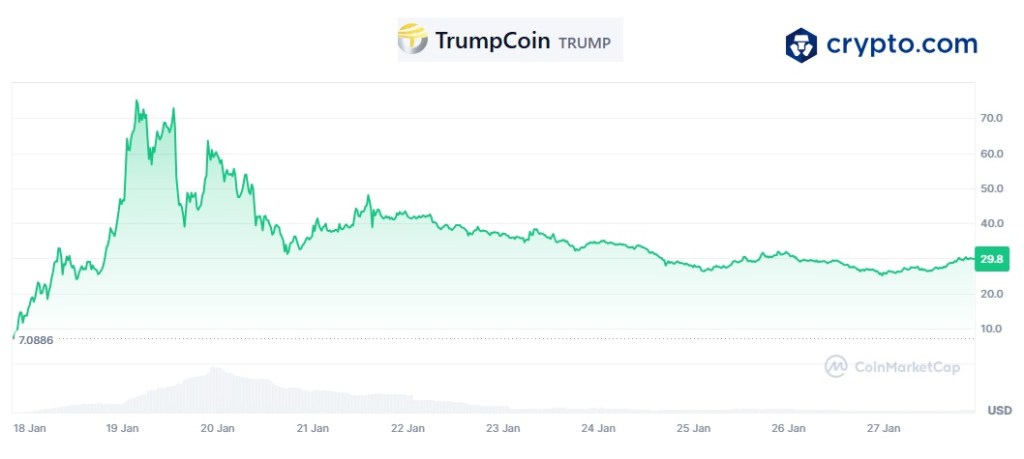

The launch of $Trump, a cryptocurrency unveiled during President Donald Trump’s inauguration festivities, has stirred both excitement and skepticism, shining a harsh light on the flaws in the cryptocurrency market. Promoted as a revolutionary token, $Trump initially surged to a $15 billion market cap within hours, only to lose over half its value days later. For critics like Global Macro Monitor, the $Trump saga epitomizes why cryptocurrencies lack credibility: they have no intrinsic value and fail to meet John Maynard Keynes’ definition of a currency—1) a store of value, 2) a medium of exchange, and 3) a unit of account.

A Gimmick-Driven Launch

Announced during the star-studded Crypto Ball, $Trump entered a market already rife with speculation. Backed by a Trump-affiliated entity controlling 80% of the supply, the memecoin promised supporters a way to share in the “crypto revolution.” However, the launch was followed swiftly by Melania Trump’s competing token, $Melania, and later by the Reverend Lorenzo Sewell’s $Lorenzo coin, introduced just hours after his inauguration benediction. Sewell, a Detroit pastor, pitched $Lorenzo as a funding tool for charitable initiatives, only to see its value spike briefly before collapsing—mirroring $Trump’s trajectory.

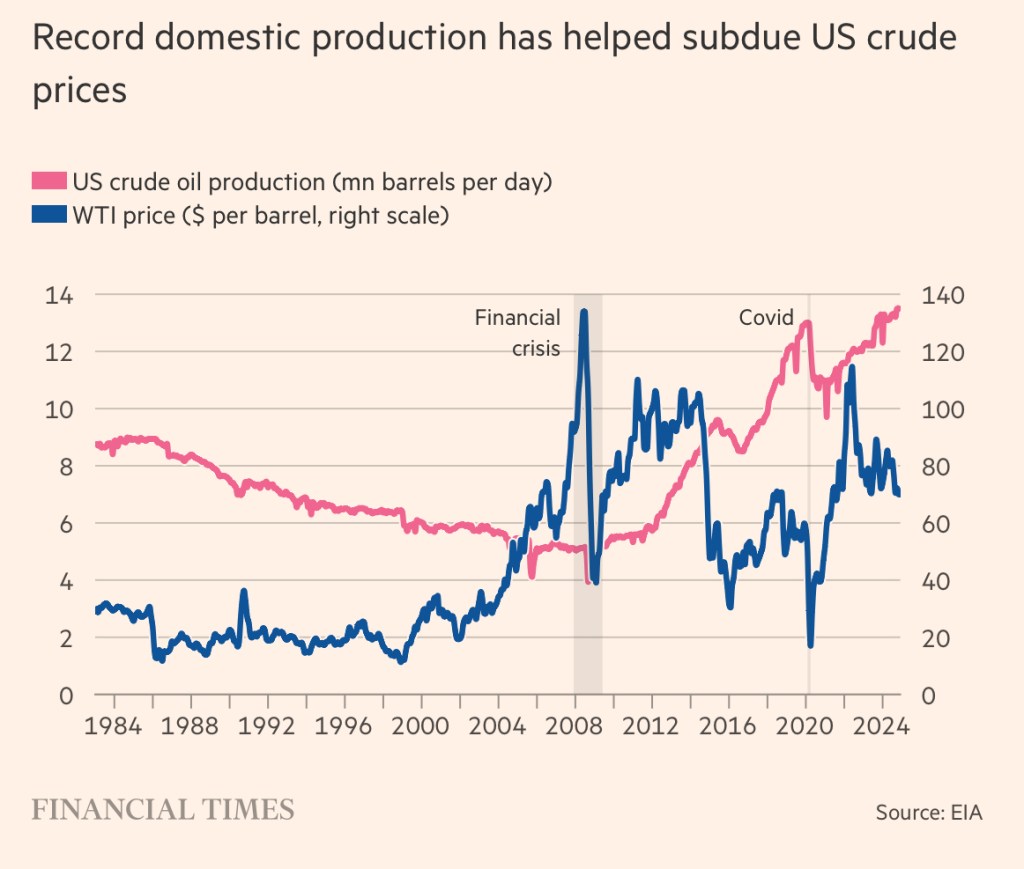

The ease with which these tokens were minted highlights the fundamental problem with crypto scarcity. While Bitcoin is touted as “digital gold” due to its fixed supply, the flood of memecoins—ranging from $Trump to celebrity coins like $LeBron (LeBron James) and $Leo (Leonardo DiCaprio)—reveals that cryptocurrencies can be created out of thin air, eroding the foundation of the investment thesis tied to scarcity.

A Questionable Wealth Boom

The broader cryptocurrency market now exceeds $3 trillion in capitalization, creating vast wealth for some without producing anything of tangible value. This speculative boom is undeniably inflationary on the margin, as money flows into unproductive assets rather than contributing to real economic output. For Global Macro Monitor, this wealth accumulation, untethered to intrinsic value — or a value anchor, for that matter — amplifies concerns about cryptocurrencies’ long-term sustainability.

Failing Keynes’ Test of Currency

While Bitcoin enthusiasts argue that crypto represents financial innovation, it fails Keynes’ test of currency. Its extreme volatility makes it a poor store of value, few merchants accept it as a medium of exchange, and its fluctuating prices undermine its role as a unit of account. The chaotic launches of $Trump and $Lorenzo only exacerbate these weaknesses, reducing the market to a speculative playground.

Industry and Public Reactions

Critics within the crypto community were quick to decry the $Trump coin. Nic Carter, a Trump supporter and crypto investor, called the move a cash grab that undermined the industry’s credibility. Ethereum creator Vitalik Buterin went further, warning that political and celebrity coins are tools for manipulation and a threat to democracy. Social media backlash was swift, with many accusing the Trump family of exploiting their positions for personal enrichment while tarnishing the industry.

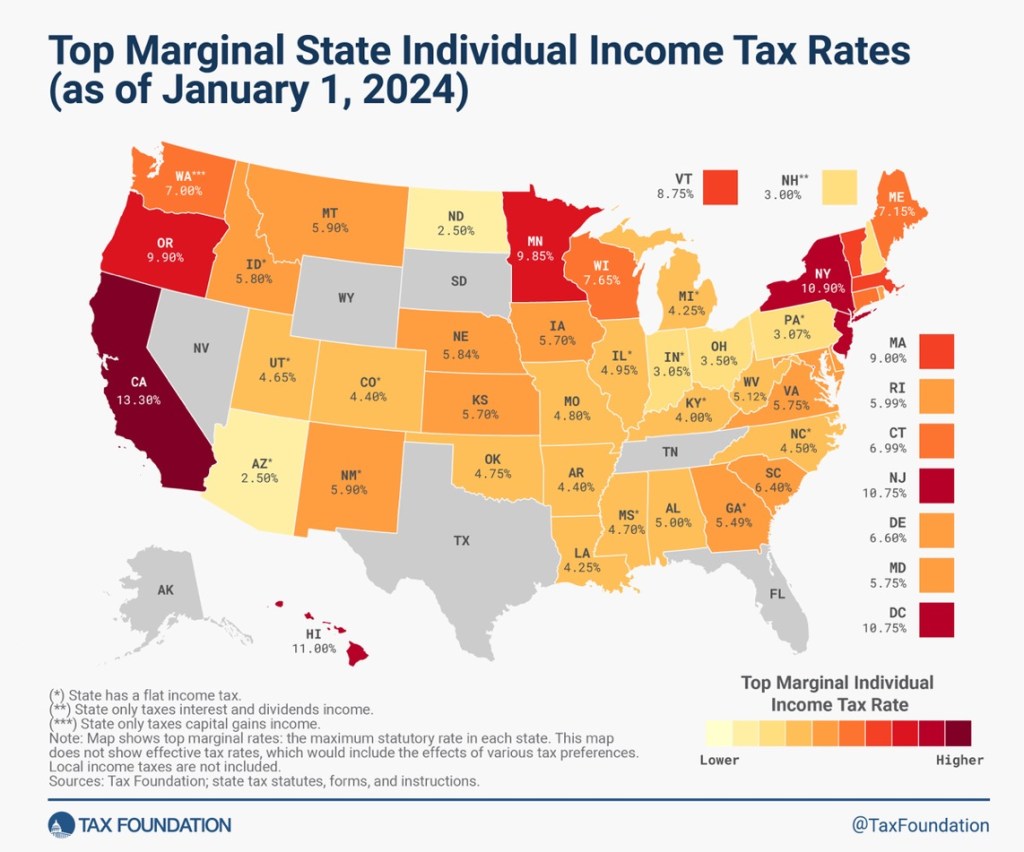

Despite the controversy, the Trump administration continues to champion crypto, with executive orders aimed at easing regulations. Anyone counting on regulation to bring stability should think again. The next four years in the cryptocurrency market are set to make the “Wild West look like a Sunday picnic,” as new tokens and speculative ventures flood the space, testing the limits of both investors and regulators. In addition, the crypto industry is hoping for a “takeout” by the U.S. G. by means of the creation of a U.S. Bitcoin strategic reserve.

A Cautionary Tale

The $Trump coin also highlights the fragility of the cryptocurrency market and the dangers of unregulated speculative assets. For Global Macro Monitor, cryptocurrencies’ lack of intrinsic value and inability to function as currencies per Keynesian theory make their long-term appeal dubious. That said, we do trade Bitcoin, recognizing its unique position as the most established cryptocurrency and the trading opportunities it presents.

The fundamental value of Bitcoin is ambiguous at best and entirely untethered to any notion of “fair value.” There is no fair value because there is no intrinsic value. Price is dictated purely by flows, driven by investor and trader psychology, with no underlying anchor to ground it. As a result, Bitcoin’s price can go anywhere—soaring to unimaginable highs or crashing just as quickly—because it is detached from any tangible economic or financial foundation.

Still, the $Trump saga serves as a sobering reminder that without foundational reforms—and perhaps even with them—cryptocurrencies may remain financial mirages rather than revolutionary innovations.

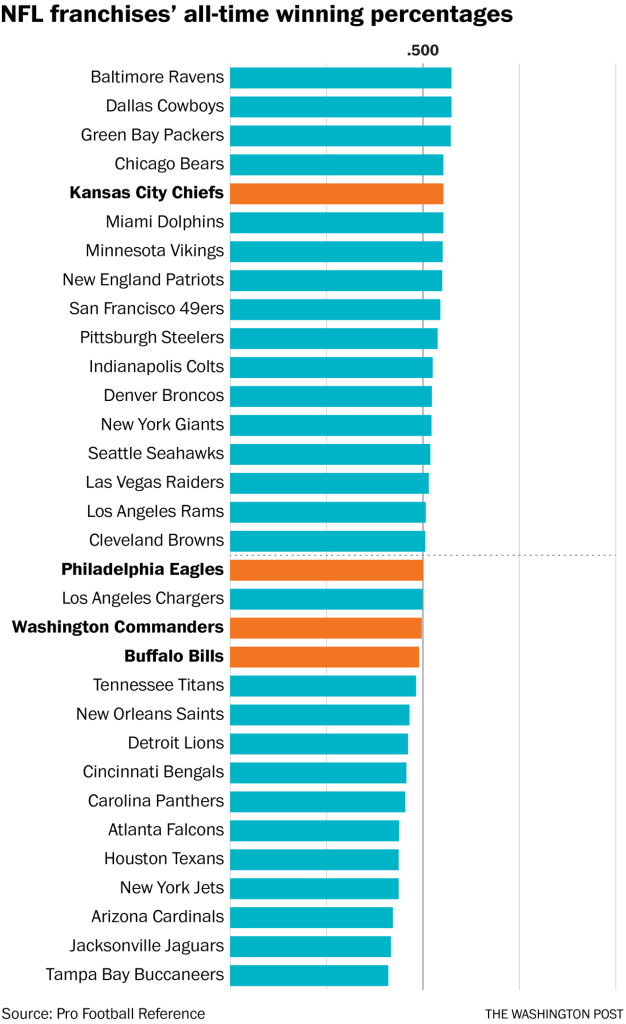

Nevertheless, at the end of the day, what ultimately matters to the crypto industry and its investors can be summed up by paraphrasing the late Al Davis, former owner of the Oakland Raiders:

“Just [keep rising in price and] win, baby.”