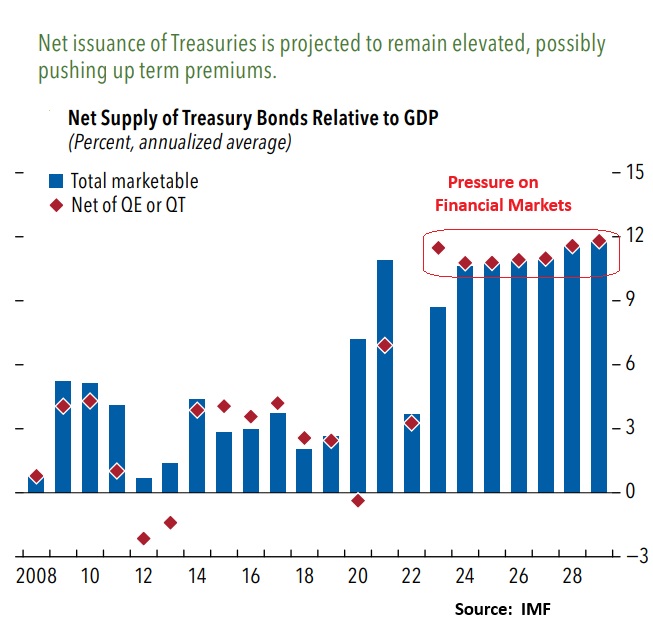

The International Monetary Fund has raised a cautionary alert on an issue we’ve highlighted at the Global Macro Monitor for years: the supply-demand dynamics of the U.S. Treasury market. We maintain that Treasury yields will face sustained upward pressure due to a significant increase in net issuance, rising from less than 3% of GDP—at times even negative after the Fed absorbed more than the entire annual net issuance—to well over 10% of GDP.

Additionally, the shift in bond ownership toward more price-sensitive investors and away from the largest buyers for the past few decades – the Fed and global central banks – will continue to drive volatility in government bond markets, particularly if issuance rises further to fund expanding fiscal deficits.

In the U.S., quantitative tightening (QT) has raised the proportion of free-float Treasury securities, a trend expected to gradually push yields and volatility higher. Furthermore, the Treasury’s increased reliance on shorter-term debt to manage immediate borrowing costs may lead to higher financing expenses over time. Large dealer inventories also pose a medium-term risk, as these holdings could limit dealers’ capacity to absorb Treasury sales in adverse market conditions, potentially amplifying sell-offs.

Finally, given the lack of spending restraint or public debt concerns among both presidential candidates, the likelihood of a “Liz Truss moment” in Washington next year is significantly higher than current pricing reflects.

How to know? Watch real yields and term premiums.

Pingback: Global Risk Monitor: Week In Review – November 1 | Global Macro Monitor