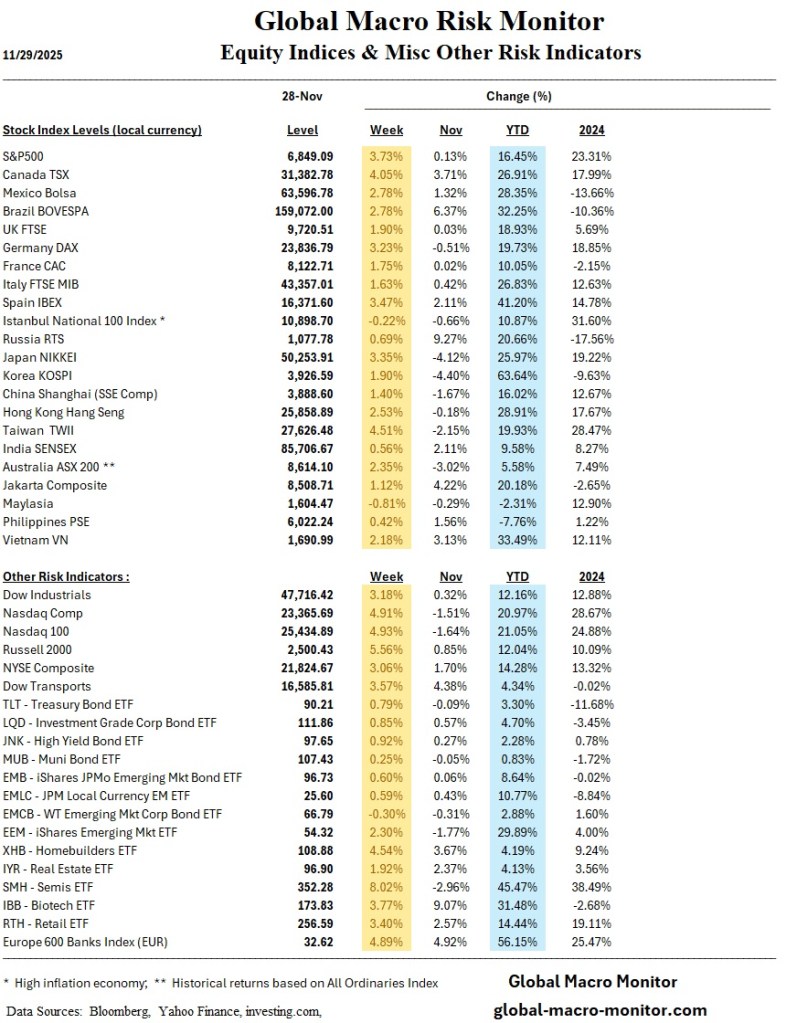

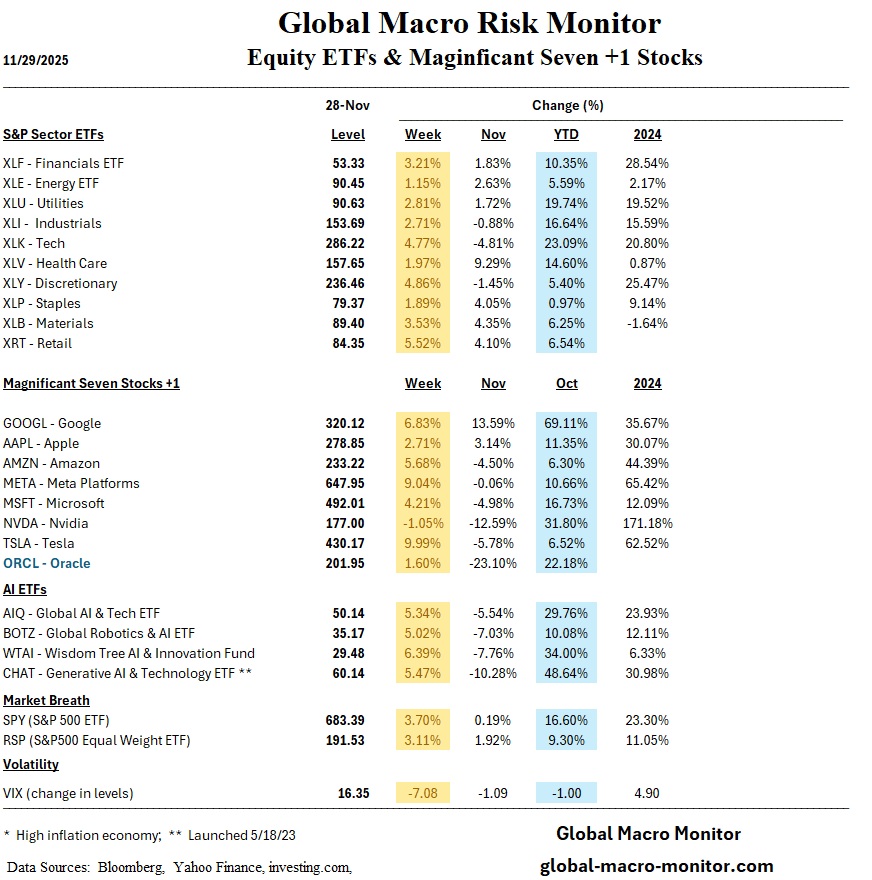

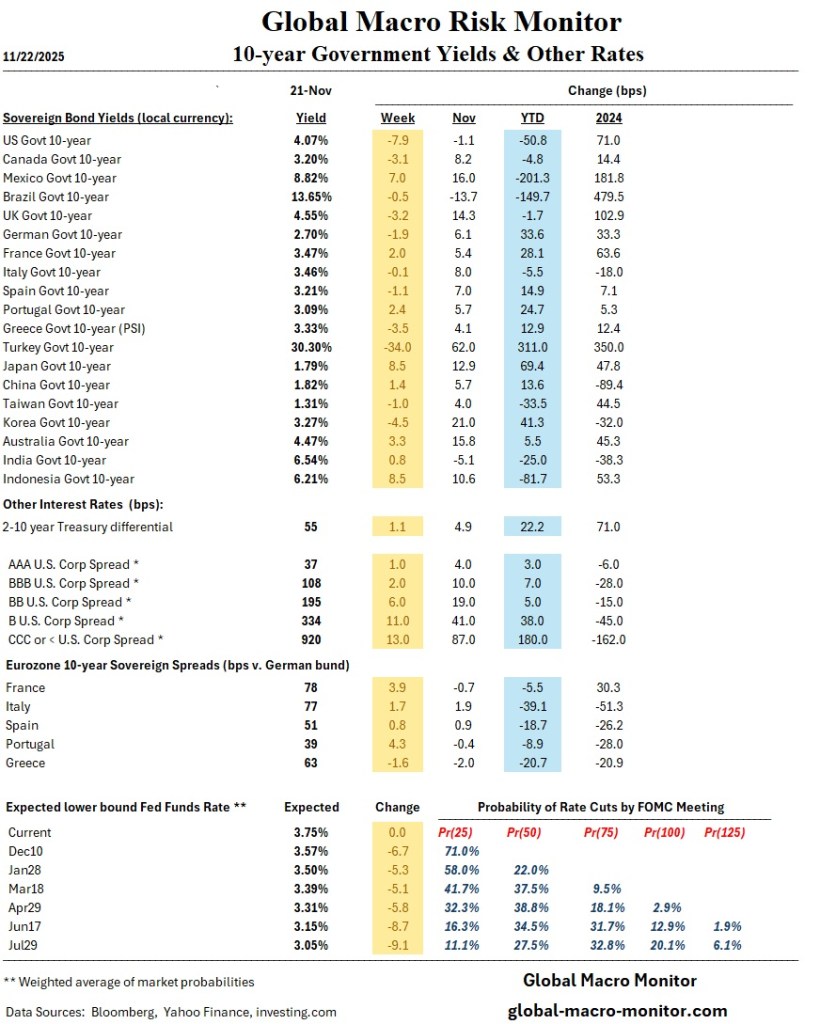

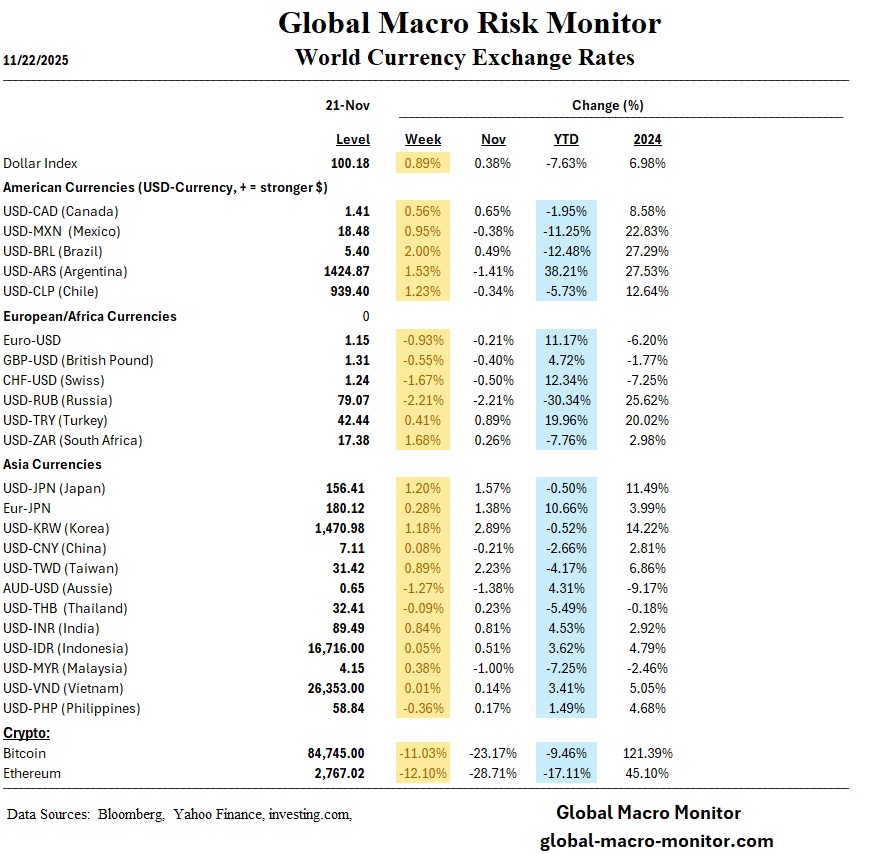

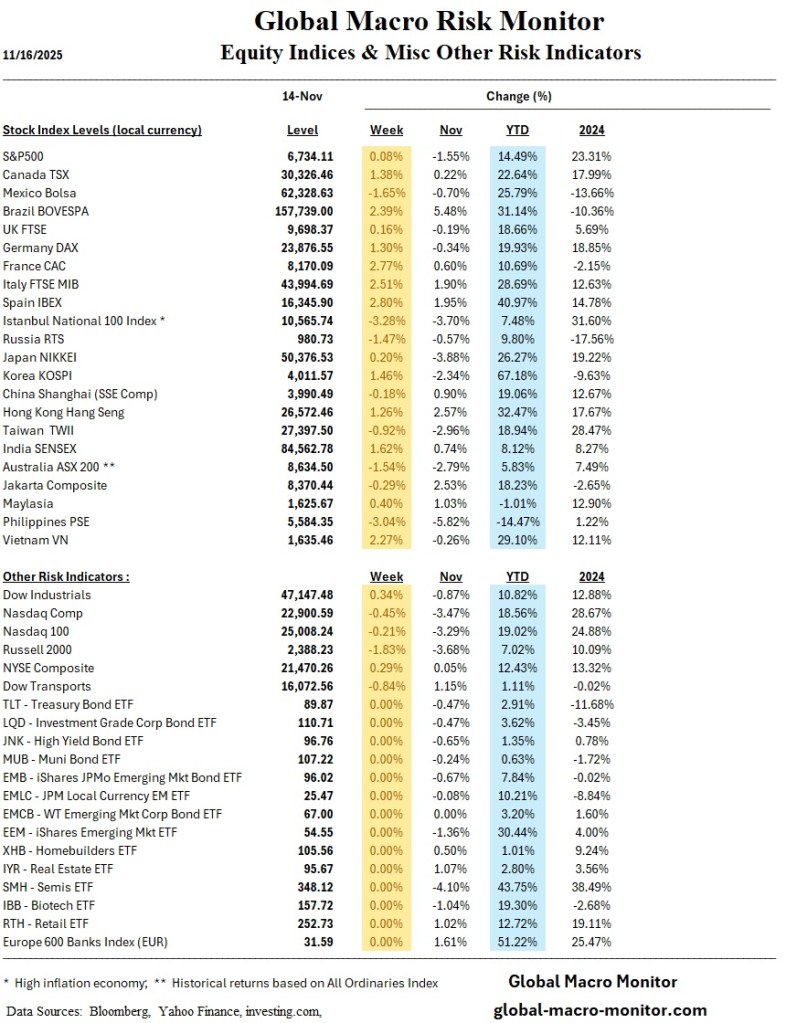

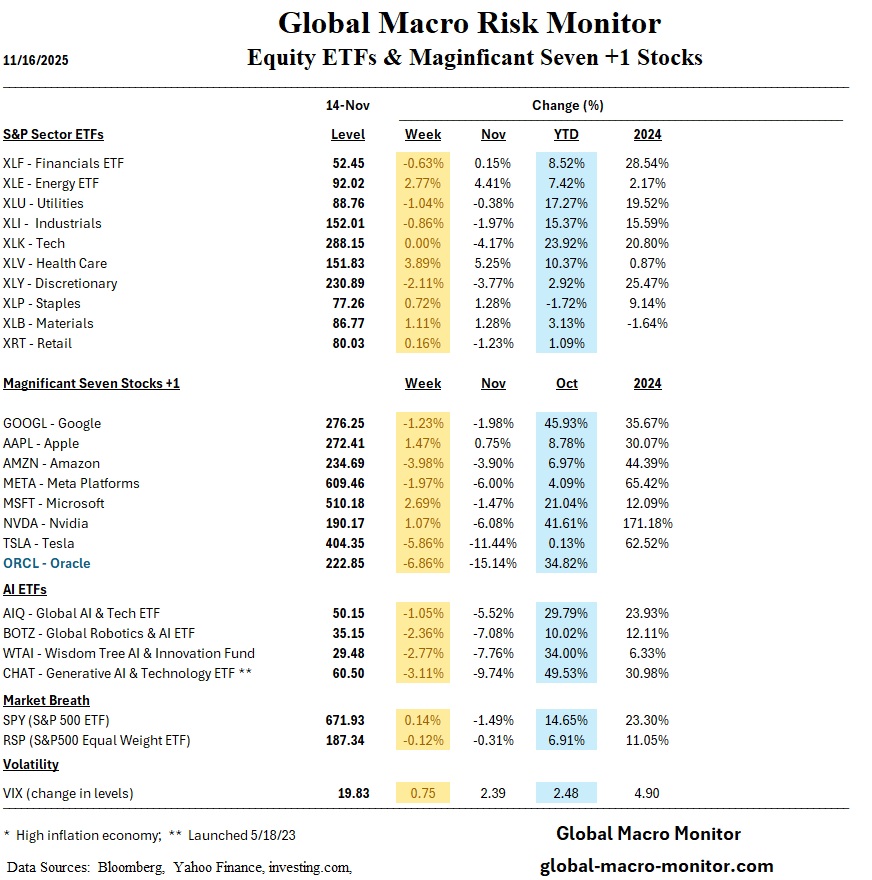

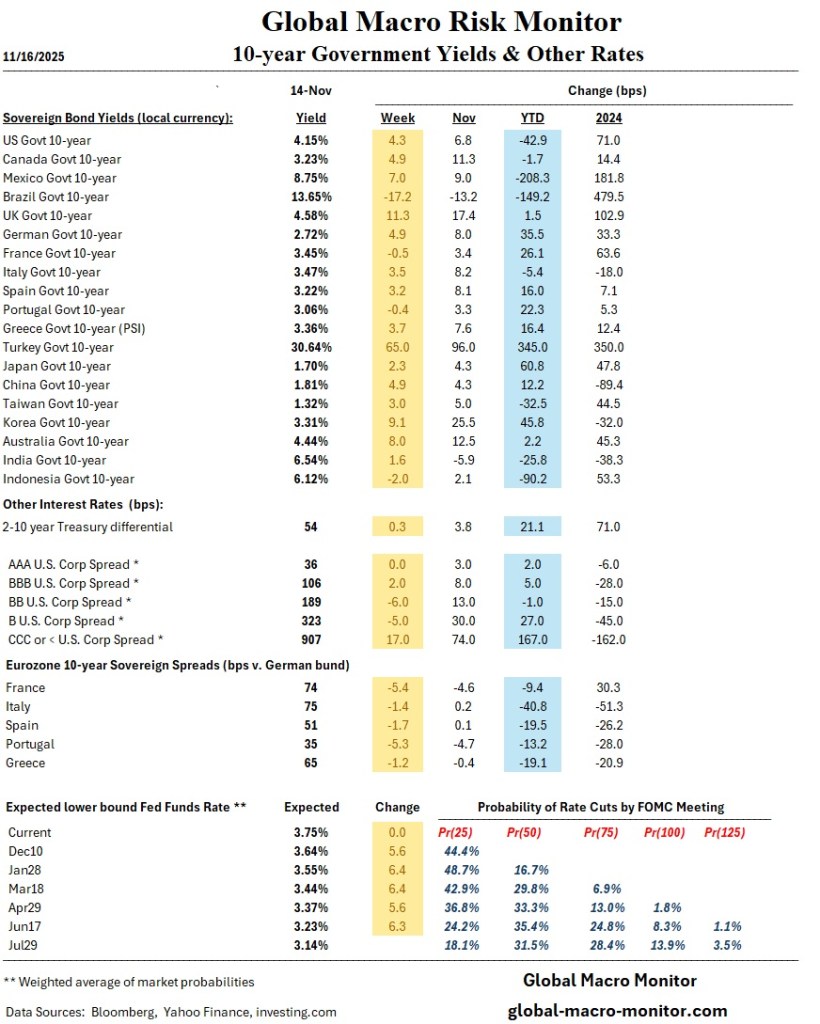

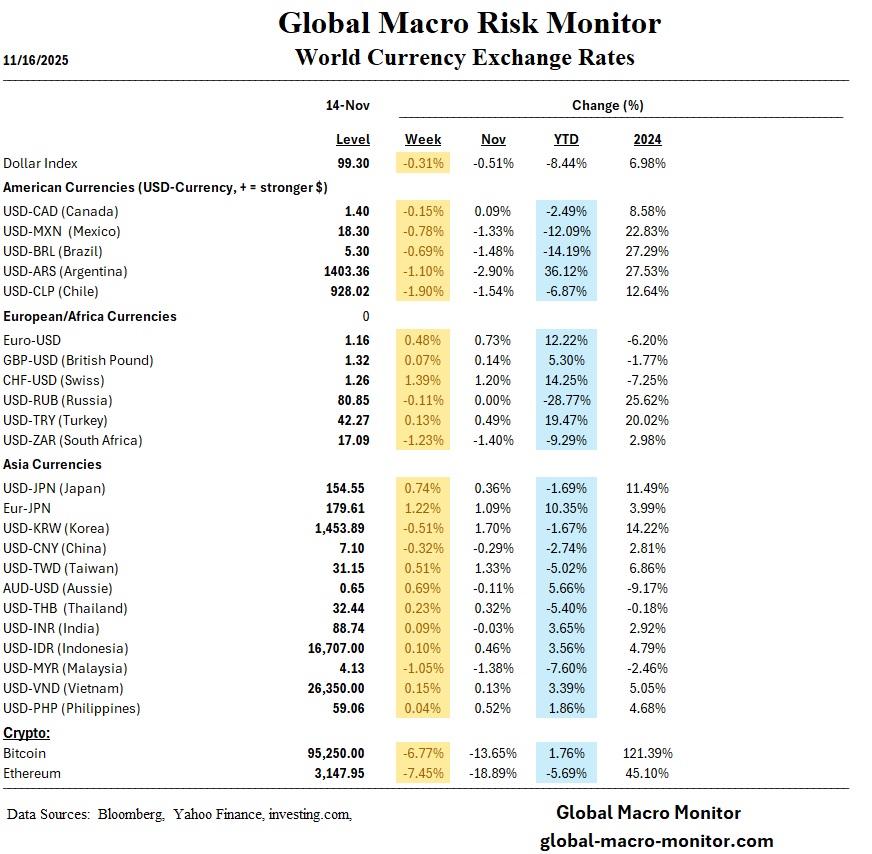

Global risk sentiment stayed constructive this week despite a sharp back-up in global bond yields and lingering growth concerns. Higher long-end yields across 19 bond markets—led by a 27 bp rise in Canada—coincide with markets pricing an 80–90% chance of a 25 bp Fed cut, but limited conviction on further easing into March. Equities ground higher in the U.S. and Europe, with transports, cyclicals, and small caps outperforming as investors rotate toward rate-sensitive and economically geared sectors.

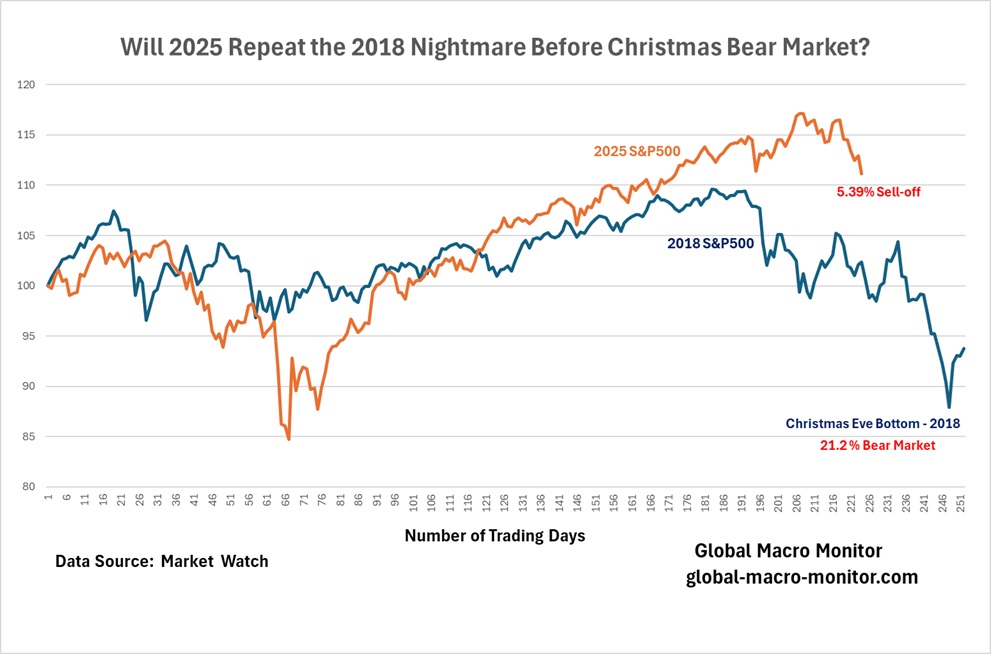

Data continue to paint a mixed global picture: U.S. manufacturing remains in contraction while services expand at the fastest pace in nine months; labor indicators are softening at the margin, but initial jobless claims sit at a three-year low. Eurozone inflation has ticked up slightly above 2%, reinforcing an ECB-on-hold stance, while Japan edges closer to BoJ rate normalization as JGB yields hit multi-year highs. China’s PMIs underline weak domestic demand, even as exports and tech/AI themes support local equities. Across EM, policy is drifting more dovish, with India and several Asian and EEMEA central banks cutting rates. Overall, valuations look increasingly stretched, leaving the rally vulnerable to rates, earnings, or policy surprises.

Regional Economic Insights

United States

-

Mixed labor data: ADP showed the largest job loss in two years while jobless claims hit multi-year lows.

-

Stock performance supported by weaker inflation (core PCE below expectations) and Fed-cut optimism.

-

Oil, yields, and gold moved in response to shifting expectations for next week’s FOMC call.

Eurozone

-

Market sentiment influenced by inflation divergence—CPI roughly aligned with expectations while PPI remains firm (from broader template structure).

Japan

-

JGB yields rising, interacting with U.S. yields and potentially altering risk sentiment next week.

China

-

No new macro updates in Week_Dec5; monitoring holiday-related demand trends (per document structure).

Inflation: CPI–PPI Dynamics

-

U.S. core PCE inflation cooled slightly in the latest release (0.1% below expectations), helping maintain the disinflation narrative.

-

Producer prices (PPI) due next Thursday are a potential catalyst for volatility.

Markets

Equities

-

Strongest sectors: consumer durables, transportation, and manufacturing.

-

Dow Transports had an outsized weekly gain, breaking into leadership territory and signaling cyclical momentum.

Bonds

-

Yields fell on weak ADP data but reversed higher on cooling inflation expectations and anticipation of the FOMC meeting.

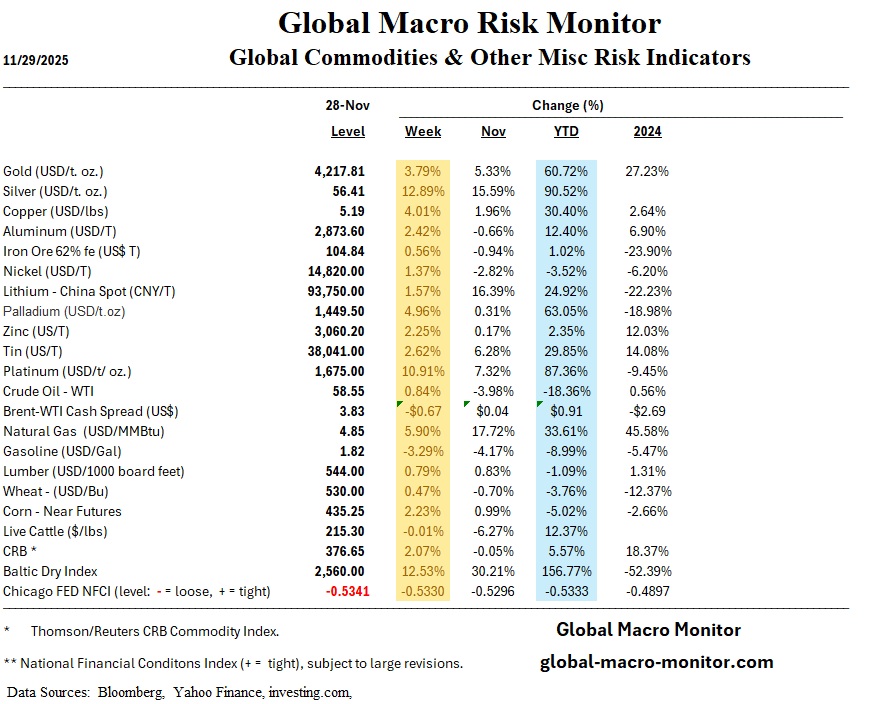

Energy, Metals & Crypto

-

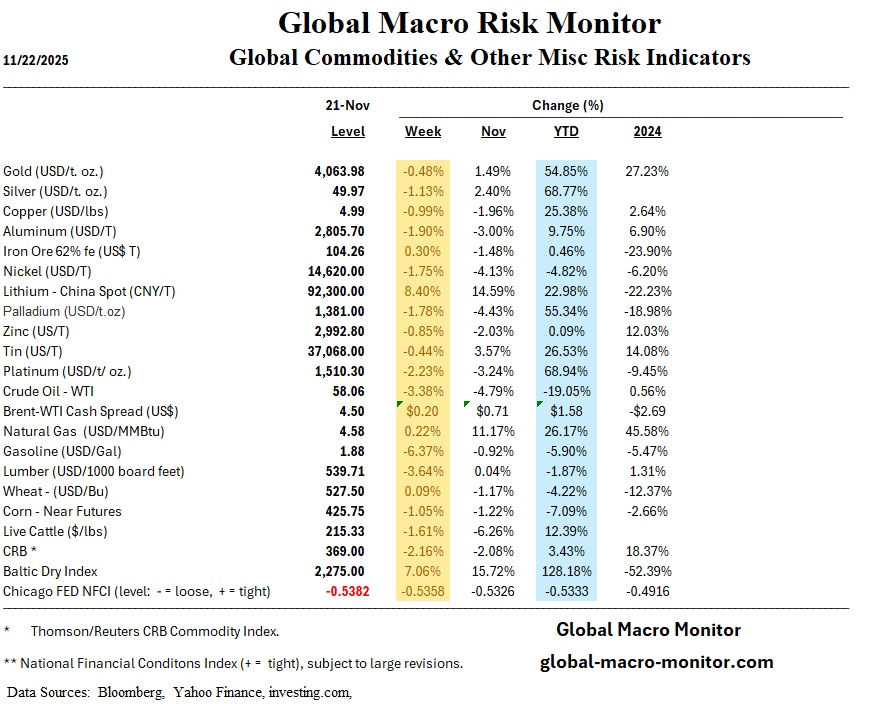

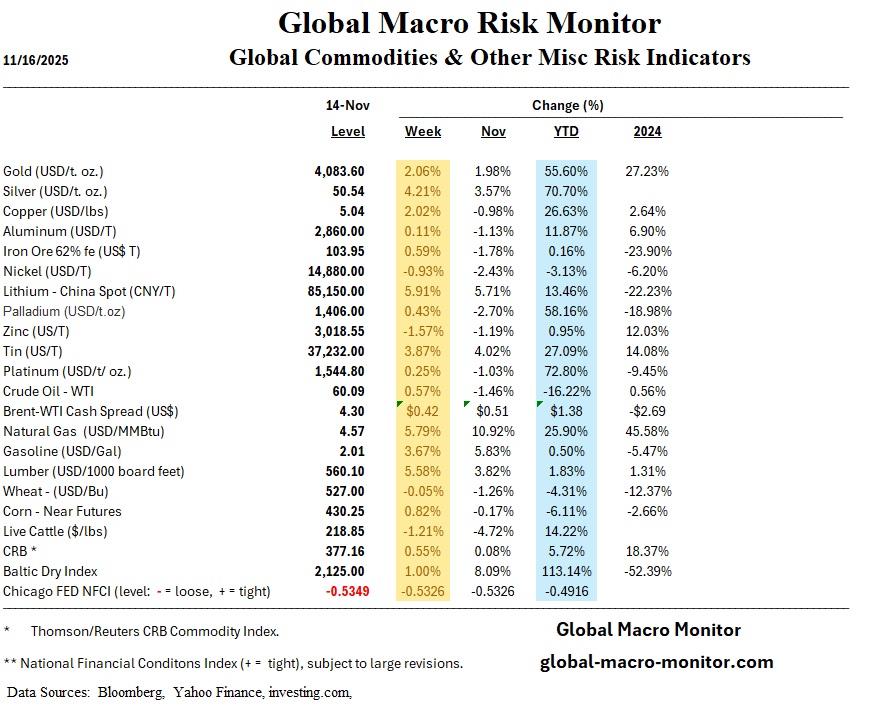

Oil: Rose mid-week on geopolitical tensions, then moderated on inventory builds.

-

Gold: Softened after the prior week’s 3.8% rally.

-

Crypto: Bitcoin and Ethereum whipsawed; ETH boosted temporarily by its Fusaka upgrade.

United States Outlook (Week Ahead)

Key releases include JOLTS, ECI, PPI, crude oil inventories, and the FOMC decision on Dec. 10.

Central Bank Actions

The FOMC is expected to cut rates by 25 bps, though committee dissents are likely; guidance suggests fewer cuts ahead.

Risks & Outlook

-

Volatility expected in the latter half of next week due to Fed messaging and Oracle earnings—a binary catalyst for AI-linked sentiment.

-

Rising JGB yields may pressure U.S. long rates and shift the market tone.