It’s that time again.

No, not the, now annual October fires in California (helluva a Chinese hoax, btw) we’re running from but the S&P moving into the selling zone.

We are reposting a piece we published on the very day the market peaked in July right around here. The S&P came close to making a new high today, within 1/2 point and end at its closing high of 3025.86.

Money was made on that trade but not the kind that we think is coming.

We maintain this is good place to sell and set up shorts again. We will sell all day up until 3125, at which point, we will cut and capitulate that “this time may be different.” Arghh.

Stock valuations are at record highs and the markets are so, so gummed up and distorted by government intervention, mainly the Fed — the ultimate socialism, in our book — policymakers and market analysts have lost their compass and can’t tell, north from south, east from west or front from back. The cheerleaders are out in full force with their pom-poms this week, by the way.

Tight Liquidity

Nobody can seem to figure out this “liquidity problem” in the repo market and why banks with excess reserves are not arbing the Fed funds and repo rate.

The shadow puppets that we see dancing on the wall of the cave are based on our first principles.

1) Interest rate distortions. If prices are not allowed to move to equilibrium, quantities will. Go back are read some of our rent control analogies on how the repression of interest rates will lead to excess demand for liquidity, which can only be filled by monetization, ie., the Fed. Witness the now.

2) Larger budget deficits and structural changes in Treasury financing. The structural changes in the Treasury market and pro-cyclical deficits are wreaking havoc on liquidity and crowding out funding in other markets. See here.

Few understand that the U.S. G used to fund up to 50 percent of its annual shortfalls with the social security surplus (off-budget), limiting its financing pressure on the markets. No mas, comrades.

Social Security is now running monthly deficits, which will continue to get worse until the geniuses fix it. The Treasury will have to increase its reliance on the market not only to fund the on-budget deficit but now an off-budget deficit (Social Security plus USPS).

More in the next few posts.

Finally, check out the twisted logic of the markets. Rick Reily is one smart dude and the real brains at Black Rock. He, in essence, states, last year interest rates were too high now they are too low but the market needs the liquidity from the Fed. Do you have a feeling everyone is winging it?

In a well-functioning economy, interest rates would rise, reducing the demand for funding from zombie companies and/or drive them out business, for example, and savings would increase. But interest rates can’t rise because it’s not a well-functioning economy. There is too much debt, too many distortions, and the economy is too dependent on asset bubbles.

Enter The Selling Zone

We have entered the selling zone — S&P 3025-3100 — to execute the Get Shorty trade. This also provides an excellent opportunity for long-term investors to start cutting back on risk if they have not already been doing so.

You know our view. Rarely should LT investors reduce risk in a significant manner, maybe just three to four times during their working lives, but this is one of those times, we believe.

Structural Headwinds

The tectonic plates of the global international economic order are breaking apart and moving in the wrong direction and valuations are at historic extremes.

Not to mention the absurdity that “billions upon billions” of fixed-income securities seem to enter the negative interest rate Twilight Zone on a daily basis.

Moreover, the Fed is about to take the unprecedented action of cutting rates next week with stocks at historical highs and inflation marching higher. That signals, at least to us, a Fed gone political and that policymakers have created a beast they cannot tame.

We expect the summer Friday afternoon ramp into the close, which will be an opportunity to start letting some go or setting some up. It’s hard to sell strength but much more enjoyable than selling into weakness and into a big hole.

Stocks Out Of Runway

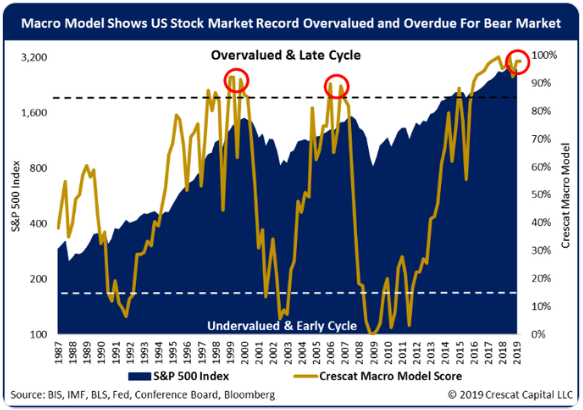

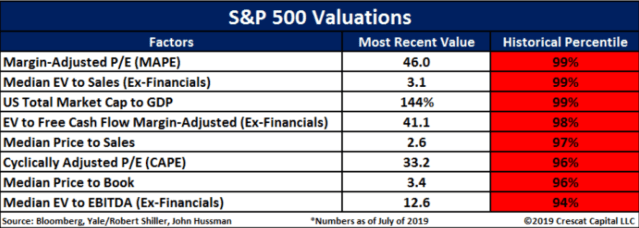

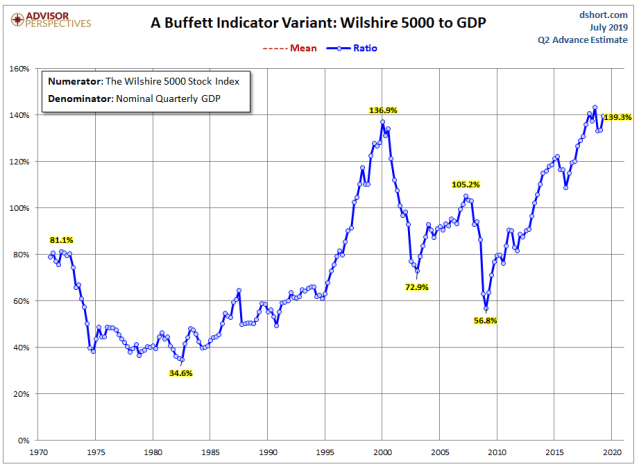

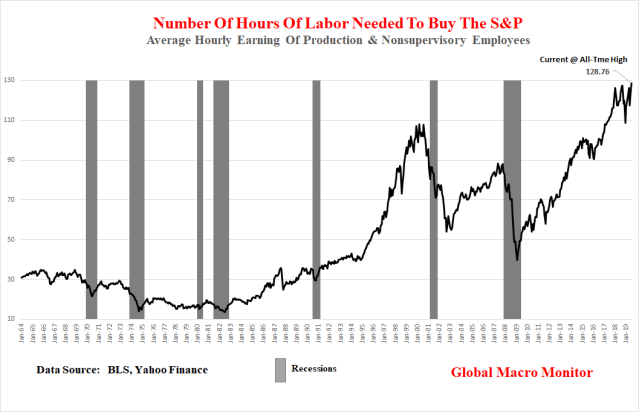

The charts below illustrate that history dictates that stocks have very little room to run to the upside from current levels. We could be wrong and ‘this time may be different.”

We seriously doubt it, however, but discipline always trumps conviction and that is why we have a hard stop at 3125 to cover. We will then wait to put them out at even more absurd valuations.

Long-term investors that do sell should have a Plan B to get reinvested if they are wrong.

Good luck, folks. See ya’ thirty-plus percent lower.

Micro Metrics

Hat Tip: Antonio Pérez Algás @apanalis

Hat Tip: Kevin C. Smith, CFA @crescatkevin

Macro Metrics

See disclaimer

Pingback: Fed To Cut With “Loose As A Goose” Financial Conditions | Global Macro Monitor

Pingback: Why Did Stocks Fall After Rate Cut? | Global Macro Monitor

Pingback: Summer Fridays With The S&P500 | Global Macro Monitor

Pingback: Summer Of Discontent Cometh | Global Macro Monitor

Pingback: The S&P’s Very Long Top | Global Macro Monitor

Pingback: Heads Up! Friday’s Rare S&P Shooting Star Candlestick | Global Macro Monitor

Pingback: Enter The Selling Zone 2.0 | Global Macro Monitor

Pingback: Enter The Selling Zone 2.0 | Zero Hedge

Pingback: Enter The Selling Zone 2.0 – SYFX+

Pingback: Enter The Selling Zone 2.0 - StockExchange.international

Pingback: Enter The Selling Zone 2.0 | ValuBit

Pingback: Enter The Selling Zone 2.0 | Real Patriot News

Pingback: Enter The Selling Zone 2.0 – aroundworld24.com

Pingback: Enter The Selling Zone 2.0 – Forex news forex trade

Pingback: Enter The Selling Zone 2.0 | Verity Weekly

Pingback: Enter The Selling Zone 2.0