QOTD – Quote of the Day

Enlightened statesmen will not always be at the helm. – James Madison, Federalist Papers #10

QOTD – Quote of the Day

Enlightened statesmen will not always be at the helm. – James Madison, Federalist Papers #10

Historical Origin of the Idiom (Literal Roots)

Cultural & Linguistic Context

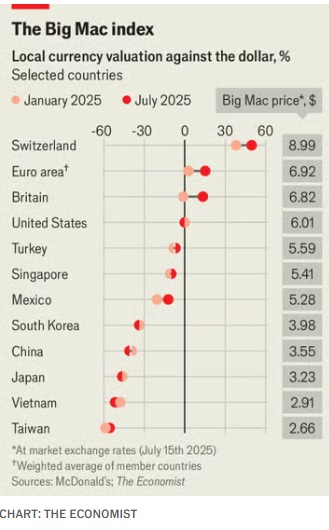

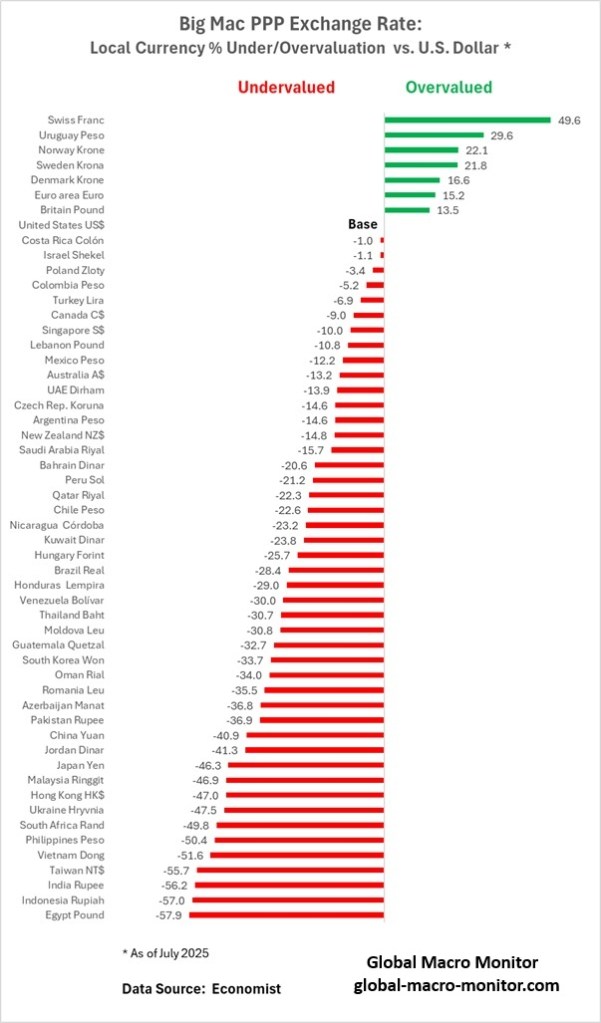

As an international economist earlier in my career, I long appreciated The Economist‘s Big Mac Index, a deceptively simple yet revealing tool for assessing purchasing power parity (PPP) and currency under or overvaluation. In the Economist’s latest iteration, the Index continues to spotlight the disparities between market exchange rates and what currencies should be worth based on the price of a McDonald’s Big Mac. At its core, the Big Mac Index compares the cost of the iconic burger across countries. If a Big Mac costs significantly less in one country than in the U.S. (when adjusted for exchange rates), that currency is likely undervalued—and vice versa.

Swissie Expensive

According to the recent update, the Swiss franc remains notably overvalued, while many Asian currencies, including the Chinese yuan and Japanese yen, appear undervalued. The dollar itself is still relatively strong, skewing valuations globally. The Big Mac Index, though informal, remains a useful shorthand for understanding real-world consumer purchasing power.

I remember a summer visit to Copenhagen, where a simple Big Mac meal cost me nearly $8 USD, while a Big Mac in the States was around $5 USD. It wasn’t just sticker shock; it was a vivid reminder of Denmark’s high cost of living and the krone’s strength. Contrast that with a later trip to Japan, where the same meal set me back just under $3 USD. The affordability wasn’t just a function of cheap labor or ingredients, but of broader macroeconomic factors, reflected, in part, in the undervalued yen.

One hundred years ago, on July 21, 1925, John T. Scopes was found guilty in a Tennessee courtroom for teaching evolution in violation of the state’s Butler Act. Known as the Scopes Monkey Trial, this legal spectacle pitted science, religion, and education against each other in a way that still resonates today. Though Scopes was convicted (a $100 fine later overturned), the trial became a pivotal moment in America’s struggle between modernism and traditionalism, illuminating a deep cultural rift that has never fully healed.

One hundred years later, it’s troubling to observe that the debate over scientific truth has not evolved; in fact, in many ways, it has regressed. We are witnessing a resurgence of anti-science sentiment across the United States, echoing the same ideological battles that occurred in Dayton, Tennessee, that summer.

From Evolution to Devolution – A Battle for Scientific Integrity

The Scopes Trial was never simply about one man or one lesson in biology. It was a staged confrontation, orchestrated in part by the ACLU, between progressive thinkers like Clarence Darrow and fundamentalists represented by William Jennings Bryan. The courtroom became a national forum where evolution, the Bible, and academic freedom collided.

Although Scopes lost, the trial galvanized public attention and eventually led to greater acceptance of evolutionary theory. The scientific community believed the battle had turned in their favor. Yet nearly a century later, this optimism feels misplaced.

Back to the Bible: Ten Commandments in Classrooms

In 2024, the Louisiana state legislature passed a law requiring the Ten Commandments to be posted in every public school classroom, reigniting the separation-of-church-and-state debate. Governor Jeff Landry, who signed the bill, argued it instills “moral clarity,” a veiled justification for promoting religious doctrine in public education.

Similar bills in Texas, Oklahoma, and Florida seek to reintroduce creationism or “intelligent design” into science curricula. These efforts disregard Supreme Court precedents (Edwards v. Aguillard, 1987) and defy decades of educational progress.

At the end of the day, this isn’t really about moral instruction. It’s an assault on secular education and feels like a strategic push toward theocratic governance.

Modern-Day Heresies: Vaccines, Viruses, and Flat Earths

During the COVID-19 pandemic, anti-vaccine movements surged, fueled by disinformation and distrust in scientific authority. Despite the overwhelming evidence of vaccine safety and efficacy, millions opted out, often citing conspiracy theories linking vaccines to government control, microchips, or infertility. This resistance led to preventable deaths and prolonged economic and social disruption.

Scientific researchers, particularly in climate science and public health, now report harassment, funding shortages, and censorship—a chilling atmosphere where truth must navigate political landmines.

Platforms like X (formerly Twitter), YouTube, and TikTok are awash with pseudoscience: from “flat earth” advocates to influencers claiming cancer is a “mindset.” This mass rejection of empirical evidence reflects a cultural rot, not just ignorance but a willful return to pre-Enlightenment thinking.

Stone Age Thinking in the Digital Age

The irony of our regression is stark. We are amid and on the eve of the most profound technological advances in history as AI achieves escape velocity (it helped in writing this post), and we now carry supercomputers in our pockets, yet some still deny the Earth is round. We sequence genomes in hours, yet distrust mRNA vaccines. Public discourse is increasingly favoring ideology over inquiry, belief over biology.

Like the fundamentalists of the Scopes era, today’s anti-science crusaders mask fear as faith. They seek control over the narrative, not through reasoned debate, but by banning books, rewriting curricula, and discrediting experts.

This is not merely political. It’s epistemological: a war on how we know what we know.

The Real Lesson from Dayton

The Scopes Trial was a warning, not a relic. It showed how quickly truth can become a casualty in cultural warfare. Today, the stakes are even higher. From climate collapse to global pandemics, the survival of civilization depends on our collective ability to think rationally, embrace science, and resist primitive instincts.

We must ask ourselves: Are we moving forward into a future of reason and progress, or stumbling backward into a symbolic Stone Age, where superstition reigns and ignorance is weaponized?

I will never forget the deep discomfort and near outrage I felt sitting in a church pew, listening to the preacher declare, “I’m not going to let science make a monkey out of me.” In that moment, I realized I could never align myself with a version of faith that demanded that I reject the integrity of scientific understanding.

Faith and science need not be adversaries; in fact, they can, and should complement each other like two lenses bringing a complex world into clearer focus. Just as a person uses both a compass and a map to navigate a journey — one offering direction, the other providing context—faith can guide moral purpose while science explains natural phenomena. Believing in the value of human life, for example, doesn’t conflict with studying biology or medicine; it often inspires deeper care for the physical world. When we recognize that faith asks “why” and science asks “how,” we can allow both to enrich our understanding without demanding they speak the same language.

Let July 21 serve not only as a memory of a trial in Tennessee but as a mirror reflecting America’s uneasy relationship with truth. The verdict we render today, through our schools, votes, and voices, will shape whether history repeats itself or finally evolves.

“This is a highly fluid situation and we’ll need to manage quantity decisions as we measure the price elasticity of impacted items,” underscoring how Walmart adjusts its inventory and pricing strategy based on customers’ sensitivity to price changes.” – John David Rainey, Walmart CFO

In a recent interview (see below), Walmart Chief Financial Officer John David Rainey explained the company’s adaptive pricing strategy amid escalating tariff pressures. Rainey made it clear that Walmart does not apply blanket price increases to all tariffed goods. Instead, the company uses economic fundamentals—particularly the concept of price elasticity of demand—to decide which products absorb costs and which products offset them through price increases.

Rainey stated:

“If you’re selling something that’s maybe a discretionary item for $300 and there’s a 50 or 100% tariff on that, it’s going to be more challenging to sell the same number of units.”

This comment reflects a textbook application of elasticity theory. If a product is price-sensitive (elastic), such as a discretionary good like electronics or seasonal apparel, a price increase due to tariffs could cause a sharp drop in sales. In such cases, Walmart is likely to absorb the cost increase to maintain volume.

Protecting the Profit Margin

However, as Rainey continued:

“We’re going to look across all categories of products and… maybe change prices on other products that might not have a tariff applied to them.”

This marks the strategic pivot. Walmart selectively raises prices on products with inelastic demand, such as household necessities and staple items, where consumers are less likely to reduce their quantity purchased despite modest price increases. These goods act as economic buffers to sustain profit margins without triggering a sharp decline in overall sales.

In summary, Walmart’s approach is not reactive but economically surgical: shield elastic goods from price hikes and strategically increase prices on inelastic, non-tariffed items. The CFO reinforced that this flexibility allows Walmart to protect its market share while managing margin pressures:

“We want to make sure that we’re maintaining the appropriate price points and the price gaps to our customers.”

Appendix – Understanding Price Elasticity of Demand (Econ 101)

Definition:

Price elasticity of demand (PED) measures the sensitivity of consumer demand to a change in price.

Equation:

Price Elasticity of Demand = % Change in Quantity Demanded/

% Change in Price

Elastic demand (|PED| > 1): Demand drops significantly when prices rise.

Inelastic demand (|PED| < 1): Demand remains relatively steady despite price changes.

Application at Walmart:

For elastic goods (e.g., TVs, imported toys), Walmart partially absorbs tariff costs to avoid losing customers.

For inelastic goods (e.g., toothpaste, toilet paper), Walmart raises prices, knowing demand won’t drop significantly.

This allows the company to offset losses on tariffed items with margins on stable-demand goods—a cross-subsidization model powered by demand analytics.

Real-World Examples and Strategic Outcomes

Walmart’s elasticity-based pricing strategy shows how foundational economic theory can guide real-world decisions at scale. Consider these illustrative examples:

Imported Bluetooth speakers face a 50% tariff. Given their elastic demand, Walmart absorbs the cost and holds the price at $29.99 to avoid volume loss.

Laundry detergent, a non-tariffed good with inelastic demand, sees a subtle price increase from $9.49 to $9.89. The small uptick boosts margins with negligible impact on unit sales.

Pet food or vitamins, typically low-elasticity items, could also carry mild price increases to help Walmart maintain profitability across the broader product portfolio.

As Rainey noted,

“There might be some areas where we want to play offense… absorb some of that impact in the short term for the benefit long term.”

Walmart’s ability to integrate elasticity, inventory timing, and tariff forecasting exemplifies smart macroeconomic thinking in retail operations. It’s a strategy rooted in Econ 101, executed with Fortune 1 scale.

Go to 1:16 in the video.

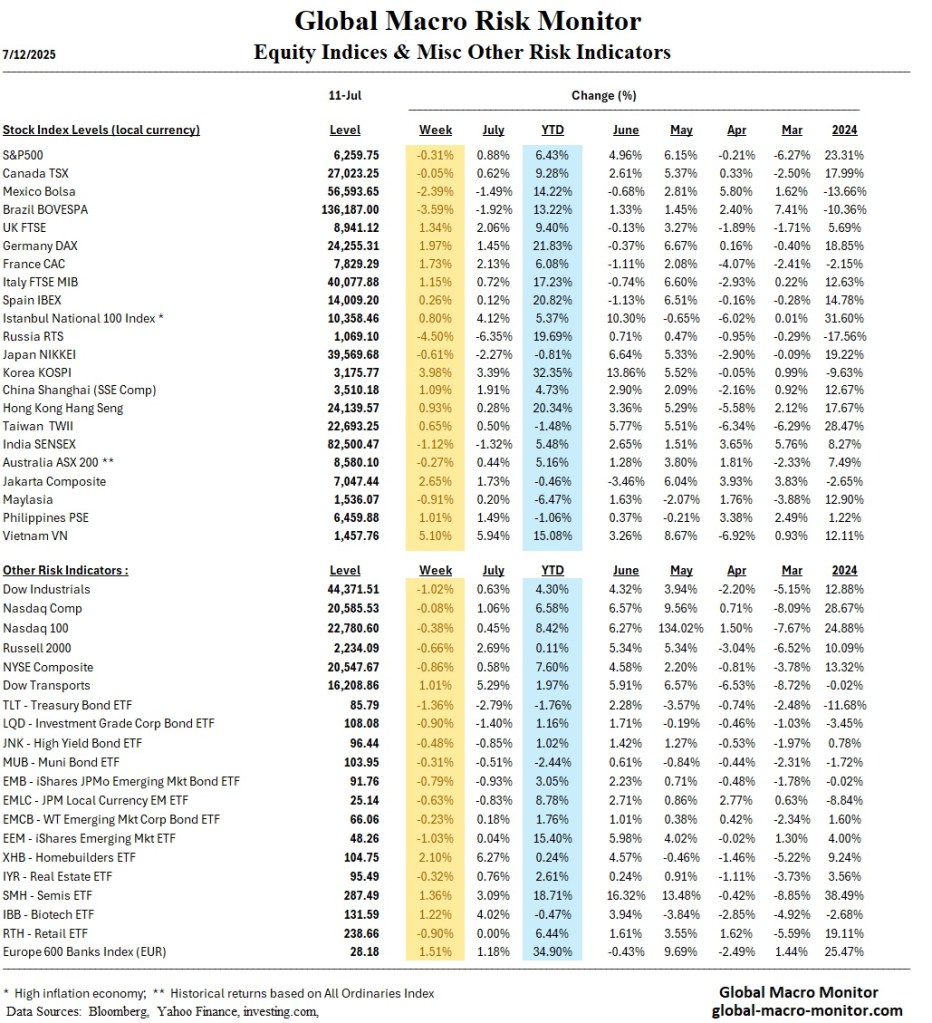

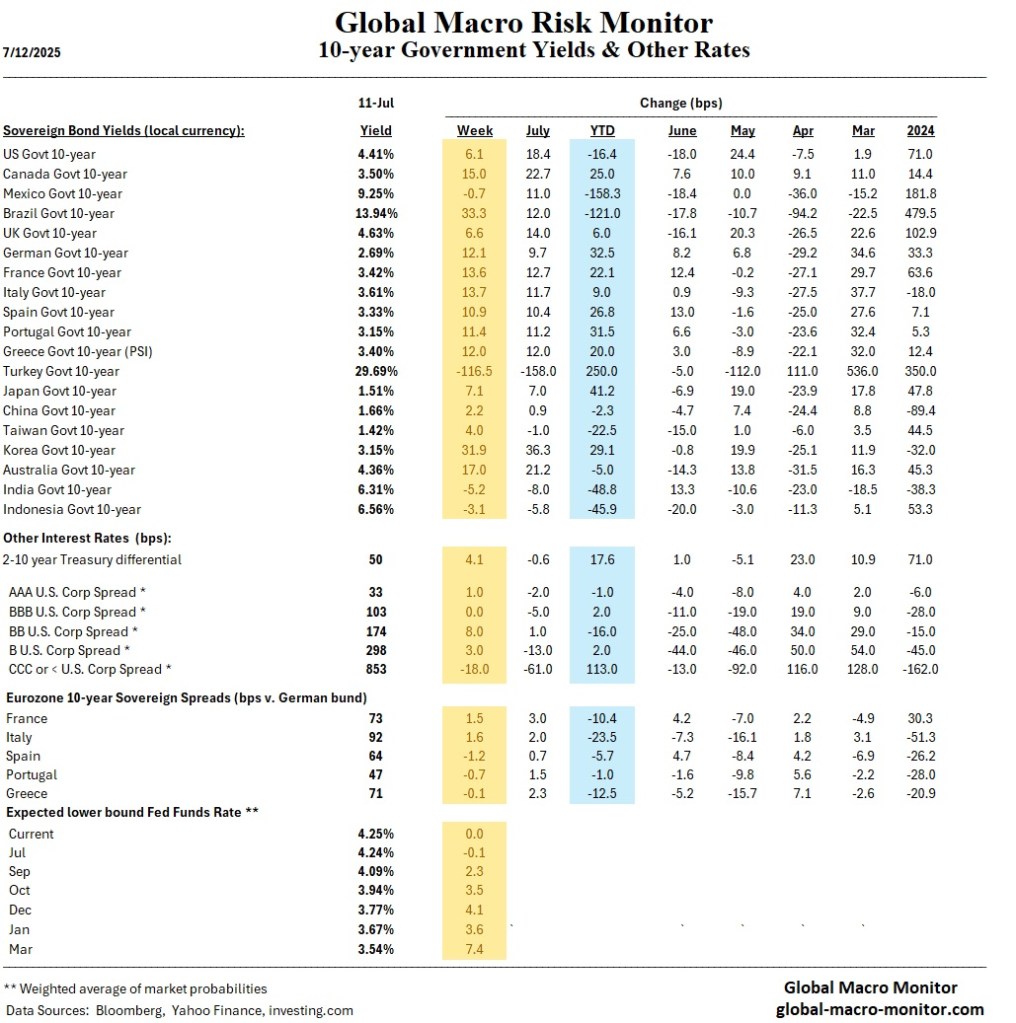

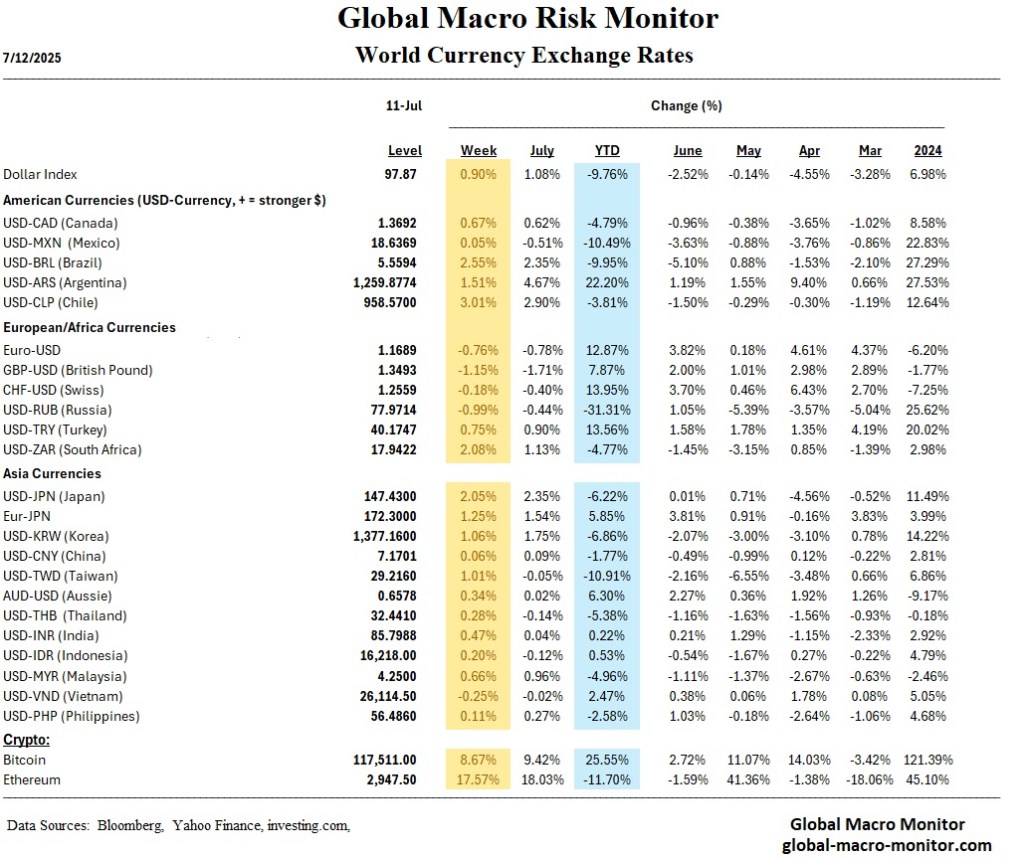

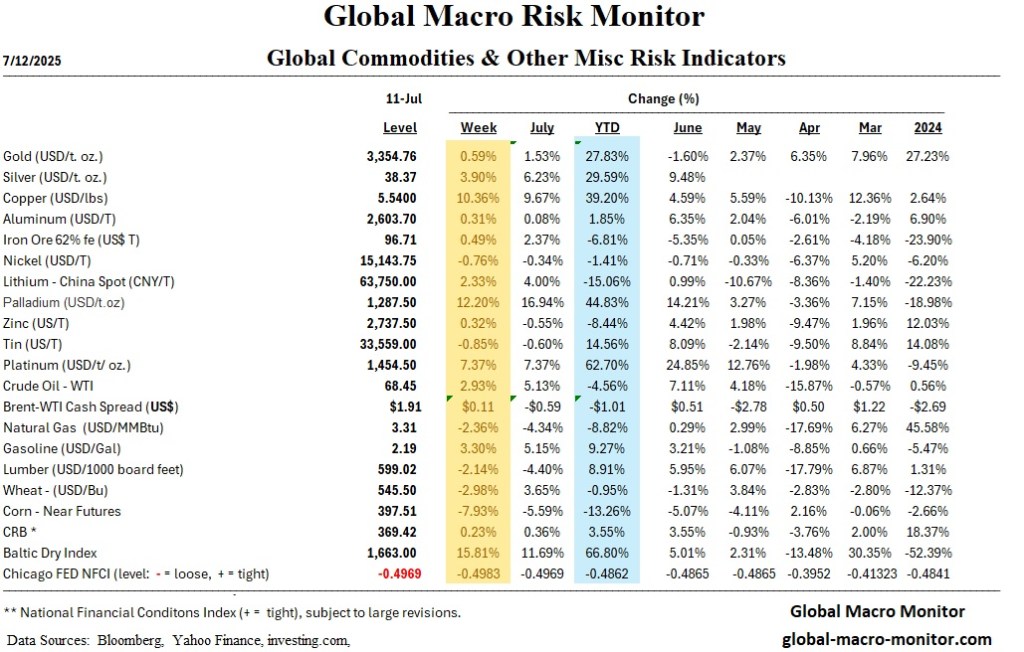

Markets wrapped up the week with a paradoxical sense of calm, even as trade tensions re-escalated on multiple fronts. At the center of the uncertainty is President Donald Trump’s hardline tariff rhetoric, including threats of sweeping new levies on the United States’ major trading partners. While markets continue to discount his threats as political theater, the cumulative weight of uncertainty is beginning to test investor patience, especially during the traditionally sluggish “Dog Days of Summer.” Artificial intelligence (AI) trends remain a bright spot for sentiment, but beneath the surface, warning signs are emerging.

In a sharp escalation, Trump announced unilateral tariff hikes—30% on the EU and Mexico, 50% on Brazil and copper products, and threats of a 200% pharmaceutical levy. The stated justification ranges from narcotics enforcement to trade imbalances, with timing set for August 1. According to Bloomberg, Trump’s “maximalist stance” has left U.S. trading partners scrambling, with some countries (like India) racing to finalize partial deals to avoid being swept up in the tariffs.

Despite the aggressive tone, markets appear to view the latest salvo as another bluff. Traders point to a pattern of bluster followed by walk-backs. Nonetheless, the barrage of tariff letters and the rapidly approaching deadline have rekindled fears of a disrupted global trade regime. As one European official stated, the administration’s “fits-and-starts” approach undermines predictability and stability, the two pillars essential for cross-border investment and supply chain resilience.

While geopolitical rhetoric intensified, market volatility remained surprisingly subdued. Fidelity, Manulife, and Schwab all reported relative calm in U.S. equity indexes. The VIX actually backed up for the week. The S&P 500 and Nasdaq continued to trade near record highs, buoyed by robust AI demand and resilient tech earnings. Yet the calm may be deceptive.

Charles Schwab’s weekly outlook noted that equity valuations remain historically elevated, and market breadth is narrowing again, another potential red flag. The latest leg of the rally has been disproportionately driven by a handful of tech giants, even as cyclical and value sectors lag. The fear is that a deterioration in macro fundamentals, such as renewed supply chain stress from tariffs, could derail the rally just as seasonal volume declines.