-

In economics, things take longer to happen than you think they will, and then they happen faster than you thought they could.

-

Join 1,220 other subscribers

Contribute To GMM

Categories

- 3D Printing

- Agriculture

- AI

- Algos

- Apple

- Automation

- Banking

- BFTP

- Bitcoin

- Black Swan Watch

- Bonds

- Brazil

- Brexit

- BRICs

- Budget Deficit

- Capital Flows

- Cartoon of the Day

- Cashless Society

- Chart of the Day

- Charts

- China

- Clean Tech

- Climate Change

- Coach C

- Commodities

- Coronavirus

- COVID

- Credit

- Crude Oil

- Currency

- Cyprus

- Daily Risk Monitor

- Day In History

- Debt

- Demographics

- Disinflaton

- Dollar

- Earnings

- ECB

- Economics

- Economist

- Egypt

- Electric Vehicles

- Emerging Markets

- Employment

- Energy

- Environment

- Equities

- Equity

- Euro

- Eurozone Sovereign Spreads

- Exchange Rates

- Fed

- Finance and the Good Society

- FinTech

- Fiscal Cliff Monitor

- Fiscal Policy

- Food Prices

- France

- Futurist

- Game Theory

- General Interest

- Geopolitical

- Geopolitics

- German Bund

- Germany

- Global Macro Watch

- Global Reset

- Global Risk Monitor

- Global Stock Performance

- Global Trend Indicators

- Gold

- Greece

- Healthcare

- Heat Map

- Hedge Funds

- Housing

- Human Interest

- Immigration

- Impeachment

- India

- Inequality

- Inflation/Deflation

- Infographics

- Innovation

- Institutional Investors

- Interest Rate Monitor

- Interest Rates

- Interviews

- Italian Yields

- Italy

- Japan

- Jobs

- Lectures

- Macro Notes from Conference Calls

- Manufacturing

- Masters

- Mexico

- Monetary Policy

- Movies

- Muni Bonds

- Muni Market

- Natural Gas

- News

- Nonlinear Thinking

- North Korea

- Overbought Markets

- Picture of the Day

- PIIGS

- PMIs

- Policy

- Politics

- Population

- Populism

- Poverty

- President Trump

- Qunat Strategies

- Quote of the Day

- Quotes

- Rare Earth Elements

- Readership

- Reads

- Real Estate

- Relative Strength Index

- Robert Shiller

- RSIs

- S&P500

- Sector ETF Peformance

- Semiconductor prices

- Semiconductors

- Social Media

- Socialism

- Song for the Week

- Sovereign Debt

- Sovereign Risk

- Spain

- Sports

- State and Local Government

- Tail Risk

- Technical Analysis

- Technology

- The Big Reset

- The Weekend Read

- This Day In Financial History

- Trade War

- Trades

- Tweet of the Day

- Ugly Chart Contest

- Uncategorized

- US Releases

- Video

- Volatility

- Wages

- Week Ahead

- Week in Review

- Weekend Reads

- Weekly Eurozone Watch

- Whales

-

Recent Posts

Meta

Global PMI: Growth at 17-month Low

Key Takeaways:

-

Global economic growth slowed in April 2025, with the Composite PMI falling to 50.8—its lowest in 17 months and below the long-term average.

-

Service sector expansion weakened significantly, while manufacturing remained tepid with only slight growth in consumer and intermediate goods.

-

Major economies like the US, China, and the euro area lost momentum, though India stood out as the only bright spot with accelerating growth.

-

New business and export orders softened, with exports contracting at the sharpest pace since December 2022.

-

Business sentiment hit a near five-year low, and global employment was flat as services hiring offset manufacturing job cuts.

Global economic output expanded at its slowest pace in 17 months, highlighting growing signs of fatigue in the world economy. The J.P. Morgan Global Composite PMI® Output Index fell to 50.8 from 52.0 in March, marking its eleventh consecutive month below the long-run average of 53.2. This deceleration was driven mainly by weaker service sector growth and persistently weak manufacturing performance, with particularly noticeable slowdowns in the United States, China, and the euro area.

The service sector, despite posting its 28th consecutive month of expansion, saw growth slow to one of the weakest points in its current cycle. Business and consumer services both experienced diminished momentum, while financial services was the lone sub-sector to record a slight acceleration. Meanwhile, manufacturing output saw only modest gains. Production in consumer and intermediate goods rose, but investment goods merely stabilized following a contraction in March.

Regionally, the economic deceleration was broad-based. The US, China, the euro area, and Australia experienced a loss of momentum. The UK and Brazil fell back into contraction territory, and Canada registered a deeper downturn. Conversely, India remained a standout performer, with robust and slightly accelerating growth.

New business volumes also showed signs of fragility. Although total new orders rose for the 18th straight month, the pace was the second-slowest in that sequence. Service sector new business growth was the weakest since November 2023, and manufacturing new orders contracted slightly—the first decline in four months. Export demand was particularly weak: after a brief uptick in March, new export orders fell sharply in April, posting the steepest decline since December 2022, affecting both manufacturing and services.

Business sentiment suffered due to increasing economic uncertainty and trade instability. Confidence hit a near five-year low, with pessimism rising in major economies including the US, euro area, China, Japan, and India. Only France and Canada showed improved outlooks.

Employment levels remained static in April. Job gains in the services sector, especially in business services and consumer-related categories, offset manufacturing job losses. Input costs continued to rise, extending an almost five-year inflationary trend. However, cost inflation eased to a three-month low and aligned with long-run averages. Businesses continued to pass some of these higher costs to customers through increased output prices.

Summers on Trump, Tariffs, and Threats to the Economy

This is a long interview, but an excellent one. It’s worth your time.

Posted in Uncategorized

Leave a comment

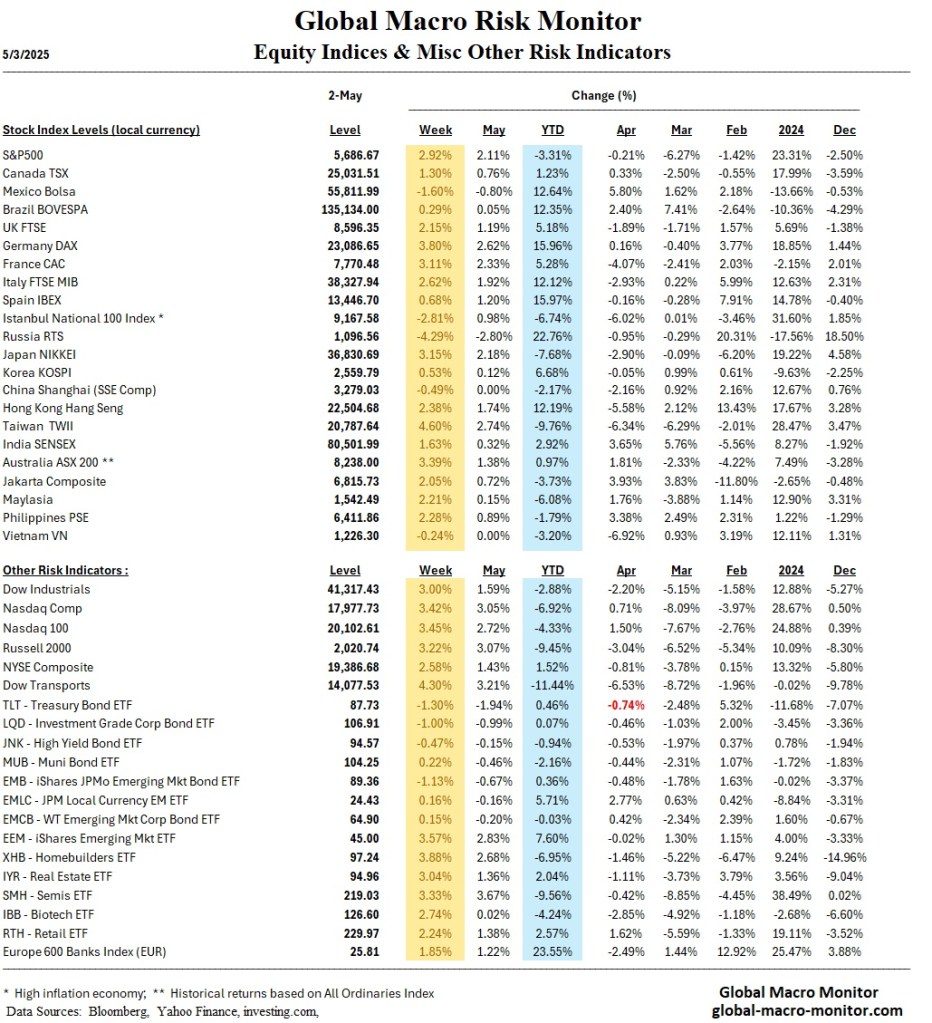

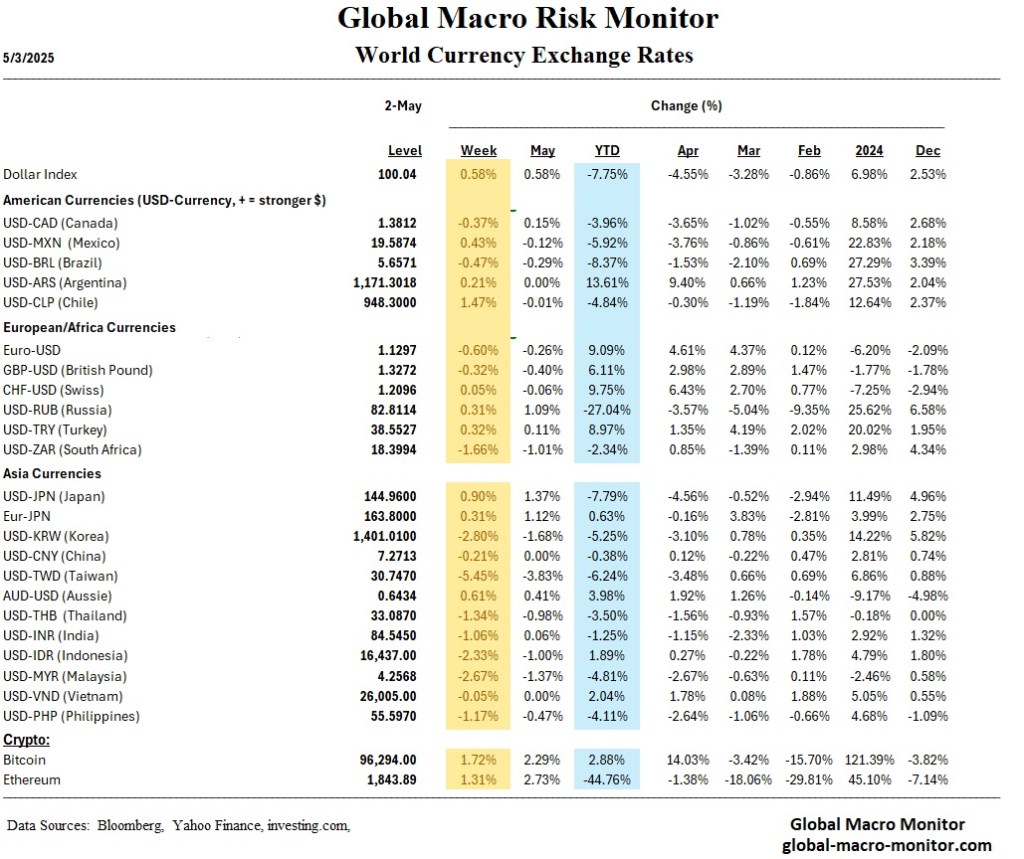

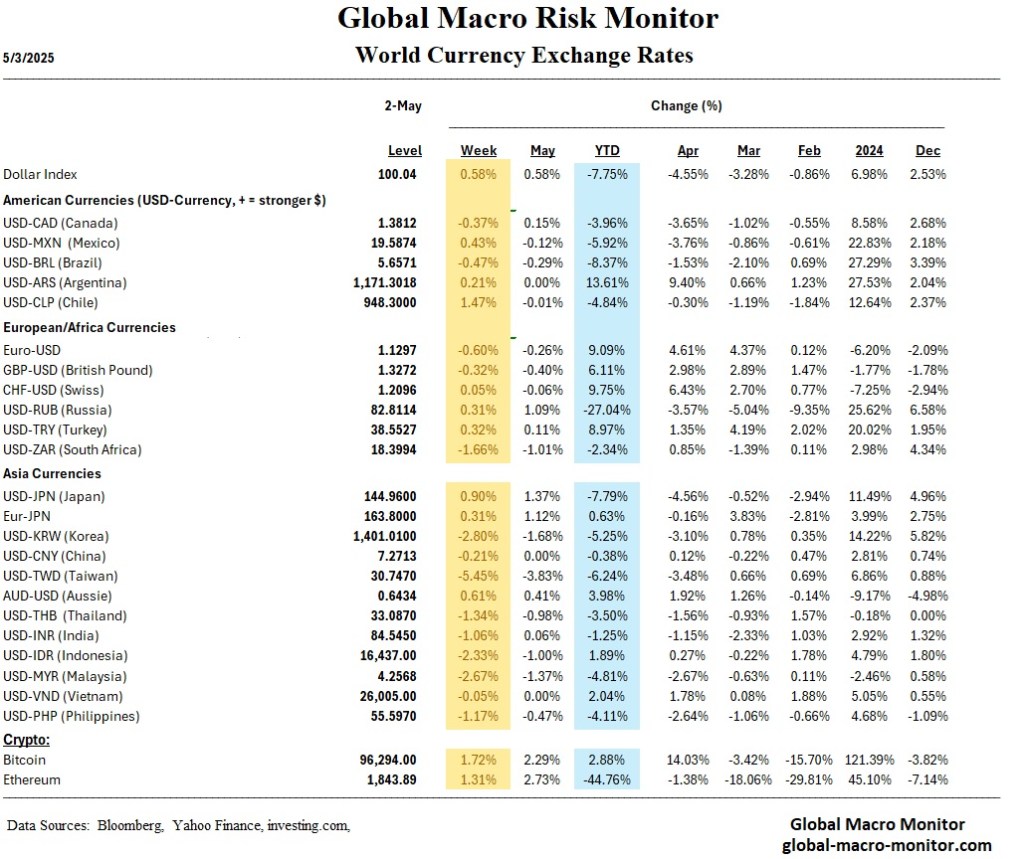

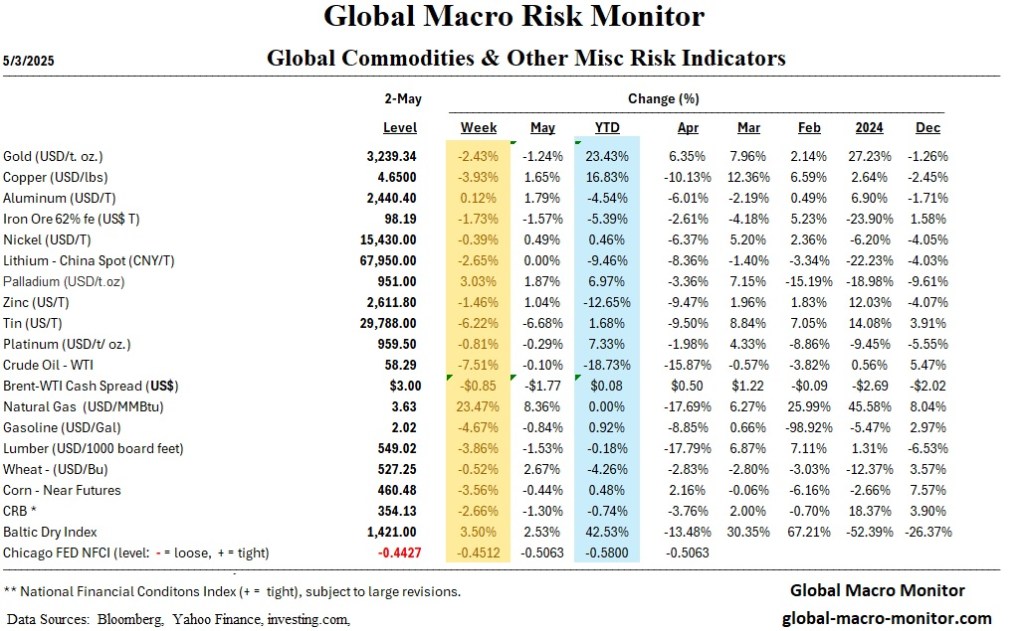

Global Risk Monitor: Weekly Update – May 2

This week, global equities extended their recovery, buoyed by rising optimism over potential U.S.–China trade negotiations. Though no formal talks or trade agreements have been signed and most tariffs remain in place—including broad-based global levies—markets responded positively to U.S. administration signals suggesting some trade deals may be near (recall “Infrastructure Week” during Trump 1.0). This has helped drive the S&P 500 to its ninth consecutive gain, approaching a key technical level at 5747.66, its 200-day moving average.

Investor sentiment has shifted, despite contradictory macroeconomic data. April’s U.S. payrolls report exceeded expectations with 177,000 new jobs, indicating labor market resilience. Meanwhile, Q1 GDP contracted 0.3%, driven primarily by an import surge ahead of expected tariffs. The contraction masked the underlying strength in consumption and business investment, which is probably distorted by the tariffs, pointing to front-loaded demand rather than structural strength.

Dazed and Confused

This divergence is creating confusion among economists. The rally appears disconnected from fundamentals, yet persists amid AI enthusiasm, solid tech earnings x/ Apple, and easing energy prices. Historically, markets revert to hopium and to a bullish default mode. Data from our “S&P500 Significant Digits” table supports this: since 1950, the S&P 500 has posted gains 72.46% of the time on an annual basis, with an average return of 8.71% and a standard deviation of 16.20%. On a monthly basis, the S&P500 is up 60% of the time.

Market breadth has improved, led by mega-cap tech, small-caps, and renewed strength in the AI sector. However, as noted in multiple reports, the post-tariff economic environment lacks historical analogs, similar to how language models operate without pattern certainty. Without a clear forward path, investors are defaulting to the historical mean—bullish.

Global Markets

Globally, Eurozone Q1 GDP surprised to the upside, but inflation remains sticky. UK sentiment and housing have softened. Japan’s BoJ held rates steady and pushed back policy tightening, citing trade uncertainty. Chinese PMIs deteriorated, yet signals of trade thaw, including selective tariff exemptions, have supported regional equities.

Upshot

In sum, the market rally reflects forward-looking optimism rooted more in narrative than in data. The next test lies at the 5747.66 mark—whether momentum can overcome macro headwinds remains uncertain. The 200-day is just a chip shot away. Until then, markets appear to be pricing in the best-case scenario, which, in our opinion, will not be the best case as the Administration appears not to know what it wants: 1) Reshoring of manufacturing? 2) The tariff revenue? Or 3) Lower tariffs for American exports and freer trade? The macro market is choosing #3, but we believe Trump wants #1; both are mutually exclusive.

We believe empty shelves are just a few weeks away.

Stay frosty, folks.

Markets

- U.S. equities extended their recovery: S&P 500 posted a ninth consecutive gain, supported by strong earnings and easing trade fears.

- S&P 500 approaching 5747.66, its 200-day moving average, a key technical resistance level.

- Market breadth improved, with gains across large-cap tech and small/mid-cap stocks.

- Investor sentiment is buoyed by optimism over potential U.S.–China trade negotiations, though no agreement has been finalized.

U.S. Market Analysis

- Strong labor data: April nonfarm payrolls rose by 177,000, exceeding expectations; unemployment steady at 4.2%.

- Q1 GDP contracted –0.3%, mainly due to a surge in imports ahead of tariff implementation.

- Markets interpreted the negative GDP print as temporary and driven by front-loaded demand.

- AI and tech stocks led gains; mega-cap earnings (e.g., Microsoft, Meta) surprised to the upside.

- Treasury yields rose late in the week, reacting to jobs data; credit markets stable with narrowing spreads.

Global Market Analysis

- Europe: STOXX 600 +3.44% as trade tension eased; Germany +4.63%, France +3.57%, Italy +4.13%.

- Eurozone GDP beat expectations in Q1 at +0.4%; inflation remained elevated at 2.2% headline, 2.7% core.

- Japan: Nikkei +3.15%, TOPIX +2.27%. BoJ held rates steady and downgraded growth and inflation forecasts.

- Yen weakened modestly; 10Y JGB yield fell to 1.26%.

- China: Mainland indexes down slightly; Hang Seng +2.38%. Manufacturing PMI fell to 49.0—deepest contraction since Dec. 2023.

- Beijing hinted at a willingness to resume trade talks with the U.S.; partial tariff exemptions granted on select U.S. goods.

Economics

U.S. Economic Overview

- Labor market resilient, though early-week data (ADP, JOLTS) showed signs of softening.

- Consumer spending rose 0.7% in March; PCE inflation flat, offering comfort to the Fed.

- Market anticipates the Fed will hold rates steady in May; futures pricing of June cut has declined.

- Surging imports dragged GDP but suggested stronger-than-expected demand fundamentals.

Global Economic Overview

- Eurozone confidence indicators weakening, pointing to potential softness ahead despite Q1 strength.

- BoJ cautious amid trade uncertainty; inflation forecasts lowered, rate hike now likely delayed.

- UK housing cooled; mortgage approvals and business sentiment fell. BoE rate cut expectations rising.

- EM Asia shows divergence: India progressing in U.S. trade talks; China still assessing path forward.

Week Ahead (May 5–9)

Key U.S. Events:

Economic Data

- Mon: ISM Services

- Tue: Trade Balance

- Wed: FOMC Rate Decision, Consumer Credit

- Thu: Jobless Claims, Productivity, Unit Labor Costs

- Fri: No major reports

Earnings Highlights

- Mon: Palantir, Tyson Foods

- Tue: AMD, Arista, Marriott, EA

- Wed: Disney, Uber, Shopify, DoorDash

- Thu: Coinbase, ConocoPhillips

- Fri: Enbridge, Sun Life

Key Global Events:

- Japan CPI: Trade-sensitive inflation indicator due Friday

- Eurozone PMIs: Key growth/inflation gauge out Wednesday

- Tariff headlines: Continued trade talks remain the primary wildcard for risk sentiment

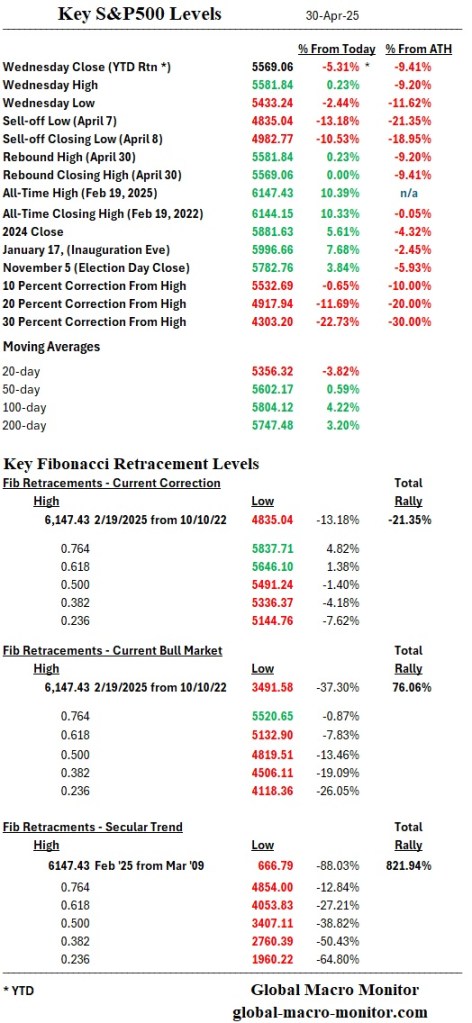

S&P 500 Key Levels – April 30

Equity markets extended their rebound today, bouncing smartly from a sharp early morning sell-off. The S&P 500 closed at its highest level since the recent correction, marking a notable shift in sentiment. Based on where futures are trading this evening, the index appears poised to open above its 50-day moving average (currently at 5602.17), a level closely watched by systematic and momentum-driven strategies. A decisive move above this threshold could trigger mechanical buying and attract further technical inflows.

The next resistance lies at the 0.618 Fibonacci retracement level (5646.19), a technically significant marker often associated with sentiment inflection points. Given the still-uncertain macroeconomic backdrop, reclaiming that level would be notable—if not perplexing.

The market continues to play chicken with the economic data, refusing to turn bearish until it sees the whites of recessionary eyes. Despite mixed macro signals, investors are holding their ground, unwilling to price in a downturn without clear, negative confirmation. So far, the data hasn’t delivered a decisive blow. Meanwhile, tonight’s strong prints from Meta and Microsoft underscore that the AI-driven growth narrative remains intact, providing just enough fuel to keep risk appetite alive, particularly in the mega-cap tech space.

Posted in Uncategorized

1 Comment

Tariffing Santa Claus?

Struggling families may find they can’t afford presents this Christmas — or worse, they may face empty shelves altogether — thanks to Trump’s tariff policies.

And really, what’s the point? It’s hard to imagine a sudden surge of American elves lining up to work in toy factories — unless perhaps it’s immigrants, who are being shown the door anyway.

But never mind. The tariff revenue from imported toys will no doubt help finance another round of Ebenezer-sized tax cuts.

This holiday season’s best pairs trade? Short Santa Claus/Long Ebenezer Scrooge…And weep for our children

Note: As of the first seven months of last year, mainland China still made 79% of toys sold in the United States and Europe, versus 82% in 2019.

This will be a huge political loser for Trump and we wouldn’t be surprised to soon see exemptions for the toy industry. Stealing kids toys for tax cuts? We don’t think so.

Posted in Uncategorized

3 Comments

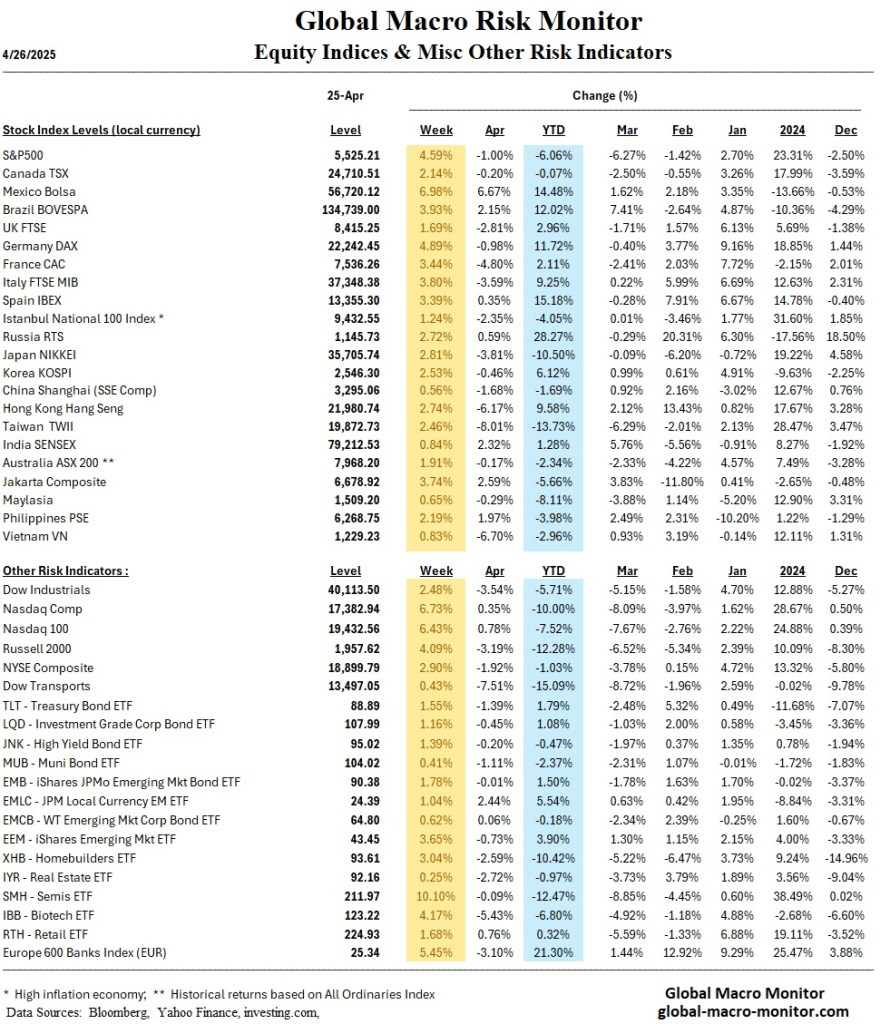

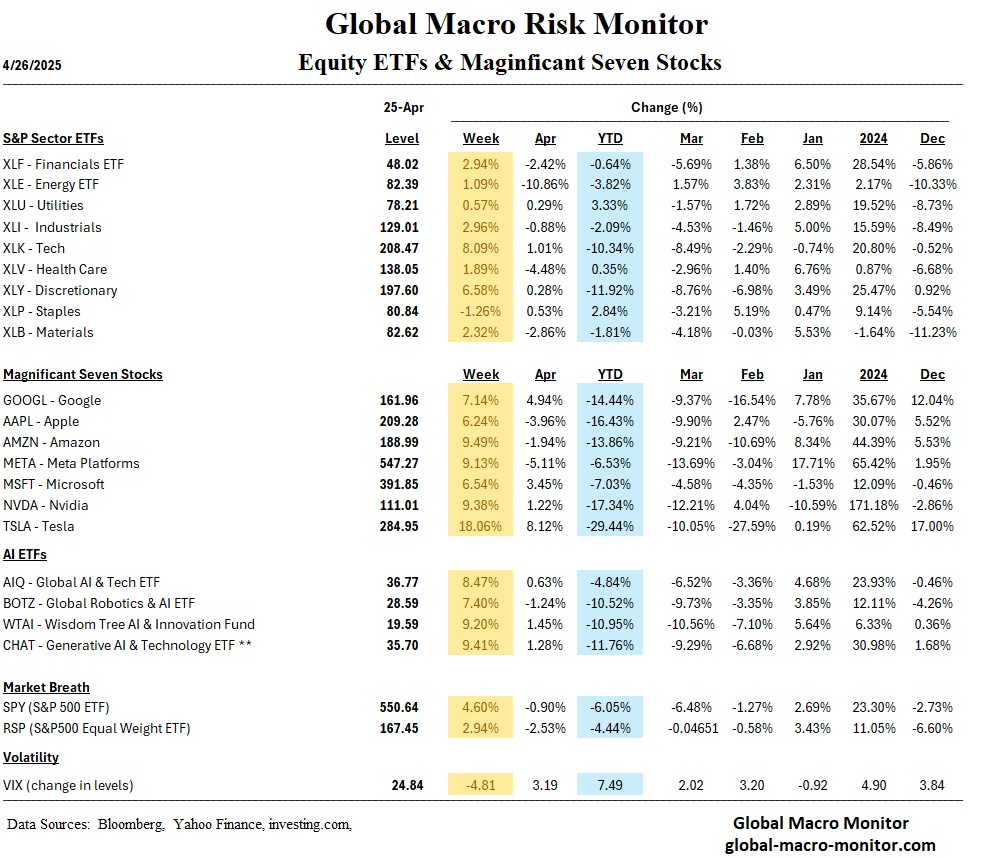

Global Risk Monitor: Weekly Update – April 25

Global markets staged an impressive rebound this week, fueled by growing optimism that trade tensions between the United States and China may soon ease and that some bilateral trade deals are imminent. Investors eagerly latched onto comments from U.S. Treasury Secretary Scott Bessent and President Trump suggesting that tariff levels were unsustainable and that some dialogue, formal or informal, might be underway. This generated a powerful relief rally, with the S&P 500 and Nasdaq surging approximately 4.6 percent and 6.7 percent, respectively. However, despite the ebullient market response, no formal negotiations or agreements have been reached, and the underlying political dynamics remain deeply adversarial.

Hope v Reality

The reality is that while hopes of de-escalation buoy markets, the U.S.-China standoff is mired in political ego. President Trump appears reluctant to make the first move toward a deal, wary of appearing weak ahead of the 2026 elections. Conversely, President Xi Jinping, emboldened by China’s relative economic stabilization and newly announced stimulus plans, is taking a patient, strategic approach. With no official meetings scheduled, the current atmosphere reflects more wishful thinking than tangible progress.

Therein lies the core risk: investors may be underestimating the political barriers to resolution. Trump’s current position is precarious. Without a trade breakthrough, the U.S. could soon face visible consequences—empty store shelves, rising consumer prices, and a dent in consumer confidence—as tariff impacts cascade through supply chains beginning next month. If economic pain intensifies, Trump may be forced into a humiliating climbdown to avoid severe electoral damage.

Bulls Back In Charge

Nevertheless, the S&P500 bulls captured a key level on Friday, the .5 Fibonacci retracement at 5491, putting the bulls in charge for now. Shorts are foolish to fight this market, especially knowing it is very likely that some large traders/investors have access to material non-public information and are trading on it, which is an absolute f$%king disgrace.

Watch Your Time Horizons

We believe that medium to long-term optimism may be mispriced. There is a prevailing belief that resolving trade tensions would automatically unlock a fresh wave of global growth. Yet this is misleading. Even if tariffs were significantly reduced from current levels, the global economy will still face the structural headwind that tariffs will be much higher than they were at the beginning of the year, reducing world trade and therefore global growth.

Imagine, for example, if Macy’s doubled its prices, then announced a 25% off weekend sale. Are customers really better off than before the price hikes? Of course not. Yet that’s exactly how the market seems to be reacting to the latest headlines. Sure, 25% off sounds better than a 100% increase—but seriously, Mr. Market? Tariffs will remain much higher than they were before this entire mess began.

Moreover, the uncertainty generated by the tariff wars has already inflicted lasting damage on investment confidence. The idea that a quick deal would fully reverse these scars is naïve.

A Zero Tariff Deal?

One significant development this week was the soft proposal, or more like an idea thrown out by German Finance Minister Jörg Kukies, for a comprehensive zero-tariff agreement between the U.S. and Europe. Kukies eloquently argued, “The easiest way to ensure balance and fairness is for everyone to go to zero. Then we have free trade, efficiency, and economies of scale. We can think about standardization, mutual market access, and many other things”.

From a pure economic perspective, this is sound logic. True free trade would enhance productivity, lower costs, and strengthen growth on both sides of the Atlantic.

However, President Trump does not align with free trade orthodoxy. His administration’s goal is not greater global economic efficiency; it is to reshore manufacturing and generate tariff revenues to finance prior tax cuts. These objectives fundamentally conflict with a zero-tariff deal. Accepting such an agreement would dismantle the entire strategic rationale, if there is one at all, behind the tariff regime. Thus, despite Germany’s overtures, it is highly unlikely that Trump would agree to zero tariffs—unless political and economic pressures render his position untenable.

Looking ahead, while the recent rally in equities has been impressive, there are clear limits to upside potential unless there is a definitive resolution on trade. The markets are functioning on hope rather than substance. Earnings risks are rising, though Q1 is shaping up to be better than expected, economic indicators are softening, and monetary policymakers, including the Fed and ECB, are increasingly hamstrung by uncertainty.

If trade tensions linger—and especially if tariffs continue to feed into inflation and constrain growth—the global economy could be pushed into a downturn in the coming quarters. The durability of the current market rally is, therefore, suspect. As real economic impacts begin to materialize, the cheerful narrative driving markets today may give way to renewed volatility and risk aversion.

Summary

While the past week brought a welcome reprieve to markets and may continue, the fundamental dynamics have not changed. The U.S.-China standoff remains unresolved, driven as much by political pride as economic strategy. The German proposal for a zero-tariff regime, while admirable, is almost certainly dead on arrival in Washington. Thus, caution remains warranted. Investors should not be lulled into complacency by superficial signs of progress; instead, they must prepare for the possibility that the real economic fallout of tariff escalation is only just beginning.

Markets

U.S. Market Analysis

Markets Rebound Sharply:

U.S. equities posted their strongest week since late 2023, buoyed by optimism over potential de-escalation in U.S.-China trade tensions. The S&P 500 rose 4.6%, the Nasdaq surged 6.7%, and the Dow gained 2.5%.

Small-Caps Lead Gains:

The Russell 2000 rose 4.1%, outpacing large caps for the second consecutive week, helped by strong tech earnings and expectations of a more dovish Fed.

Market Breadth Improves:

Participation broadened across sectors. The percentage of S&P 500 stocks above their 200-day moving average rose to 34.2%, up from 29.4%.

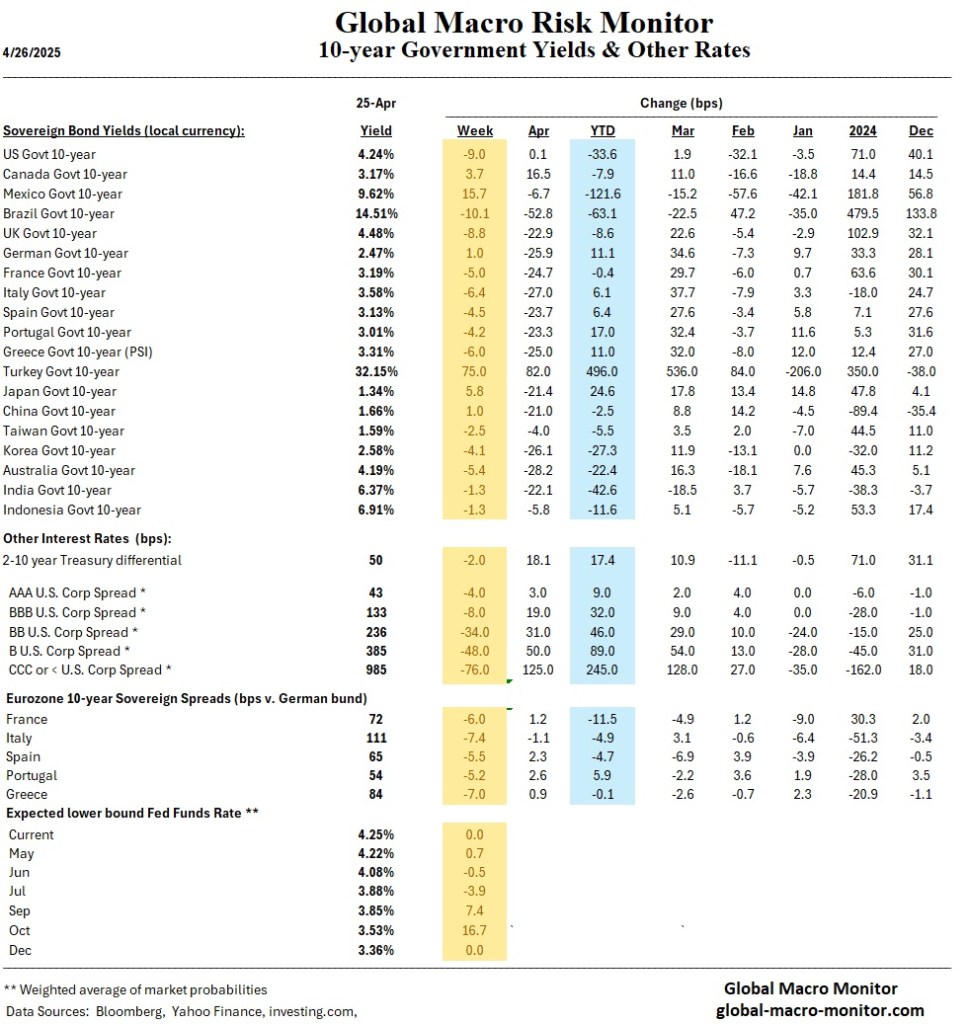

Bond Yields Ease:

10-year Treasury yields fell 8 bps to 4.24% as safe-haven demand moderated and growth concerns lingered.

Bitcoin Rally Continues:

Bitcoin surged over 11%, rebounding toward the $100K mark, supported by optimism around broader risk appetite.

Credit Spreads Tighten:

Investment-grade credit spreads narrowed slightly, indicating improved investor risk sentiment amid hopes of trade stabilization.

Global Market Analysis

Europe:

STOXX Europe 600 gained 2.77%, led by Germany’s DAX (+4.89%) and France’s CAC 40 (+3.44%), following Trump’s softer tone on tariffs and improving earnings sentiment.

Asia:

- Japan:

Nikkei 225 advanced 2.8%. BoJ policymakers hinted at maintaining easy monetary policy amid tariff uncertainty. - China:

Shanghai Composite rose 0.56% as stimulus expectations bolstered sentiment despite continuing trade tensions.

Emerging Markets:

- Emerging Asia:

GDP downgrades for Singapore, Malaysia, and Korea weighed on sentiment, but policy stimulus measures are expected to cushion the slowdown. - Latin America:

Held up relatively well as supportive domestic factors offset external headwinds. - EEMEA:

Caution prevails amid capital flow risks, but no immediate crises are detected.

Economics

U.S. Economic Overview

Positive Earnings, But Slower Growth:

73% of reporting S&P 500 companies beat earnings expectations. However, S&P Global PMI data showed business activity slowing to a 16-month low, especially in services.

Tariff Inflation Risks Reemerge:

Prices charged for goods and services rose at the fastest pace in over a year, largely due to tariffs.

Consumer Sentiment Weakens:

University of Michigan’s Consumer Sentiment Index fell for the fourth consecutive month, highlighting persistent uncertainty around trade policy.

Fed Outlook Steady:

Markets maintain expectations for two Fed rate cuts in 2025. Longer-term rates fell this week amid rising concerns about Q2 growth.

Housing Market Softens:

Existing home sales plunged 5.9% in March to the lowest March level since 2009, weighed down by high mortgage rates.

Global Economic Overview

Eurozone:

Growth outlook dimmed as April PMI data pointed to weakening services and manufacturing. German GDP forecasts downgraded to zero growth for 2025.

China:

Despite better-than-expected Q1 GDP, new tariffs threaten future exports. Beijing’s Politburo announced preparations for emergency stimulus measures.

Japan:

Tokyo CPI inflation rose faster than expected, bolstering the case for a BoJ rate hike later this year, but tariff risks complicate the timeline.

Australia & Colombia:

Central banks kept rates steady; rate cuts still expected as global risks intensify.

India:

RBI expected to cut rates by 25 bps following softening inflation and weaker growth.

Mexico & Norway:

Key inflation data due next week will likely dictate the timing for further easing.

Week Ahead (April 28–May 2, 2025)

Key U.S. Events:

Economic Data:

- Tue (Apr 29): Advanced International Trade, Consumer Confidence

- Wed (Apr 30): ADP Jobs Report, Q1 GDP, Pending Home Sales

- Thu (May 1): ISM Manufacturing Index, Jobless Claims

- Fri (May 2): Nonfarm Payrolls, Unemployment Rate

Earnings:

- Mega-Cap Tech Reports: Microsoft, Meta (Wed); Apple, Amazon (Thu)

Key Global Events:

- China PMIs: Wednesday—will gauge early tariff impact.

- Eurozone GDP & CPI: Wednesday—critical for ECB policy outlook.

- Bank of Japan Meeting: Thursday—no change expected, but tariff commentary crucial.

- Tariff Developments: Any new trade announcements could cause sharp market moves.

QOTD: The Fog & Confusion of a Trade War

QOTD: Quote of the Day

What does this administration exactly want? Do they want a new trade deal? Do they want tariffs? We just don’t know,” – Eelco Heinen, finance minister of the Netherlands.

Posted in Uncategorized

Leave a comment

Viva Free Trade: How Tariffs Make Us Poorer

Great video, must view.

Posted in Uncategorized

Leave a comment

HOTD: Not So Fast

Posted in Uncategorized

Leave a comment