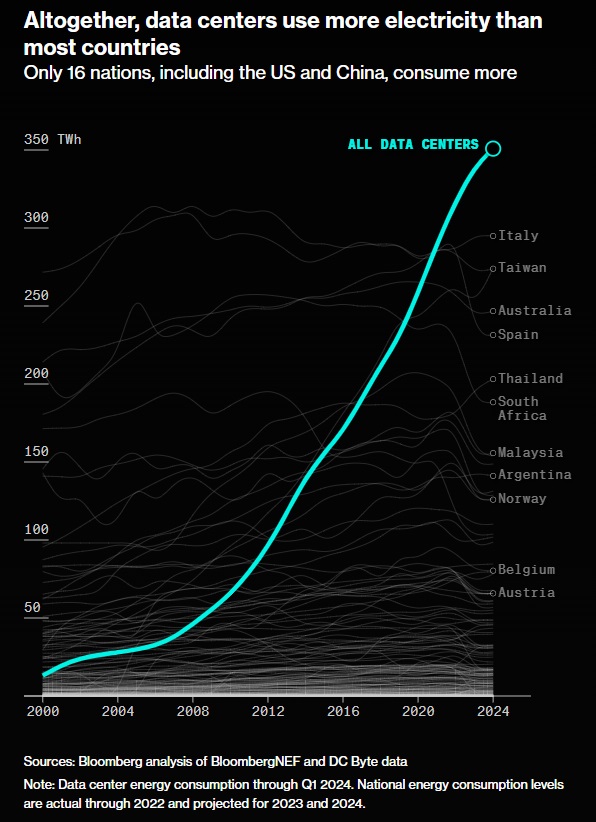

In the spirit of yesterday’s post, AI’s Impact On Energy Demand, a whimsy repost.

Upshot? One gallon of gasoline = the energy equivalent of 54.7K Big Macs.

IBFTP = Blast From The Past

Greatest Arb Ever: Cracking Gas into Big Macs

OK, time for a little fun. You can try this and let us know if it works.

OK, time for a little fun. You can try this and let us know if it works.

Almost everything today comes down to energy, right?

The rise in food prices is really nothing more than an energy problem. After all, food consumption is about the digestion of calories — one metric of energy measurement – to fuel the human machine.

Scientists have learned to “crack” the energy of foodstuffs, mainly corn and sugar, and convert these into transportation fuel. It gives new meaning to “cracking corn.”

If we could do the reverse and crack highly efficient refined fuels into foodstuffs, for example, we believe we have found the greatest arbitrage of all time.

The Energy Conversion Table below shows that one British Thermal Unit (BTU) is equivalent to 252 calories and one gallon of gasoline is equivalent to 125K BTUs. Therefore, one gallon of gasoline is the energy equivalent of 31.5M calories.

The energy component of a Big Mac without cheese, for example, is 576 calories, so one gallon of gasoline is the energy equivalent of 54,688 Big Macs. Still with us?

We’ve included the following table/matrix to show that if you drove 50 miles today in a car that gets 20 miles per gallon, you consumed the energy equivalent of 137K Big Macs. Yuck!

The last table, The Greatest Arbitrage Ever, shows the dollar price of a Big Mac in various countries (no wonder the Brazilians are now aligning with U.S. against China ‘s FX policy) and the Big Mac energy equivalent price of a gallon of gas. That is, one gallon of gas is the energy equivalent to 54,688 Big Macs and with the price of a Big Mac in Brazil at $5.26, the Big Mac energy equivalent price of a gallon of gas in, say Sao Paulo, is $287,656.25.

What an arb, no? Buying a gallon of wholesale gasoline in Rio for $2.45, “cracking” it into 54,688 Big Macs, and selling them at $5.26 for $287,656.25 sounds like a “splendid arbitrage” to us!

Fun exercise and we can’t wait for the e-mails from the economists on this one. Before you waste your time, remember, we’re not serious!