquidity and repressed market interest rates. When I was a trader on Wall Street, the Japanese piling into a market was usually a sign of a top. Not because they were inferior but because they had so much asset purchasing power, i.e, money, and their conservative culture of decision-making by committee almost guaranteed they were always late to the party.

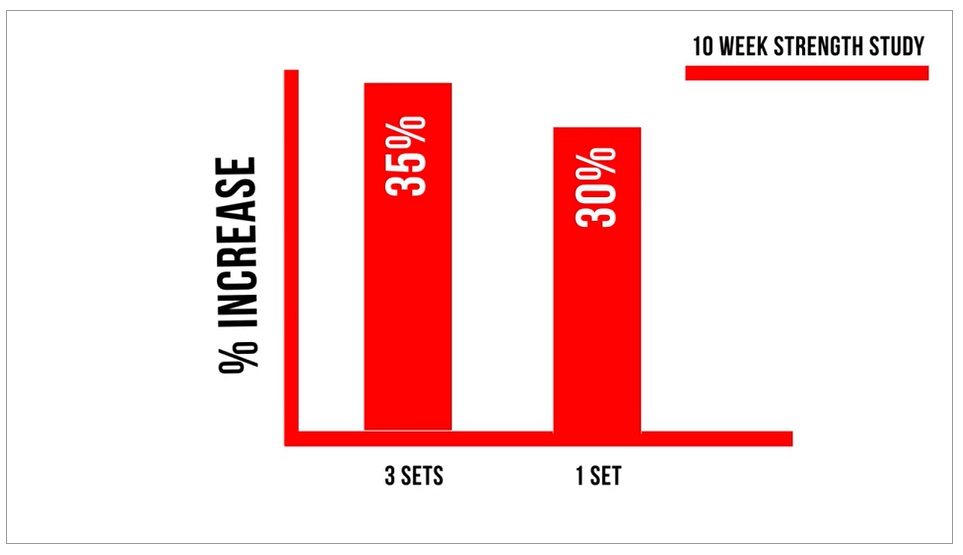

Diminishing Marginal Returns In The Weight Room

I have discovered the law of diminishing marginal returns in the gym, which has changed my life and significantly improved my health.

In their MOOC (massive online open course) – Hacking Exercise For Health. The surprising new science of fitness – Martin Gibala and Stuart Phillips of McMaster University teach the concept of diminishing marginal productivity or returns in the gym without using the economic mumbo jumbo. It cut down my workout time from, say, two hours to just 30 minutes, and here’s how.

I used to be very rigid in my workout, never straying from three sets of 10 repetitions. That third set I hated most would slow me down, procrastinating to pump it out until the cows came home.

Two or three hours in the gym was too much and led to an inconsistent workout schedule and less than optimal health.

I learned from the McMaster MOOC that 85 percent of the benefit of a three-set exercise comes from the first set! Doing just one set over a 10-week period improves your strength by 30 percent, while doing three sets increases your muscle by 35 percent, just an extra 5 percent increase for the last two sets.

That is the best and most practical example of diminishing marginal productivity or returns I have seen and experienced. The second and third set, though, still improves overall strength, but most of the bang for your buck is in the first set.

I cut my workouts down to just two sets for each muscle group and get in and out of the gym in thirty minutes. I will trade off the extra 7 percent benefit of the third set for a shorter and more consistent and disciplined workout schedule, any day.

Thirty minutes work for me.

Diminishing Marginal Utility (Satisfaction)

I used a simple golf analogy to teach the concept of diminishing marginal utility, which my students could relate to.

After a four-hour round of golf in the hot sun, the first beer on the 19th hole tastes fabulous. The second is fantastic but not as awesome as the first. —a classic case of diminishing marginal utility (satisfaction). The third? Call an Uber. We’re talking craft beer, folks, not Coors Light.

Pretty simple, no?

Watch This Video!

We highly recommend this video, which taught us how to make our exercise more efficient. The five-minute investment of your time will change and may save your life.

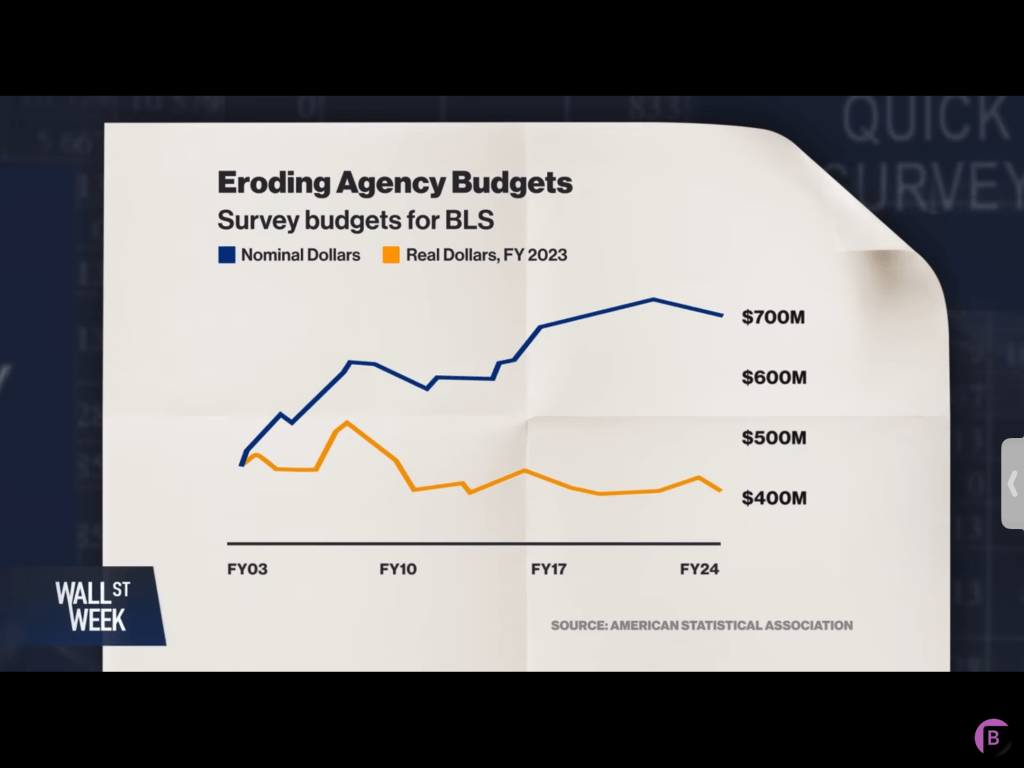

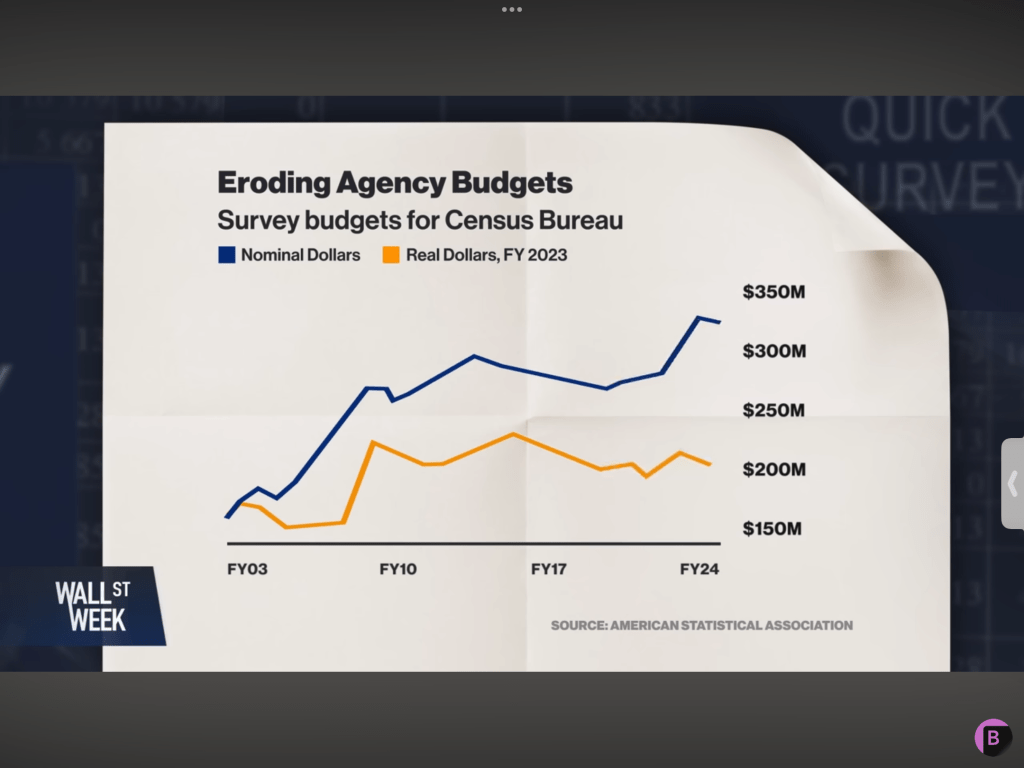

BLS = Bureau of Labor Statistics

There are three kinds of lies: lies, damned lies, and statistics. – Benjamin Disraeli via Mark Twain

The BLS gets that data [employment data] by contacting a representative sample of the population and then weights those results to reflect the broader population. The trouble is…that sample is at risk of getting smaller. And one key reason for that… is how much money the BLS has to conduct those surveys. – Bloomberg

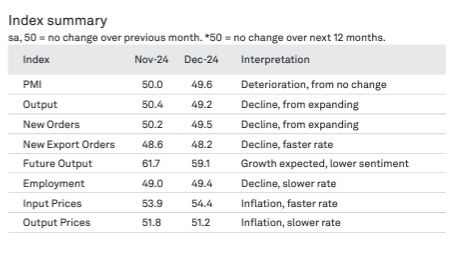

As 2025 begins and the incoming U.S. administration outlines its economic priorities, global manufacturing faces significant headwinds. The J.P.Morgan Global Manufacturing PMI for December 2024 posted a modest contraction, reflecting a complex interplay of regional disparities, policy uncertainties, and sector-specific trends.

Key Highlights:

Global Manufacturing Contraction: The Global Manufacturing PMI fell to 49.6 in December, down from 50.0 in November, marking the fifth contraction in six months.

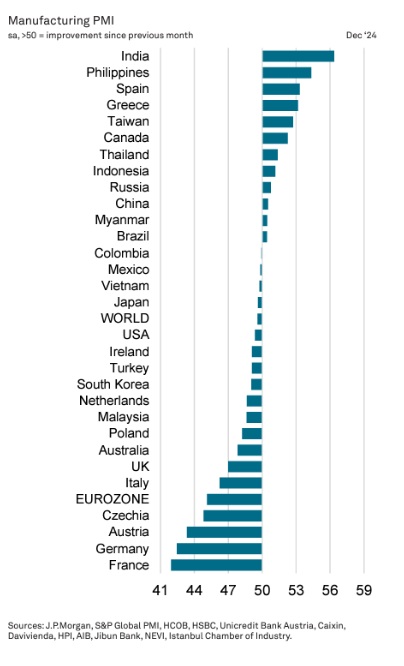

Regional Disparities: Strength in India and select Southeast Asian nations contrasted sharply with pronounced declines in France, Germany, Austria, the US, and the UK (see chart below).

Sectoral Divergence: Consumer goods production rose for the seventeenth consecutive month, while intermediate and investment goods sectors contracted.

Trade Weakness: International trade volumes declined for the seventh consecutive month, with only eight nations reporting growth in new export orders.

Input and Selling Prices: Input cost inflation hit a four-month high, while selling price inflation eased to a nine-month low.

In-depth Analysis:

The global manufacturing sector ended 2024 on a weaker footing, with both output and new orders contracting in December. These declines erased the gains of the previous two months, resulting in near-stagnation for the final quarter. Only 13 of the 30 nations surveyed reported production growth, led by India, the Philippines, and select eurozone nations like Spain and Greece. In contrast, industrial heavyweights such as France and Germany faced sharp contractions, indicative of broader eurozone challenges.

Uncertainty around potential U.S. tariffs under the new administration is clouding business sentiment. This risk is particularly acute for export-dependent economies in Europe and Asia. Meanwhile, the U.S. manufacturing sector saw its sharpest contraction in 18 months, further signaling domestic vulnerabilities amid a global slowdown.

Consumer goods production remained resilient, extending a 17-month growth streak. However, this strength failed to offset declines in intermediate and investment goods industries, underscoring uneven demand dynamics. The divergence highlights opportunities for sector-specific investment strategies.

International trade volumes declined for the seventh straight month, with only eight nations, including India, Taiwan, and South Korea, reporting export order growth. Weak trade dynamics fed into global employment trends, with job losses recorded in major regions like the euro area and China, even as the U.S. and Japan added jobs.

Input cost inflation accelerated to a four-month high in December, driven by supply chain disruptions and higher raw material costs. Yet, selling price inflation eased to a nine-month low, reflecting softening demand and competitive pricing pressures. Investors should watch for potential margin compressions in cost-sensitive industries.

Investment Implications:

Regional Rotation: Strength in India and Southeast Asia could offer opportunities for regional rotation as Western economies struggle.

Sector-Specific Strategies: The divergence between consumer goods and other manufacturing categories provides scope for targeted investment.

Policy Monitoring: Close attention to U.S. tariff announcements will be critical for forecasting trade and manufacturing dynamics.

Supply Chain Risks: Persistent input cost inflation warrants a focus on supply chain resilience in portfolio companies.

Employment Metrics: Declining employment in key regions could signal broader macroeconomic weakness, warranting cautious optimism.

The December Global Manucaturing PMI underscores the fragility of the global manufacturing landscape as we enter 2025. For portfolio and hedge fund managers, aligning strategies with these evolving dynamics—from regional strengths to sectoral disparities and policy risks—will be essential in navigating the year ahead.