In celebration of MLK Weekend, we are reposting a repost of a repost of post in honor of Dr. King, one of our most outstanding Americans, a true patriot, and a modern-day saint. Hard to believe it’s been thirty years.

During my Lehman days as a young bond strategist, the firm’s research group would do a January roadshow in many of America’s major cities to present our ideas to institutional investors. One particular year, we were in Atlanta at end of the week and scheduled for another “greatest show on earth” in Chicago the following Tuesday.

A Weekend In The Peachtree Hyatt

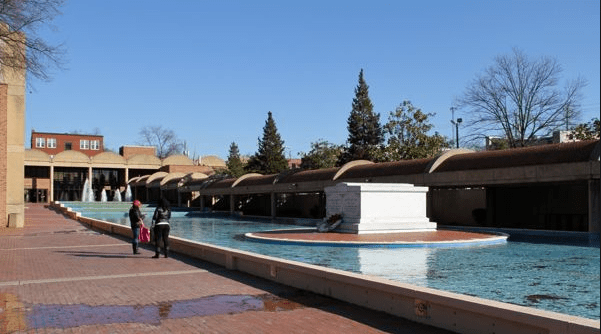

Rather than flying home to New York, I decided to stay over in Atlanta and migrate north on Monday evening. It was MLK weekend, and I wanted to attend services at the Ebenezer Baptist Church, where Martin Luther King, Jr. was baptized as a child and gave his first sermon. If my memory is correct, I believe his father also pastored the church. His mother was shot and killed while she played the organ in that church in 1974.

Dr. King’s tomb is located just outside the side door of the church in the middle of a reflecting pool.

Three Memories Of Ebenezer

I recall my three main takeaways from that Sunday morning.

First, I was maybe one of ten whites out of 600-700 people sitting in the pews. Sadly, as Dr. King said almost 60 years ago.

I think it is one of the tragedies of our nation, one of the shameful tragedies, at 11 o’clock on Sunday morning is one of the most segregated hours, if not the most segregated hour in Christian America. – MLK, Jr Meet the Press, April 17, 1960

Nevertheless, I felt incredibly welcome and never — not for one nanosecond — was conscious about such a silly thing as the difference in the color of my skin. During the greeting time, the Ebenezers made me feel so welcome and a part of their family.

Second, not to contradict Dr. King, but I believe the service started at 9:30 AM and went to almost 1:00 PM! Maybe it was an exceptional MLK weekend service. The pastors in the primarily white churches I have attended have trouble keeping the congregation’s attention for more than 20 minutes.

Third, the sermon differed entirely from those I had experienced in middle-class white churches. Less doctrine, though similar theology, and more authentic life experiences. The struggles of raising children in poverty. Grandparents raising their grandchildren. Troubles with children with drug addiction. The struggles of being black in white America, all of the life struggles which are just as ubiquitous in the white and all communities of color. No pretense of sinless and perfect, no holier than thou vibe, judgment, condemnation, guilt, or shaming. All love, compassion, kindness, and forgiveness. Just like the real Jesus.

Also, the sharing of the same joys and blessings. New babies, college graduates, marriages, medical recoveries, and others.

“Daddy King” was referred to several times.

It truly echoed the genius and saintliness of Dr. King.

I walked away convinced the Church for the African-American community was much more — that is a considerable part of their life — than what I had experienced in white evangelical America.

Yes, maybe some of us attend more than just Sunday services, but many, such as yours truly, often do so with the dubious motive of seeking the blessings of personal peace and personal prosperity. The community of the Church, as it is for the African-Americans, though not always, is secondary.

I spent the next day, Martin Luther King Jr Day across the street at the King Center.

More Empathy, Less “Being A Dick“

What great memories from that unforgettable MLK weekend.

I grew up in the middle-class white suburbs of Los Angeles, attending an all-white high school. Fortunately, I had a father who was politically left of the salad fork (out of a rebellion, I became a conservative in college), and also spent my first 25 years playing sports, fighting in the baseball trenches with, pulling for, breaking bread, and downing brewskies with my teammates of color; or as I grew to learn colorless.

I am very thankful for those experiences. It helped me integrate into and see the real greatness of America.

I feel sad for my many brothers and sisters who have not had the same privilege and are stuck still watching black and white television, unable or unwilling to embrace and enjoy the tremendous diversity of this great country.

Ditto for the similar ignoramuses from other races and ethnic groups.

I can’t imagine eating steak and potatoes every day and every night.

Ignorance And Racism Know No Boundaries

Let me finish by qualifying all of the above.

Racism is a prominent feature of so many human societies that some evolutionary psychologists have concluded it is “natural” or “innate.” We don’t know about that but are sure it is not just a “white thing,” a “black thing, or a “brown thing,” etc.

I have shared the story of my brother who was murdered by an undocumented worker, who stated, after stabbing him, “all anglos need to be exterminated.” This sociopathic asshole killed my brother not because he was brown or undocumented but because he was one sick and crazy mother f$@ker.

Now, more than ever, it is time to commit to expanding our menu. Let’s make it a point to understand and enjoy the perspectives and cultures of all the different races and ethnic groups.

Allegorically and literally, let’s eat more balaedas, falafel, babaghanoush, borscht, moussaka, and bouilli, among others. The steak and potatoes will taste sooo much better.

Sorry to end on a note that violates the spirit of Dr. King but I can’t help myself.

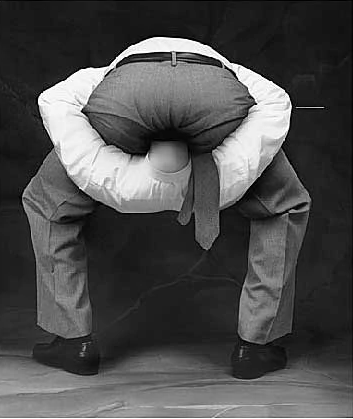

Any white man (probably less so for a white woman) who thinks he knows what it is like to be an African-American growing up and living in America, has his head…well…you know where.

Bring it on!