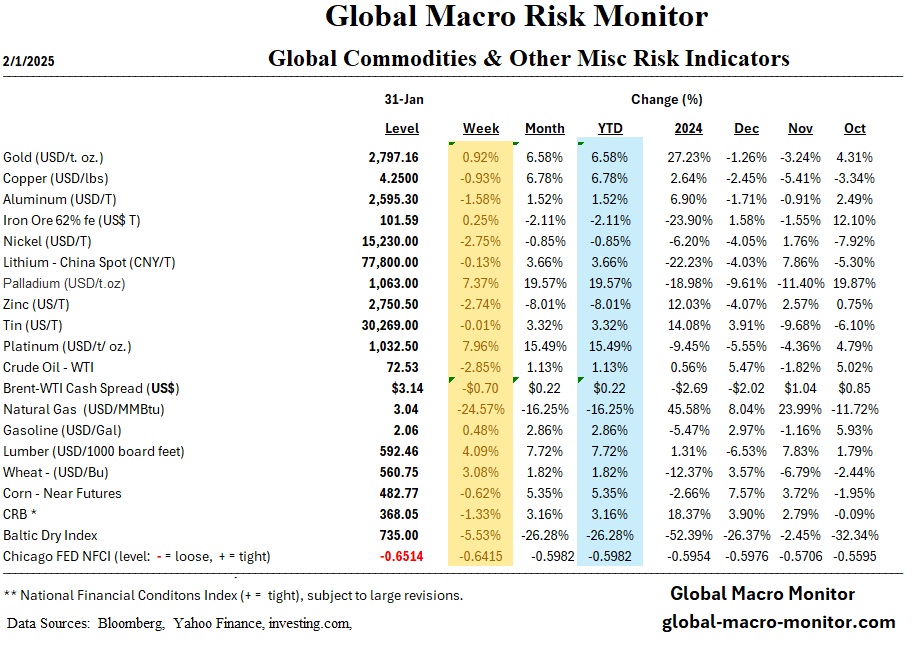

The financial markets are poised for heightened volatility following President Donald Trump’s decision to impose broad tariffs on Mexico, Canada, and China. The move, which includes a 25% tariff on imports from Mexico and Canada and a 10% tariff on energy imports from Canada and goods from China, has injected uncertainty into global trade relations. Investors now face two key risks: potential retaliation from U.S. trading partners and the impact on inflation, corporate earnings, and economic growth.

Markets typically react swiftly to major geopolitical and policy shifts before evaluating the long-term consequences. While some may view the tariffs as an aggressive opening stance in negotiations, markets tend to “shoot first and ask questions later.” The latest measures come at a time when global growth is already fragile—China’s economic data showed contraction across multiple sectors, and the eurozone reported stagnation in Q4 GDP.

Market and Economic Recap (Week Ending January 31, 2025)

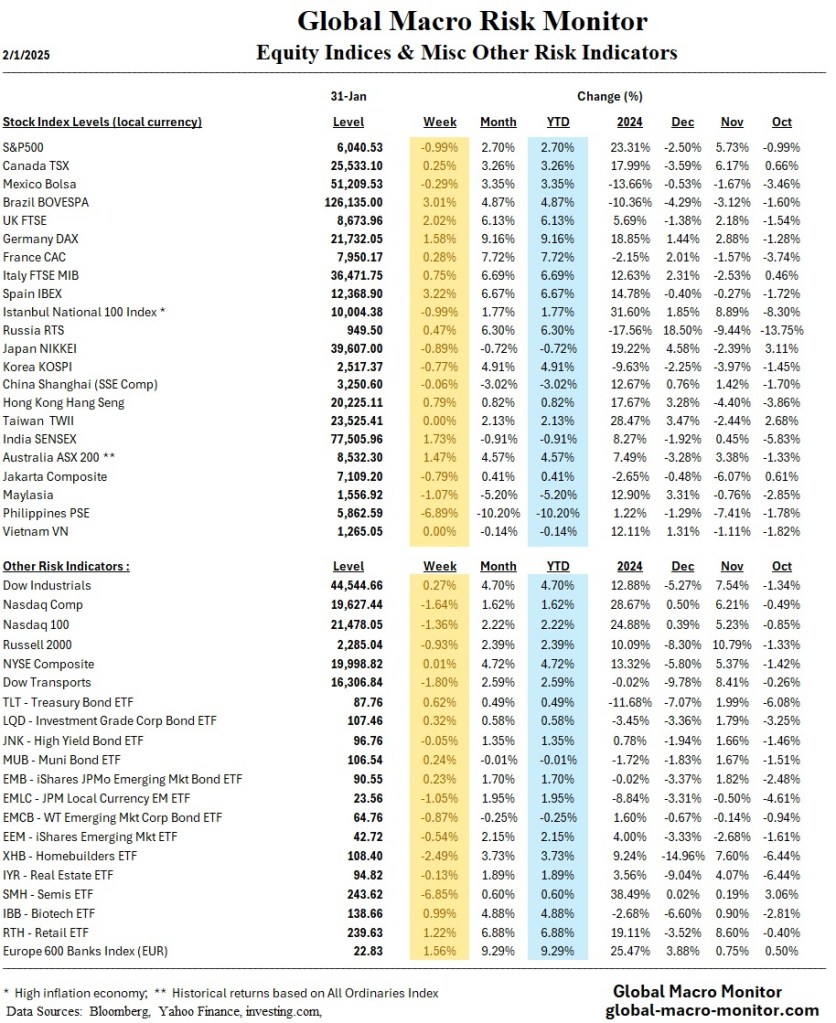

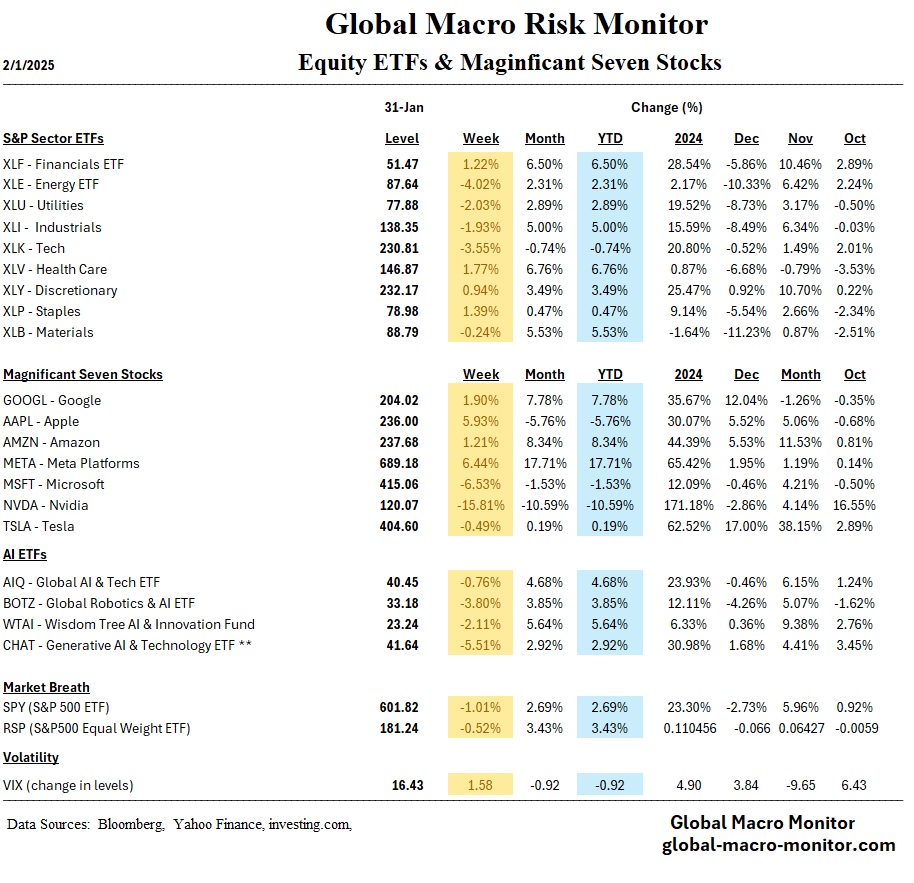

- Equity Markets: U.S. stocks were volatile, with the Dow Jones rising modestly for the third consecutive week (+120 points) while the S&P 500 (-60 points) and Nasdaq (-326 points) faced losses. Tech stocks were particularly hit after AI competition concerns from DeepSeek.

- Federal Reserve Policy: The Fed held rates steady at 4.25%-4.50%, signaling patience in policy adjustments. Core PCE inflation remained at 2.8% YoY.

- Economic Growth: U.S. GDP grew at 2.3% in Q4 and 2.8% for the full year, slightly below expectations but ahead of long-run forecasts.

- Fixed Income Markets: Treasury yields fell for most of the week but rebounded after the tariff announcement.

- Earnings Season: Roughly 40% of S&P 500 firms reported, with notable earnings beats from Meta and Apple, while Microsoft and Tesla provided mixed results.

- European Markets: The ECB cut rates by 25 basis points to 2.75% amid weak eurozone growth.

- China’s Economy: PMI data pointed to worsening conditions across manufacturing, services, and construction.

Market Outlook: Higher Volatility Ahead

The immediate concern is whether this tariff escalation will lead to retaliatory measures from Canada, Mexico, or China. If so, supply chain disruptions and inflationary pressures could prompt renewed Fed scrutiny. Investors should brace for increased volatility in equity and fixed income markets as the implications of Trump’s tariff strategy unfold.