-

In economics, things take longer to happen than you think they will, and then they happen faster than you thought they could.

-

Join 1,218 other subscribers

Contribute To GMM

Categories

- 3D Printing

- Agriculture

- AI

- Algos

- Apple

- Automation

- Banking

- BFTP

- Bitcoin

- Black Swan Watch

- Bonds

- Brazil

- Brexit

- BRICs

- Budget Deficit

- Capital Flows

- Cartoon of the Day

- Cashless Society

- Chart of the Day

- Charts

- China

- Clean Tech

- Climate Change

- Coach C

- Commodities

- Coronavirus

- COVID

- Credit

- Crude Oil

- Currency

- Cyprus

- Daily Risk Monitor

- Day In History

- Debt

- Demographics

- Disinflaton

- Dollar

- Earnings

- ECB

- Economics

- Economist

- Egypt

- Electric Vehicles

- Emerging Markets

- Employment

- Energy

- Environment

- Equities

- Equity

- Euro

- Eurozone Sovereign Spreads

- Exchange Rates

- Fed

- Finance and the Good Society

- FinTech

- Fiscal Cliff Monitor

- Fiscal Policy

- Food Prices

- France

- Futurist

- Game Theory

- General Interest

- Geopolitical

- Geopolitics

- German Bund

- Germany

- Global Macro Watch

- Global Reset

- Global Risk Monitor

- Global Stock Performance

- Global Trend Indicators

- Gold

- Greece

- Healthcare

- Heat Map

- Hedge Funds

- Housing

- Human Interest

- Immigration

- Impeachment

- India

- Inequality

- Inflation/Deflation

- Infographics

- Innovation

- Institutional Investors

- Interest Rate Monitor

- Interest Rates

- Interviews

- Italian Yields

- Italy

- Japan

- Jobs

- Lectures

- Macro Notes from Conference Calls

- Manufacturing

- Masters

- Mexico

- Monetary Policy

- Movies

- Muni Bonds

- Muni Market

- Natural Gas

- News

- Nonlinear Thinking

- North Korea

- Overbought Markets

- Picture of the Day

- PIIGS

- PMIs

- Policy

- Politics

- Population

- Populism

- Poverty

- President Trump

- Qunat Strategies

- Quote of the Day

- Quotes

- Rare Earth Elements

- Readership

- Reads

- Real Estate

- Relative Strength Index

- Robert Shiller

- RSIs

- S&P500

- Sector ETF Peformance

- Semiconductor prices

- Semiconductors

- Social Media

- Socialism

- Song for the Week

- Sovereign Debt

- Sovereign Risk

- Spain

- Sports

- State and Local Government

- Tail Risk

- Technical Analysis

- Technology

- The Big Reset

- The Weekend Read

- This Day In Financial History

- Trade War

- Trades

- Tweet of the Day

- Ugly Chart Contest

- Uncategorized

- US Releases

- Video

- Volatility

- Wages

- Week Ahead

- Week in Review

- Weekend Reads

- Weekly Eurozone Watch

- Whales

-

Recent Posts

Meta

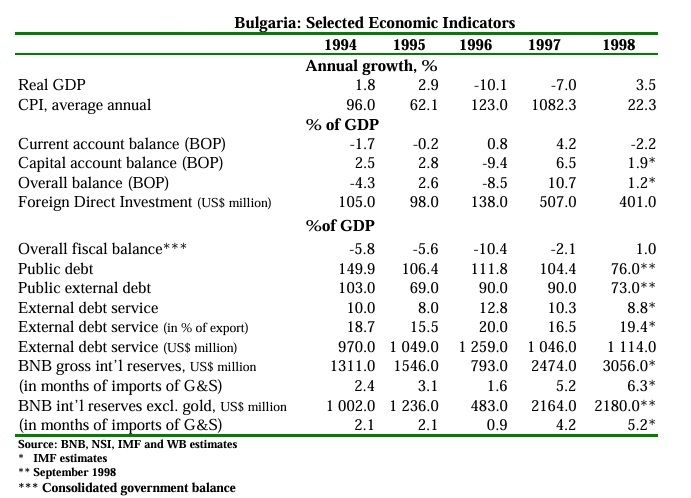

The Anatomy of a Bond and Currency Crisis

It was the autumn of 1996 when I arrived in Sofia, Bulgaria. I was working for a major Wall Street investment bank and had a clear and urgent mission to assess the sustainability of Bulgaria’s sovereign debt. The atmosphere in the capital was tense; the economic and political uncertainty hung thick in the air. The government was hanging by a thread while struggling to roll over its maturing Treasury bills. The early signs of a major burst of inflation were no longer subtle, as confidence in the Bulgarian currency was rapidly diminishing. In a series of high-level meetings with senior officials, one stood out: a particularly strained and revealing encounter at the Bulgarian National Bank (BNB), where the full scale of the crisis came into sharp focus.

Central Banker Confession

What I remember most vividly was sitting across from a senior BNB official. When I asked how the government would roll over its large tranches of domestic Treasury bills coming due, he looked me in the eye and said, “Gregor, we will not let the government default.”

Hyperinflation

It was less reassurance than a veiled admission—the central bank would monetize all the debt coming due if need be. At that moment, I knew a currency collapse and hyperinflation were imminent. As soon as I stepped out of the central bank, I called our trading and sales desk in New York to warn that the lev was about to collapse and hyperinflation was coming.

Indeed, within months, monthly inflation hit 242%, and the lev was virtually worthless, losing 90 percent of its value before the country was forced to implement a currency board. I remember buying a bottle of good wine for the equivalent of 27 U.S. cents. During a hyperinflationary spiral, the exchange rate moves first, and domestic prices follow.

Bad Economic Policy

Bulgaria’s crisis was the product of delayed reforms, systemic banking fragility, and most importantly, a collapse of market confidence. After the fall of communism, its banking sector remained riddled with non-performing loans and politically motivated credit issuance. When the government failed to roll over its domestic debt, the central bank was forced to buy unsold Treasury bills, initiating a fatal inflationary spiral. By late 1996, the BNB had monetized nearly the entire public domestic debt, with inflation exploding and currency substitution rampant. There was no functmioning bond market—no buyer of last resort except the printing press.

U.S. Economic Policy

In contrast, during the COVID-19 crisis, the U.S. Federal Reserve engaged in massive Treasury purchases, effectively monetizing the new debt. In the table below, we illustrate how the U.S. government issued almost $5 trillion of new debt to finance the massive COVID deficits. The markets could not absorb such a large new issuance, and the Fed stepped in and took down 91 percent of all net new debt — not through the auctions but indirectly from primary dealers — including 84 percent of all coupon securities and much of the incremental increase in T-bills.

This move, however, did not trigger hyperinflation. Why? Because global confidence in the U.S. dollar remains deeply entrenched. As Ray Dalio, Barry Eichengreen, and other economists note, the dollar’s role as the world’s reserve currency allows the U.S. to borrow cheaply despite a public debt exceeding 120% of GDP

Fading Confidence

But that privilege appears to be eroding. Recent headlines reveal a sharp sell-off in the dollar, rising Treasury yields, and spiking gold prices not from inflation fears alone, but from doubts and lack of credibility in the U.S. government itself.

If a similar crisis were to hit today, given current market conditions, particularly the falling confidence in U.S. assets, it is questionable whether the Fed could act so aggressively.

The “exorbitant privilege” is now in question. Foreign holders of U.S. Treasuries, possibly China and Japan, appear to be quietly trimming their U.S. debt exposure. The traditional “flight to safety” into Treasuries during crises is faltering. Even safe-haven capital is drifting elsewhere—into German bunds, gold, the Japanese yen, and the Swissie.

Heed the Lesson

Bulgaria’s crisis teaches a painful lesson: when confidence is lost, governments can’t borrow, and central banks must print. That’s not theoretical—it happened. It happened in many of the countries that I worked with, including Argentina, Venezuela, Poland, and Brazil. And while the U.S. is a world apart in size and economic complexity, the fundamental rules of finance still apply. If global investors lose faith in the dollar the way they lose faith in an emerging market, the U.S. will face higher borrowing costs, capital flight, and weakened policy flexibility.

The Congressional Budget Office now warns of “significant fiscal risk” if current debt trends continue. Tariff wars, political instability, and threats to Federal Reserve independence all compound this risk. The next crisis may not grant the U.S. the luxury of borrowing its way out. If that confidence evaporates, we will be staring into the mirror of Bulgaria’s past.

Confidence is Fragile

I’ll leave you with a fitting quote from the GOAT of NFL quarterbacks, Joe Montana:

“Confidence is a very fragile thing.”

Let’s hope the President takes that to heart—and soon.

QOTD: “Ejectoral” College Is Voting

QOTD = Quote of the Day

A currency is only as good as the government that backs it. – Economist

Chart Source: Barchart.com

Posted in Uncategorized

Leave a comment

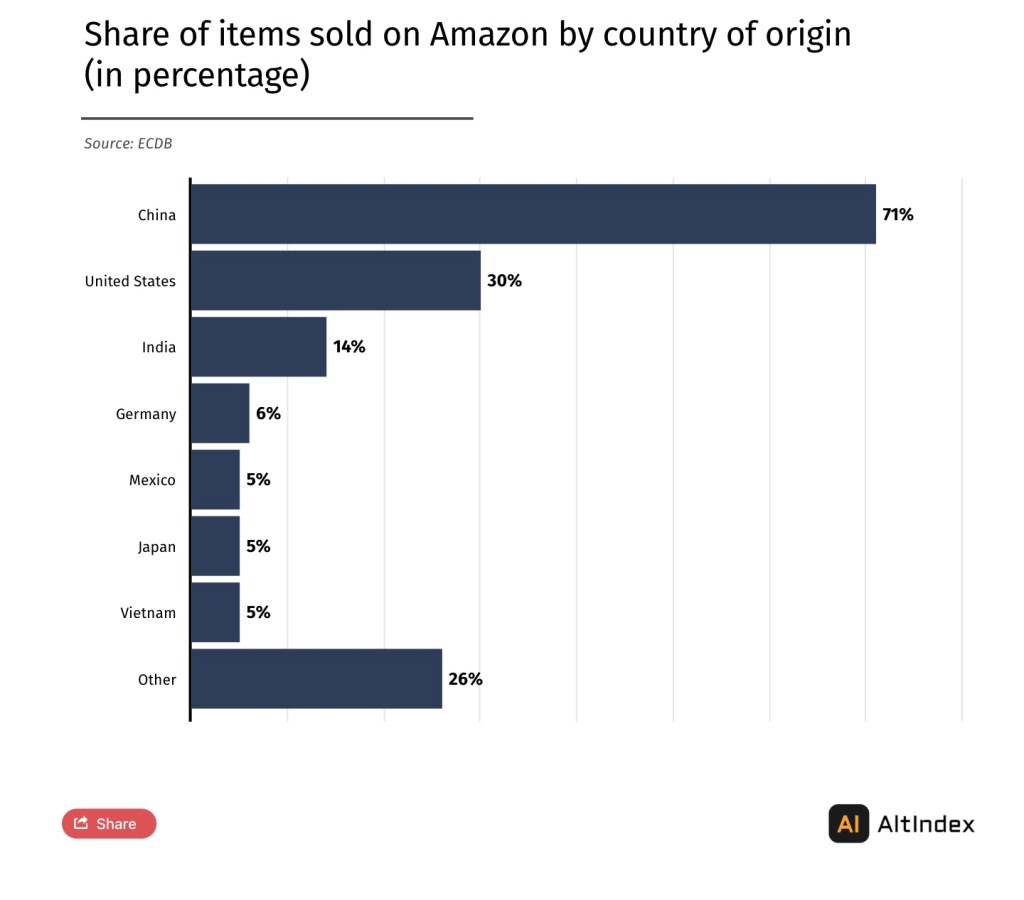

Amazon’s China Exposure

As the single largest player in the ecommerce industry, Amazon generates between 10% and 15% of global online sales. In its home market, the US ecommerce giant makes up to 40% of total ecommerce sales and generates the highest revenue in three out of four major product categories, outperforming competitors by a large margin. But ironically, while Amazon is seen as emblematic of American success in ecommerce, Chinese products are the backbone of its marketplace.

According to data presented by AltIndex.com, more than 70% of all products sold on Amazon are made in China…

Statistics show that 71% of the products that wholesalers and retailers sell on Amazon are produced in China, or 2.4 times more than in the United States, illustrating China’s importance for Amazon’s business. US products have a much smaller share and account for 30% of all total goods sold through the US e-commerce giant, while India stands in third place with a 14% share. – AltIndex

Posted in Uncategorized

1 Comment

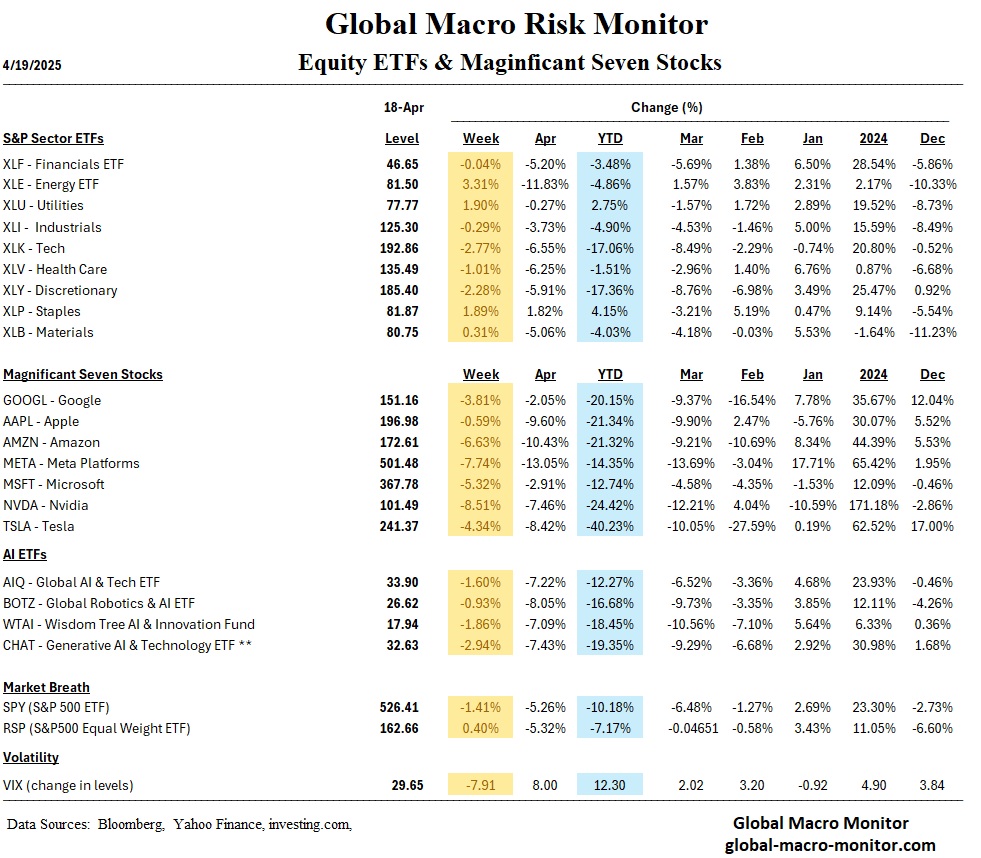

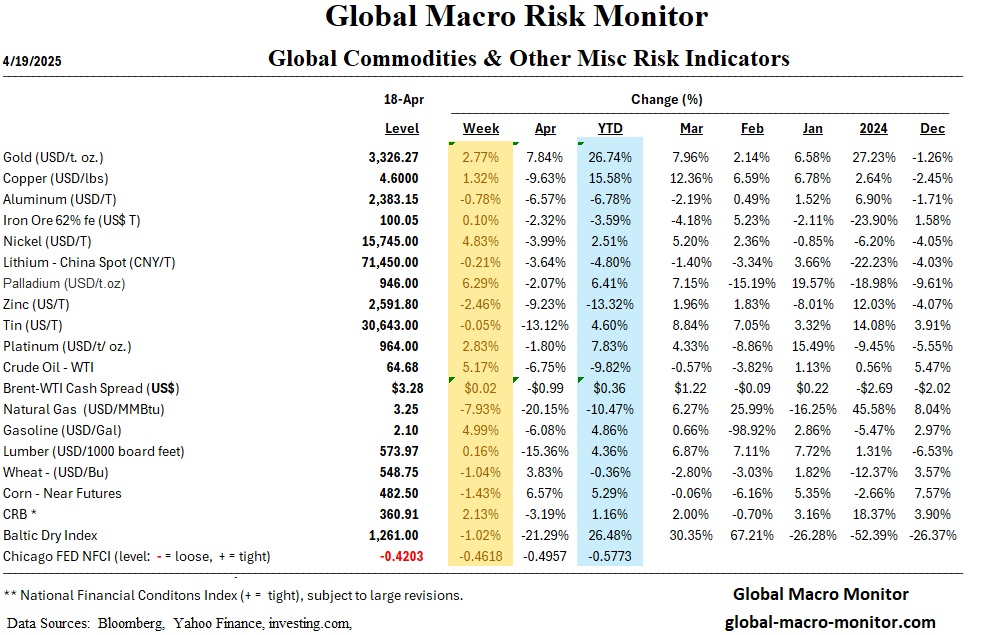

Global Risk Monitor: Weekly Update – April 18

Happy Easter, folks!

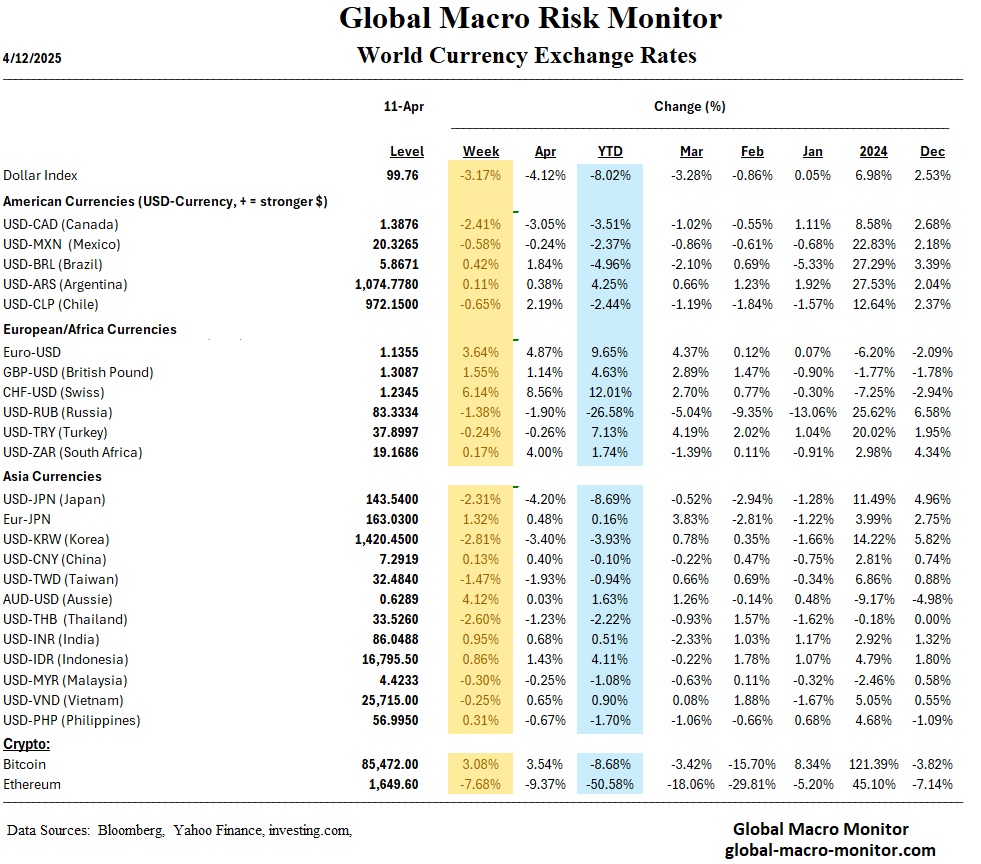

The Trump administration’s tariff strategy continues to function less as a deliberate trade policy and more as a volatile, reactionary experiment. Markets are grappling with a growing realization: there is no unified objective anchoring current U.S. trade actions. Is the administration trying to reshore manufacturing? Raise revenues? Or promote freer and fairer trade? All three goals conflict—and the markets know it. The result has been a weakening dollar, rising gold prices, and diverging capital flows.

This week’s 3% rally in gold, alongside the sixth decline in seven weeks for the U.S. dollar, underscores a broader erosion of investor confidence in the U.S. policy framework. While U.S. bond yields stabilized and credit spreads modestly contracted, the underlying message remains clear: investors are hedging against deeper policy missteps. Until the administration resolves its own internal contradictions, volatility is likely to persist, and global capital will remain in search of clarity elsewhere.

The administration’s approach has produced a confusing cycle: new tariffs imposed, then partially reversed under pressure; sector-specific exemptions offered one week, then threatened again the next. The pause on semiconductor and electronics tariffs has done little to reassure investors given the lack of a consistent framework. Meanwhile, tariff-driven inflation threatens to stall growth just as the Fed tries to preserve monetary flexibility.

Market pressures may eventually force a strategic retreat. But until then, the White House appears more responsive to market headlines than to long-term macroeconomic outcomes. The central lesson of this week: instability is becoming structural.

Markets

U.S. Market Analysis

- Major indexes mixed: S&P 500 –1.5%, Dow –2.6%, Nasdaq –2.6%, Russell 2000 +1.1%.

- Sector rotation: Non-energy minerals and utilities outperformed; tech and consumer durables lagged.

- Gold surges: +2.8% % for the week, now up 26.7% YTD as investors seek protection from U.S. policy risk.

- Dollar decline accelerates: USD hits a three-year low, now down 8.5% YTD.

- Bond market stable: Yields declined across maturities. 10Y Treasury at 4.33%, credit spreads modestly narrower.

Global Market Analysis

- Europe: STOXX 600 +3.9%. ECB cuts deposit rate to 2.25%, signals more easing. Italy +5.74%, Germany +4.08%.

- Asia:

- Japan: Nikkei +3.4%, cautious BoJ; yen strengthens amid trade tension.

- China: Shanghai +1.19%; Q1 GDP +5.4%, but driven by pre-tariff demand. Stimulus expected.

- Emerging Markets: Risk-off sentiment persists, but no major capital dislocations yet.

Economics

U.S. Economic Overview

- Retail sales jump 1.4%, possibly boosted by pre-tariff buying.

- Fed holds line: Powell warns tariffs will raise inflation and lower growth. June rate cut still base case.

- Housing deteriorates: Housing starts –11.4% in March; builder confidence remains weak.

- Dollar weakness raises inflation risk, complicating Fed strategy.

Global Economic Overview

- ECB turns dovish: Rate cut to 2.25%, signals 2.0% likely by June.

- BoJ cautious: Trade risk delays rate hikes.

- BoC stays on hold: Canada acknowledges potential recession in trade war scenario.

- UK inflation drops to 2.6%, labor data softens. BoE likely to cut in May.

Week Ahead (April 21–25)

Key U.S. Events:

- Economic Data:

- Mon: Leading Indicators

- Wed: New Home Sales, Crude Inventories

- Thu: Jobless Claims, Durable Goods, Existing Home Sales

- Fri: University of Michigan Sentiment

- Earnings Highlights:

- Tesla (Tue), Alphabet (Thu), IBM, Intel, P&G, Boeing, PepsiCo, Merck

Key Global Events:

- Japan CPI: Friday – gauge of BoJ direction

- Eurozone PMIs: Wednesday – growth and inflation barometer

- Tariff Headlines: Potential trade deal news remains the primary wildcard

S&P 500 Key Levels – April 15

Happy Jackie Robinson Day! What a great American.

The rebound in the S&P 500 has thus far stalled at a key technical level—specifically the 50% Fibonacci retracement of the current correction from the recent highs, which stands at 5491.24. Today’s intraday high of 5450.41 failed to surpass the April 9th rebound peak of 5481.34, reinforcing the significance of the 5450–5500 zone as a formidable resistance range.

This area marks the midpoint of the decline and is closely watched by institutional players. A sustained break above this level would shift momentum in favor of the bulls; however, until then, it serves as a technical ceiling capping rallies.

From a trading perspective, market conditions have become increasingly erratic, bordering on untradable for directional players. Initiating short positions in this range carries elevated risk, as any unexpected de-escalation in U.S.-China tensions or a surprise tariff relief headline could ignite a sharp short-covering rally. Volatility remains headline-driven, and risk-reward is skewed to binary geopolitical outcomes.

The S&P 500 will likely remain range-bound between 5200 and 5500 in the near term as market participants await more definitive indications of the economic impact stemming from current policy decisions. In our view, as signs of strain begin to emerge—whether through softening macro data, downward earnings revisions, or tightening financial conditions—the index will face renewed selling pressure. This will send the index for a retest of the April 7th low, with an elevated risk it will not hold.

Stay frosty, folks.

Posted in Uncategorized

1 Comment

Masters Week: Jack and German POWs (BFTP)

BFTP: Blast From The Past

Answer to yesterday’s Masters quiz question:

Anthony Kim posted 11 birdies in the second round of the 2009 Masters.

German WWII POWs

Here’s some more 19th hole fodder to impress your buddies and something I bet you didn’t know about Augusta:

German POWs from nearby Camp Gordon built the bridge over Rae’s Creek next to the 13th tee box during WWII. They were part of Rommel’s Panzer division in North Africa responsible for building bridges to enable tanks to cross rivers.

While Augusta National is famed for its almost unnaturally beautiful flora, as it turns out some rather interesting fauna once called the course home as well: 200 heads of cattle and more than 1,400 turkeys. From 1943 until late 1944, Augusta National was closed for play and transformed into a farm of sorts to help support the war effort. Some of the turkeys were given to club members during Christmas (meat rations were in effect) while the rest were sold to local residents to help fund the club. And the cows? Well, they acted as natural lawnmowers but also inflicted quite a bit of damage to Augusta National, devouring many of the course’s famed plants and shrubs.

To help repair cattle-related damage and revive Augusta National for its reopening, 42 German prisoners of war from nearby Camp Gordon were shuttled back and forth to work on the course.

Writes John Strege in “When War Played Through: Golf During World War II:”

“The POWs had been with the engineering crew serving Rommel, the Desert Fox, in North Africa, part of the Panzer division responsible for building bridges that enabled German tanks to cross rivers. It was a useful skill for the renovation work to be done at Augusta National. The Germans were asked to erect a bridge over Rae’s Creek adjacent to the tee box at the thirteenth hole.”

The Masters resumed at Augusta National — now free of German prisoners and barnyard animals — in 1946. And interestingly enough, the Supreme Commander of the Allied Forces in Europe during World War II, Dwight D. Eisenhower, later became a member of Augusta National. Two Augusta National landmarks bearing Eisenhower’s name still stand today: the Eisenhower Tree (a loblolly pine at the 17th hole that the former president and avid golfer repeatedly struck with golf balls and requested be cut down; photo above) and the Eisenhower Cabin (built in the 1950s according to Secret Service security guidelines by the club for the former president’s visits).

Posted in Masters

Tagged Anthony Kim, art, books, Food, German POWs, Jack Nicklaus, Masters, News, Sports

Leave a comment

Global Risk Monitor: Weekly Update – April 11

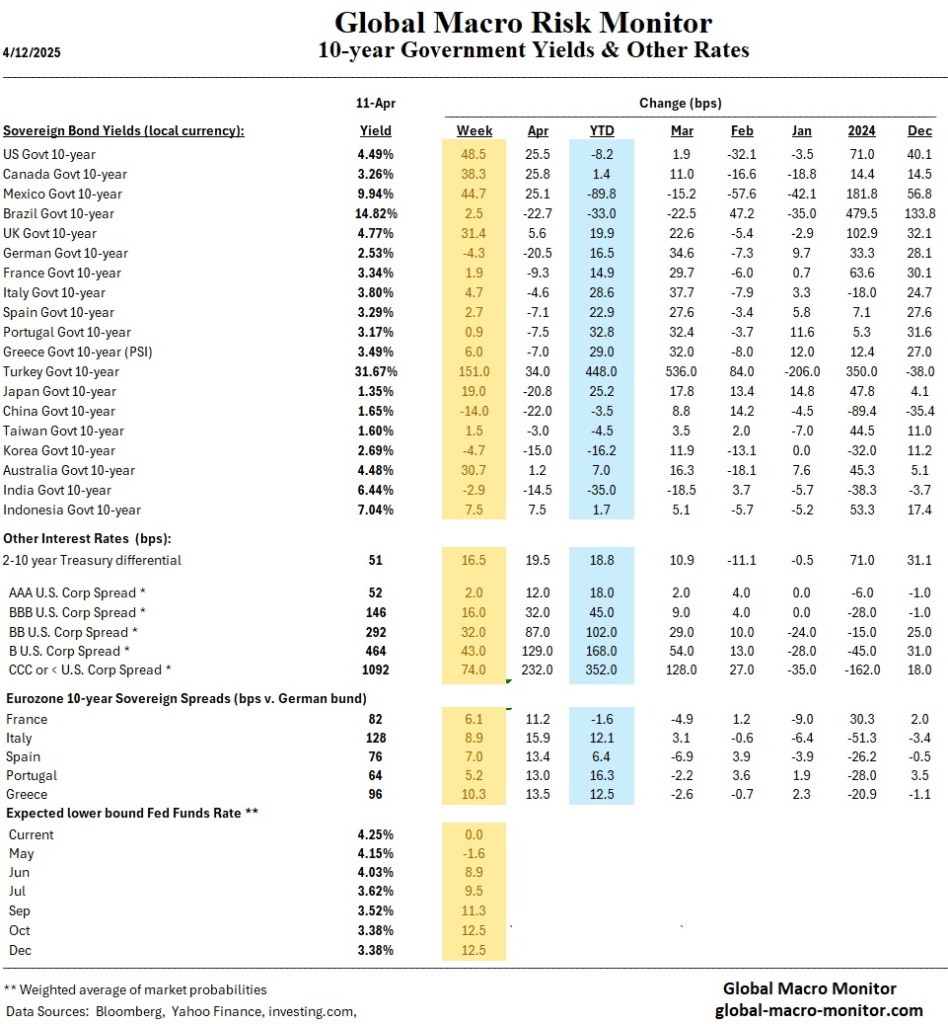

The United States’ current tariff regime reveals not a strategic plan but an erratic response to market volatility, suggesting a governing philosophy resembling reactive day trading more closely than structured economic policymaking. As the week’s developments show, the absence of a coherent framework has amplified financial instability and is now beginning to erode the traditional safe-haven status of U.S. assets. The dramatic 50 basis point surge in U.S. Treasury yields—contrasting with a 4 basis point decline in German bunds and a 6.1% appreciation of the Swiss Franc—signifies an unsettling reality: capital is fleeing the U.S. in patterns more commonly associated with emerging markets in crisis.

This capital flight reflects growing investor anxiety over both the economic impact and political incoherence of U.S. trade policy. In particular, the decision to impose sweeping and massive tariffs on China —then abruptly exempting $390 billion in consumer electronics, including smartphones and chips —undermines confidence in policy predictability. As revealed in the Friday night tariff exemption announcements, the White House walked back its own levies under intense market pressure, with Apple, Nvidia, and Microsoft among the major beneficiaries. While this move will spark another positive market response early next week, it also reinforces the perception that policy is being dictated by equity indices, not long-term economic goals.

Meanwhile, U.S. credit spreads widened significantly, Treasury market volatility surged, and equities remain fragile despite a mid-week bounce. The broader implication is troubling: without a principled policy reversal, not merely ad hoc relief, U.S. markets may remain hostage to political instability and stagflationary risk. If change comes, it will be driven not by strategy, but by necessity.

Markets

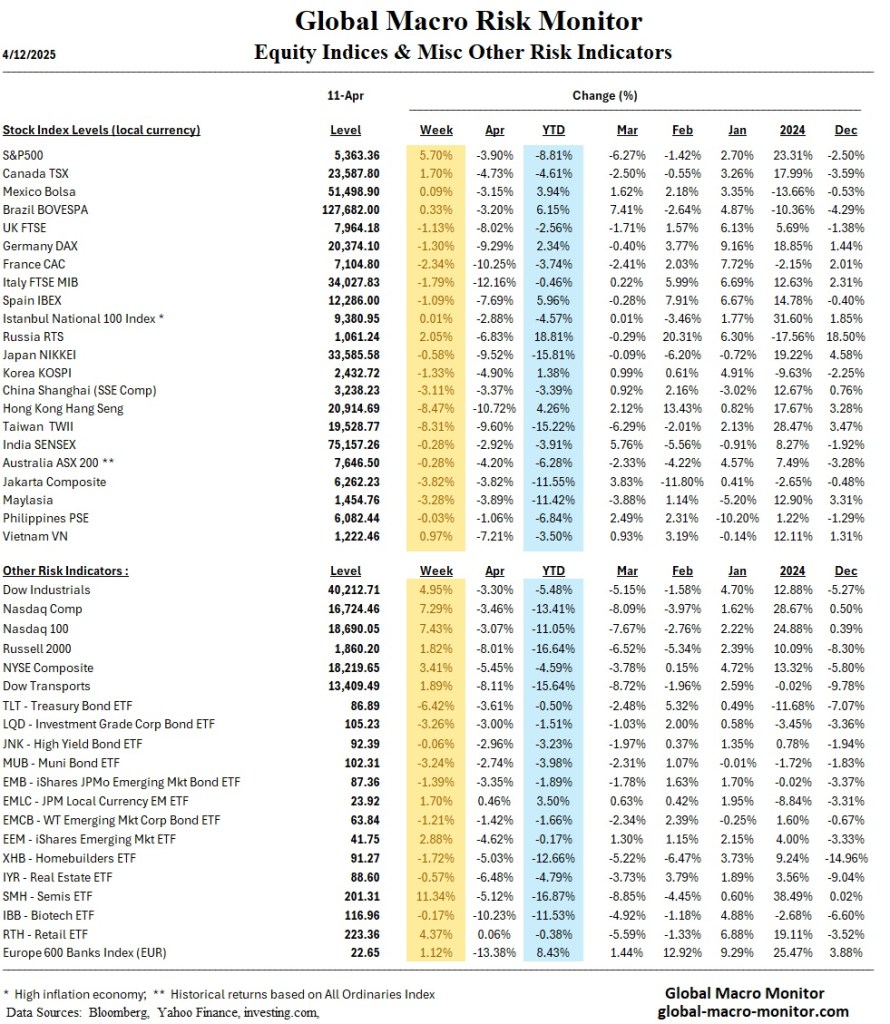

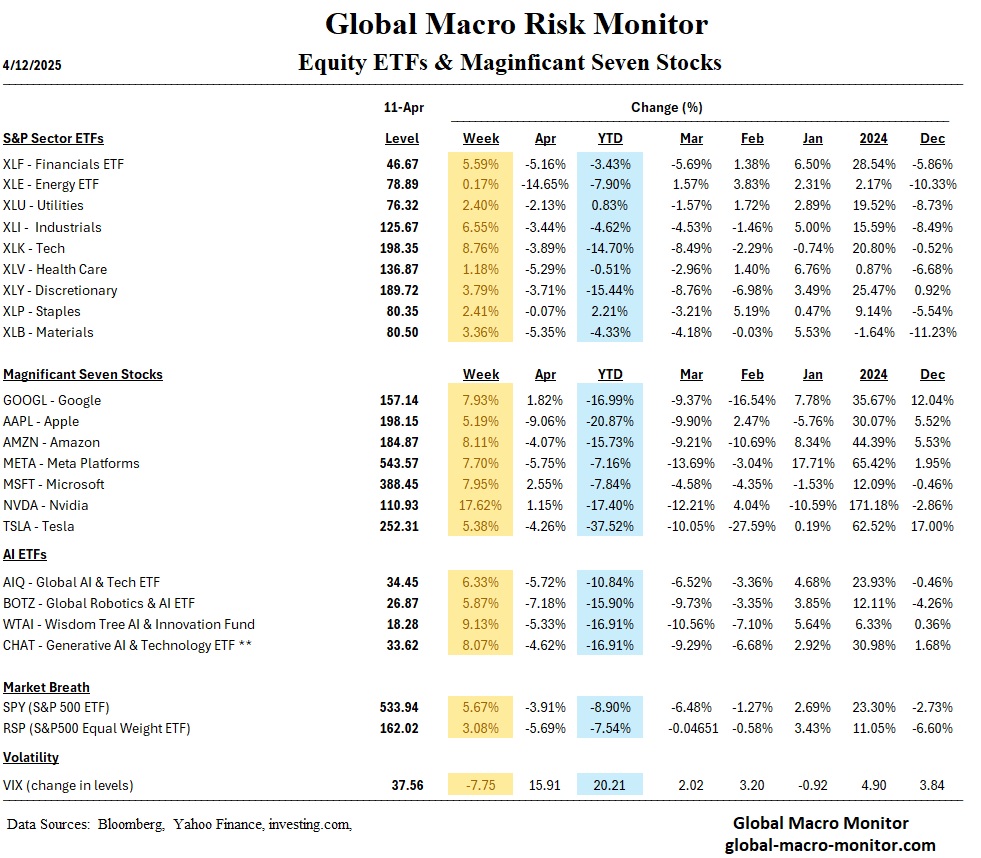

U.S. Market Analysis

- Wild Rebound, but Breadth Collapses: U.S. indices bounced midweek (S&P 500 +5.7%, Nasdaq +7.3%), but participation was narrow—SPX breadth fell to 26.4% from 37.4%.

- Volatility High: The CBOE Volatility Index surged early in the week, peaking at 5-year highs before subsiding.

- Yields Spike: 10-year yields jumped from 3.99% to 4.51%. The yield curve steepened sharply.

- Credit Spreads Widen: IG spreads +8 bps to 102 bps; HY spreads +50 bps to 387 bps.

- U.S. Dollar Weakens: DXY briefly broke below 100, compounding uncertainty.

Global Market Analysis

- Europe: STOXX 600 –1.9%. Germany’s DAX –1.3%, Italy’s FTSE MIB –1.8%. Bunds rally. ECB signals concern over global trade risks.

- Asia:

- Japan: Nikkei and TOPIX each down ~0.6%. Tariffs spook exporters; BoJ may delay rate hikes.

- China: Shanghai Composite –3.1%. China raised retaliatory tariffs to 125%. GDP growth forecast cut to 4.1%.

- Emerging Markets:

- Latin America: Mixed impact—some relief from tariff exemptions (e.g., metals), but vulnerable to commodity weakness.

- EEMEA: Less exposed directly, but capital flow and FX volatility remain elevated.

Economics

U.S. Economic Overview

- Consumer Sentiment Collapses: University of Michigan’s Index fell to 50.8, lowest since 2022. Inflation expectations jumped to 6.7%—highest since 1981.

- CPI & PPI Soft, but Misleading: March CPI flat m/m, Core CPI +0.1%. PPI also declined, but these reflect pre-tariff conditions.

- Fed Outlook Muddled: Rate cut odds for June remain high, but hawkish commentary persists amid inflation uncertainty.

- Yield Moves Defy Inflation Prints: Bond yields rose despite soft data, suggesting market concern over structural risks—not cyclical weakness.

Global Economic Overview

- Eurozone: March CPI eases to 2.2%. ECB expected to cut rates Thursday. Recession risk rising.

- China: Tariff impacts to trim 1–3 pp off GDP. Beijing expected to roll out new fiscal stimulus.

- Japan: Tankan survey firm; BoJ cautious. Yen appreciated on global risk aversion.

- India: RBI cuts rates 25 bps. More easing likely as GDP downgraded.

- Mexico & Brazil: CPI supports further easing; Banxico likely to cut in May.

Week Ahead (April 14–18, 2025)

Key U.S. Events:

- Economic Data:

- Tue (Apr 15): Empire State Manufacturing, Import/Export Prices

- Wed (Apr 16): Retail Sales, Industrial Production, Housing Market Index

- Thu (Apr 17): Housing Starts, Jobless Claims, Philly Fed Index

- Earnings:

- Mon: Goldman Sachs, M&T Bank

- Tue–Fri: J&J, BAC, Citi, UNH, Schwab, AXP, DHI, Comerica, and more

Key Global Events:

- China GDP: Wednesday—expected slowdown from late-2024 strength.

- ECB & BoC Rate Decisions: Thursday (ECB cut expected); Wednesday (BoC to hold).

- Tariff Watch: Any update on China-U.S. trade dynamics will drive markets.