See our post, Newton’s Q1 Law Of Motion For The S&P, by clicking here

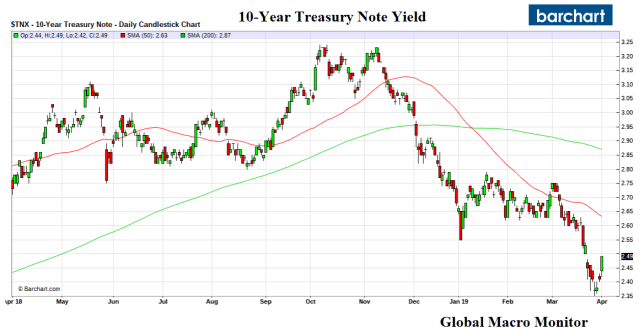

The past few weeks were a classic exercise in how markets tend to “retrofit” price action to their expectations of economic fundamentals and illustrates the risk of a self-fulfilling feedback loop. The 10-year bond yield fell more than 40 basis points from March 1 to March 27 and the 10-year less 3-month yield curve temporarily inverted, leading even the President’s top economic advisor and his nominee to the Federal Reserve to call for an emergency 50 bps interest rate cut by nation’s central bank.

Day trading the market and economic noise to set longer-term economic policy can be dangerous thang. That’s Chauncey Gardener-esque, folks, and puts the credibility of U.S. policymaking into question.

Why Did Rates Collapse In March?

Nobody really knows for certain but we suspect it was the collapse in the 10-year German bund yield, which crossed over into negative territory once again, falling from 18 bps on March 1 to -8 bps on March 27th. The German manufacturing sector is now in a “deep recession” and the shortage of German bunds due to ECB asset purchases has distorted the economic signal of interest rates.

Interest rates in the U.S. are affected and somewhat anchored by the German bund yield.

Interest rates in the U.S. are affected and somewhat anchored by the German bund yield.

Nevertheless, we were a bit perplexed by the sharp move down in U.S. yields as we didn’t see the U.S. economy collapsing. Au contraire,

Note the Atlanta’s Fed GDP now forecast for Q1 2019 has moved up from around 0.5 percent at the beginning of the month to around 1.2 percent, which is a big move lost on the markets. – GMM, March 22

Markets are way over their skis on the deflation and growth scare.

The Atlanta Fed’s GDP Now Q1 forecast has skyrocketed over the past few weeks, up from 0.3 percent to 1.7 percent. There is no deflation and it’s entirely possible the Cleveland Fed Median CPI prints 3 percent y/y in March with energy prices now skyrocketing. The daytraders in and out of the administration calling for a 50 bps rate cut are panicked and clueless unless they see something nobody else does. Could they be signaling the China trade deal is in trouble? Just askin’. – GMM, March 31

The GDP now Q1 forecast is currently at 2.1 percent.

Moreover, the talk of deflation is just nonsense.

…the Fed began sucking dollars out of the economy. This combination of a reduced supply and heightened demand for dollars produced an entirely unnecessary deflation. – Stephen Moore, Wall Street Journal, March 13th

Actually, that sucking sound is not the Fed reducing bank reserves but it’s the U.S. Treasury increasing the size of its monthly note and bond auctions in order to maintain its balances (checking account) at the Fed as the central bank shrinks its balance sheet. That is coming to end in September, however.

Take a look at the Cleveland Fed’s Median CPI running at an annual rate of 2.7 percent, which may approach or breach 3 percent for March with the rise in energy prices.

What Now?

If you have been reading GMM, you know our thoughts on equities. The sheer momentum of such a strong first quarter carries over into the rest of the year, which is the justification of our year-end S&P target of 3025.

There has not been one year since 1950, not one, where the S&P has increased by more than 10 percent in Q1, after experiencing a negative prior year, which didn’t close the year up less than 20 percent. It’s Newton’s Q1 Law of S&P Momentum. Is this time different?

We don’t think the move will be sustainable, however, and are selling the strength in the final three quarters, which we suspect the bulk of the final move will take place in Q4.

Bonds

Bond yields are more interesting.

Clearly for yields to take off and move much higher, Euro yields will need to get off the mat. The German manufacturing sector may emerge and show some improvement if China has truly bottomed. We also expect pressure to build on German policymakers to introduce a significant fiscal stimulus.

We are now watching the key levels of 2.57, 2.63 (50-day), and 2.70 percent as the next hurdles for the 10-year to heal thyself. Stay tuned.

Pingback: Heads Up! Friday’s Rare S&P Shooting Star Candlestick | Global Macro Monitor

Pingback: Discipline Trumps Conviction | Global Macro Monitor